Bank of America said the U.S. economy is headed for instability as President Donald Trump takes office, despite strong employment and retail sales figures. This has brought the future of the crypto market back into focus. Will it prosper?

On January 20, Bank of America announced that employment statistics, retail sales, and core inflation remained strong, with core inflation at 3.2%, Jinshi reported. But this inflation number is above the baseline, meaning the Fed has no room to cut rates any further.

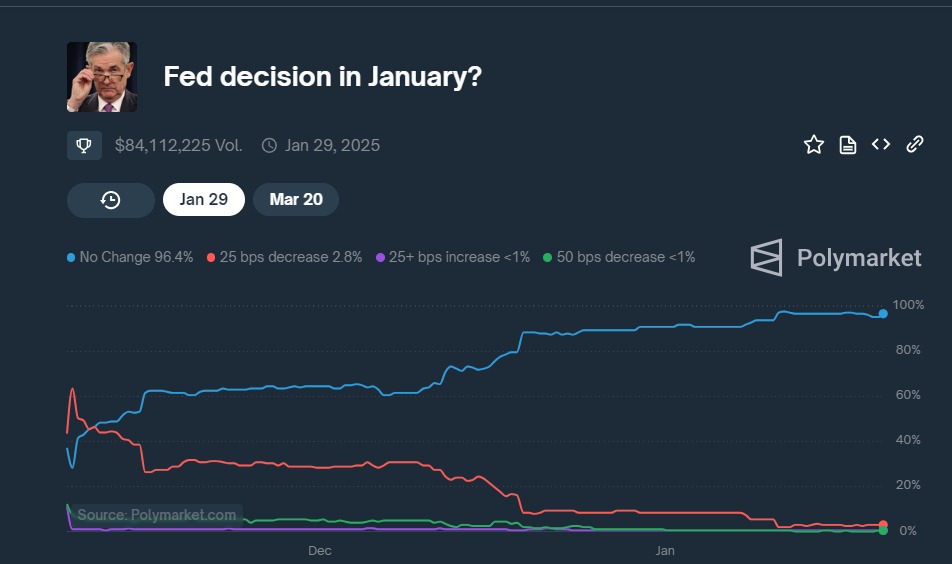

The Fed cut interest rates by 25 basis points in November and 50 basis points in September, followed by a 25 basis point rate cut in December 2024. Fed Chairman Jerome Powell said at the December meeting that the Fed would not cut rates further unless economic data improves.

Sentiment for further rate cuts is further reflected in Polymarket voting, with over 96% of bettors believing there will be no rate cut in January.

Bank of America now believes that the incoming president's inauguration and associated Trump 2.0 policies could create extreme security and fiscal uncertainty that could have a disparate impact on economic managers. I'm thinking.

President Trump's protectionist policy

Protectionist policies are government measures taken to protect domestic industries from foreign competitors, such as tariffs, taxes, and trade restrictions on imported goods.

During Donald Trump's first term, these had a huge impact on the stock market. For example, tariffs on Chinese products and steel contributed to a decline in the competitiveness of U.S. manufacturing. Still, as the Tax Foundation reported in May 2024, costs have increased for companies that rely on imports, such as automakers and tech companies. These continued to impact market ups and downs, especially during the trade war with China.

Reuters also reported that President Trump's re-emergence could impose 60% tariffs on Chinese goods, which could impact the economy. This drives up prices and creates uncertainty for investors in global markets.

What will happen to the cryptocurrency market?

The future fate of cryptocurrencies will largely depend on the interaction between President Trump’s policies and the Fed’s decisions. Protectionist policies commonly affect traditional financial markets through inflation, supply chain disruptions, and investor sentiment, but they also have knock-on effects on crypto markets.

Protectionist measures typically increase the cost of goods and services, and those costs are typically passed on to consumers by businesses.

For example, if inflation remains high, Bitcoin (BTC), which is often seen as an inflation hedge, could continue to gain momentum, especially since the president has given significant support to Bitcoin reserves. Highly sexual. Furthermore, if the Fed does not cut interest rates to curb inflation, cryptocurrencies could become popular as a store of value.

Although many analysts are positive about the creation of a Bitcoin reserve, some within the crypto market are voting against it. As of January 20th, only 57% of Polymarket voters were confident that a Bitcoin reserve fund would be created within the next 100 days.

Additionally, President Trump's crypto-friendly policies could pave the way for the institutional adoption of cryptocurrencies by supporting the Cryptocurrency Promotion Act, which would replace the SEC-mandated virtual currency transactions under the Biden administration. There is a possibility that lawsuits against the institution may be suppressed.

Overall, protectionist policies could increase the price of some high-tech imports and slow the development of blockchain, but President Trump's pro-crypto stance could help boost the sector's growth. will offset some of that through