Domoscanonous

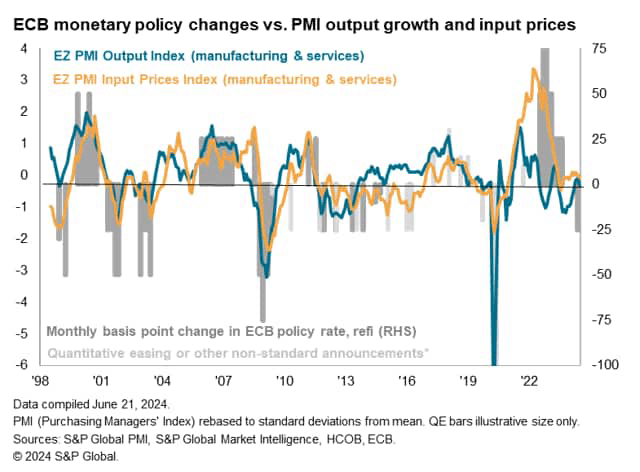

The preliminary PMI survey data for June provides an early look at the euro zone's economic health after the European Central Bank cut interest rates for the first time in five years. The survey showed an unexpected slowdown in the pace of economic recovery. Economic growth slowed, counter to consensus expectations of faster growth, and manufacturing in particular continued to deteriorate and the pace of deterioration accelerated, but at the same time price pressures fell further, to levels that historical comparisons suggest would be consistent with the ECB's inflation target.

S&P Global PMI, S&P Global Market Intelligence, HCOB, ECB

Here are five key takeaways from the preliminary June PMI data:

1. Economic growth declined in June

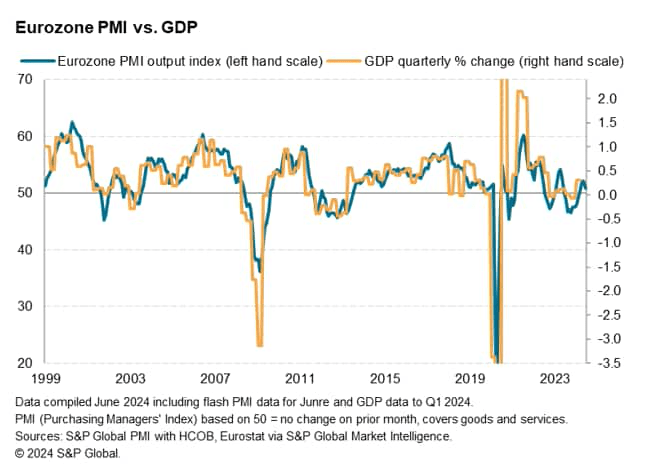

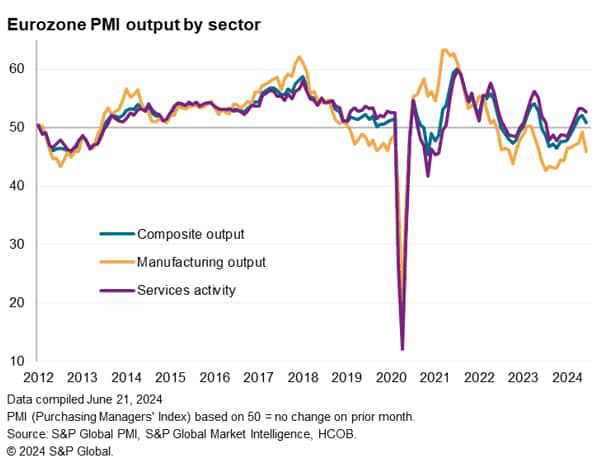

The seasonally adjusted HCOB flash Eurozone Composite PMI Production Index is compiled by S&P Global based on approximately 85% of normal survey responses. The index rose to 50.8 in June from 52.2 in May. Economists had expected a rise to 52.5.

While it suggests output has grown for a fourth consecutive month after a nine-month period of decline, the latest reading is the lowest in three months and points to euro area GDP languishing with quarterly growth of just over 0.1% (according to a simple OLS regression model based only on previous PMI and GDP data). For the second quarter as a whole, the PMI average of 51.6 suggests GDP will rise by 0.2%.

