Important points

- MicroStrategy plans to increase its authorized shares to support its Bitcoin buying strategy.

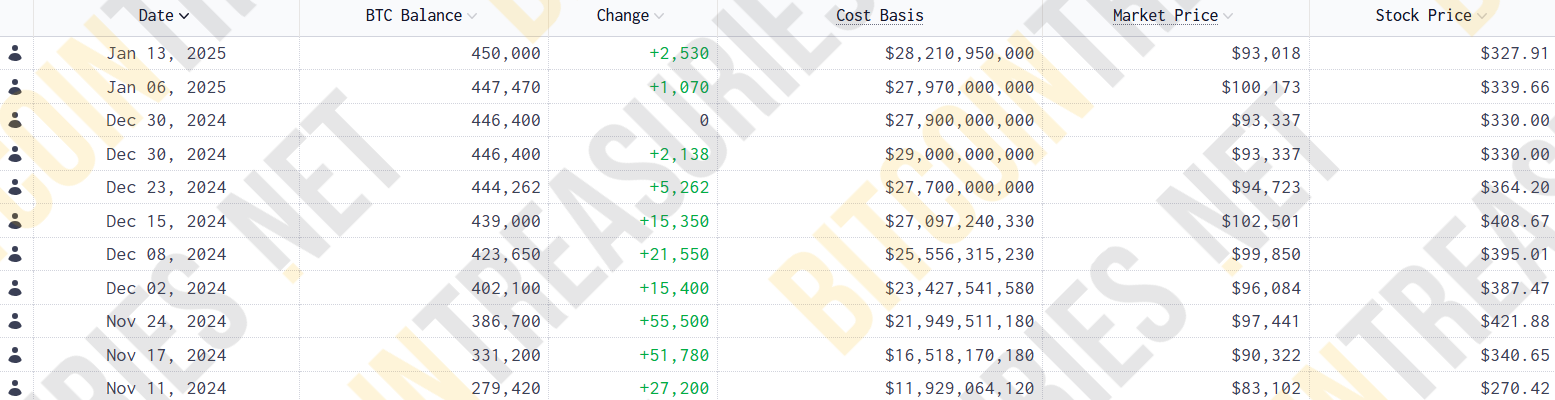

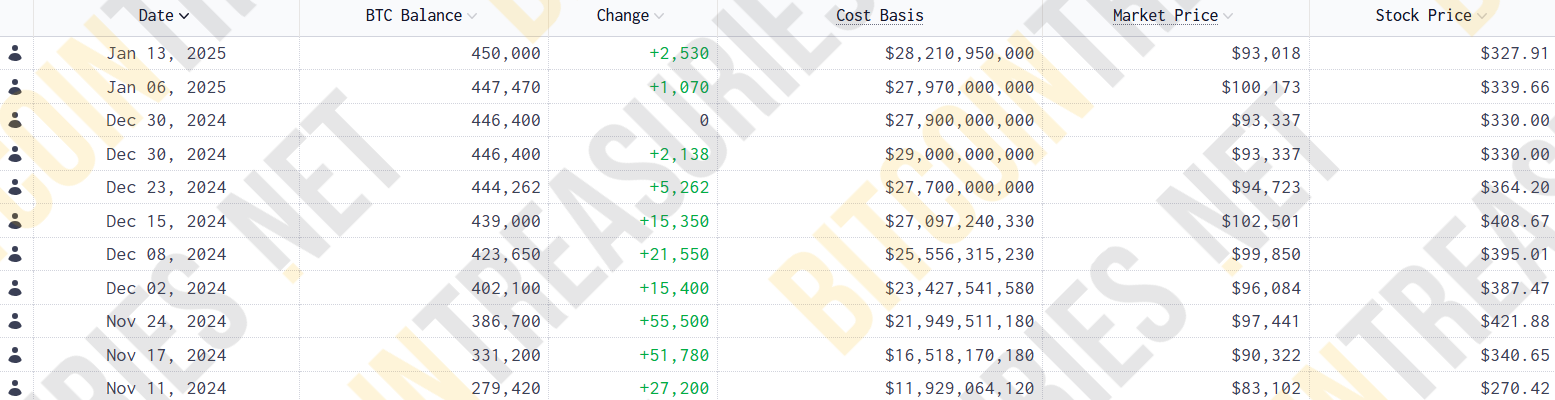

- The company's Bitcoin holdings have soared to 450,000 BTC and are now worth $48.5 billion.

Share this article

According to a recent report from Bloomberg, MicroStrategy shareholders are scheduled to vote on several key proposals at a special meeting scheduled for Tuesday at 10 a.m. New York time.

The primary focus of the vote will be to approve an increase in authorized Class A common stock from 330 million shares to 10.3 billion shares. Shareholders will also consider increasing the number of authorized preferred shares from 5 million shares to 1 billion shares.

Bloomberg believes MicroStrategy's upcoming shareholder vote will easily approve the proposed action, given co-founder and chairman Michael Saylor's substantial voting power of approximately 46% with Class B shares. reported that it is highly likely.

The company also plans to raise up to $2 billion through an offering of preferred stock on top of its Class A shares.

The increase advances MicroStrategy's 21/21 plan, which aims to raise $42 billion over three years through equity issuance and bond sales to support a major Bitcoin acquisition.

Since revealing this plan, MicroStrategy has accumulated 197,780 BTC through 10 consecutive weeks of purchases, reaching almost halfway to its goal in over two months. Mr. Thaler previously told Bloomberg that the company would reevaluate its capital allocation strategy after reaching its goal.

The next meeting will also include amendments to the company's stock incentive plan, including automatic stock grants to newly appointed directors.

After its latest Bitcoin purchase, MicroStrategy maintains $6.5 billion in equity issuance under its $42 billion plan.

The Tysons, Virginia-based company currently holds approximately 450,000 BTC, worth $48.5 billion at current market value. He has invested about $28 billion in Bitcoin holdings, with an average price of $62,691.

Share this article