There is room for debate about when and how to sell bitcoin, but if you are planning to acquire this cycle, it is essential to do it strategically. Having bitcoin indefinitely is an option for some people, but many investors are aiming to earn, cover living expenses, or reinvest at low prices. Historical trends indicate that Bitcoin often experiences 70-80 % drawdown and provide opportunities to reduce ratings and re -accumulate.

To check this topic in detail, see the recent YouTube video.

Why isn't it always taboo?

Like Michael Sailor, some supporters never sell bitcoin, but this stance does not always fit individual investors. For those who do not manage billions, gaining partial interests can provide flexibility and security. For example, if you reach a peak of $ 250,000 and face a fairly conservative 60 % correction, it will revisit $ 100,000 and create opportunities to enter at a lower level.

The goal is not to sell everything, but to strategically scaled from positions, maximize returns, and manage risks. To achieve this, it is not an emotional reaction, but a practical and data -led decision. But again, if you never want to sell, don't do it! Everything works best for you.

Major timing tools

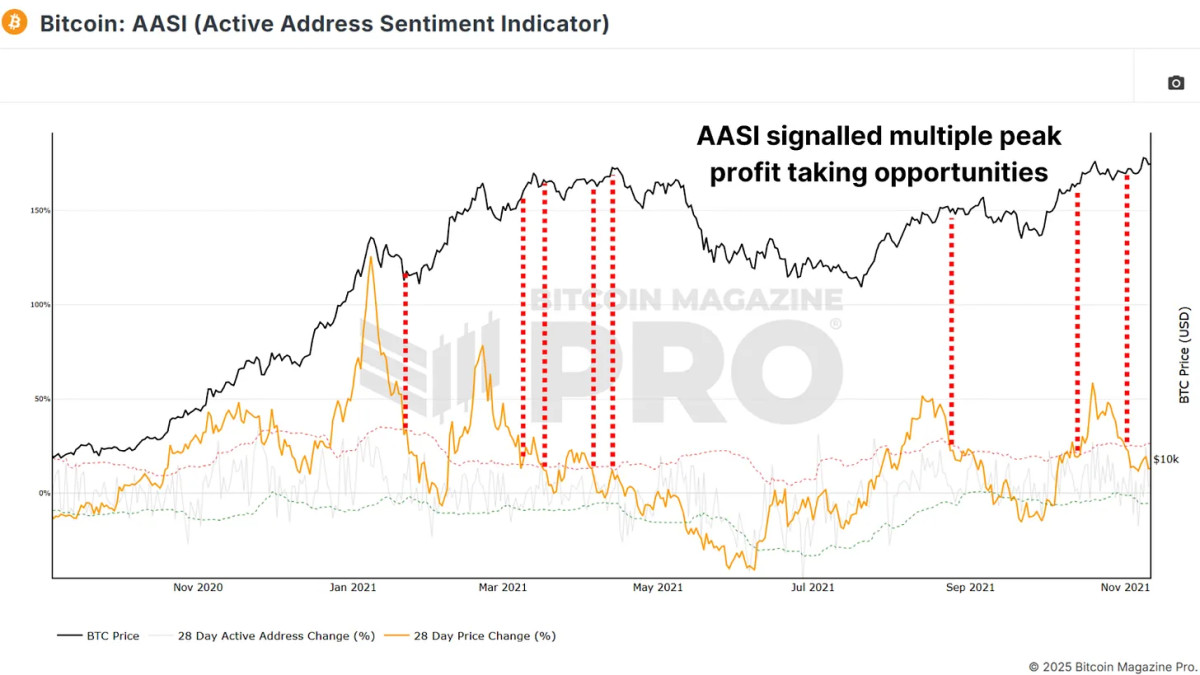

This active address sentiment indicator (AASI) compares changes in network activity with bitcoin prices. Measure the deviation between the price (orange line) indicated by the green and red deviation band and the network activity.

Display live charts Lingering

For example, in 2021 Burrun, a signal appeared when the price changes exceeded the red band. Sales signals appeared at $ 40,000, $ 52,000, $ 58,000, and $ 63,000. Each provided the opportunity to scale out as the market overheated.

Fear and greedy index is a simple but effective emotional tool that quantitizes the happiness and panic of the market. More than 90 values are extremely greedy, such as 2021, when bitcoin rose from $ 3,000 to $ 14,000.

