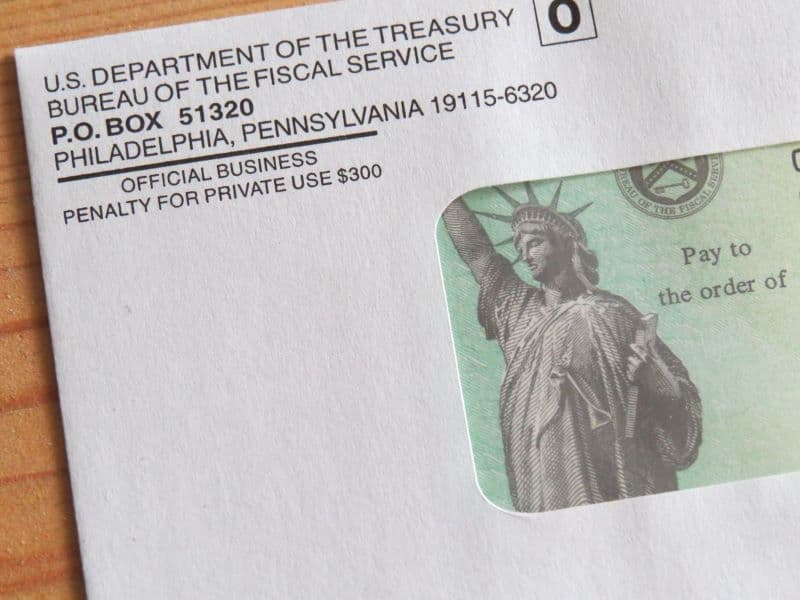

Four years ago, Americans received $1,200 stimulus checks from the government to help them recover from the economic losses suffered during the coronavirus pandemic, and investing the money was one of the popular options among check recipients.

In fact, the Internal Revenue Service (IRS) has been issuing stimulus checks, or so-called “Economic Impact Payments,” under the Coronavirus Aid, Relief, and Economic Response Act (CARES Act), with the first round of payments being $1,200 (an additional $500 per child).

Investing in Bitcoin

For those who chose to invest their $1,200 stimulus checks into Bitcoin (BTC) at the time, it would have been a highly lucrative decision, considering the price of this flagship decentralized finance (DeFi) asset had risen nearly 1,218% from $5,201.07 in March 2020.

In other words, investing $1,200 when the Bitcoin price was around $5,201 would mean that today the investor in question would own around $15,816 worth of the initial cryptocurrency, representing a significant profit if they chose to sell at the current price.

Bitcoin Price Analysis

Currently, Bitcoin is trading at $68,540, which represents a slight decline of 0.88% over the past 24 hours, but according to data from May 27, it has risen 2.52% over the past seven days and 8.92% over the past month, bringing its year-to-date gain to 62.35%.

Meanwhile, Bitcoin whales appear to have returned to the cryptocurrency waters as they have recently begun to show significant buying activity, Finnbold reported on May 25. This reflects confidence from the largest holders in the future price of the crypto asset and signals a resurgence of bullish sentiment in the space.

All things considered, investing in Bitcoin when the government signed stimulus checks into law in March 2020 would have been extremely profitable, and certain indicators suggest that the price of the crypto market's largest asset is set to rise even further in the coming years.

Disclaimer: The content of this site does not constitute investment advice. Investing is speculative and your capital is at risk when investing.