As one of the most widely known and used privacy coins in the crypto space, monero (XMR) hardly needs an introduction. Amidst a rising tide of privacy concerns and quests for data sanctity, XMR is cementing its position as a coin of choice for those yearning for anonymity in their financial escapades. Yet buying monero can be confusing for many — especially if you are a crypto newcomer. This detailed guide demystifies the process, exploring everything you need to know about the famed privacy coin, including how it works and how you can buy monero securely.

Our methodology for choosing the top platforms to buy XMR

This review lists the best platforms for buying and trading Monero (XMR). It includes Kraken, Binance, and Bitfinex — each tested by the BIC’s team for experts for over six months. From security posture to additional staking and lending features to the ease of swaps and purchases — everything XMR-specific was tested.

Our selection of these platforms was based on their strong reputations, among other important factors. We carried out detailed assessments, delving into each exchange’s distinct trading capabilities and functionalities.

Note: The list also comprised OKX, but the exchange delisted XMR as of early 2024.

Buying and holding XMR on Kraken

Kraken’s comprehensive analytics tools were especially noteworthy, playing a key role in monitoring our XMR investment’s performance and planning subsequent trades. Kraken, at press time, even allows trading XMR features. Plus, Kraken also excels in fund security, courtesy of two-factor authentication and other implementations. Also, Kraken’s popular Monero pairs, XMR/USD and XMR/XBT, comprise almost 1.5% of the global XMR trading volume — each with a liquidity score of above 480.

Why choose Binance for buying XMR?

Binance differentiated itself with its wide range of trading options, including spot and futures markets, offering various tools for varied investment strategies and effective risk management. Our assessment of Binance, particularly their futures contracts, focused on Binance Futures, which allows traders to buy or sell assets at predetermined prices on future dates. Binance’s XMR/USDT pair comprises over 16% of the XMR perpetual trading volume.

The platform’s leveraged trading feature was thoroughly evaluated, highlighting how it enables users to borrow funds, potentially magnifying profits and losses. This testing assessed the effectiveness and risks of leveraged trading in various market scenarios. As for popularity, Binance’s XMR/USDT and XMR/ETH are the most sought after spot pairs with high liquidity.

As for fund security, Binance features biometric logins, 2FA, passkeys, and more.

Bitfinex for buying Monero (XMR)

In testing Bitfinex’s features, we focused on their graphical trading experience with advanced charting functionality. This feature was assessed to allow traders to visualize orders, positions, and price alerts effectively. The user interface was also evaluated for its ease in modifying order properties. Specifically for XMR, Bitfinex’s XMR/USDT pair, courtesy of a decent liquidity score of 435 out of 1000, ensures speedy trades. Plus, for assets like XMR, Bitfinex even allows 10x leveraged trades.

Each platform exhibited unique qualities, emphasizing its commitment to providing secure, efficient, and user-centric trading experiences. To know more about our evaluation process and BeInCrypto’s methodology verification, click the mentioned link.

Do you want to buy XMR? Use and test these exchanges

Secure exchange with high deposit & withdrawal limits

Explore Kraken

on Kraken’s official website

Supported assets

120+

Deposit fees

0

Trading fees

0,02%-0.05%

Trustworthy exchange with complete crypto ecosystem

Explore Binance

on Binance’s official website

Supported assets

350+

Deposit fees

0

Trading fees

0,1%

What is Monero?

Monero (XMR) is a cryptocurrency that launched in 2014 with a focus on privacy. Unlike many digital currencies that lay out all transaction details on a public ledger, monero operates differently. It aims to be a cloak of invisibility, shielding users’ financial activities from prying eyes. In other words, monero keeps the details of every transaction private, meaning that no one can see the amount of Monero you own or the transactions you’ve made just by looking at the blockchain.

This level of privacy can be appealing for various reasons, from a personal desire for privacy to businesses wanting to keep financial information confidential. The idea is simple: when you transact with XLM, whether you’re grabbing a coffee or looking to buy Monero as an investment, your financial business remains your own.

Monero emerged from the cryptonote protocol, a blueprint for privacy-focused cryptocurrencies, unlike Bitcoin’s transparent blockchain. Developed by a group of seven anonymous contributors in 2014, Monero aimed to fulfill the promise of financial privacy inherent in cryptonote. Only two developers, Riccardo Spagni and David Latapie, opted to reveal their identities, while the others remained anonymous — fitting for a privacy-centric project.

Initially a fork of Bytecoin, the first cryptonote implementation, Monero sought to enhance privacy compared to its progenitor. Over time, Monero diverged into its own distinct network, evolving beyond merely addressing Bytecoin’s flaws. Through ongoing innovation, Monero now boasts a unique identity grounded in enhanced user anonymity and untraceable transaction facilitation.

