Oleg Erkov

The buzz surrounding artificial intelligence (AI), along with strong financial results, is providing strong stimulus to stock markets, particularly in the euro area. Eurozone stocks are trading at record highs, with the EuroStoxx 600 index reaching the 496 level.1

Can eurozone stocks sustain these gains? Macroeconomic indicators in the euro area have not yet shown a convincing improvement. But many of Europe's biggest companies sell around the world, from the United States to China, and their global context helps.

It is also possible that the European Central Bank (ECB) will take precedence over the Federal Reserve (Fed) in terms of monetary policy. A subsequent rate cut could ease tensions in the eurozone economy and set the stage for a more constructive stock market.

Easing labor market tensions paves the way for early launch of the ECB pivot

Our biggest belief in the ECB changing policy faster than the Fed is downward pressure from wages. Wage growth remains a key bottleneck for further rate cuts by the ECB.The euro area currently faces a larger overshoot in wage growth than the US

While the unemployment rate has stabilized at historically low levels over the past year, the job vacancy rate has fallen sharply from a peak of 3.2% in Q2 2022 to 2.7% as of Q4 2023 . The growing tightening of the labor market has already subsided. The economy is expected to remain range bound in the short term, with the labor market expected to further soften in the coming months.

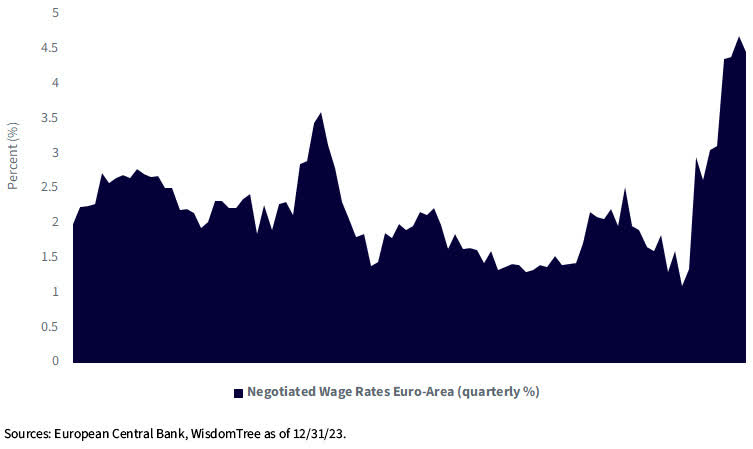

Quarterly negotiated wages are one of the few ECB “official” wage statistics that have fallen from their record high in the third quarter of 2023. For the ECB to wait until wage growth has fully slowed would mean interest rates would remain high for a longer period of time, risking a recession. .

ECB negotiations push wages back from record highs

ECB directors led by President Christine Lagarde, Isabel Schnabel and Joachim Nagel tried to dampen expectations for rate cuts at a meeting of European finance ministers and central bank governors in Ghent. The ECB does not seem to be able to manage expectations, mainly because, unlike in the US, where economic indicators do not suggest an immediate need for rate cuts, there is an immediate need for interest rate cuts in the euro area. This is because it suggests that

Earnings results highlight increased resilience

The Magnificent 7 effect has clearly reached Europe, with five stocks leading the rise in European stocks, led by ASML (ASML, OTCPK:ASMLF) (+39%) and Novo Nordisk (NVO, OTCPK:NONOF) (+34%), SAP (SAP) (+16%), LVMH (OTCPK:LVMHF, OTCPK:LVMUY), ((+16%), Schneider (+8%), YTD (YTD).2

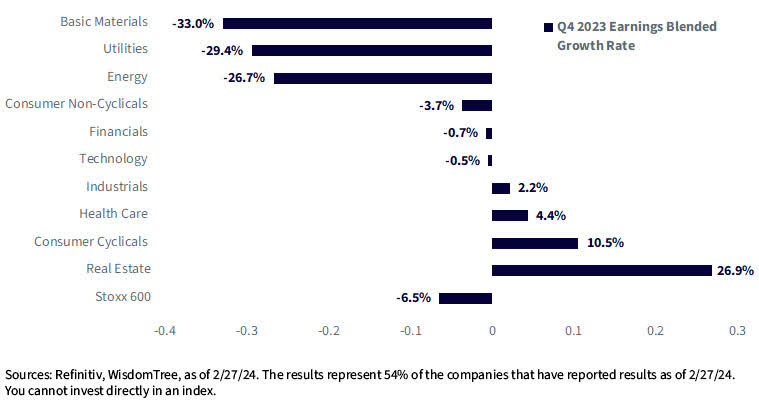

Unlike in the U.S., the year-to-date stock prices of major eurozone stocks are spread across sectors such as information technology, consumer discretionary and industrials. Looking back at Q4 2023 earnings results, consumer circular industries, healthcare, and industrials lead the scoreboard with the highest revenue growth (out of 54% of companies reporting earnings), while energy, utilities , it became clear that the material was the biggest stumbling block. About financial statements. Against the backdrop of ECB interest rate easing and weak macroeconomic conditions, the euro is likely to weaken further against the US dollar, giving exporters a competitive edge.

EuroStoxx 600 Index – Q4 2023 Earnings Dashboard

Spain stands out as a representative of Europe

Spain surpassed the four largest European countries in 2023 and remains the most positive case in 2024. Investment growth slowed in 2023 due to rising interest rates. However, consumption remained fundamentally strong due to the resilience of the labor market. Spain's labor market was strong. The structure of Spain's labor market has shifted from temporary employment to permanent contracts. The trend towards open-ended contracts tends to encourage more consumption due to improved job stability.

