- Buying pressure on Lido was high throughout last week.

- On the charts of LDO, most indicators and market sentiment were bullish.

The hype Ethereum ETFs had a positive impact Lido DAO [LDO] The magnitude of the price increase was huge as the token boosted its price significantly, with the cryptocurrency posting double-digit gains on the charts in the past 24 hours alone.

Lido Bull Market

Lido has been one of the tokens that has benefited most from the Ethereum ETF approval, with its price increasing by more than 40% in the past seven days. CoinMarketCapOver the past 24 hours, the token has increased in value by over 11% and is trading at $2.53 at the time of writing, bringing its market cap to over $2.25 billion.

However, what is interesting here is that while Lido has grown by double digits, the value of ETH has only increased by 1% in the aforementioned period. In fact, a bullish pattern is expected to emerge on the LDO price chart, which could lead to further increases in LDO price.

Popular crypto analyst World of Charts recently Tweet A bullish flag pattern has emerged. The latest price rally has pushed LDO price towards the upper limit of the pattern, above which a further growth of around 250% is expected in the coming weeks.

Will LDOs continue to grow?

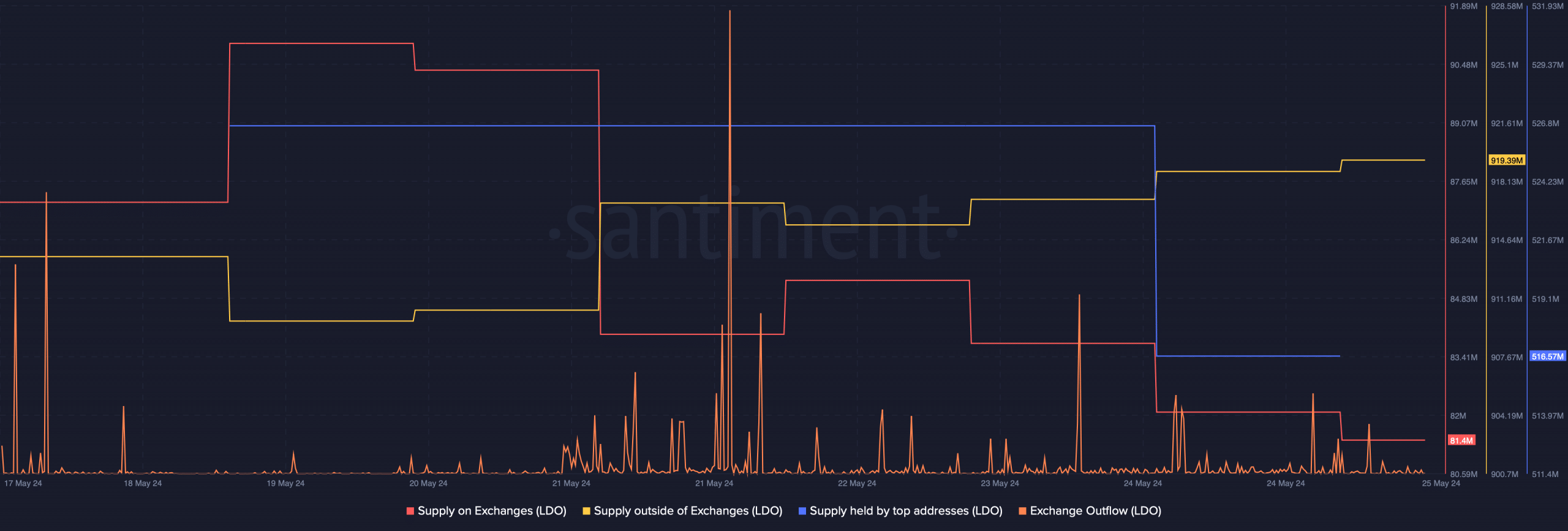

To see if LDO can break out of the bull market, AMBCrypto analyzed data from Santiment. According to our analysis, LDO outflows from exchanges surged last week, indicating increasing buying pressure. The fact that investors are buying LDO is further evidenced by exchange data.

The token's on-exchange supply has fallen sharply, while off-exchange supply has increased. Increased buying pressure often drives prices higher, increasing the likelihood of a bullish breakout. However, the token's supply held by top addresses fell on May 24, a sign that whales sold their holdings to take profits.