Display live charts Lingering

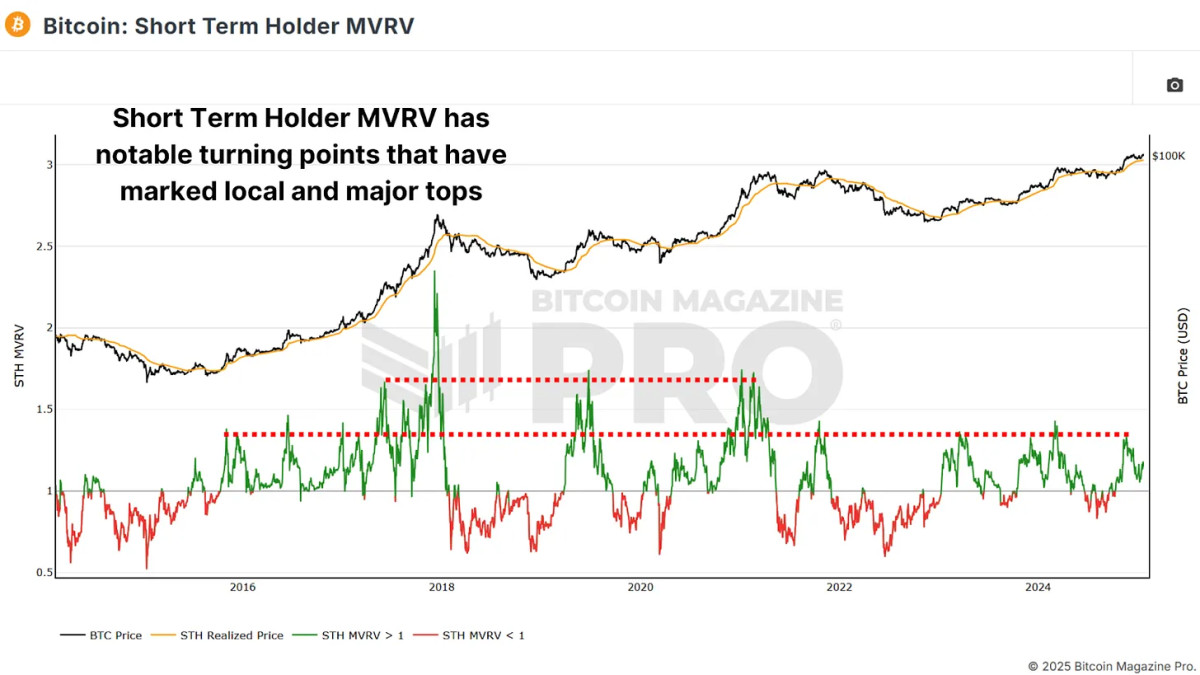

The short -term holder MVRV measures the average unrealized profit or loss of new market participants by comparing cost -based prices. In many cases, about 33 % of profit levels are reversed and local intra cyclpiks, and if unreasonable profits exceeds about 66 %, the market may often be accelerated and close to major cycle peaks.

