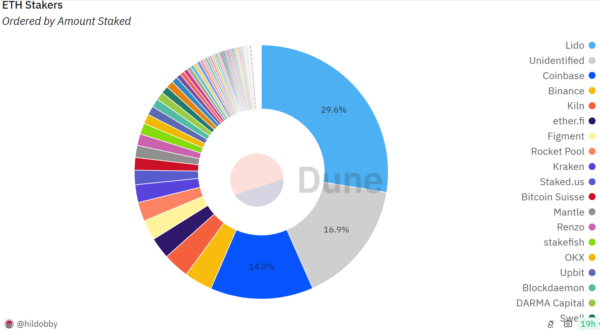

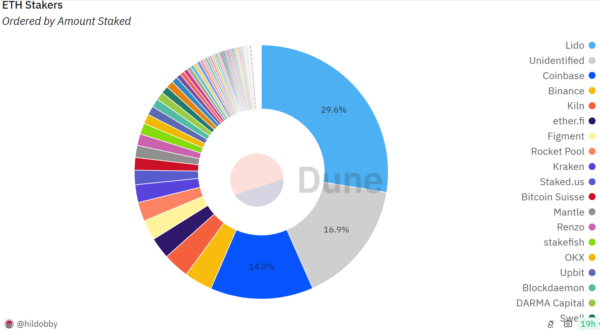

Due to the proliferation of Ethereum stakers, Lido's market share has declined, from 32% in December 2023 to 29.57% currently. This decline alleviated concerns surrounding Lido's dominance in the ecosystem.

Lido has been able to control a significant portion of the market due to its dominance and limited competition in ETH staking. However, concerns in the community grew as a company holding over 33% of the Ethereum chain's market share could have some influence.

As of April 4, Lido's market share in staked ETH is below 30%, according to Dune data.

Cryptocurrency exchanges such as Coinbase and Binance play a key role in ETH staking, along with Ethereum staking platform Kiln, holding 14.04%, 3.75%, and 3.5% respectively. .

Surprisingly, unidentified entities accounted for the second largest share at 16.9%. Of the 26 known companies, Kraken, Bitcoin Swiss, OKX, and Upbit also contributed, with shares ranging from 1.1% to 2.4%.

Vitalik Buterin, co-founder of Ethereum, defender We set a stake pool control cap of 15% and adjust fees accordingly to maintain this threshold.

The Lido decentralized autonomous organization (DAO) community attempted to address the issue of Ethereum (ETH) staking dominance by proposing hard limits in May 2022. However, this proposal was rejected by the DAO in June 2022 with a vote of 99.81%.

Increasing competition among Ethereum (ETH) staking service providers is expected to significantly contribute to the continued decentralization of the staking ecosystem.

Also read: VanEck predicts Ethereum Layer 2 network cap at $10 trillion in 6 years