Source: Santiment

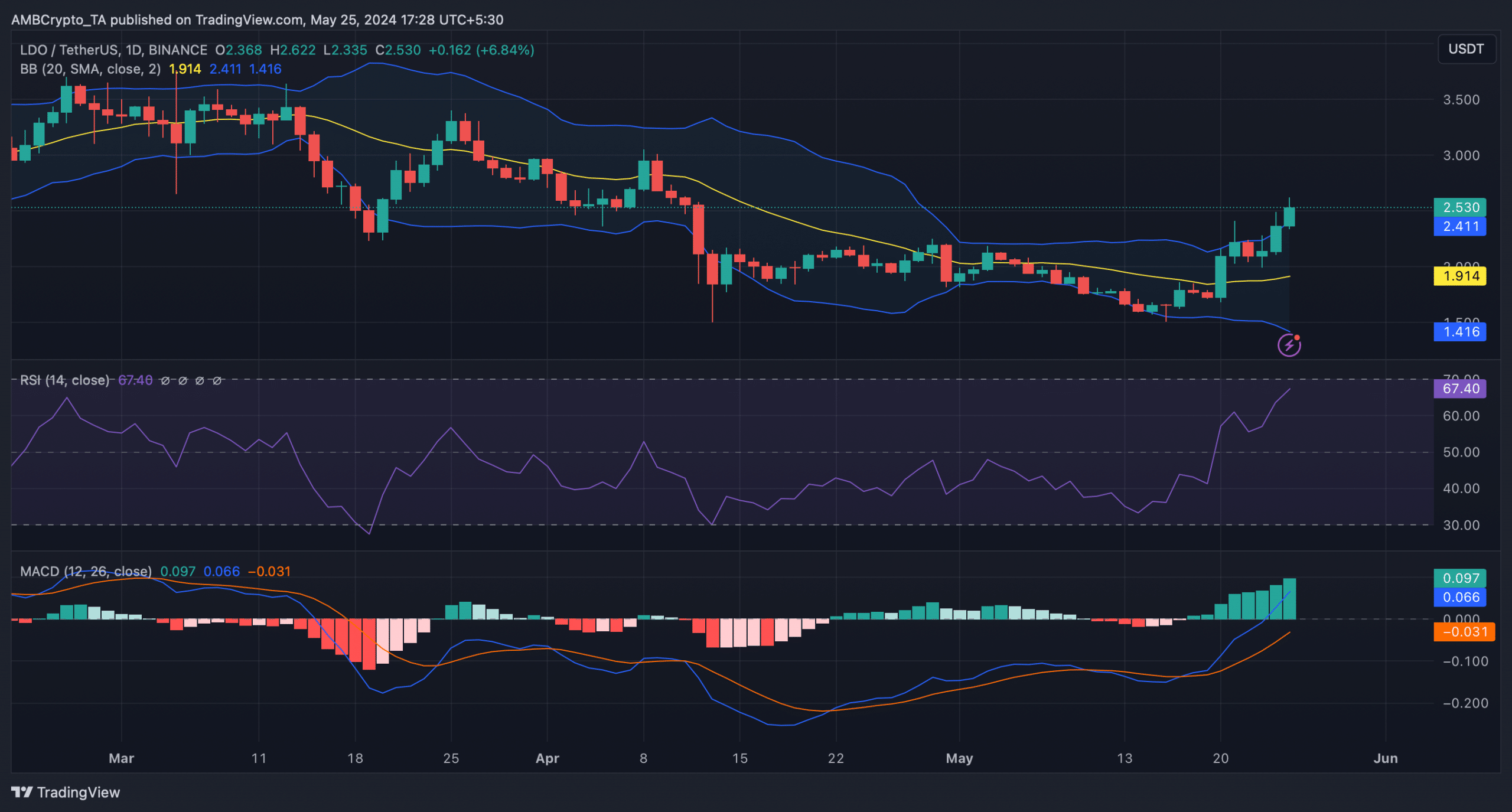

We then analyzed the daily chart to get a better understanding of whether LDO will continue its bull run. The technical indicator MACD showed a clear bullish dominance in the market.

Additionally, the Relative Strength Index (RSI) also recorded a sharp increase, suggesting a sustained price upswing. However, the token’s price has reached the upper end of the Bollinger Band, which often leads to a price correction.

Source: TradingView

read Lido DAO [LDO] Ply Forecast 2024-25

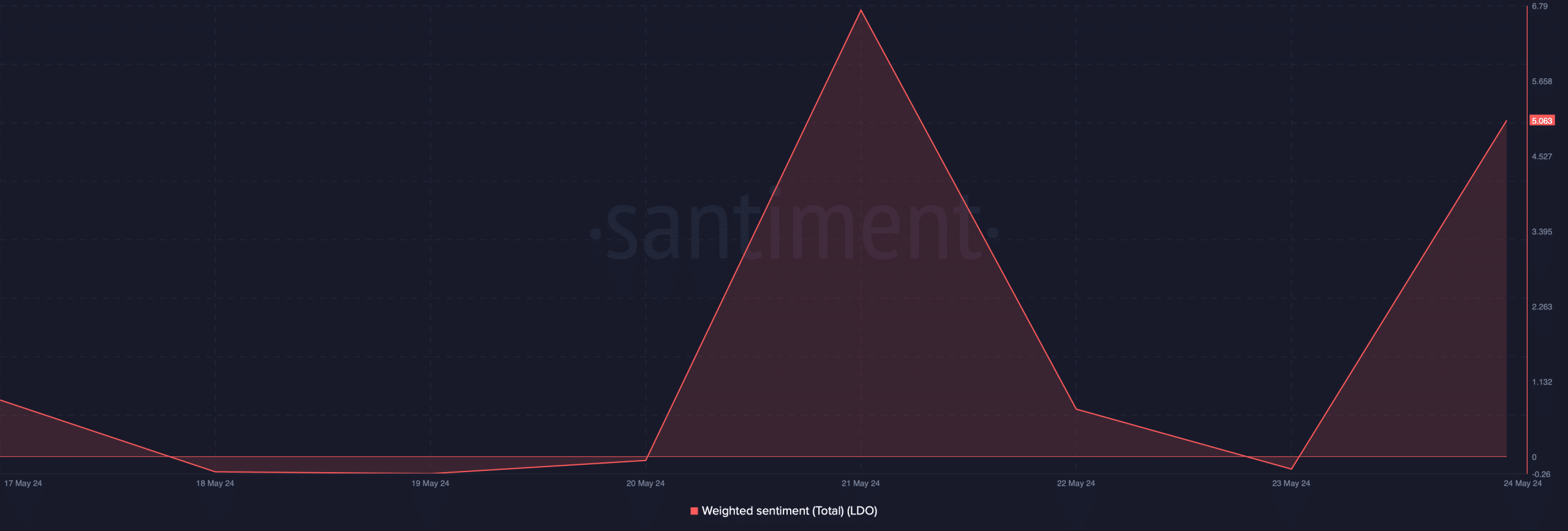

That being said, investor confidence in Lido remains high.

The same was evident from Santiment data, which revealed that LDO's weighted sentiment spiked on May 24 after a decline.

Source: Santiment