Preliminary data from the PMI® survey shows business activity in the euro area slowed to its slowest pace in six months in January, despite continued weakness in both manufacturing and services due to a further decline in new business. I felt depressed. Still, the decline in overall new orders was the smallest since June last year, boosting employment levels to stabilization and business optimism for the year ahead to an eight-month high.

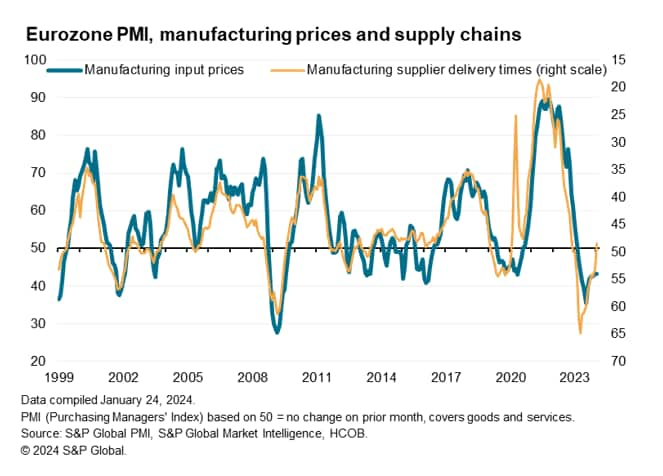

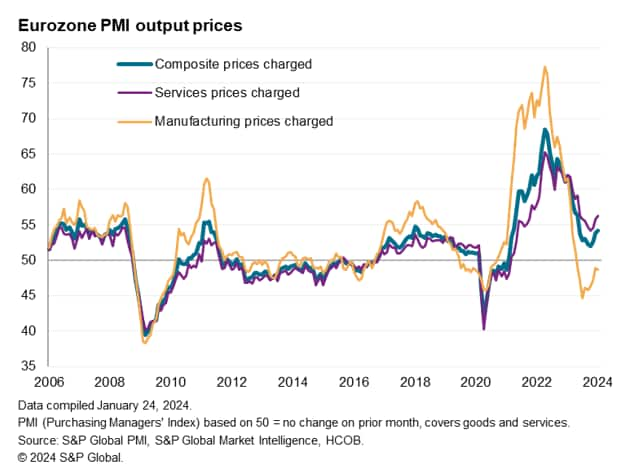

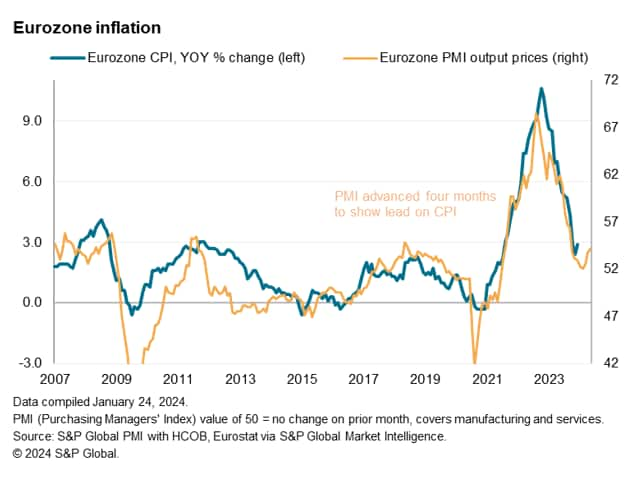

Manufacturing input costs continued to fall on average, although supply chains were extended for the first time in a year due to shipping disruptions in the Red Sea. However, service sector cost growth accelerated during the month, contributing to overall prices of goods and services to rise by the largest amount since May last year, with inflation accelerating by three months from October's 32-month low. did.

Survey data, particularly price developments, are likely to encourage ECB policymakers not to rush into rate cuts, given the prospect that the first rate cut will only occur towards the middle or second half of this year.

“Recession” will continue until 2024

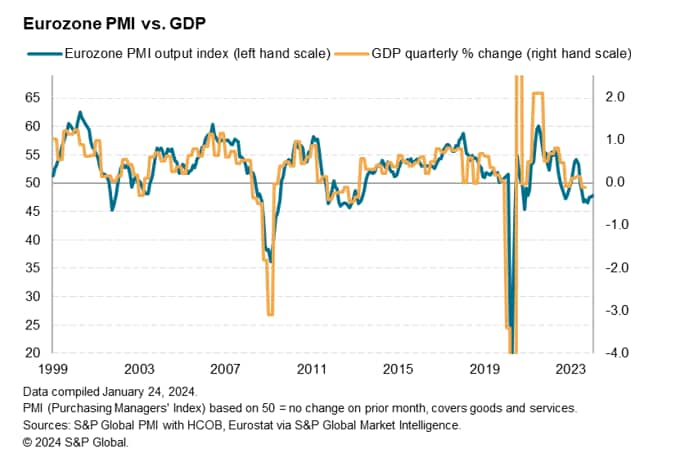

The seasonally adjusted HCOB Flash Eurozone Composite PMI Production Index, compiled by S&P Global based on about 85% of regular survey responses, rose to 47.9 in January from 47.6 in December. Although this marks the eighth consecutive month of production decline, January's decline was the smallest since July last year.

