Ethereum founder Vitalik Buterin is under pressure from the US Securities and Exchange Commission (SEC). Now, his CEO at ConsenSys is hitting back at the commission's move. Here's what you need to know.

A top-down preview of Ethereum shows that it is broader and deeper than Bitcoin. This layer pioneered smart contracts and gave it an edge over the world's most valuable networks.

But despite billions of dollars moving through Ethereum each year and developers finding new ground, the U.S. Securities and Exchange Commission (SEC) has decided that, at least for now, its native currency, ETH, is no different from Bitcoin. I think they are not similar.

Bitcoin was introduced without an ICO or pre-mining. No one received anything. There are no foundations, team members, advisors, or other resources. To earn BTC, you had to mine it. Satoshi has mined 1 million BTC, but these coins have not been moved in over 15 years.

What's going on with Ethereum founders, ConsenSys, and the SEC?

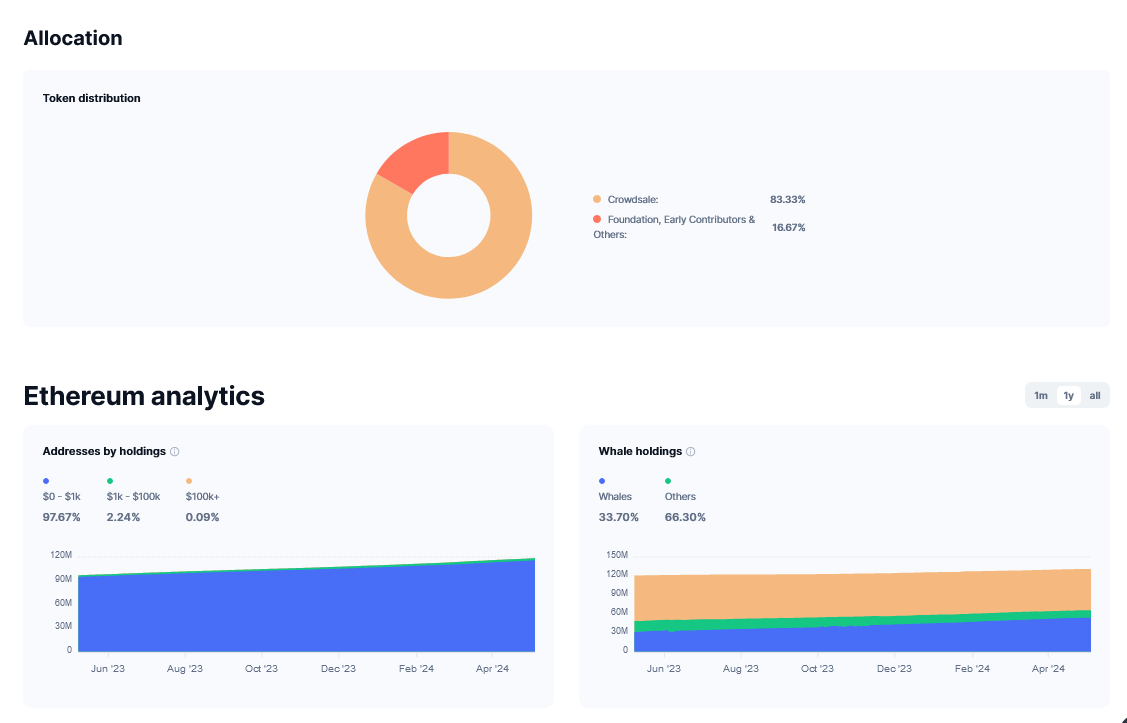

Looking at Ethereum, a large portion of the initial supply of 72 million ETH, estimated at 70%, was distributed or pre-mined to the Ethereum Foundation, teams, advisors, etc. even before the platform launched.

(Dune)

This decision poses a major problem for Ethereum nearly a decade after its launch. Reports in April suggested that the US SEC was investigating the Ethereum Foundation and was considering classifying ETH as a security.

Some say that for the past year or so, chairman Gary Gensler has considered ETH to be an unregistered security. ConsenSys, an Ethereum-focused company founded by Joe Lubin, sued the agency over the classification of ETH.

Specifically, the company filed a complaint expressing concerns about the SEC's actions against Ethereum, specifically the impact it could have on the network of investors' portfolios.

The concerns appear as regulators are about to take a hard crack at Metamask, a non-custodial wallet used by millions around the world to connect to Ethereum-compatible platforms such as Ethereum and Polygon. Occasionally occurs.

Discover: The best way to easily buy Ethereum in May 2024

Conclusion: A victory for ConsenSys is also a victory for Vitalik Buterin.

ConsenSys accuses the SEC of overreach and enforcement regulation.recently interviewJoe Rubin also argued that ETH, like Bitcoin, is a commodity and not a security.

As cryptocurrency rules evolve in the United States, ConsenSys' victory could accelerate the development of clearer legislation and bring clarity to ETH. Rubin said in an interview that regulators are reinforcing the false narrative that the coins are securities.

Clarity on Vitalik Buterin’s Ethereum could pave the way for spot ETFs to be finally approved in the coming months. BlackRock, Fidelity and others have expressed interest in issuing derivative products, which could open up new investment opportunities.

Rubin worries that an SEC victory could stifle innovation, hinder the development of cryptocurrencies, and lead to the centralization of power. Their lawsuit is an attempt to prevent regulators from extending their jurisdiction over the future of the internet, the co-founders added.

ConsenSys hopes this lawsuit will provide clarity and establish a “safe haven” for decentralized protocols to thrive. Still, this lawsuit (learning from a similar battle with Ripple) could drag on for years.

Explore: Cryptocurrency will extend human lifespans: Revealing DeSci – How VitaDAO is accelerating longevity science

Disclaimer: Cryptocurrency is a high-risk asset class. This article is for informational purposes only and does not constitute investment advice. You could lose all your capital.