The following is a guest post by Rajagopal Menon, Vice President of WazirX.

When a bull market arrives, models emerge to predict the price of Bitcoin. During the last bull market of 2021, the stock-to-flow (S2F) model became a feature of the season. The model created by Plan B assessed asset scarcity by comparing inventory to annual production. Applying the S2F model to Bitcoin highlighted its “digital gold” potential and provided long-term price predictions based on scarcity. However, the S2F model will disappear in the crypto winter of 2022.

But don't worry. The current bull market has seen the emergence of a new model called the power law model, which claims to predict the price of Bitcoin with amazing accuracy.

Understand power laws

In a world seemingly filled with chaos and randomness, scientists have uncovered hidden patterns and relationships known as power laws. These laws provide a framework for understanding how different phenomena interact and reveal consistent mathematical patterns that govern different aspects of the universe.

Power law in daily life

Power laws are interesting mathematical relationships that appear in numerous phenomena and provide insight into the underlying simplicity of complex systems. They describe how two quantities are related to each other, such that a change in one quantity causes a proportional change in the other quantity. This relationship spans many scales, from the microcosm to the cosmos, and affects biology, society, technology, and natural phenomena.

animal size limits

Galileo's square-cube law is a classic example of a power law in nature and explains how an animal's size affects its strength. As animals grow larger, volume and weight increase much faster than physical strength. This law sets natural limits and explains why large animals have thick bones and why the largest animals are found in aquatic environments where their weight is offset by buoyancy.

metabolic rate

Max Clever's work on metabolic rate further demonstrates the applicability of power laws. This reveals that an organism's metabolic rate is proportional to its mass to the 3/4th power, indicating that larger animals are more energy efficient. This principle has profound implications for our understanding of species life cycles, growth rates, and sustainability.

Natural phenomena and human activities

Power laws govern a variety of phenomena, from the distribution of earthquake sizes to the frequency of words in a language. These explain why we observe a small number of important events along with a large number of smaller cases. For example, Zipf's law describes the frequency of words in a language and emphasizes that common words occur disproportionately compared to less frequent words.

Beyond natural phenomena

Power laws extend to human activities such as economics, finance, and technology. They elucidate the distribution of wealth, where a small number of individuals own a significant portion of the wealth. A power law in technology describes how content interacts on the Internet, with a small number of popular nodes and a large number of less popular nodes forming a long tail of distribution.

Bitcoin power law

Astrophysicist Giovanni Santasi discovered this connection. He said 15 years of data shows that Bitcoin also follows the power law principle. Santostasi first shared the power law model on his r/Bitcoin subreddit in 2018. However, the model was revived in January after financial YouTuber Andrei Jeikh mentioned it to his 2.3 million subscribers in a video.

Giovanni's theory suggests that Bitcoin prices are not as random as they seem. Despite the randomness, in the long run, the price of Bitcoin follows a certain mathematical model. It's not just a mathematical formula where someone drew a line. Instead, it follows a power law like the one observed throughout the universe.

