- Demand for XMR has surged in recent days

- This comes despite proposed plans to shut down LocalMonero.

Monero’s native coin, XMR, appears poised to continue its seven-day rally despite the negative sentiment surrounding the shutdown of LocalMonero, a peer-to-peer (P2P) trading platform for privacy coins.

May 7, LocalMonero Announced The company announced that it has disabled all new registrations and advertising posts for XMR on its platform, adding that it will disable new XMR transactions on May 14 and remove the website by November 7.

XMR turns a blind eye

At the time of writing, the popular privacy coin is valued at $132.52, according to CoinMarketCap, and has risen 8% over the past seven days. This is despite the fact that the overall market has generally remained cautious thus far.

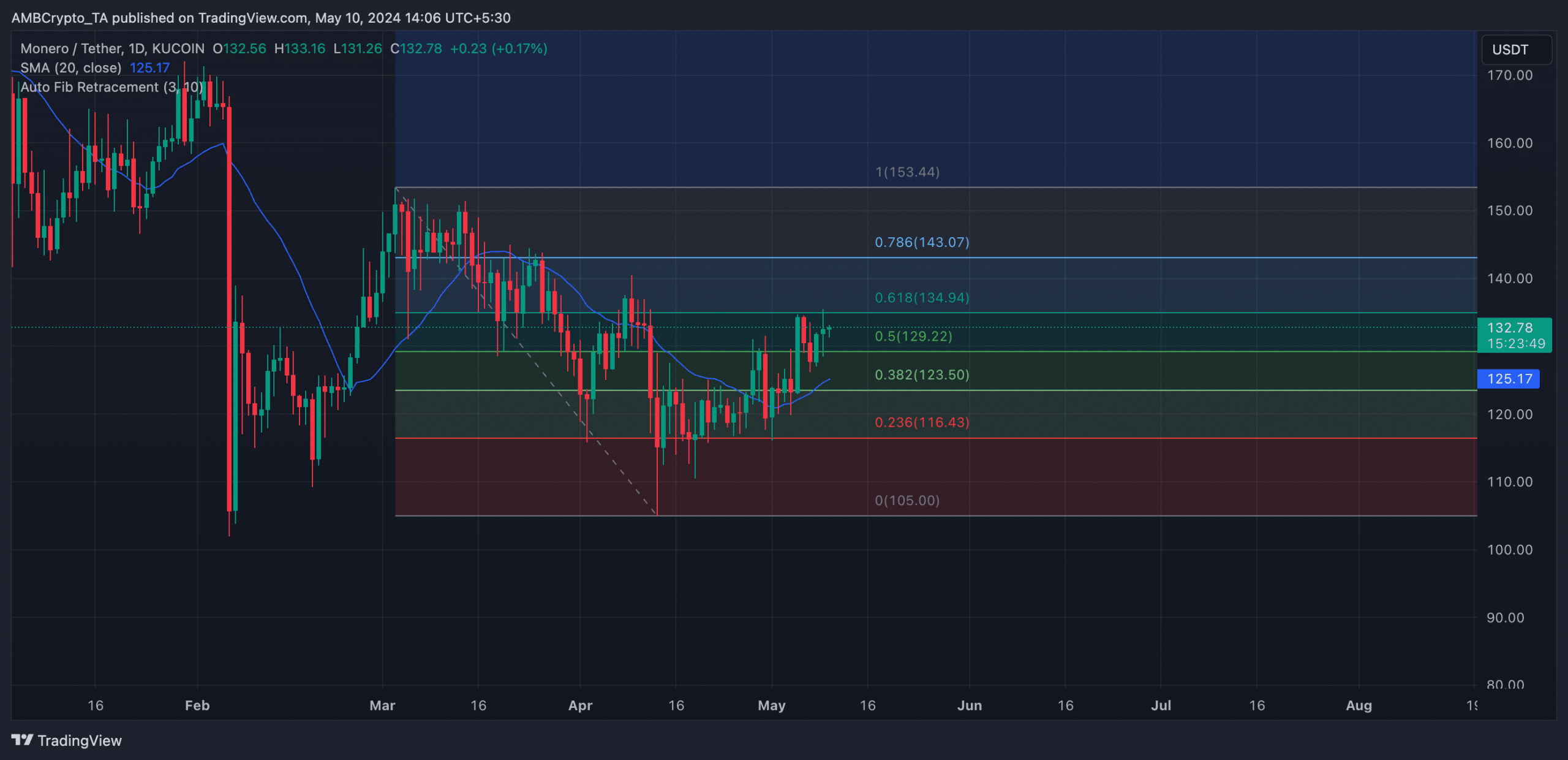

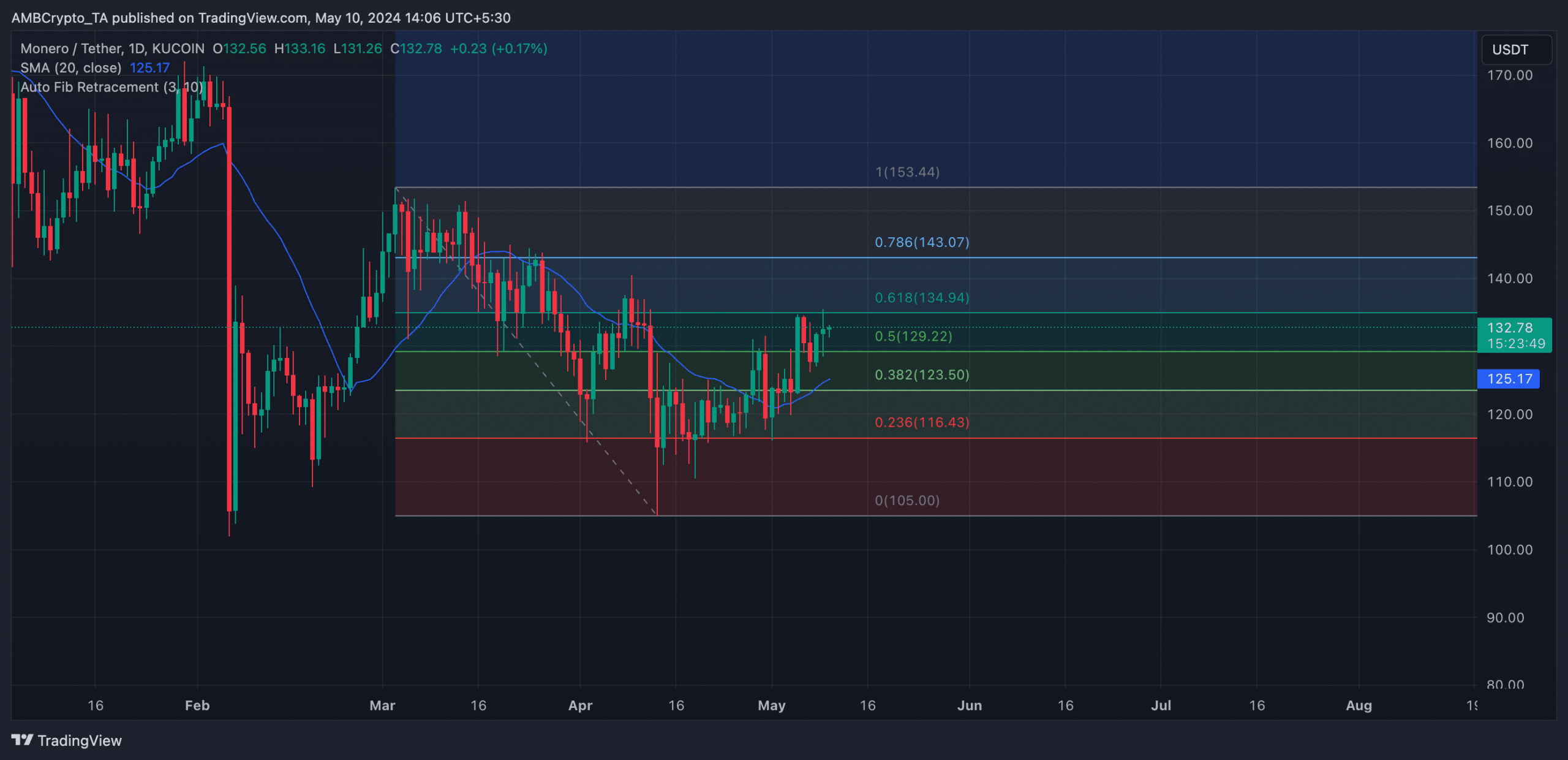

Evaluating the price action on the daily chart confirms that the upside may continue in the short term. For instance, at the time of writing, the altcoin's price was trading above the 20-day small moving average (SMA). An asset's 20-day SMA is a short-term moving average that reflects the average closing price over the past 20 days.

When an asset's price is below market value, it indicates that the short-term trend of that asset is trending up. This is often seen as a sign that buyers are in control of the market and a sustained upswing is possible.

An asset's 20-day SMA is a short-term moving average that reacts quickly to price changes. It reflects the average closing price of an asset over the past 20 days.

Monero [XMR] Price Forecast 2024-25

Additionally, XMR’s upward momentum indicators suggest that buying momentum is picking up across the market: At press time, the coin’s Relative Strength Index (RSI) was at 57.13 and Money Flow Index (MFI) was at 71.69.

At these values, these indicators suggest that market participants prefer accumulating XMR over distributing it.

To check the inflow of liquidity into the XMR market, the Chaikin Money Flow (CMF) reading was 0.14 at the time of writing. This indicator measures the inflow and outflow of funds into and out of an asset, and a positive CMF is considered a sign of market strength.

As for XMR’s next price point, a Fib retracement reading reveals that if XMR breaks through the $134 price level, it will aim to trade at $143 on the charts.

XMR/USDT chart. Source: TradingView

However, if this proves invalid and the bears exert pressure on the market, the altcoin price can sink below $125.