Bitcoin's appeal is growing as investors become more aware of its unique characteristics. A spot Bitcoin exchange-traded fund (ETF) could simplify the process for investors and drive Bitcoin prices up substantially.

Motley Fool analysts emphasized that the approval of a Bitcoin ETF would be a big step forward in the acceptance of the cryptocurrency, which they believe could drive the price of Bitcoin to $400,000 or even $1 million.

Bitcoin's journey to over $400,000

ETFs give retail investors easier access to Bitcoin by allowing them to avoid complex cryptocurrency exchanges and digital wallets.

However, there is significant growth potential for institutional investors entering the Bitcoin market. These include pension funds, retirement plans, and hedge funds that manage huge sums of money. Until now, these institutional investors have been hampered by the complexity of digital assets, but ETFs now make it easier for them to include Bitcoin in their portfolios.

Read more: Bitcoin Price Prediction 2024/2025/2030

To date, around 700 professional investment firms have invested around $5 billion in these ETFs. Leading investors include Millennium Management, which has allocated around 3% of its $64 billion portfolio to the Bitcoin ETF. Other notable participants include Morgan Stanley, Bracebridge Capital and the Wisconsin State Board of Investment.

Despite this growth, institutional investors still only account for around 10% of ETF total holdings. This figure is on the rise, signaling growing institutional interest, which could significantly boost demand for Bitcoin. Institutional investors often conduct extensive due diligence before diversifying into a new asset like Bitcoin.

“But I think after doing their research, they will likely come to the same conclusion: Bitcoin's inherent properties make it a must-have in any portfolio. Ultimately, we will see widespread adoption among institutional investors and a tsunami of capital inflows,” the Motley Fool analyst said.

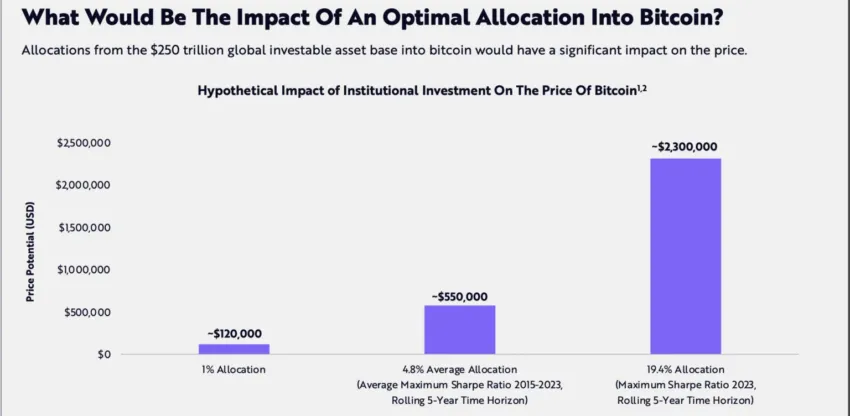

This investment shift isn't just about increasing Bitcoin ownership. It's also about strategic financial planning. The assets under management at these institutions are huge, so even a small allocation to Bitcoin could have a big impact. Allocating 5% of the $129 trillion in assets under management by institutions to Bitcoin could drive the market cap to over $7 trillion and the price to over $400,000.

Some analysts believe a 5% allocation is too conservative, with ARK Invest suggesting that an optimal portfolio should include up to 19% Bitcoin to maximize risk-adjusted returns.

Read more: 7 Best US Cryptocurrency Exchanges to Trade Bitcoin (BTC)

Their recommendations are based on five-year ongoing analysis and favor higher allocations to maximize portfolio performance.

As investment strategies evolve, Bitcoin's role in future financial portfolios appears to be becoming more important. Observing the gains made by their peers, more institutions may feel the need to increase their investments in Bitcoin.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto strives for fair and transparent reporting. This news article aims to provide accurate and timely information. However, readers are encouraged to independently verify facts and consult with experts before making any decisions based on this content. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.