As a privacy coin, Monero represents more than just an asset — it symbolizes a movement for anonymity and financial privacy. As such, Monero has fostered a thriving community aligned to its core values.

How Monero works

Now, before we delve into how you can buy XMR coins securely, let’s take a quick look at how the Monero network works.

The network aims to ensure privacy and anonymity through the use of a variety of cryptographic techniques. The three primary techniques used to achieve this include ring signatures, stealth addresses, and Dandellion++.

Ring signatures

Ring signatures allow a sender to obscure their identity by grouping their transaction with a number of other transactions. This makes it difficult to determine which transaction was actually initiated by the sender.

Stealth addresses

And as you dig deeper, you come across Monero’s next layer of privacy: stealth addresses. Each transaction you make creates a unique address, breaking the chain of transactions and making it a ghost trail impossible to track. This ensures that your financial narrative remains a book closed to unwanted eyes.

Dandelion++

But what about the IP traces left behind? Well, while initially, Monero aimed to tackle this with Kovri, the baton has now been passed to Dandelion++ to obscure IP addresses. Kovri was a proposed implementation of I2P (Invisible Internet Project) for Monero, but it was never fully implemented. Dandelion++ is a more advanced transaction obfuscation technique that is designed to be more effective than Kovri. It ensures that the origin of your Monero transactions remains a mystery.

Monero’s “privacy first” approach

As a result of these features, Monero is considered one of the most privacy-centric cryptocurrencies available. This has made it popular among users who are concerned about their financial privacy.

Monero is also known for its resistance to ASIC mining. This means you can start monero mining using using standard computer hardware. This has helped to decentralize the Monero network and prevent the formation of mining pools.

Monero has a limited supply of 18.4 million XMR and follows a deflationary model. In addition to its privacy and security features, Monero is also a fast and efficient cryptocurrency. Transactions are typically confirmed within a few minutes.

While XLM is a popular choice for users who are concerned about their financial privacy, it is also a good option for users looking for a decentralized and ASIC-resistant crypto.

Monero is focused on ensuring transaction anonymity and maintaining secrecy and is committed to full decentralization.

Why people buy monero: Reasons behind XMR’s popularity

Monero has gained popularity due to several key features and principles:

- Anonymity: Monero uses ring signatures, stealth addresses, and other cryptography to ensure transactions remain untraceable and confidential. This sets it apart from cryptocurrencies with transparent blockchains.

- Security: Robust encryption and privacy techniques secure users’ funds and information against threats and fraud.

- Decentralization: Monero operates on a decentralized, peer-to-peer network not controlled by any single entity, aligning with cryptocurrency ideals.

- Fungibility: Monero’s indistinguishable coins are truly fungible due to privacy features obscuring transaction history.

- Active community: Monero enjoys an engaged developer community focused on continuously improving security and privacy.

- Accessible mining: The Monero mining algorithm aims to be open to ordinary computer hardware, promoting decentralized participation.

- Adoption: Privacy advocates, individuals, and entities valuing anonymity have embraced Monero, fueling adoption.

- Censorship resistance: Monero’s untraceable transactions cannot be easily censored, making it attractive for those needing privacy.

Together, these values and technical strengths underpin Monero’s appeal as a privacy coin for users seeking confidentiality and security in their financial transactions and beyond.

How to buy monero (XMR)?

Do you want to buy XMR? Use and test these exchanges

Secure exchange with high deposit & withdrawal limits

Explore Kraken

on Kraken’s official website

Supported assets

120+

Deposit fees

0

Trading fees

0,02%-0.05%

Trustworthy exchange with complete crypto ecosystem

Explore Binance

on Binance’s official website

Supported assets

350+

Deposit fees

0

Trading fees

0,1%

You can buy XMR coins securely from a crypto exchange like Binance and, alternatively, also from a peer-to-peer (p2p) platform such as LocalMonero. Let’s walk through the step-by-step procedures in both cases.

How to buy monero from crypto exchanges

Several major centralized and decentralized exchanges support XMR. The step-by-step procedures to buy monero are mostly the same across all of these platforms, barring a few differences here and there. We will demonstrate the procedure using Binance as an example.

Step 1: Create an account

Register on your preferred exchange via its website or app using your email and mobile number. Note that you may have to undergo the mandatory KYC verification process in order to deposit funds and start buying/trading. Most exchanges ask you to submit some personal information and documents, including your name, address, email, phone number, and a valid ID proof.