However, the recovery has been uneven across sectors, with the construction, real estate, information technology and communications services sectors lagging behind. The Spanish economy needs to improve productivity through the restructuring of capital investment, and Spain is well placed to do so. Spain has been the most affected by monetary tightening, so the ECB's expected interest rate cuts should have a relatively large impact on the Spanish economy. Spain is also Europe's largest recipient of recovery funds. It has been effective in raising $37 billion in funding.3 Spending is expected to be more than 2% of GDP in 2024, most of which will go to capital investment. Spain is well placed to take advantage of a supportive macro environment.

A tilt towards exports to the euro area that brings dividends

The WisdomTree Europe Hedged Equity ETF (HEDJ) provides investors with exposure to dividend-paying euro area companies that earn at least 50% of their income outside the euro area, while hedging their exposure to the euro.

By including dividend-paying euro area exporters, HEDJ gives a higher weight to sectors with strong profit growth, such as consumer discretionary, industrials, finance, and information technology, while giving a lower weight to sectors with slower profit growth, such as energy. I think it's lowering it. , Utilities and Materials.

The link between revenue growth and performance is clear from HEDJ's performance in 2024. The EuroStoxx 600 index is up 3.3%, the MSCI Europe index is up 4.8%, while the WisdomTree Europe Hedged Equity ETF (HEDJ) is up 8.1%.Four

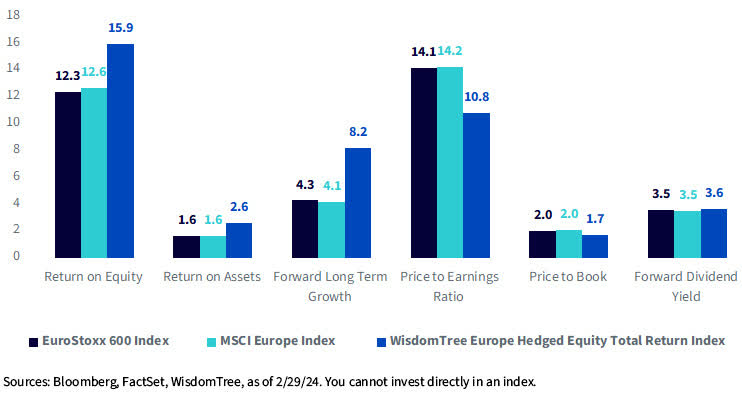

We know that Europe trades at attractive valuations relative to global stock markets. The WisdomTree Europe Hedge Stock Index performs better than its benchmark when looking at fundamental metrics.

Comparison of fundamentals

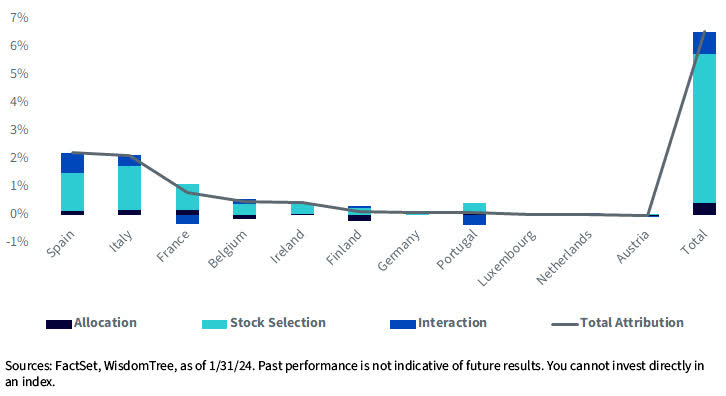

Over the past year, the WisdomTree Europe Hedge Equity Index outperformed the MSCI EMU Local Currency Index by 6.55%. The region-wide attribution highlighted a higher allocation to Spain, resulting in a positive overall contribution of his 2.24%, benefiting the overall performance.

Geographical Attribution – 1 year

1 Bloomberg, as of February 23, 2024.2 Bloomberg, December 31, 2023 to February 26, 2024 (in USD).3 European Commission,Four Bloomberg performance from December 31, 2023 to February 29, 2024.

Past performance is not indicative of future results. The return on investment and the principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Click here to view the latest month-end and standardized performance and download the fund's prospectus.

Important risks associated with this article

Investments involve risks such as possible loss of principal. Foreign investments involve special risks, including the risk of loss due to currency fluctuations and political and economic uncertainty. Investing in currencies involves additional special risks such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities and more sensitive to the effects of various economic conditions. Because the Fund may be concentrated in a few issuers, the Fund may be adversely affected by changes that affect those issuers. The Fund's investment strategy may result in higher capital gain distributions than other ETFs. Dividends are not guaranteed, and companies that currently pay dividends may stop paying them at any time. Please read the fund's prospectus for specific details regarding the fund's risk profile.

About the poster

Aneeka Gupta, Director of Macroeconomic Research

Aneeka Gupta is Director of Research at WisdomTree. Before she acquired ETF Securities in April 2018, Aneeka worked as an equity and commodity strategist at the company. Aneeka has 17 years of experience working as a research analyst across a wide range of asset classes. In her current role, she is responsible for conducting analysis of all internal stock, commodity and macro publications and assisting the sales team with customer questions regarding products and markets.

Prior to joining WisdomTree, Aneeka began her career as an equity analyst at Bear Stearns International Ltd in London. She also worked as a stock sales her trader at Sunrise Brokers across US and pan-European exchanges. Previously, she worked as an equity derivatives sales manager at Mashreq Bank in Dubai.

Aneeka holds an MSc in Mathematics from the University of Oxford and a BSc in Mathematics from the University of Delhi, India. She is also a CFA Charter Holder.

original post