In a report released this Wednesday, Fidelity Digital Assets, in collaboration with Lightning Payment Provider Voltage, released a report on the state of the Lightning Network.

This report details many ways the Lightning network has grown since its launch in 2018.

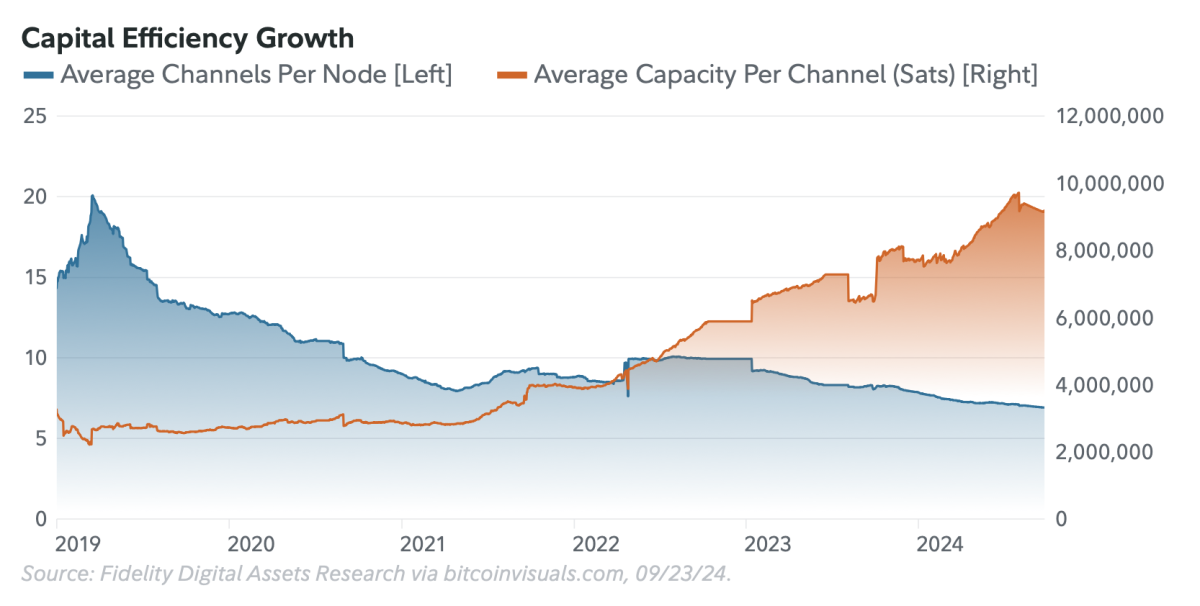

It also shows that in 2024 more companies are beginning to adopt lightning than they did last year, with larger channels being formed on the network, with more Lightning nodes coming online.

Some important statistics for the work include:

- Total lightning capacity derived in the US dollar has increased by 2,767% since 2020

- Its Bitcoin removal ability increased by 384% over the same period

- Currently, almost all payments for lightning below 1,000,000 SAT processed in under 1.1 seconds

These statistics made me optimistic, but that was the other information in the report, which really resonated with me and rethinked how I viewed Bitcoin and lightning.

Below were the top three takeaways in the report.

- Nostring's payments are gaining traction with Nostr (the world's largest Bitcoin Circulation Economy) as NOSTR users have sent over 3.6 million Zaps in the last six months

- Another Bitcoin Layer 2 protocol, ARK, shows that Lightning has use cases beyond just peer-to-peer channels (ARK is a larger user base rather than a one-to-one basis). It shows you can share virtual UTXOS (VUTXOS) with groups) – you can build it in a way that many people didn't expect first

- The “HODL” mentality is one of the things that still delay the adoption of lightning. In other words, if Bitcoin enthusiasts don't use Bitcoin, the growth of lightning could stagnate and could hurt Bitcoin's value proposition

So, we're here at the beginning of 2025, so it's a year that many people think will become bigger to lightning, so I'll see what traction has gained in the next 10 months. I'm not optimistic.

Bitcoin is used as a medium of exchange, more often than not Satoshi intended it.