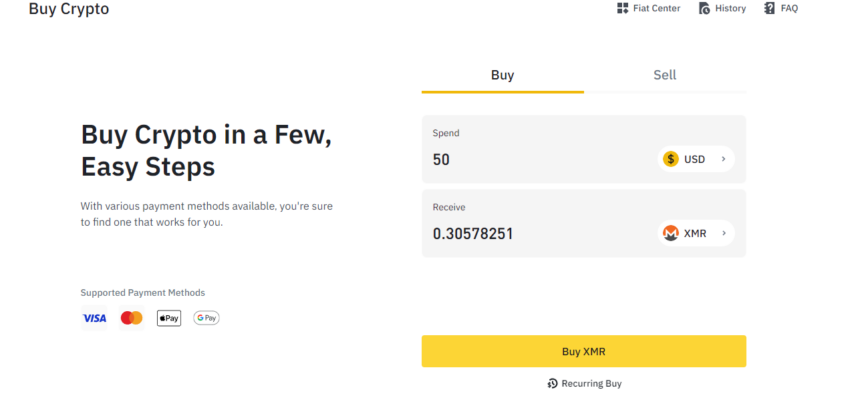

Step 2: Choose a currency and payment method

Click on “Buy Crypto” on Binance to see available options for buying monero. Options include:

- Credit or debit card (Visa/MasterCard supported)

- Bank deposit

- Third-party payment (check Binance FAQ for available channels in your region)

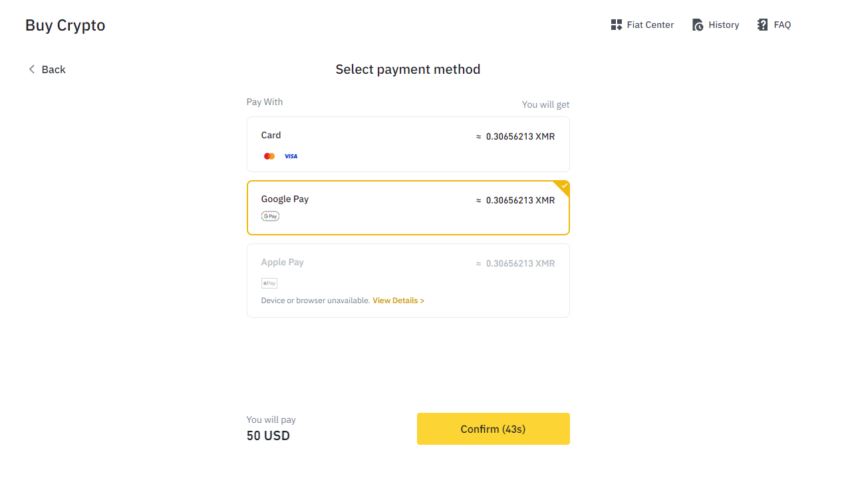

Step 3: Review payment details

Confirm your order within one minute to lock the price; after one minute, the order price may change based on market rates.

Step 4: Store or use monero

Once purchased, store monero in your personal crypto wallet or use it for trading or staking on Binance for passive income. For decentralized exchanges, consider using a trusted monero wallet such as Trust Wallet.

Where to buy monero

Some of the top centralized exchanges and swappers for Monero transactions include:

Kraken

When we used Kraken for our Monero (XMR) transactions, the platform’s commitment to security was immediately apparent. It offered us a comprehensive trading experience with features like an advanced interface integrated with TradingView, and a variety of trading options, including spot, margin, and futures. The multi-factor authentication and its track record of no major hacks as of Nov. 2023 gave us confidence in the platform’s security measures.

Binance

Trading fees

0.00% and 0.01%

Our experience with Binance for buying and trading XMR was marked by the platform’s extensive liquidity and range of trading tools. As the world’s largest exchange by volume, it provided us access to a vast market, with over 385 tokens and 1600 trading pairs. However, it’s worth noting the limitations we encountered with Binance.US, especially its restricted availability in certain U.S. states and a smaller selection of around 150 cryptocurrencies. The temporary halt of U.S. dollar withdrawals as of October 2023 due to regulatory challenges was a significant aspect we had to navigate.

Bitfinex

Bonus

get a 5% rebate for each trade made through the APIs

Buying and trading XMR on Bitfinex was a positive experience, largely due to its wide selection of trading pairs. The platform’s commitment to building open, peer-to-peer communication solutions resonated with us, offering a sense of alignment with our values. Bitfinex’s commitment to building open, peer-to-peer communication solutions added to its appeal. Notable pairs on Bitfinex, if you’re looking to invest in XMR, include XMR/USD and XMR/EUR.

