recently thread On X (formerly Twitter), renowned on-chain analyst Checkmate provided analysis on Bitcoin's future trajectory. The premier cryptocurrency is currently hovering around the $60,000 level, a pivotal moment that reflects the historical pattern of the Bitcoin market cycle.

What will happen to Bitcoin in the next six months?

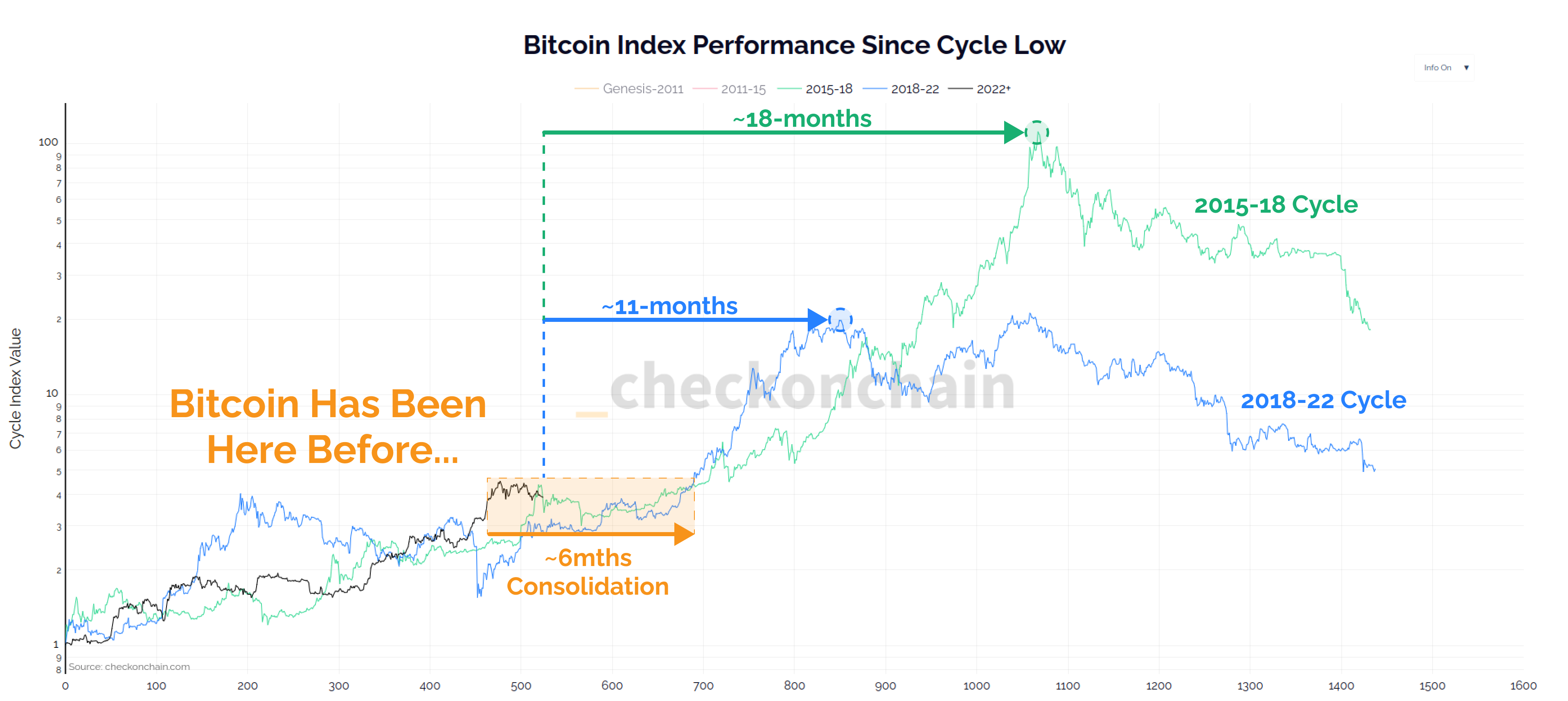

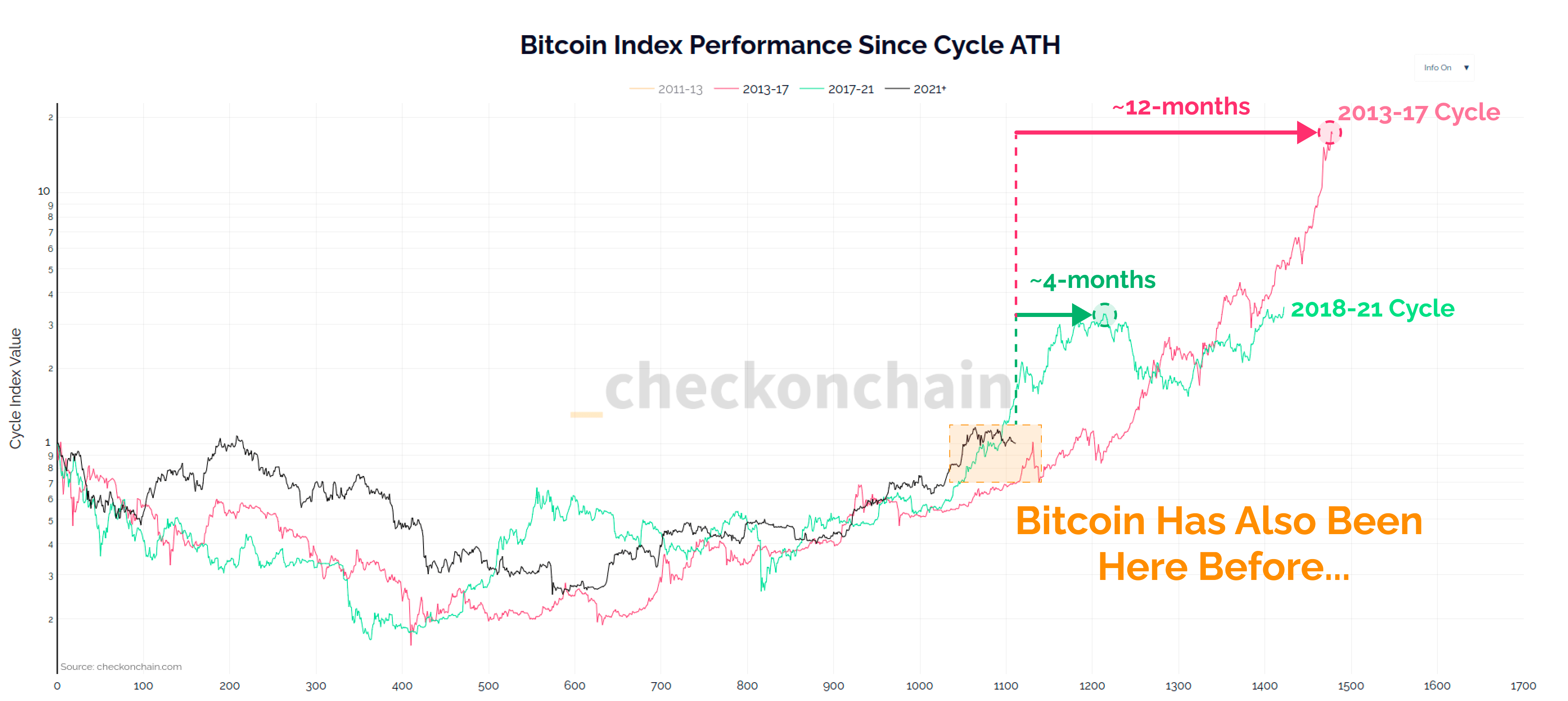

Checkmate claims that Bitcoin is in a “chopsolidation” stage. This term was coined to describe a period of stagnation but instability. Based on previous cycles, he suggests this could last about six months, leading to a parabolic growth phase that could last six to 12 months. “Bitcoin's history tends to rhyme, and so far this cycle has been no exception,” Checkmate said. “This song, sung during his last two cycles, depicts the approximately 6 months of microscopic solidification ahead of us, followed by his 6-12 months of parabolic progress. ”

