The U.S. Securities and Exchange Commission (SEC) has once again postponed its highly anticipated decision on the Ethereum Exchange Traded Fund (ETF). This postponement adds a new chapter to the complex interplay between regulatory measures and market trends in the crypto sector.

Meanwhile, amid this uncertainty, New York-based Hightower, which has over $130 billion in assets under management (AUM), has chosen to step up its investments. The company focuses on various spot Bitcoin ETFs.

Ethereum ETF outlook slows as Bitcoin ETFs show resilience

The SEC's recent filing extends the review period for Galaxy Invesco's Ethereum ETF application by an additional 60 days. As a result, the next decision deadline has been postponed to July 5th.

“The Commission may specify a long period of time for issuing an order approving or disapproving a proposed rule change to allow sufficient time to consider the proposed rule change and the issues raised therein.'' “The SEC determined that it was appropriate,'' the SEC outlined.

Read more: Ethereum ETF explained: What is Ethereum ETF and how does it work?

The delay follows a pattern, as the SEC deferred decisions on similar filings from financial giants like BlackRock and Fidelity in March. Continued delays have cast doubts across the industry. Prominent figures such as Van Eck CEO Jan van Eck have expressed skepticism about the possibility of approval anytime soon.

Bloomberg Intelligence analysts James Seifert and Eric Balchunas significantly lowered the probability of approval to less than 35%. Additionally, Todd Rosenbluth, head of ETF analysis at VettaFi, believes approval will likely be delayed “until 2024 or even later.” He attributes the delay to an uncertain regulatory environment.

Echoing Rosenbluth’s prediction, MicroStrategy’s Michael Saylor predicts that the SEC may classify Ethereum as a security. As a result, the commission could reject Spot Ethereum ETF applications from multiple asset managers, including BlackRock. Nevertheless, the market is eagerly awaiting the SEC's response to discover Ethereum ETF filings from VanEck and ARK on May 23rd and 24th.

Despite the challenges of Ethereum ETFs, Bitcoin ETFs are experiencing a contrasting situation. Mr. Hightower recently revealed significant acquisitions of various Bitcoin ETFs totaling $68.35 million. This portfolio includes Grayscale ($44.84 million), Fidelity ($12.41 million), BlackRock ($7.62 million), ARK ($1.7 million), Bitwise ($998,000), and Franklin Templeton ($778,000). Contains important stocks of stocks.

This investment spree comes at a critical time for U.S. Bitcoin ETFs. We are seeing a resurgence of investor interest.

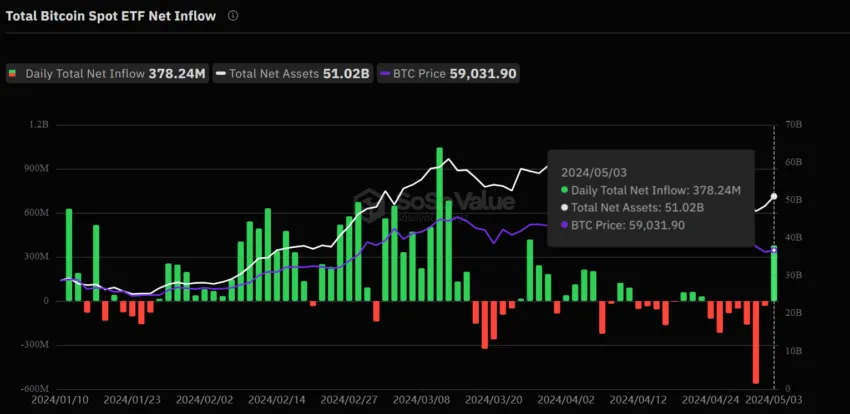

After seven consecutive days of capital outflows, the market has seen impressive capital inflows. On May 3, a total of $378.24 million flowed into US-traded Bitcoin ETFs.

Read more: How to trade Bitcoin ETFs: A step-by-step approach

Notably, Grayscale Bitcoin Trust (GBTC), which has been suffering from continuous outflows since the first day of trading, also recorded new inflows. On the same day, he received $63.01 million.

As the cryptocurrency market evolves, regulatory decisions by institutions such as the SEC will be critical in shaping its future. For now, the community remains focused and hopeful on a regulatory framework that fosters innovation while ensuring market stability and investor protection. Meanwhile, strategic moves by companies like Hightower may signal how major companies are navigating the complexities of crypto investing.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.