Bitcoin price continues to fight to close above the crucial $70,000 mark, but recent attempts have fallen short. This inability to secure a solid closing price is hurting long traders who have experienced large liquidations.

Nevertheless, overall market sentiment remains highly optimistic as traders maintain a bullish outlook on Bitcoin's potential for further upside.

Bitcoin bulls lose

In the past 24 hours, Bitcoin experienced an extended liquidation totaling $50 million following a 2% price decline. These liquidations represent the biggest losses for long traders in the past two weeks and reflect the challenge of maintaining price support around the $70,000 level. The recent decline has affected investor sentiment, with some traders starting to consider the possibility of further declines.

This prolonged wave of liquidations highlights the inherent volatility in Bitcoin price movements, as even small declines can trigger significant market reactions. Nevertheless, the tenacity of long traders is noteworthy.

Many are holding their ground, suggesting they believe Bitcoin has the ability to overcome these challenges and resume its upward trajectory. This resilience shows that market confidence remains largely intact despite short-term setbacks.

Read more: What happened during the last Bitcoin halving? Predictions for 2024

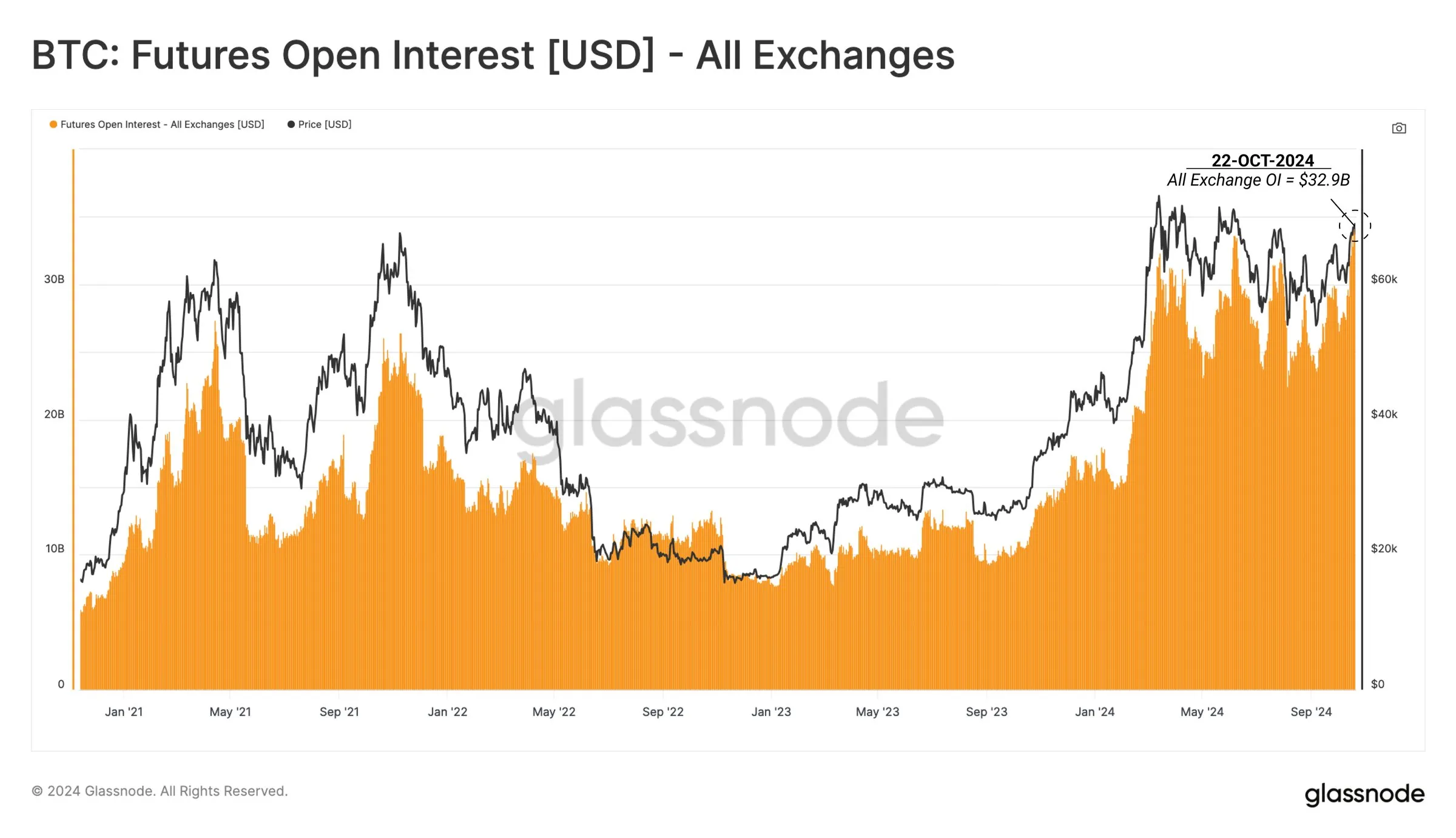

Bitcoin's macro momentum appears to be strong, with open interest (OI) reaching an all-time high of $32.9 billion. This peak indicates a high level of engagement among traders as more funds are flowing into Bitcoin despite recent liquidations.

This rise in open interest suggests that Bitcoin’s recent volatility has not hindered trader confidence. Rather, it shows that both institutional and retail investors are backing Bitcoin with large amounts of capital, reflecting their belief in the long-term potential of the Bitcoin asset.

BTC Price Prediction: Aiming for a breakout

Bitcoin is currently trading at $67,007, about 10% below its all-time high of $73,800. At this level, BTC is also approaching a potential breakout from the descending wedge pattern, a technical setup known to precede significant price movements. If Bitcoin breaks out of this pattern, it could start a strong rally towards the $73,000 level.

The wedge pattern indicates a 27% upside potential, which gives Bitcoin a target price of $88,185. While this ambitious goal is achievable, the more immediate goal remains to break through the all-time high of $73,800 as Bitcoin consolidates its upward trajectory.

Read more: The history of the Bitcoin halving: Everything you need to know

However, Bitcoin is still struggling to achieve a clear breakout, with $67,000 serving as a key support level. Failure to hold this support could cause BTC to fall to $65,000, delaying the expected breakout and damaging the bullish outlook.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although BeInCrypto strives for accurate and unbiased reporting, market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.