Across California, prices have fallen year-over-year as sales have plummeted and supply has more than doubled. And no, this isn't just a seasonal downturn.

From WOLF STREET by Wolf Richter.

San Francisco and Silicon Valley are now firmly leading the charge in California's ongoing housing bubble burst, with home sales plummeting and prices falling at an alarming pace from their April peaks.

Almost everything came together. After two years of work-from-anywhere worker exodus, the start of 2021 saw the startup and cryptocurrency industry collapse that continued unabated, quickly earning a place in my pantheon of “collapsed stocks.” Mortgage rates soared in early 2022. Big Tech hiring slumped in mid-2022. By then, the Fed had relentlessly raised interest rates and quantitative tightening had begun. This was made all the more evident by the disorganized dismantling of Twitter and its ecosystem workforce over the past two months.

Local budgets are in deep deficits, but most still have plenty of cash thanks to pandemic relief funds they received from the federal and state governments.

Vacant office space being offered for lease or sublease continues to grow, while landlords have begun applying for steep reductions in assessments to lower property taxes, which will further reduce revenues.

This was joined by a New York Times article that said Twitter had stopped paying rent on leased offices and had been instructed not to pay vendors. At least one of the unpaid vendors – a Silicon Valley company from which Twitter licensed software – filed a lawsuit in San Francisco Superior Court last week for non-payment. The lawsuit states, “Shortly after the completion of Mr. Musk's acquisition of Twitter, Twitter refused to pay an outstanding quarterly invoice that was due on November 30, 2022, and waived its obligation to pay future invoices…”

These are all signs of further turmoil in the housing market. Prices fell the sharpest in San Francisco, followed by Silicon Valley's San Mateo and Santa Clara counties.

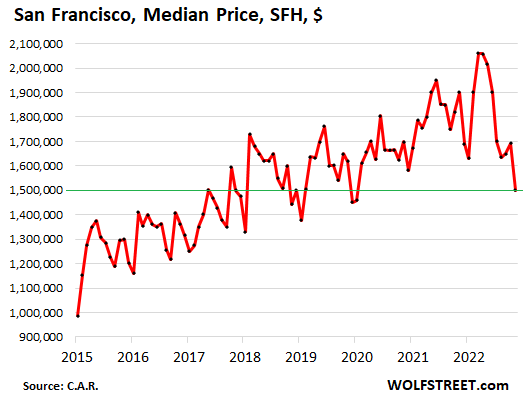

In San Francisco.

Average price of a single-family home According to the California Association of Realtors, home prices in San Francisco fell 11.4% from October to $1.5 million in November and are down 27% from their April peak. That's an ugly chart.

Apartment prices plummet Apartment prices fell 4.3% month-on-month to $1.15 million and 9.5% year-on-year. The median apartment price is down 15.5% since its April peak. Apartment sales in November were down 49%.

The cheapest months seasonally are December and January, and this is yet to come.

But who will buy them this spring sales season?Prices usually rise in the spring as demand rises, but which enthusiastic tech workers are willing to borrow against their stock options when stock prices plummet and pay top dollar for a home? Those lucky enough to still have jobs and stock options?

The housing market in San Francisco and Silicon Valley is tied to the boom and bust cycles of the startup world (and now the crypto world and cryptocurrencies), the stock prices of the area's startups, big tech companies, and social media companies, the jobs available locally, and the value of stock options. It's all nauseating.

The median price of a single-family home in San Francisco fell 21% from a year ago, marking the sixth consecutive month of year-over-year declines and the largest year-over-year percentage decline since the first peak of the housing bubble.

Silicon Valley, San Mateo County.

The median price of a single-family home in San Mateo County, which makes up the northern part of Silicon Valley, fell 6.2% from October to $1.78 million and is down 26% from its peak in April.

Year-over-year, median home prices fell 20%.

Silicon Valley, Santa Clara County.

Santa Clara County, which makes up the southern part of Silicon Valley and includes the Bay Area's largest city, San Jose, is lagging behind but making steady progress: The median price of a single-family home fell 1.5% from October to $1.6 million in November and is down 19% from its April peak.

Year-over-year, median home prices fell 5.5%, the first significant year-over-year decline this cycle. Prices had already fallen significantly year-over-year in 2018 and 2019 and were trending downwards until trillions of dollars of money printing, a surging stock market, and suppressed interest rates caused prices to start rising again.

Right now, Santa Clara County appears to be several months behind San Francisco and San Mateo.

Across California.

According to the California Association of Realtors, sales of single-family homes in California fell 47.7% in November from a year ago, the biggest drop since 1980. Condominium sales fell 46%.

Unsold inventory more than doubled from a year ago to 3.3 months, and days on market also more than doubled, before sellers again took unsold homes off the market.

Across California, the median price of a single-family home in November fell another 3.0% from October, and prices were down year-over-year (-0.6%). The median price of a condo in November fell 2.1% from October, slowing the year-over-year increase to just 2.7%.

Enjoy reading WOLF STREET and want to support us? You can donate, we'd be so grateful! Click on Beer and Iced Tea Mugs to find out how.

Want to be notified by email when WOLF STREET publishes a new article? Sign up here.

![]()