Display live charts Lingering

Related: Bitcoin Deep Dive Data Analysis and Chain -on Chain Round Up

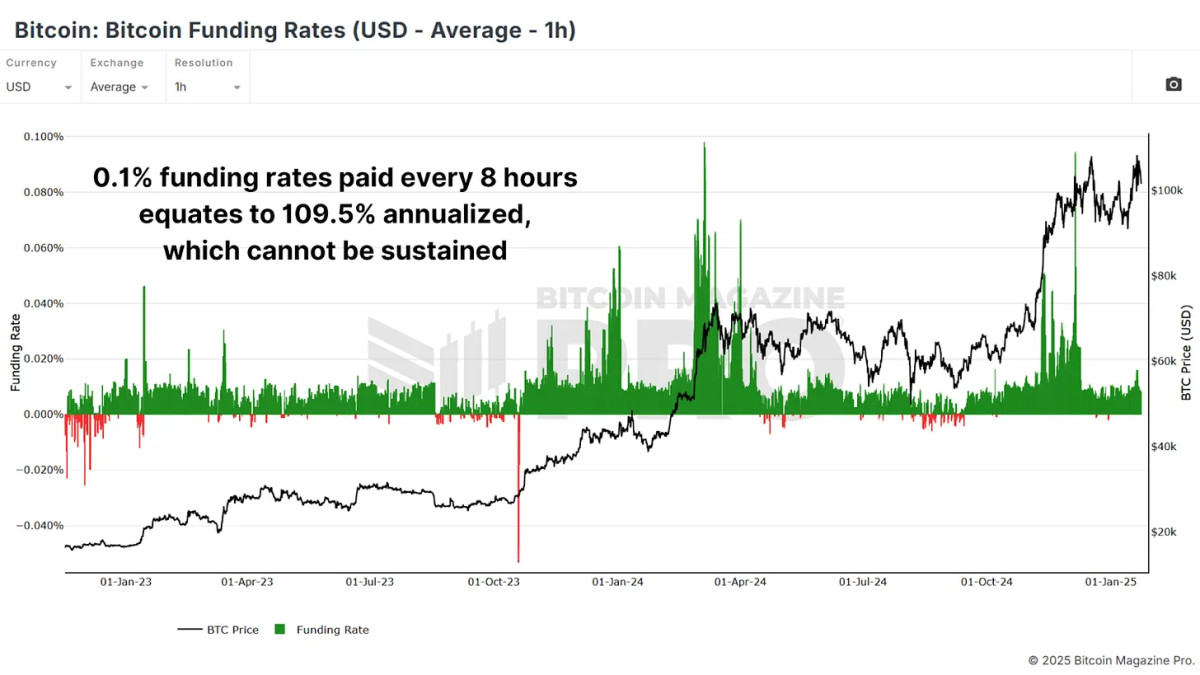

Bitcoin's funding is reflected the premium paid by traders to maintain leverage positions in the futures market. The very high funding rate often suggests excessive bulletability ahead of correction. As with most metrics, you can see that the excessive number of overly euphoric majority usually provides edges.

Display live charts Lingering

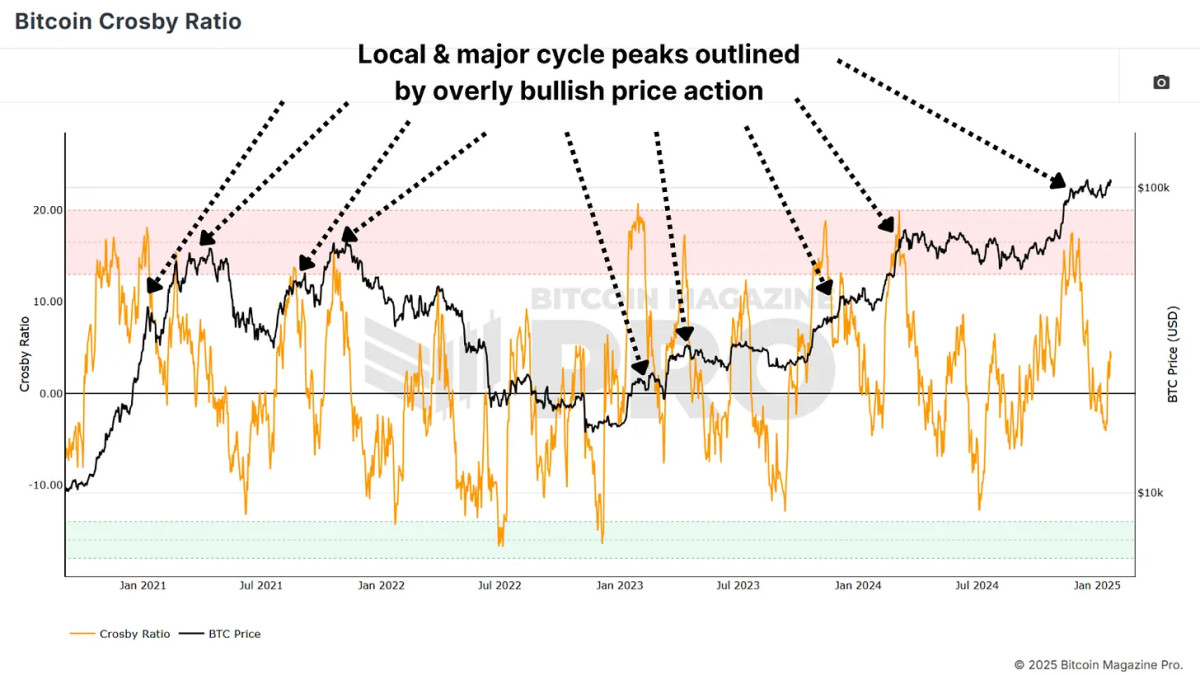

The crossbie ratio is an indicator of exercise that emphasizes overheated conditions. When the ratio enters the red zone of the daily chart, when the Indicator TradingView version is used, the lower the time frame, the marketing point of the market usually occurs. When these signals merge with other top mark metrics, the probability of large -scale prediction is solidified.

Display live charts Lingering

Conclusion

The exact top timing is virtually impossible, and a single metric or strategy is absolutely certain. Combine multiple indicators for concrete to avoid selling the entire position at once. Instead, the trailing stops linked to the ratio of key levels or prices to capture additional profits when the main indicator shows the overheated conditions and captures additional profits when the price rises further. Consider setting.

Check out the advanced functions such as more detailed bitcoin analysis, live charts, personalized indicator alerts, and detailed industry reports. Bitcoin Magazine Pro。

Disclaimer: This article is for information only and should not be considered financial advice. Before making an investment decision, we will always conduct our own surveys.