In a landmark decision, the U.S. Securities and Exchange Commission (SEC) issued Staff Accounting Bulletin (SAB) No. 121, a controversial rule that has long prevented banks from providing custody services for Bitcoin and cryptocurrencies. It was announced that the issue would be officially cancelled. The move, announced Thursday, marks a significant change in the SEC's approach to regulating bitcoin and cryptocurrencies and paves the way for greater financial integration.

BREAKING NEWS: 🇺🇸SEC Officially Revokes SAB 121 That Blocked Bank Custody #bitcoin pic.twitter.com/VCnggkCGmL

— Bitcoin Magazine (@BitcoinMagazine) January 23, 2025

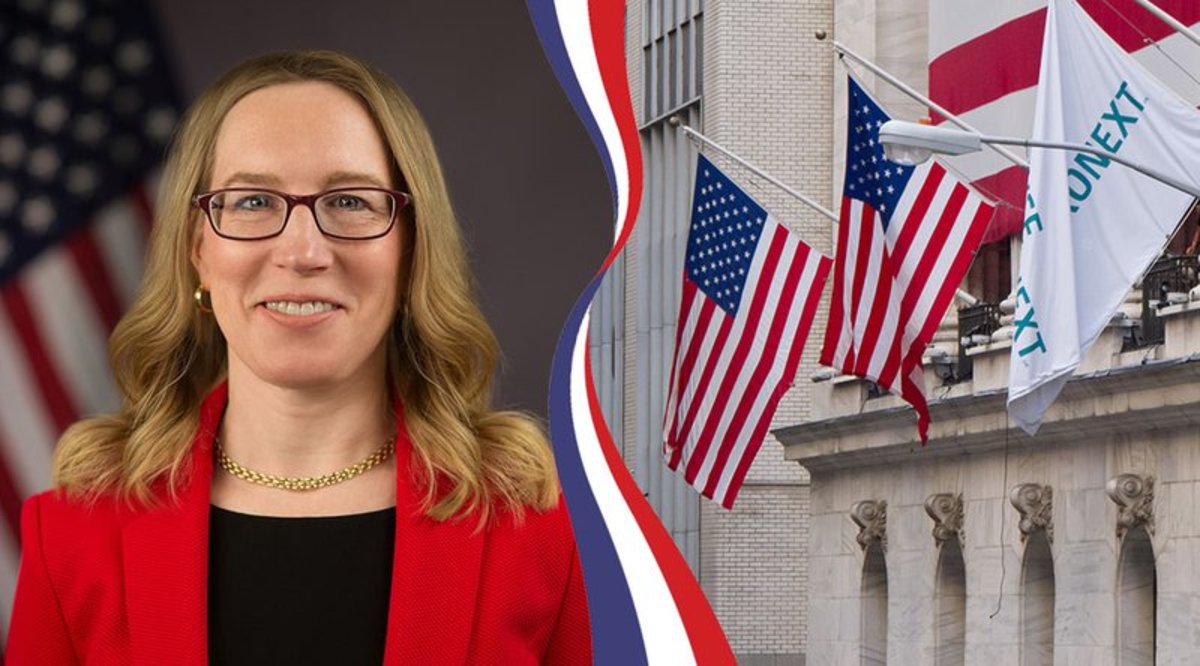

Introduced in March 2022 under former SEC Chairman Gary Gensler, SAB 121 requires institutions that hold customers' Bitcoin and crypto assets to record those holdings as liabilities on their balance sheets. Mandated. This accounting standard placed a significant operational and financial burden on banks and custodians, effectively preventing them from providing Bitcoin-related services. The rule was widely criticized by the crypto industry and lawmakers, with SEC Commissioner Hester Peirce famously calling it a “noxious weed” in April 2023.

“Goodbye, goodbye SAB 121! That wasn't fun,” Peirce wrote in a post on X (formerly Twitter) on Thursday after the SEC issued Staff Accounting Bulletin No. 122 formally rescinding the guidance.

The SEC's move to cancel SAB 121 comes just days after Gensler's resignation and marks the beginning of a new era under Republican leadership. SEC Acting Chairman Mark Ueda, who assumed the role on Monday, immediately announced the creation of a crypto task force led by Peirce to create a clearer and more practical regulatory framework for the industry. .

“To date, the SEC has relied primarily on enforcement actions to regulate virtual currencies retrospectively and after the fact, often adopting novel and untested legal interpretations along the way,” the agency said. This was acknowledged in a statement on Tuesday.

With the removal of SAB 121, we expect major banks to quickly integrate Bitcoin and cryptocurrency custody services into their services. This is an important milestone in the financialization of Bitcoin, bringing it closer to mainstream adoption.