All of the platforms above boast solid market reputations and strong security measures, plus they offer a host of trading tools and additional features.

Swappers: These platforms let you exchange XMR with other cryptocurrencies. Examples include Fixedfloat, Sideshift.ai, SimpleSwap, ChangeNow, and Godex, among others.

How to buy monero (XMR) on p2p platforms

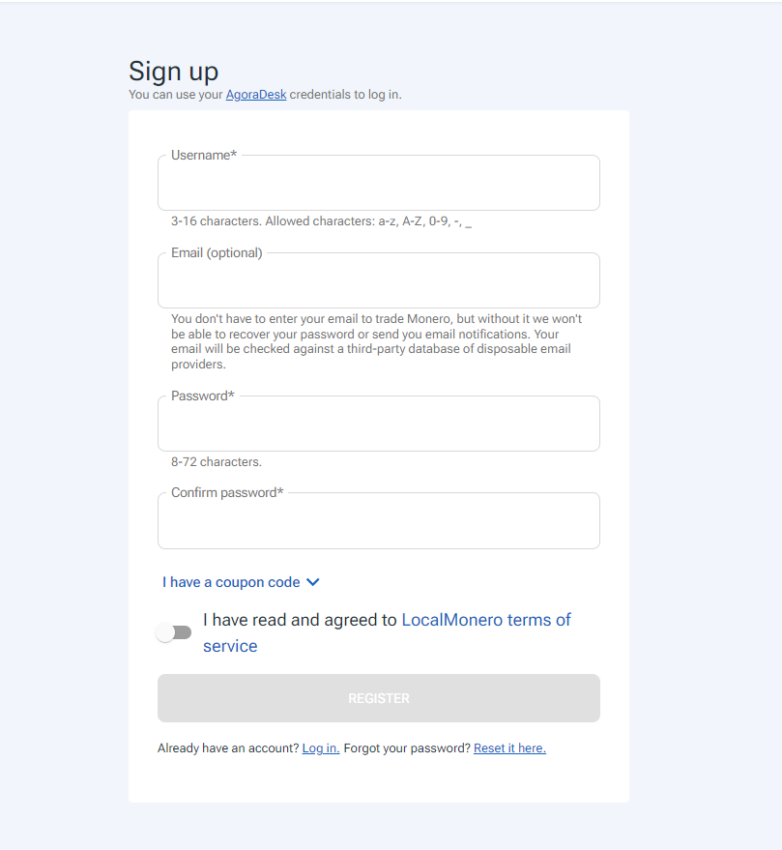

LocalMonero is by far the most popular p2p platform to buy XMR coins securely. It’s easy to use, and you don’t have to share any sensitive personal information such as phone numbers or ID proofs either. Hence, it is the more privacy-friendly choice if you compare it with any centralized exchange such as Binance. Here’s the step-by-step procedure to buy monero on LocalMonero

Step 1: Visit the website

Visit the LocalMonero website and create an account. It’s a straightforward process; you don’t even have to share your email ID if you don’t want to. (Although, signing up with an email ID has certain benefits).

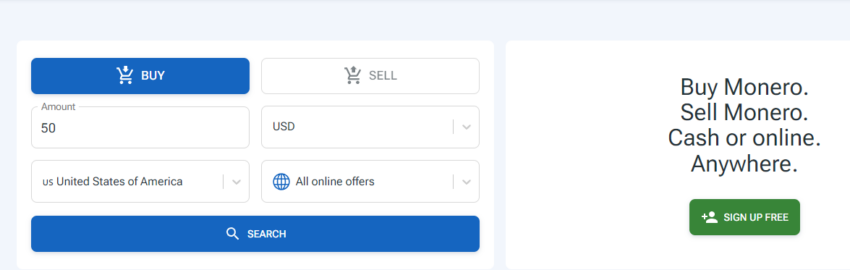

Step 2: Select the country and currency

Up next, you need to select the country you are in, the currency you want to buy monero with, the amount you are buying, and the payment method (e.g., PayPal, CashApp, National Bank Transfer, and so on). Alternatively, you could just select the “All available offers” option to get the list of all offers made by sellers regardless of payment methods.

