Monero (XMR) is altcoin We differentiate ourselves from other cryptocurrencies by making strong use of privacy.or as Monero website It states that it is a “private digital currency.” It is currently ranked 13th on coinmarketcap.com.

Monero (XMR) is altcoin We differentiate ourselves from other cryptocurrencies by making strong use of privacy.or as Monero website It states that it is a “private digital currency.” It is currently ranked 13th on coinmarketcap.com.

In this article, we will explain in detail what Monero is, how it differs from other cryptocurrencies, and how to invest in it.

What is Monero?

Monero was launched in April 2014. Previously called Bitmonero. It started at a price of around $2.47 and started rising on August 22, 2016, and is currently at $310.47. The circulating supply is 15,636,799 XMR, which is less than BTC. This means that the price of cryptocurrencies may continue to rise. Compare the supply of XMR to the supply of other popular altcoins such as Ripple which is 38,739,142,811 XRP. 2477 times more than XMR.

Monero has a vibrant developer platform of 30 developers. Continuous innovation is crucial for altcoins looking to differentiate themselves, and Monero appears to be investing in that area. Other alternative coins like EOS also have strong development teams.

Monero is similar to BTC in that it is a digital currency. Like many alternative coins, Monero has some additional features that distinguish it from BTC.

How is Monero different?

There are three main aspects of Monero privacy, which we will discuss in more detail below: security, privacy, and untraceability.

Basically, Monero hides users and transactions. Users can choose to hide all traces of their transactions, including their identity, details of currency exchange amounts, and information about the person with whom they performed the transaction. Monero accomplishes this by using stealth addresses to generate encrypted addresses that cannot be linked to previous transactions.

All Monero transactions are private. These are not visible on the blockchain, making them untraceable transactions. Part of the technology behind Monero includes ring secret transactions that hide the amount of Monero being sent. This essentially prevents anyone from checking someone else's account balance.

Ring signatures are also used to help create multiple fake signatures. Using multiple fake signatures makes it nearly impossible to attribute a transaction to a user.

As expected, this kind of obfuscation is drawn Interest from the FBI.

Monero uses dynamic block sizes. Miners can choose to perform larger or smaller transactions depending on the volume of the network. Proof of Work validates transactions and prevents malicious attacks.

The block reward will never be less than 0.3 XMR. Inflation is set at 0.3 XMR per minute.

Monero is a cryptocurrency coin. In fact, this is his one of the first ones. Cryptonote is an application layer protocol. This is why Monero can offer so many privacy features.

Cryptocurrencies built with Cryptonote can use decentralization, privacy, fungibility, ring signatures, and egalitarian proof of work. Monero uses all these features.

As mentioned earlier, Monero has a community of 30 developers and is open source using popular and reliable languages such as C++.

How to invest in Monero

Like many altcoins and non-base currency coins, XMR cannot be purchased directly. Instead, there is a roundabout way to buy XMR. The flow looks like this: Purchase BTC through Coinbase and transfer to Coinbase. Cryptopiayou can buy XMR with BTC.

Let's take a closer look at the process.

1. Create a Cryptopia account

The first thing you need to do is set up a Cryptopia account.

Cryptopia is a popular choice because it allows companies like Coinbase to trade between cryptocurrencies. Please note that you cannot send money to Cryptopia. You need to go to Coinbase -> Exchange (Cryptopia) -> XMR.

Therefore, you will always need two accounts.

- Cryptopia: What you can do sign up here

- Coinbase: Coinbase gives you $5 in Bitcoin for free when you sign up and make your first transaction.

I hope this situation changes soon, but that is the situation today.