S&P Global PMI, HCOB, Eurostat, S&P Global Market Intelligence

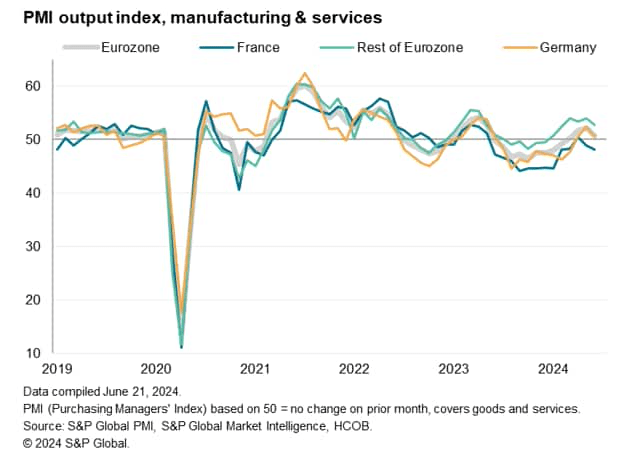

The worsening euro area growth trend was led by France, where output fell for a second consecutive month, the sharpest decline in five months. Companies reported that the deterioration was partly linked to increased uncertainty and sluggish spending following the sudden announcement of parliamentary elections. France's flash composite PMI pointed to stagnant GDP in June and a mere 0.1% expansion over the second quarter as a whole.

However, growth in Germany has also slowed significantly from a 12-month high in May, but the country recorded a third consecutive month of growth after nine months of declines.Still, the flash composite PMI reading for June showed no GDP growth for the month and quarter, and, like France, showed the economy growing at just a 0.1% pace for the quarter.

But outside of France and Germany, the picture is brighter: The rest of the euro zone reported a sixth consecutive month of output growth in June, although growth lost momentum to a four-month low, still above the long-term average.

S&P Global PMI, S&P Global Market Intelligence, HCOB

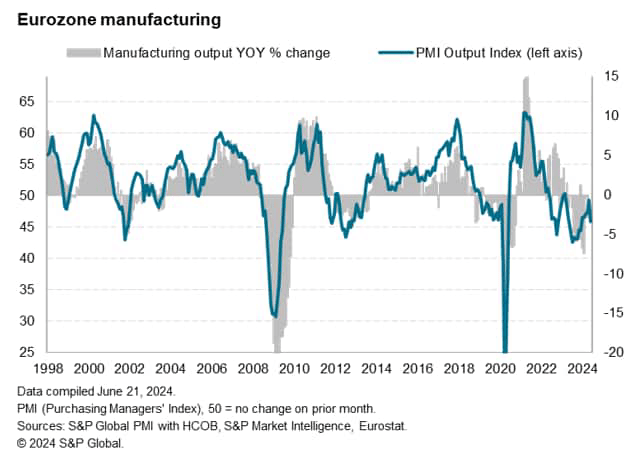

2. Declining manufacturing production

Broken down by sector, the deterioration in the euro area as a whole in June was driven by a sharp drop in manufacturing output. Factory output, which had been broadly stable in May, fell by the most in six months and the 15th consecutive month of sector decline. Output declines accelerated in France and Germany, reaching their highest levels in five and three months respectively, while output in the rest of the euro area fell again, marking the biggest drop since December.

Adding to the manufacturing slump is a sharp decline in new orders, which fell for the 26th straight month in June, reversing a gradual trend of recent months, as demand indicators worsened in France, Germany and other euro zone countries.

S&P Global PMI, HCOB, S&P Market Intelligence, Eurostat

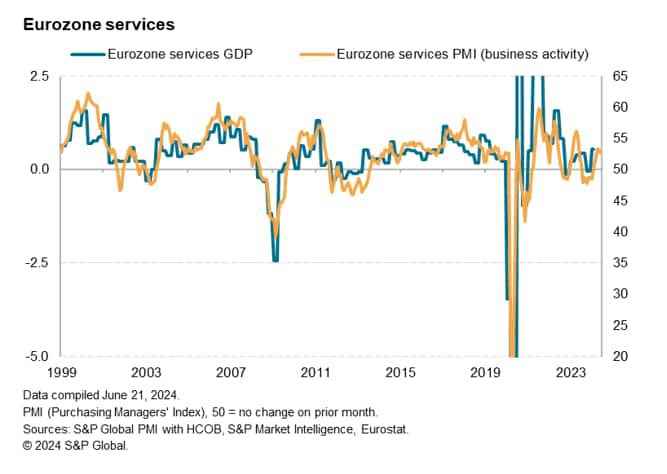

3. Expanding services sector offsets factory slump

Meanwhile, the services sector continued to expand for a fifth straight month, although growth slowed to its slowest pace since March. The slowdown mainly reflected a decline in business activity in France, which is often linked to political uncertainty (though a small decline was also recorded in May). Growth in Germany and the euro area as a whole also lost some momentum, but these expansions remained encouragingly strong by the survey's recent standards.

