- Monero (XMR) stable in the past 24 hours

- Nick Szabo recommends Monero

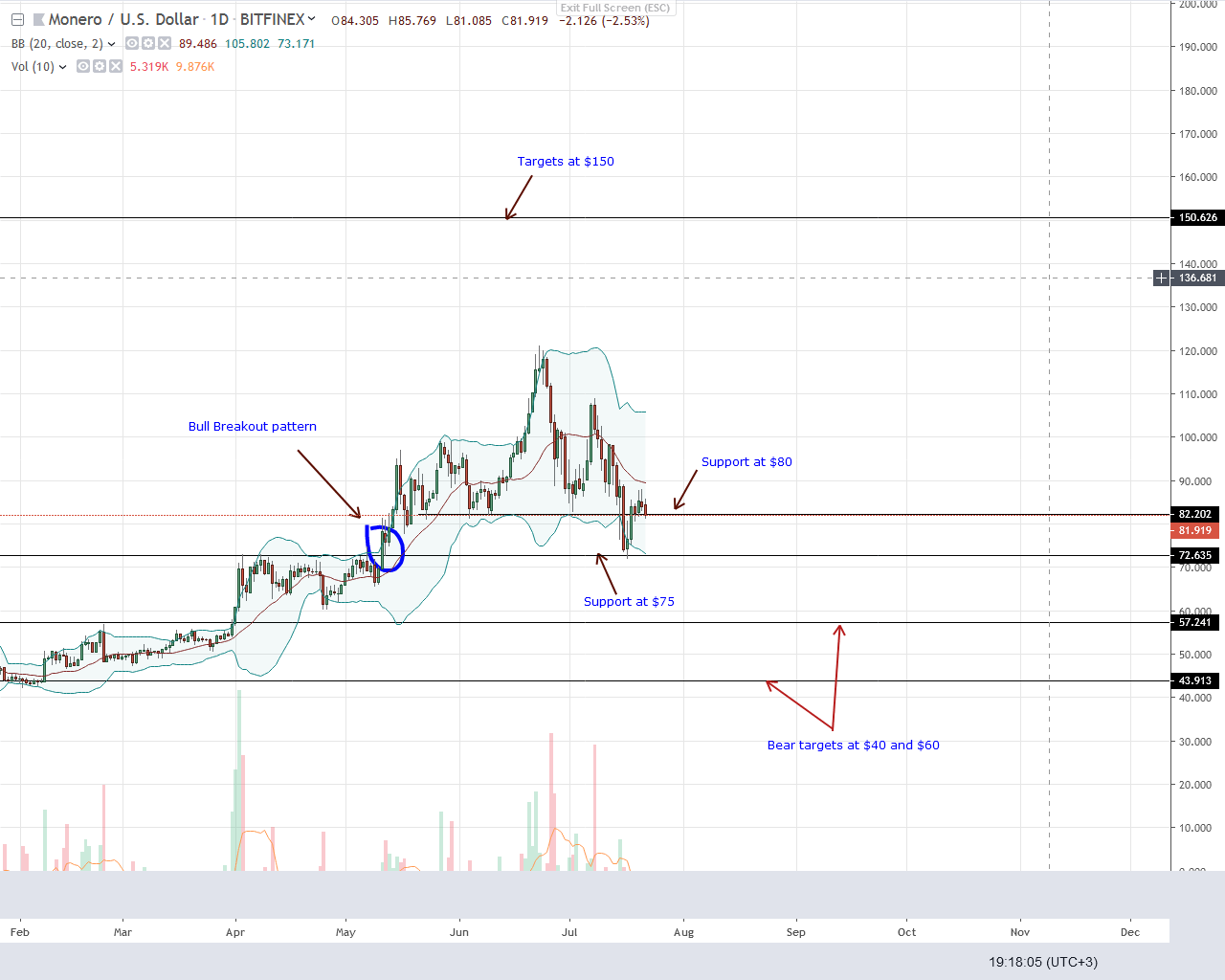

Privacy is the future, and Monero is well positioned. Despite relying on developers, Monero has been resilient as a network, rejecting attempts to centralize miners. So far, like most coins, XMR has been vulnerable. Still, it is trading within a bullish breakout pattern against the USD.

Monero Price Analysis

Basics

The future is indeed private. It is a conscious movement of citizens against megacorporations intent on collecting our data and processing it for their own profit. Social media giant Facebook is one such company. Despite a $5 billion settlement with regulators, the company is considering launching a multi-fiat backed stablecoin.

While the idea is novel in theory, it raises concerns. One is that Facebook might not be trusted with financial data, given its track record.While Facebook's Libra can weather the storm, Monero, the most talked-about privacy coin, has a chance. It's already garnering support from smart contract creator Nick Szabo.

This is a high-profit share that solidifies the ambitions of Monero developers to create the perfect cryptocurrency: cheap, secure, and above all, completely decentralized and therefore free of vulnerabilities.

Still, there is always a trade-off: in the pursuit of full decentralization and the use of ASIC miners, the network is becoming more vulnerable. Not only is it less secure in terms of computing power, but there is also the risk that Monero's code will be handed over to developers who rely on frequent upgrades.

Candle stand arrangement

Currently, XMR is stable but under pressure. Just like BTC and other highly liquid coins, the bears may return. This is regardless of whether XMR is trading within a bullish breakout pattern against the USD.

Otherwise, XMR is likely to decline unless it surges above the mid-point Bollinger Band (BB), soft resistance and the round figure of $100. From the chart, it is clear that XMR bulls are weak.

Notice that despite the undervaluation on July 17, the price is still fluctuating within the trading range of July 16. If anything, this is bearish. Therefore, in terms of effort and results, this is an opportunity for the bears to re-enter. The immediate target is $50.

Besides that, as of June 26th, XMR has been falling on the back of increased trading volume, as shown by the candlestick chart on July 8th.

Technical Indicators

As mentioned earlier, leading this trading plan is the bearish candle on July 8. Volume is decent at 48,000.

Given the participation level compared to the recent $10,000 average, a surge of over $100 on high volume above $48,000 would lock in buyers in early May.

In that case, XMR could rise to $120 and then $150. Conversely, a drop below $75 could pave the way to $60 and possibly even $40 if the bears remain persistent.

chart Provided by Trading View. Image courtesy of Shutterstock