2. Buy Bitcoin or Ether on Coinbase

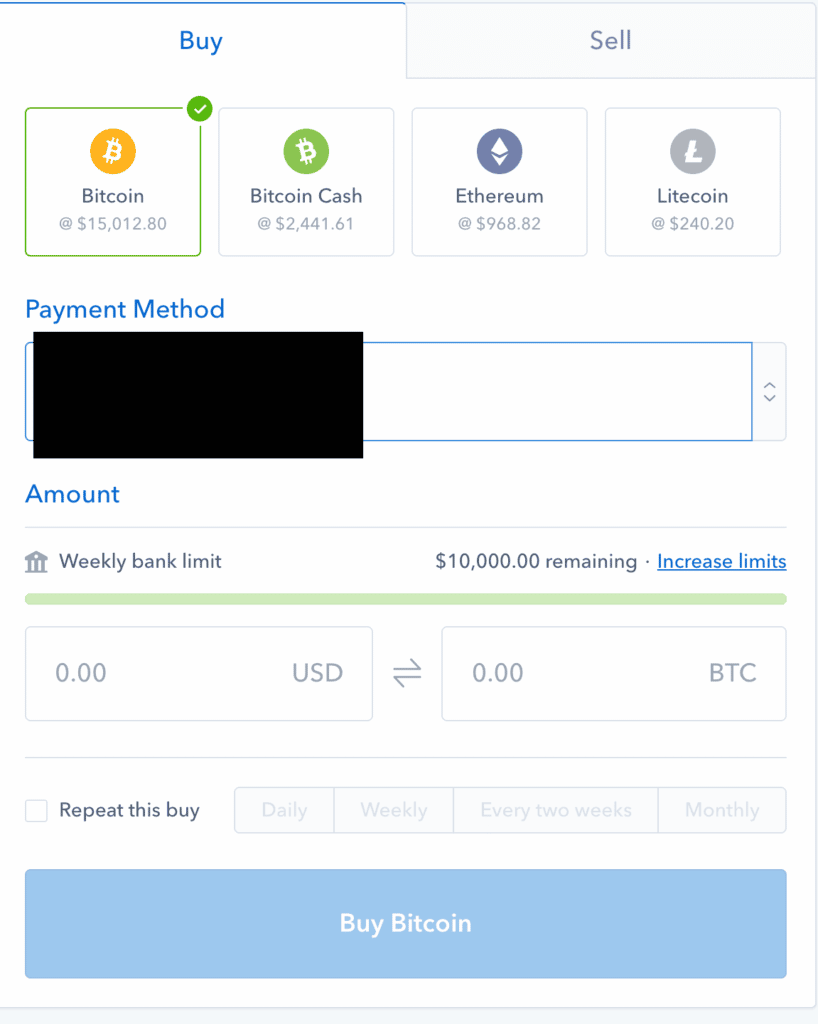

Once you set up your Cryptopia account, you can purchase Bitcoin or Coinbase Ether.

Once you set up your Coinbase account, it's very easy to do. Just go to the buy/sell page and enter your information. Your Bitcoin will then be in your wallet and you can proceed to step 3.

3. Transfer Bitcoin to Cryptopia

Once you have Bitcoin or Ether in your Coinbase account, you can transfer it to Cryptopia. This is also fairly easy to do.

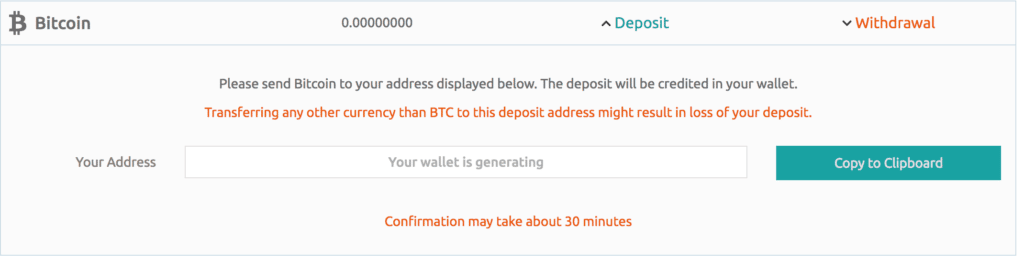

In your Cryptopia account, go to your balance and then your wallet to see all the different coins you can hold in your account.

In this case, you're sending money in Bitcoin, so when you click on Bitcoin, you'll see a wallet address generated. In most cases it will look like this:

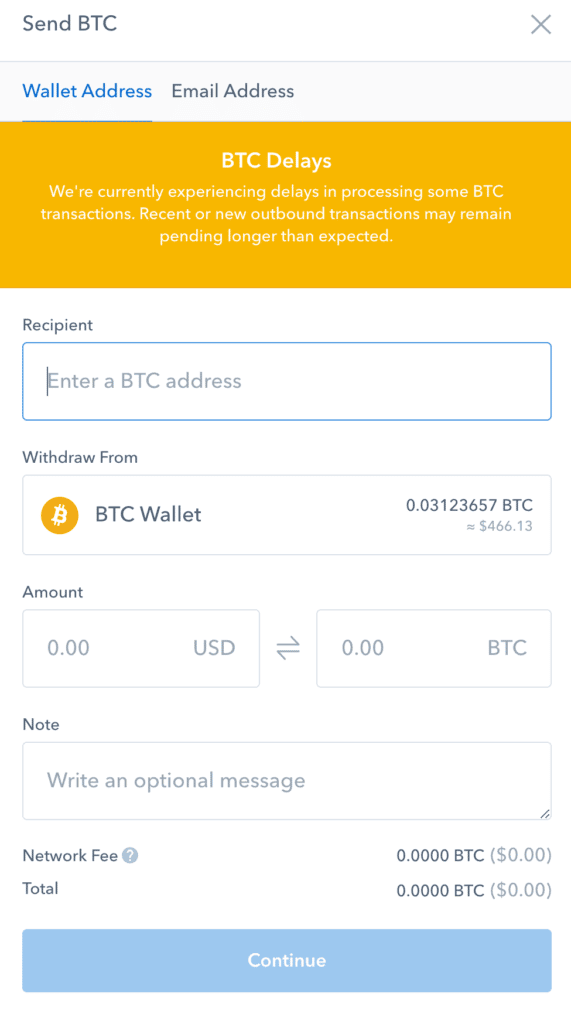

Once you have that address, go back to Coinbase and[アカウント],[送信]Select . The following screen will appear, allowing you to send Bitcoin to the address generated by Cryptopia.

4. Purchase XMR

Once you have Bitcoin in your Cryptopia account, you can finally buy XMR.

Perform an XMR/BTC (or XMR/ETH) exchange in your Cryptopia account.

Once you make a transaction, it will appear in your Cryptopia account.

final thoughts

Monero has the advantage of completely private transactions. While this may tempt some people to try to hide illegal activities, there are good reasons to keep transactions private.

Reasons may include simply not wanting others to know that you are trading cryptocurrencies. You may want to keep the amount private, or you may simply want to remain anonymous.

Monero's circulating supply is still lower than BTC, so it could be a great investment opportunity. There are many reasons why someone might consider investing in Monero, coupled with the ability to maintain anonymity.

Let us know what you think about XMR in the comments section.

Robert Farrington is America's Millennial Money Expert® and America's Student Loan Debt Expert™, specializing in helping Millennials escape student loan debt and start investing and building wealth for their future. He is the founder of The College Investor, a growing personal finance site. You can learn more about him on his About Page or on his personal site, RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics for people looking to earn more, eliminate debt, or start building wealth for their future. I am.

He has been quoted in major publications including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, and Today. He is also a regular contributor to Forbes magazine.