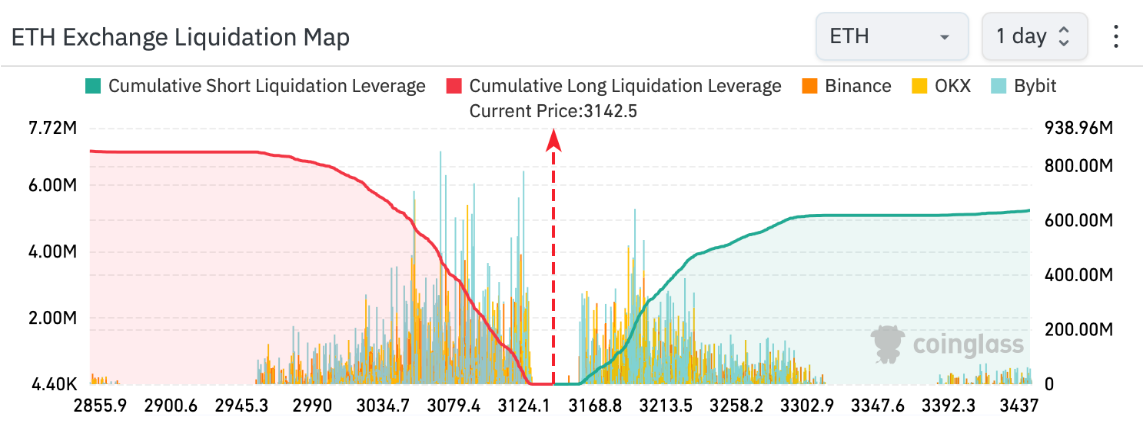

More than $500 million of long Ethereum (ETH) positions could be liquidated if the price drops further this weekend. This concern stems from the recent volatility seen in his ETH market, with sharp price movements being a recurring theme.

Price volatility threatens Ethereum longs

Last weekend, the price of ETH plummeted by 2.5%, dropping to $3,036, causing the liquidation of some long positions.

An even steeper decline of 9% occurred on April 13th, when the price fell to $2,950 before rebounding.

ETH is currently trading at $3,052, down 0.52% over the past 24 hours.

Similar price movements this weekend could lead to a larger wave of liquidations. Based on the current market position, if it falls another 9%, the liquidation amount could exceed $853 million.

Possible weekend volatility puts Ethereum longs at risk

Adding to the price uncertainty for Ethereum is the possibility that the U.S. Securities and Exchange Commission (SEC) will deny the application for a Spot Ethereum ETF in May.

Several U.S. issuers and other companies expect the Securities and Exchange Commission (SEC) to reject their applications.

#Ethereum The ETF is unlikely to be approved in May, but it is certain to be approved in August.

— Michael van de Poppe (@CryptoMichNL) April 26, 2024

The outlook follows meetings with four regulators and stakeholders in the past few weeks. The regulator maintained that all of these meetings were one-sided and that agency staff had no say in the proposed product.

Blockchain technology company ConsenSys recently filed a lawsuit against the SEC over its stance on potentially classifying ETH as a security.

The combination of potential weekend volatility and continued regulatory uncertainty surrounding spot Ethereum ETFs has created a tense atmosphere for Ethereum investors. With over $500 million long at risk, this weekend could be a pivotal moment for Ethereum investors and the altcoin market.