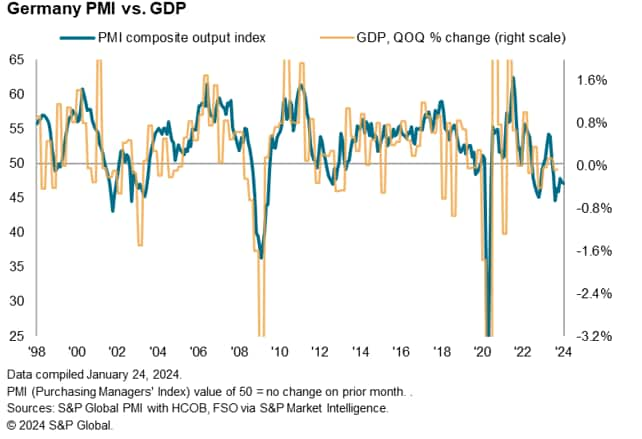

Historical comparisons show that January's PMI reading is consistent with euro area GDP contracting at a quarterly rate of 0.20%, compared with the 0.25% contraction shown in the fourth quarter of last year. The same is true.

The latest available GDP data predicts negative growth of 0.10% in the third quarter of 2023, and the PMI points out that this economic downturn will persist into the new year. Indeed, the PMI suggests that the eurozone is enduring its deepest recession since 2013 (excluding the early months of the pandemic), although recent months have signaled a bottoming out of the economic downturn. ing.

Goods-producing countries continued to lead the economic downturn, with manufacturing production declining for the 10th consecutive month in January, but the decline in factory production was the smallest since April last year. New orders for products also fell by the smallest amount in nine months.

Service activity fell for the sixth consecutive month, with the pace of decline gaining some momentum to mark the steepest decline since October last year, but the rate of decline in new contracts to service providers was the slowest since July last year. , further indicating that the economy is cooling down. Weak demand.

January also saw the region's export decline ease, with the overall rate of decline in new export orders at its lowest level in nine months, as losses for both goods and services fell.

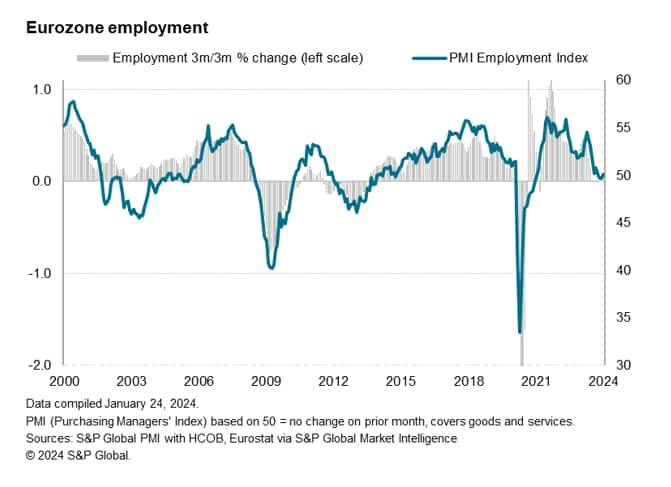

employment pending

Employment rose in January partly as a slight increase in net payrolls in the services sector offset eight straight months of declines in manufacturing payrolls. Although the slight increase in overall employment shown in preliminary PMIs represented a modest improvement from the slight decline seen in the final two months of 2023, the largely unchanged situation reflects a weak demand environment. This continues to reflect the company's reluctance to increase its workforce.

supply is cut off again

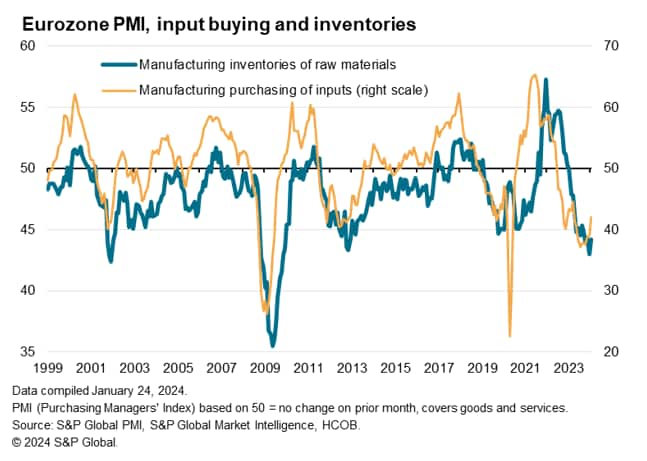

In addition to job cuts, manufacturers reduced purchasing activity for the 19th consecutive month in response to lower production needs in the coming months, resulting in raw material inventories decreasing for the 12th consecutive month.

