- Monero's price fell by more than 10% after Kraken announced it would delist XMR trading in Europe.

- Monero price fell below the key support level of $152.83 on Tuesday, signaling a continuation of the bearish trend.

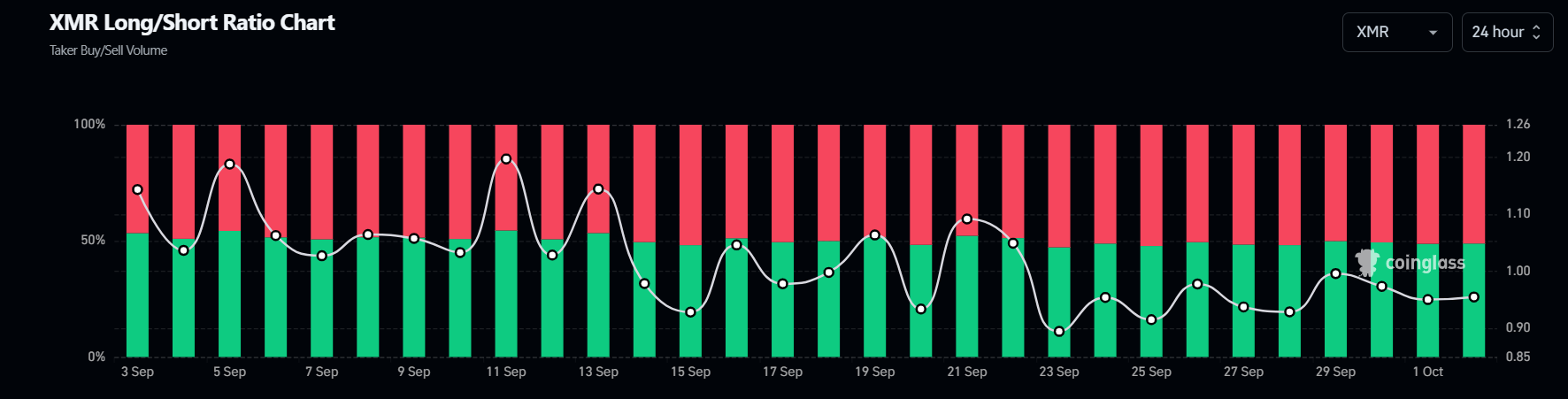

- XMR’s long-short ratio supports a bearish outlook, but a close above $156.48 would increase the chances of a recovery.

Monero (XMR) showed weak trading in the red on Wednesday after falling more than 6% the previous day. This bearish move was supported by XMR falling more than 10% at one point on Tuesday after Kraken announced it would delist XMR trading in Europe. Additionally, XMR’s long/short ratio shows that more traders are expecting a decline in Monero price.

Monero delisted from Kraken exchanges in European countries

On Tuesday, Kraken Exchange announced to its users that Monero will be delisted from the European Economic Area (EEA) due to regulatory changes. As a result, Monero closed down more than 6% on Tuesday, with losses as high as 10% earlier in the day.

“On October 31st, we will suspend trading and deposits in all XMR markets (XMR/USD, XMR/EUR, XMR/BTC, XMR/USDT) for customers registered in the EEA,” Kraken said. said. Any open XMR orders will also be automatically closed at this time. ”

It continued that the XMR withdrawal deadline is December 31st. For customers who still hold XMR balances after this date, Kraken will automatically convert their XMR to BTC at the current market rate.

Monero price trend shows weakness

Monero prices broke below the downtrend line (marked by connecting multiple lows since early August) on September 24th, and fell 14.5% in one week. On Tuesday, it closed at $152.83, below the 61.8% Fibonacci retracement level (from an early August low of $135.98 to a September high of $180.10). As of writing on Wednesday, it continues to trade around $144.96.

If the 61.8% Fibonacci retracement level at $152.83 holds as resistance, it could continue lower and retest the August 5 low of $135.98.

The Moving Average Convergence Divergence (MACD) indicator further supports the decline in Monero, showing a bearish crossover on the daily chart. It also shows a rising red histogram bar below the neutral zero, suggesting continued strong bearish momentum.

XMR/USDT daily chart

Coinglass’ long-short ratio is 0.9, further supporting Monero’s bearish outlook. A ratio below 1 reflects bearish sentiment in the market, as more traders are betting that asset prices will fall.

Monero long to short chart

Despite Monero's delisting from the Kraken Exchange, bearish price action, and weak on-chain indicators, it would be bearish if the Monero daily candlestick breaks above $152.83 and closes above the 200-day EMA of $156.47. Forecasts will be invalidated. This scenario could lead to an increase in Monero price and retest the next daily resistance level at $180.79.