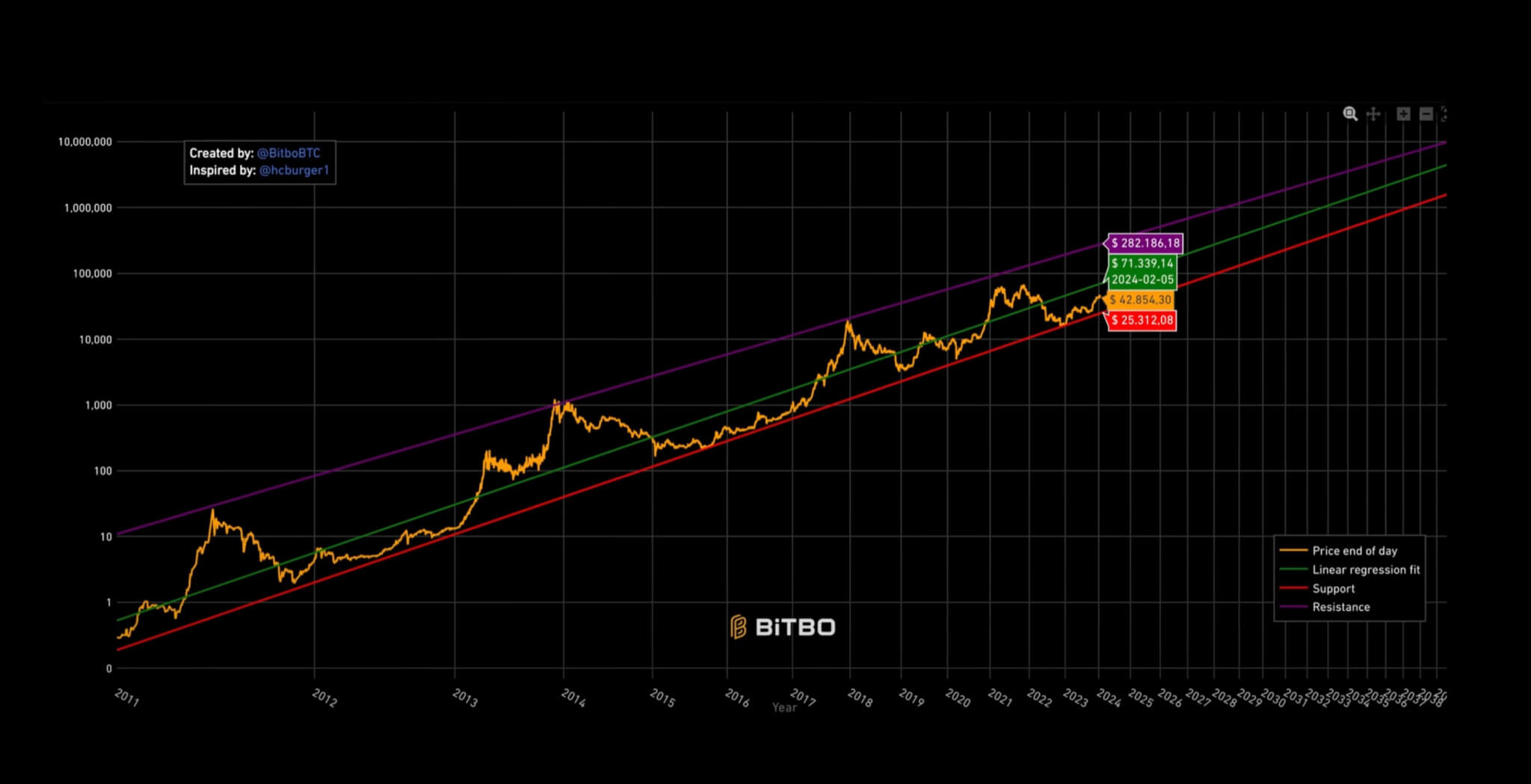

The yellow line represents the current price and the red line represents the support line. A support line is a level below which Bitcoin typically does not fall. The green line is the linear regression line, which is like the fair value price that Bitcoin will eventually return to, and the purple line is the resistance line where Bitcoin typically reaches its maximum value.

Predicting the future of Bitcoin

Santostasi's power law model graphs the trajectory of Bitcoin's price with amazing accuracy. This is a graph showing the current price of Bitcoin, a support line showing the level Bitcoin usually does not fall below, a linear regression line showing the fair value price, and a resistance line showing the level Bitcoin usually reaches before falling. is showing.

This model highlights Bitcoin's surprisingly linear growth, especially when outliers are removed. Despite occasional fluctuations, Bitcoin's overall trajectory follows a clear pattern reminiscent of other phenomena governed by power laws.

Impact on investors

The power law model provides interesting insight into Bitcoin's potential future peaks. According to Santostasi's analysis, Bitcoin could peak at $210,000 in January 2026 and then fall to around $60,000. He went on to predict that Bitcoin will be worth $1 million by July 2033. While mathematical models provide valuable insights, they are not free from error and may not account for unforeseen events that can significantly impact prices.

“All models are broken, but some are useful” means that the models may not be perfect, but can still provide valuable insights. Models such as power law models and equity-to-flow models for predicting Bitcoin prices have flaws and limitations. For example, Julio Marino of Crypto Quant pointed out problems with power law models, such as underestimating errors and giving a misleading impression of accuracy.

Interestingly, both power law and stock-to-flow models face similar criticisms. Despite their flaws, they have historically made roughly the same predictions for Bitcoin's price. However, over time, predictions can diverge.

If these models are correct, the question arises: why bother using traditional investment strategies like 60/40 portfolios? Some argue that a new model to explain Bitcoin's movements could yield better returns.

Some may think these models are worthless, but others, like the person I'm talking to, think they still have value. The scarcity caused by Bitcoin's fixed supply is contributing to the price rise. Additionally, factors such as M2 growth also affect Bitcoin price.

Although models provide useful insights, they cannot predict the future. Even if the model is flawed, Bitcoin's trajectory appears to be upwards. Therefore, it is essential to consider these models, but also to be aware of their limitations.