However, inventories were also affected by delays in the supply of raw materials. Supplier delivery times extended on average in January for the first time in a year, largely due to shipping delays caused by disruptions in the Red Sea. Nevertheless, the extent of the average extension in supplier lead times was much less severe than that recorded throughout most of the pandemic period from 2020 to 2022.

Prices are increasing rapidly

Despite the additional costs associated with delayed shipments, manufacturers' average input costs fell significantly in January for the 11th consecutive month, although the rate of decline slowed slightly, marking the smallest decline since April last year. Meanwhile, euro area service providers reported an increase in cost growth, reaching an eight-month high, with overall cost growth for goods and services accelerating to the fastest record since May last year. .

Selling price inflation also rose in January as input cost inflation accelerated. Average prices charged for goods and services also rose at the sharpest rate since May last year. Sales price inflation fell to a 32-month low last October, but has now risen for three consecutive months and remains high by the survey's historical standards. Commodity prices fell at a modest rate of increase, marking the ninth consecutive month of decline, while service charges in January increased by the highest rate since June of last year.

the outlook becomes brighter

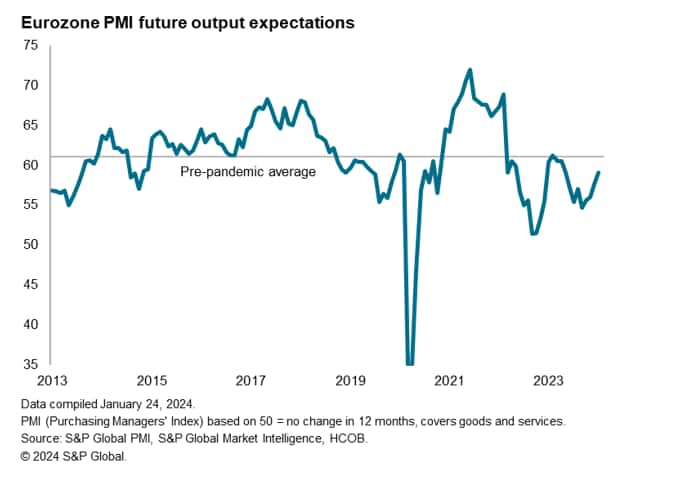

Looking ahead, business optimism for the next 12 months improved for the fourth consecutive month in January, rising to its highest level since May last year. Confidence in the manufacturing industry is at its highest level in nine months, and in the services industry it is at its highest level in eight months, although the latter remains the brighter of the two sectors.

The improved growth outlook generally reflects expectations for reduced cost of living pressures and lower interest rates over the coming year, contributing to broad-based economic growth and driving demand in domestic and international markets. Nevertheless, optimistic outlooks for the year ahead remain below the pre-pandemic average.

national trends

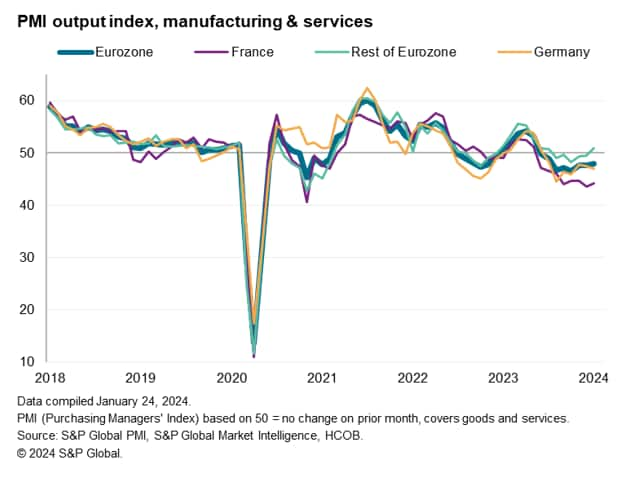

Business conditions varied by region. The economic downturn continued to be led by France, with output falling for the eighth straight month and the sharpest decline since September last year, as both manufacturing and services sectors contracted sharply.

In Germany, production also declined sharply and at an accelerating pace, although a mild economic downturn in manufacturing offset the worsening situation in the services sector.

In contrast, the rest of the eurozone as a whole returned to growth after five months of decline, posting the largest but still modest expansion since June last year. Growth in the services sector, excluding France and Germany, accelerated to the highest level in six months, while the decline in manufacturing slowed, posting the smallest decline in 10 months.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Phone: +44 207 260 2329

chris.williamson@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers Index™ (PMI)®) Data is compiled by S&P Global for more than 40 economies around the world. Monthly data comes from a survey of senior executives at private companies and is available by subscription only. The PMI dataset includes headline numbers that indicate the overall health of the economy and sub-indices that provide insight into other key economic factors such as GDP, inflation, exports, capacity utilization, employment, and inventories. Masu. PMI data is used by financial and corporate professionals to better understand where the economy and markets are heading and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, an independently managed division of S&P Global.