quick take

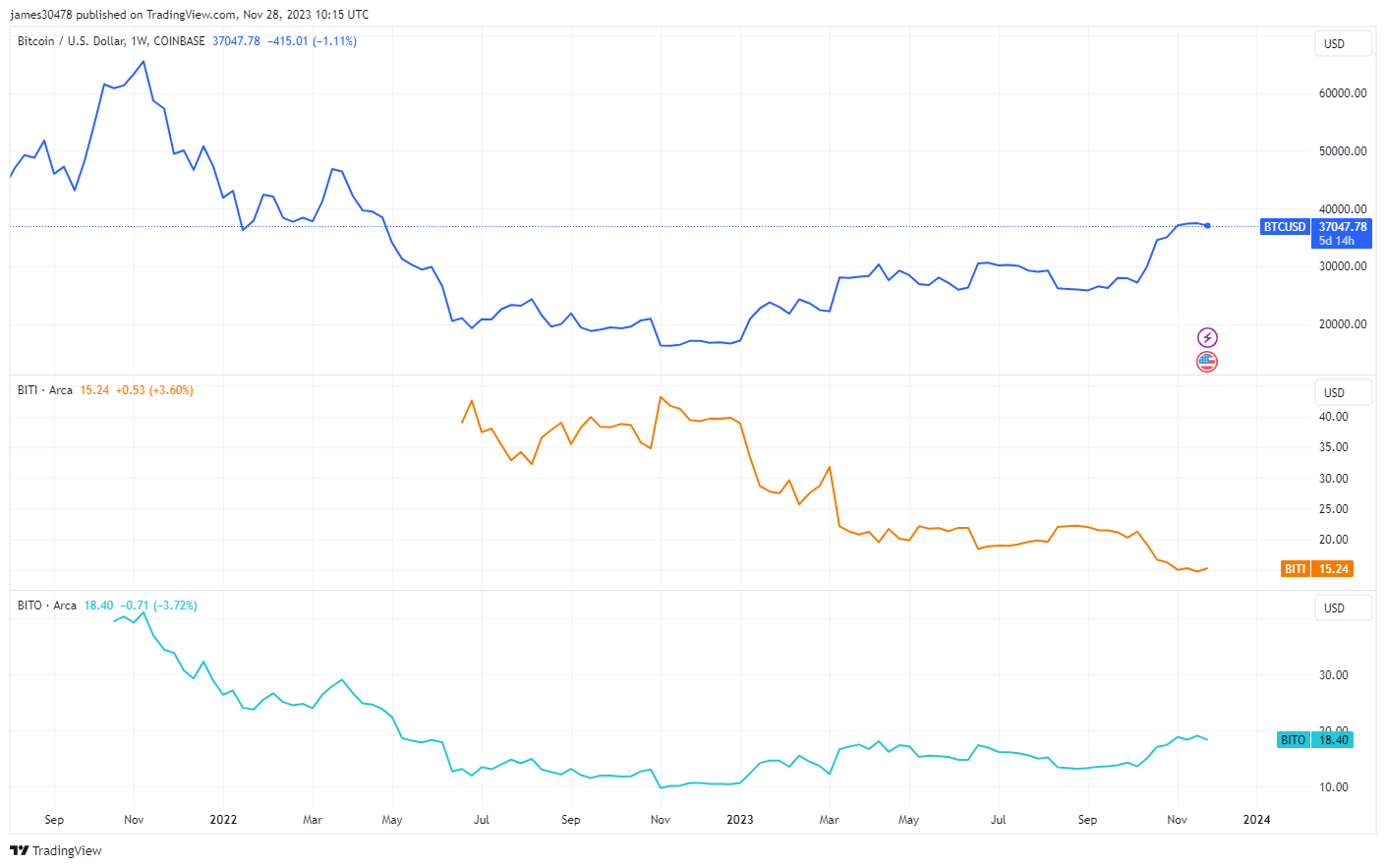

There is a well-known pattern in the world of financial assets. That is, an expected positive development or “good news” is preceded by a sharp rise in asset prices, followed by a noticeable decline once that event occurs. This phenomenon, often referred to as “buying the rumor and selling the news,” suggests an interplay between strategic, perhaps institutional, buying and retail investors who leave their buying at peak times.