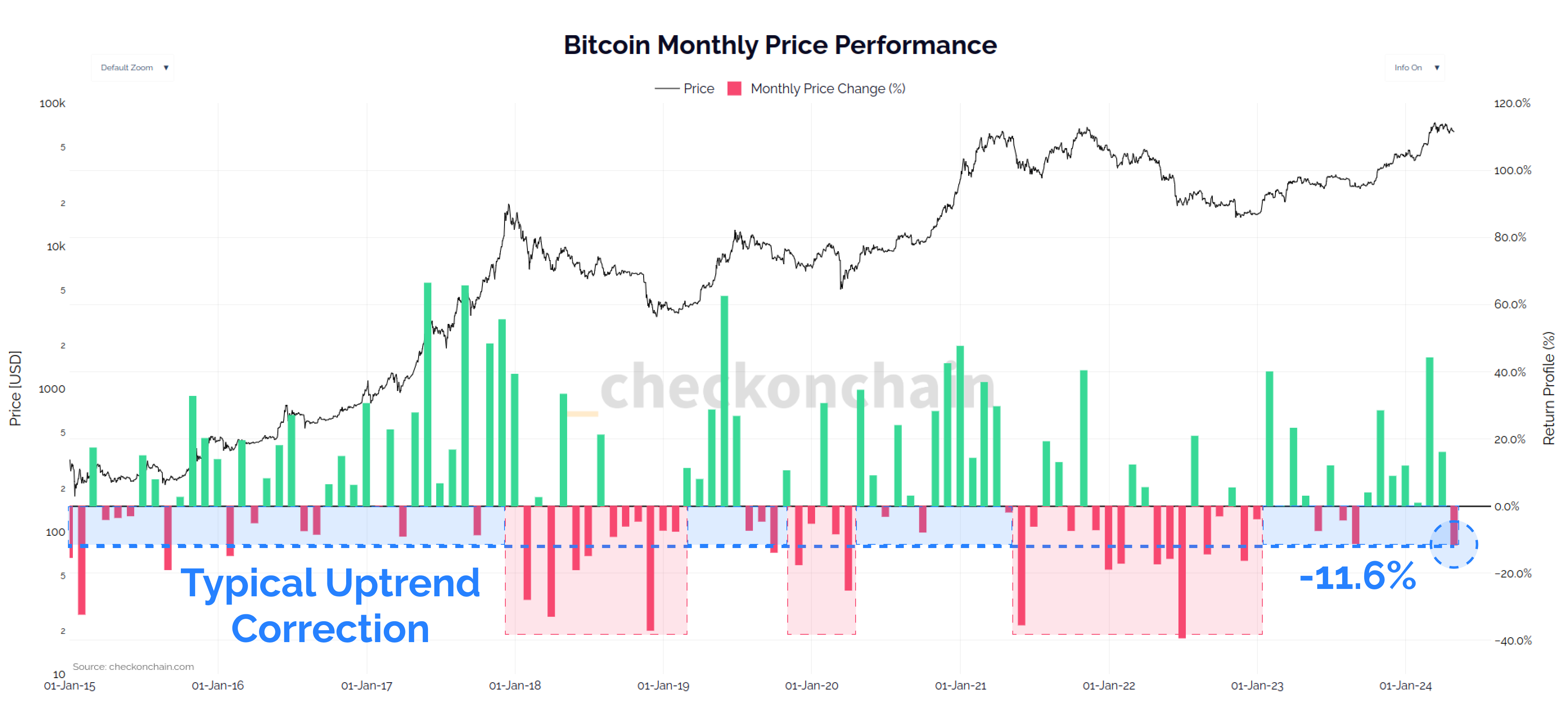

Supporting his analysis, Checkmate notes that April 2021 was an important high for Bitcoin due to “many good reasons”, leading to a significant monthly decline of over $8,250 in April. Nevertheless, he noted that such movements are typical and often indicate a healthy market correction. “This is a -11.2% monthly decline, very common during uptrends, and the correction is healthy and necessary,” he said, expressing his confidence in Bitcoin's resilience and potential for recovery. strengthened.

Further statistical support comes from historical data that focuses only on Bitcoin halvings (2012, 2016, 2020, 2024), and Checkmate concludes that such month-on-month corrections are unusual. I didn't use it to describe its value, but rather to describe what generally happens in the cyclical trends of digital assets. . Historically, the end of each year following a halving has shown strong performance, supporting the idea that the current price point could portend a significant upside.

Will it be sold in May and disappear?

Checkmate also retweeted Charles Edwards' post.Founder of Capriol Investments commented It recognizes the market's unprecedented bullishness and signals that a deeper correction is to be expected.

“This is starting to get ridiculous. Bitcoin has never experienced a rally like this since its inception. It is currently on track for the most days without a meaningful drop, set in 2011. One day is coming. [more than 25%]. If you are not ready to accept the downside of this asset class, you should not be here. Especially now,” Edwards said. His comments underscored that the market is not unusual for a severe economic downturn and suggests investors should prepare for potential volatility.