S&P Global PMI, S&P Global Market Intelligence, HCOB S&P Global PMI, HCOB, S&P Market Intelligence, Eurostat

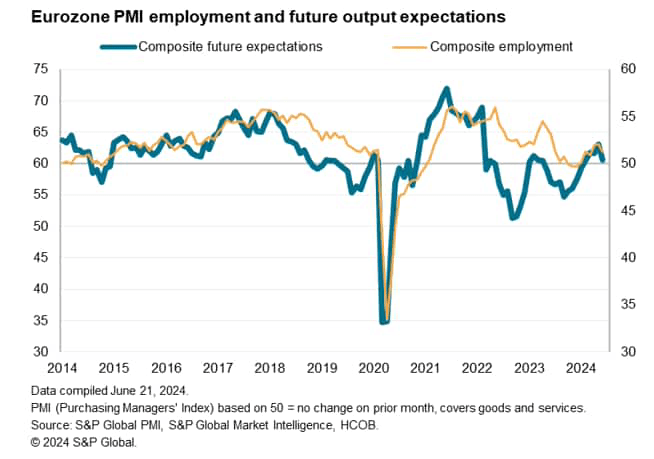

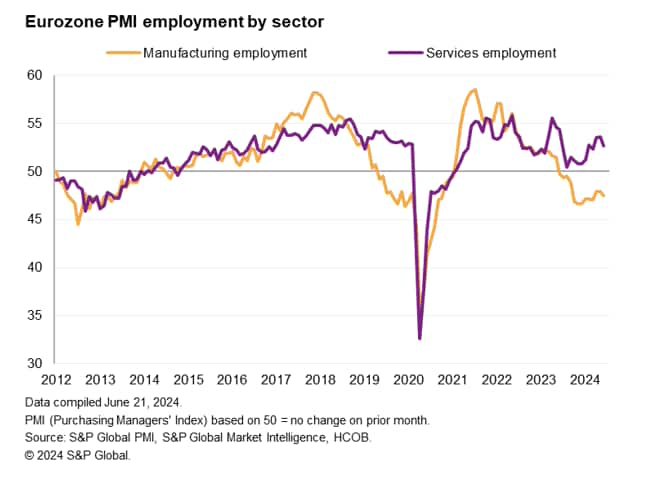

4. Uncertainty will hurt employment

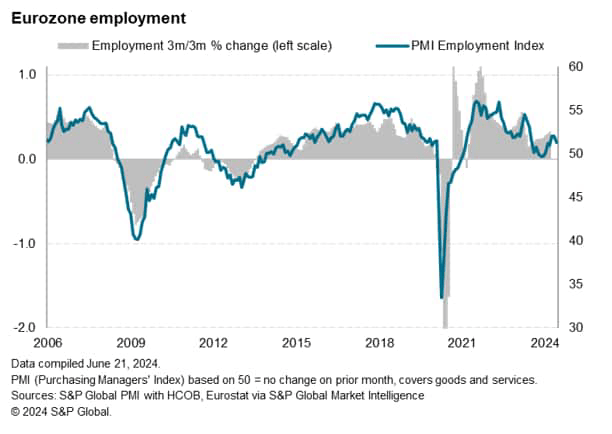

Across the euro zone, employment rose for a sixth consecutive month in June after two months of small declines at the end of last year, but the latest increase was the smallest on record in three months. In Germany, employment fell slightly for the first time in three months on the back of manufacturing layoffs, while in France and other euro zone countries it fell to three- and four-month lows respectively, driven again by manufacturing job cuts.

Hiring took a hit as businesses became less optimistic about the outlook for the year ahead, with production expectations across the euro zone falling in June to the lowest since February.

