Renowned investor Raul Pal has used key data to demonstrate that 2024 will be a favorable year for cryptocurrencies, surpassing expectations for tech stocks.

“We have NDX and cryptocurrency growth assets here, which is why it bottomed before everything else,” the statement declared.

Pal predicts cryptocurrencies will outperform tech stocks

In a series of posts on X (formerly Twitter), Pal cited key market indicators and made it clear that he believes the cryptocurrency market is likely to see a strong upswing over the next 12 months.

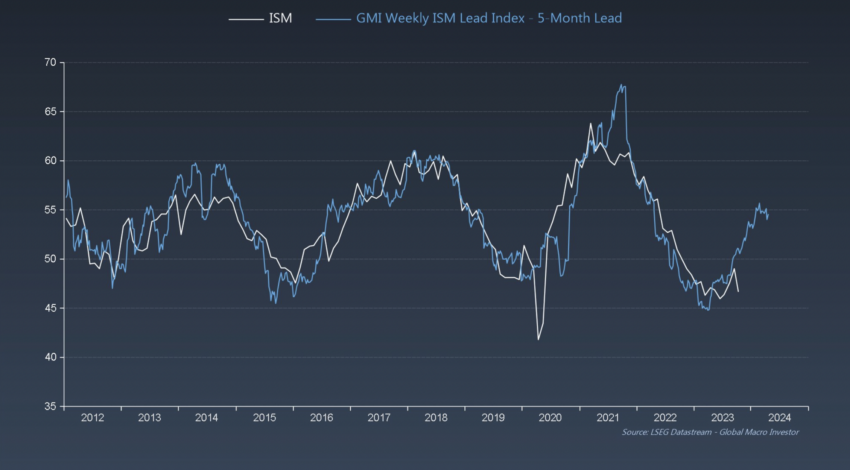

“But the ISM leading indicator is surging, which is where SPX is usually at (part cyclical, part growth) and explains the strength of SPX versus the Russell 2000 (RTY) and commodities…”

Furthermore, he Predict The cryptocurrency market could see significant growth within the next year.

“With the GMI Financial Conditions Index, we can look 11 months ahead and 2024 is expected to be a strong year. This is where the growth assets of NDX and cryptocurrencies are. This is why they bottomed before everything else…”

Read more: AI Stocks: Best Artificial Intelligence Companies to Watch in 2023

Meanwhile, Vetle Lunde, a researcher at K33 Research, said that the Chicago Mercantile Exchange (CME) expects Bitcoin (BTC) prices to rise in the future.

“CME is very long. ATH OI [open interest]which would entail huge insurance premiums,” Lunde said.

Additionally, he points out that the spread between Bitcoin's spot price and futures contracts is a good indicator of bullish sentiment.

“BTC's next-month contract has only traded at a wider premium to the last-month contract three times since inception.”

Recent buzz about the Bitcoin halving

There has been a lot of speculation in recent days about how the cryptocurrency market will fare over the next 12 months. This is especially true given the expected Bitcoin halving in April 2024.

On November 12, BeInCrypto featured analyst predictions about taking advantage of the changing market, and turning small amounts of Bitcoin into six-figure fortunes.

One analyst's model suggests that traders should buy bitcoin six months before the halving and sell it 18 months after.

This is said to be aimed at leveraging Bitcoin’s cynical patterns to capture the massive price rally surrounding Bitcoin’s halving while avoiding the subsequent bear market.

Read more: Which crypto sectors will boom this holiday season? A trader's guide

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto strives for fair and transparent reporting. This news article aims to provide accurate and timely information. However, readers are encouraged to independently verify facts and consult with experts before making any decisions based on this content. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.