For example, the launch of the ProShares Bitcoin Strategy ETF (BITO) in October 2021 coincided with the peak of the crypto bull market. The event's trading volume exceeded his $1 billion mark, marking the top of the cycle. Conversely, the BITI ProShares Short Bitcoin Strategy ETF, which offers investors the opportunity to bet on Bitcoin, hit a local low in June 2022 during the Lunar crash.

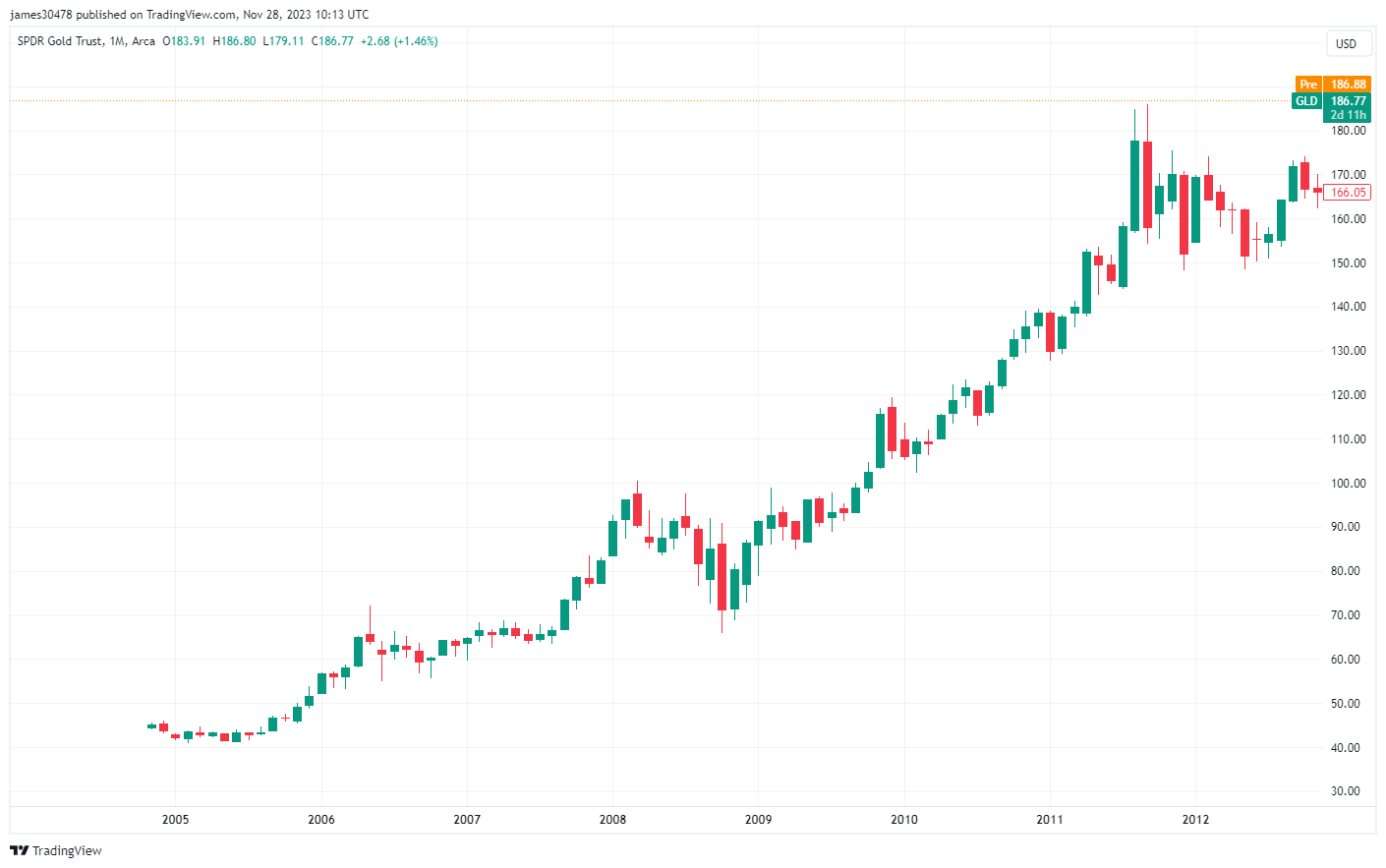

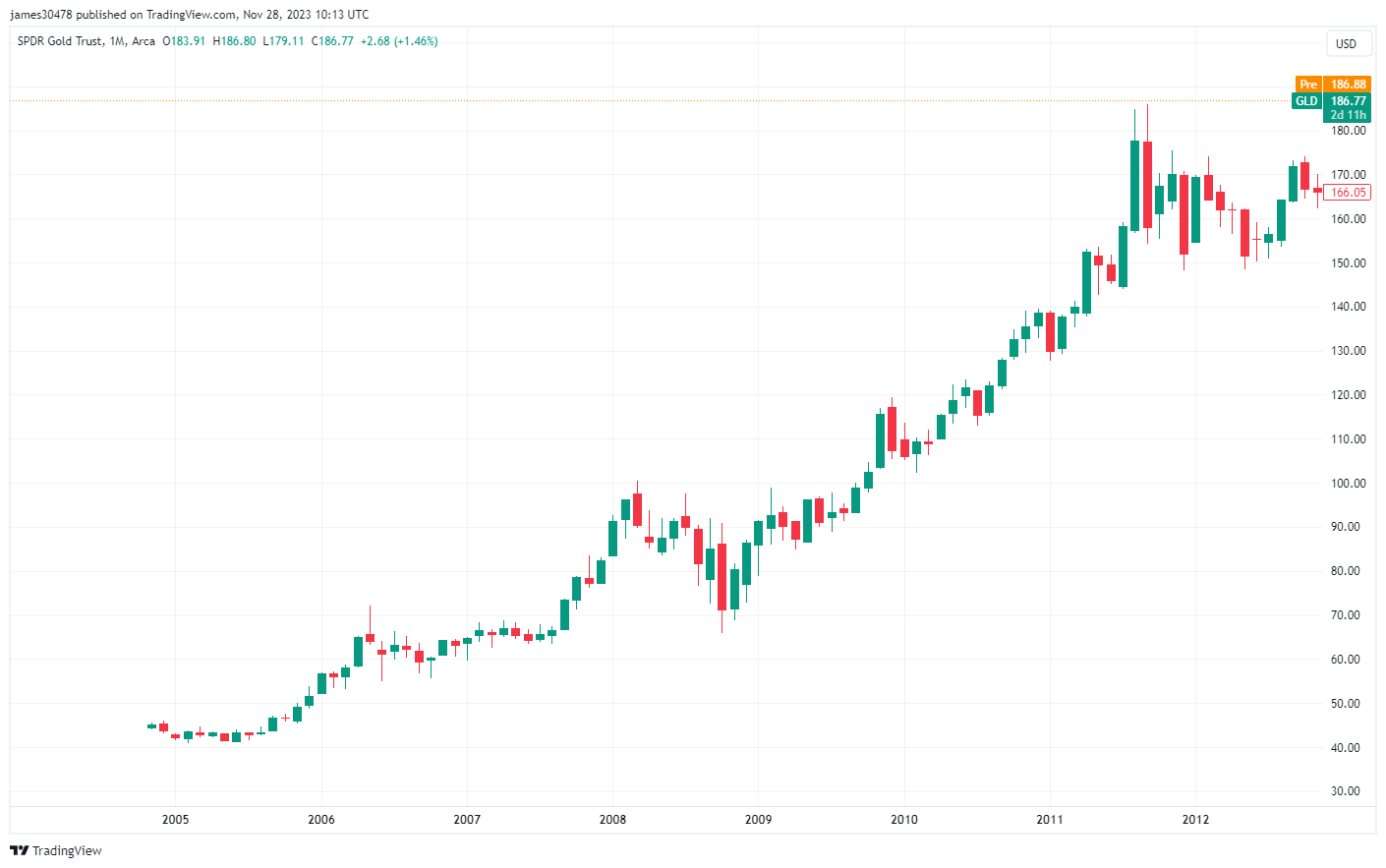

This pattern is not limited to digital assets. When the Gold ETF (GLD) was introduced in November 2004, the starting price was around $45 and by May 2005 it had fallen to around $41. But over the next seven years, it rose a whopping 268%.