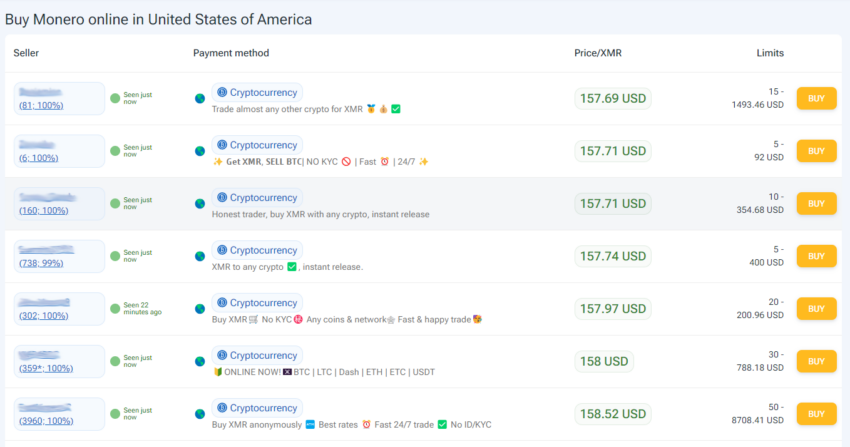

Step 3: Select a seller

As you can see in the image below, the list of sellers and their offers contain detailed records of the activity and feedback the seller has received so far. Ideally, you should go for an active seller with a high feedback score. And at the risk of stating the obvious, you also need to check the asking price — the lower, the better, of course.

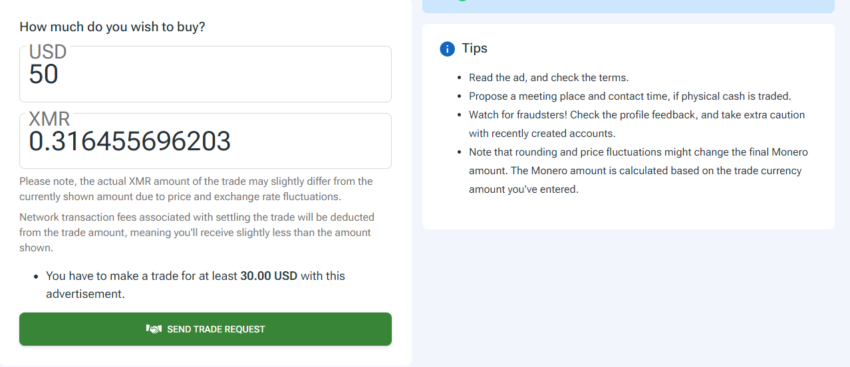

Step 4: Enter the amount and pay

Enter the amount you want to spend, and click on “SEND TRADE REQUEST.” Once the seller accepts the request, you will be notified, possibly along with a message from the seller. Follow the on-screen instructions and release the payment. You will receive a notification once the seller releases the requested XMR amount.

The best part is that LocalMonero operates an escrow service that enables secure trading between monero buyers and sellers. When a trade is opened, the seller’s monero is locked in escrow, guaranteeing availability to the buyer. The cryptocurrency remains in escrow until the buyer makes payment and the seller confirms receipt. Only then is the Monero released from escrow to the buyer.

This escrow mechanism protects both parties from fraud or loss of funds, ensuring a fair, safe transaction.

Monero wallets

When it comes to safeguarding your XMR securely, hardware wallets offer maximum security by storing keys offline on physical devices. Popular options like Ledger and Trezor support XMR.

Software wallets provide user-friendly interfaces for convenient monero management on computers. Monero GUI and MyMonero are some of the most popular and widely used software options.

For portability, mobile wallets like Exodus, Cake Wallet, and Monerujo could be your go-to solution. Just make sure to check the pros and cons of each wallet before you settle with one.

Apart from that, paper wallets allow offline cold storage of Monero keys in print form. Note that the ideal monero wallet depends on individual priorities between privacy, security, and convenience. Nonetheless, all monero wallets worth their salt share the vital role of protecting user anonymity and transactions.

Monero price prediction

Our monero price prediction is designed to provide you with the latest insights and analysis. It covers factors influencing Monero’s value, such as market trends, technological advancements, and regulatory changes. Our experts predict the price of monero could reach a maximum of $779 in 2025 and $11012 in 2030. However, note that while fundamental and technical analysis can give us an indication of future prices, it is not wise to buy crypto solely based on a single price prediction, no matter how bullish. The market is volatile and can change at a rapid pace.

Is Monero a good investment now?

The key thing about Monero is that it keeps your identity and transactions confidential. It has earned its status as one of the best privacy coins around. The network also uses some cool encryption techniques to obscure the sender, receiver, and amount in every transaction. So, if you care about financial privacy, Monero has you covered.

However, monero’s privacy does come with some risks and regulations to be aware of. Make sure to research the laws where you live since some places restrict anonymous currencies. As with any investment, if you do buy monero, purchase small amounts first and then move ahead depending on the prevailing market condition and your long-term investment strategy. The most important thing is to prioritize financial safety and responsibility.

Frequently asked questions

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.