S&P Global PMI, S&P Global Market Intelligence, HCOB S&P Global PMI, HCOB, Eurostat, S&P Global Market Intelligence S&P Global PMI, S&P Global Market Intelligence, HCOB

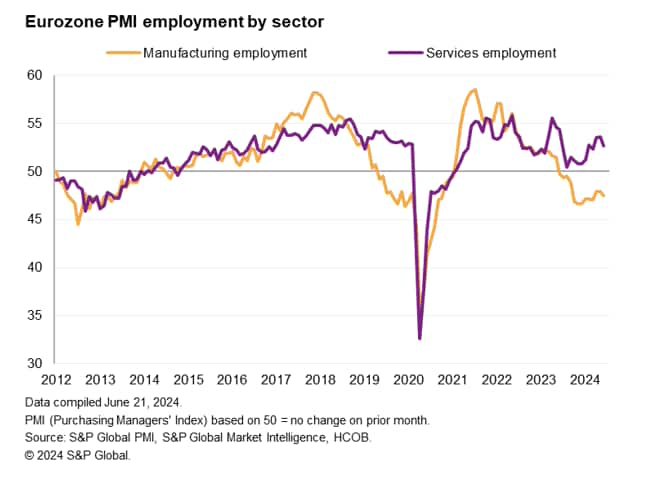

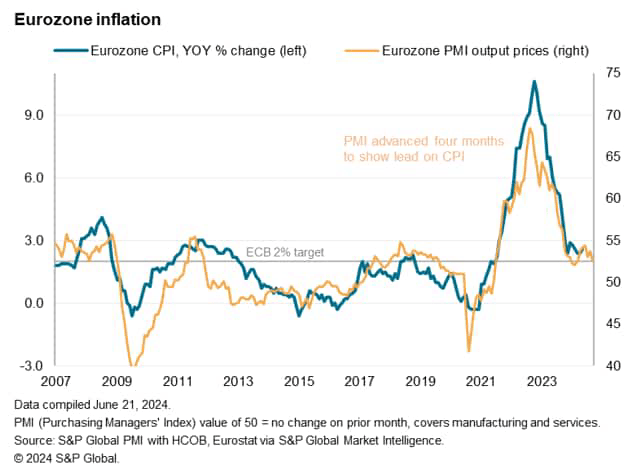

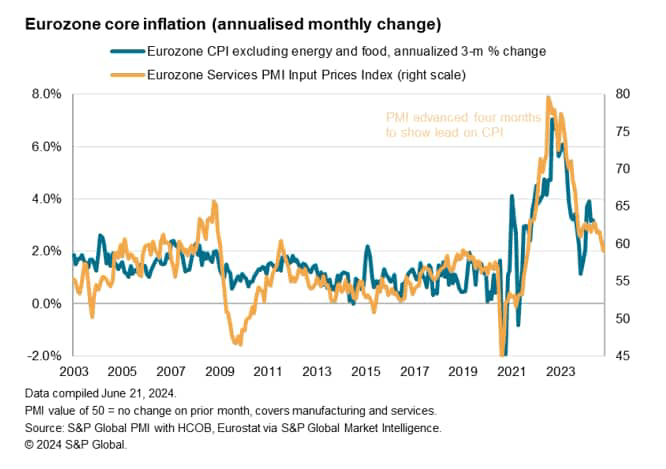

5. Price growth will slow

Average prices of goods and services across the euro area rose to the lowest level in eight months in June, the slowest rate of increase since 2010. inflation It rose sharply in early 2021. The decline has brought the index back to a level roughly in line with the ECB's 2% policy rate. inflation According to historical comparison, the goal is.

S&P Global PMI, S&P Global Market Intelligence, HCOB

Of particular note, input costs in the services sector, which are highly dependent on wage growth, increased at the slowest rate since April 2021, suggesting a cooling in the core economy. inflation (As well as to the target).

S&P Global PMI, HCOB, Eurostat, S&P Global Market Intelligence

However, deflationary trends in manufacturing eased further in June, while a decline in service sector input costs led to the weakest rate of increase in selling prices of services recorded in the survey since May 2021. Factory input costs rose for the first time in 16 months in June, while the rate of decline in selling prices of manufacturing was the smallest in just over a year. This development comes as deflationary trends in manufacturing eased further, while a decline in service sector input costs led to the weakest rate of increase in selling prices of services recorded in the survey since May 2021. inflation If it persists in the coming months.

S&P Global PMI, HCOB, Eurostat, S&P Global Market Intelligence

Within the euro area, price growth was weaker, especially in France, where the average price of goods and services rose slightly in June, the lowest rate of increase since prices began to rise in March 2021. Services prices in particular increased slightly in France. In Germany, price growth rose slightly, but the rate of increase was the lowest in three years and only slightly above the pre-pandemic decade average. inflation Meanwhile, economic growth elsewhere in the euro zone slowed to its slowest in six months.

Original Post

Editor's note: The summary bullet points for this article were selected by Seeking Alpha editors.