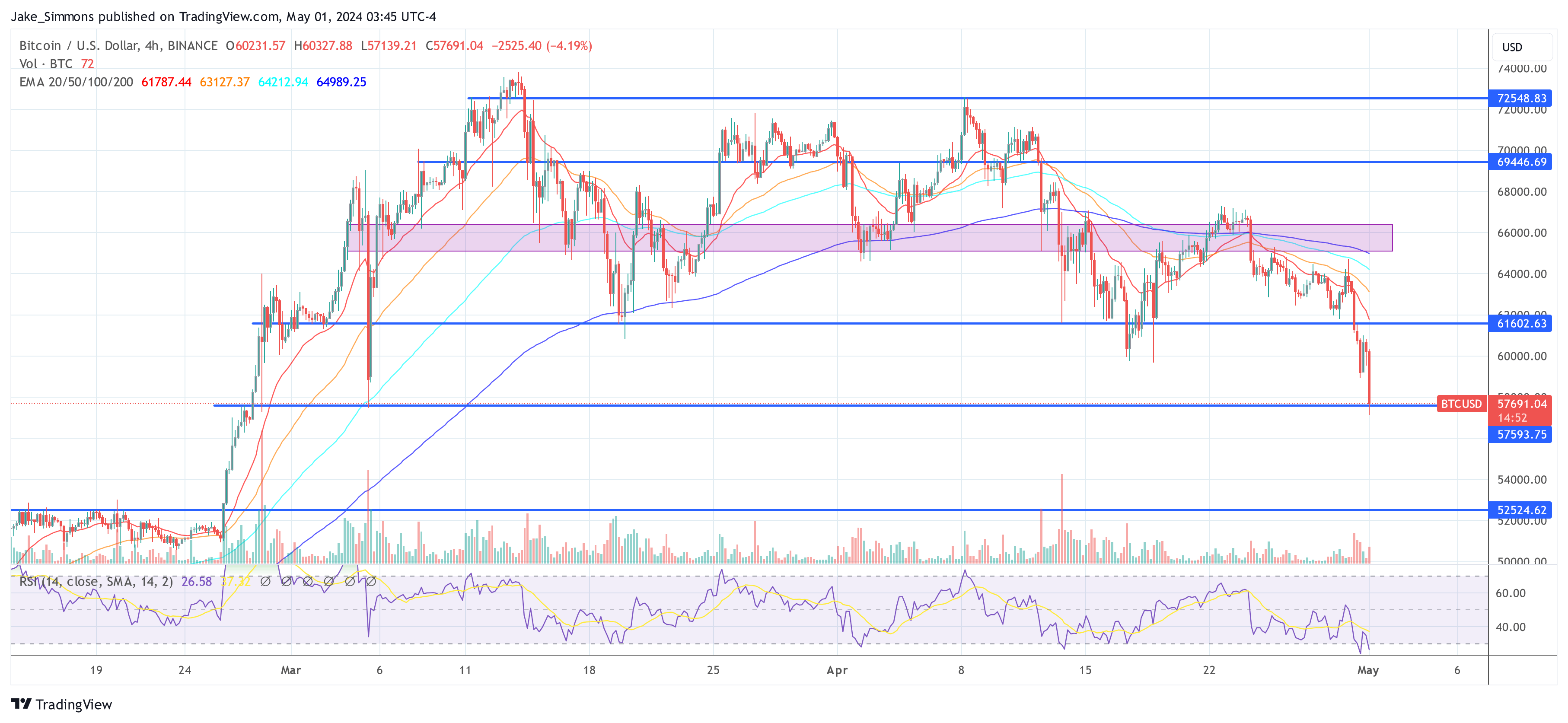

In another post about X, Edwards added a cautious note to the optimistic outlook. He advised: “Sell and leave in May. This looks like a distribution to me. As long as you trade below $61.5,000, scenario (1) is technically more likely. 61.5,000 A strong recovery in the dollar will give some hope to the bulls in scenario (2).Flashes are also good for continuing the bull market, and the sooner you get them, the more long chances you have. Masu.”

This perspective suggests that a strategic exit may be prudent in the short term, that current market conditions may be more bearish than they appear, and that a significant correction strengthens the market's long-term outlook. suggests that it is possible.

At the time of writing, BTC has fallen to $57,691.

Featured images created with DALL・E, charts on TradingView.com