On August 5th, the cryptocurrency market experienced its worst day in years. Few saw that day coming, but traders' addiction to leverage has been quietly amplifying risk across markets in recent months. If leveraged trading was the spark, the sharp upward trend in the Japanese yen was a match. Thankfully, fires can start and burn out quickly.

The soaring cost of yen-denominated loans was the cause of the collapse. Now, the market is poised for a healthy recovery as traders finally reduce their leverage and exposure to the yen. Once the broader market stabilizes, and it probably will, cryptocurrencies may soon make a comeback.

Borrowing cheap flights

It is no secret that cryptocurrencies are not traded based on fundamentals. Prices are primarily driven by short-term institutional investors who profit from the volatility of cryptocurrencies. To increase returns, traders use leverage to double their positions or borrow money, often in staggering amounts. Just before the crash, open interest, a measure of net borrowing, was about $40 billion.

All borrowed money must come from somewhere. These days, that place is Japan. In 2022, interest rates on U.S. Treasury bills exceeded zero for the first time in years and continued to rise. In Japan, interest rates remained at rock bottom. The trading companies were financed with large Japanese loans to cheaply finance transactions in other markets.

It seemed like good timing. By 2023, the crypto bull market was in full swing. Leverage trading, which can more than double profits or losses, has brought considerable profits. Meanwhile, traders were able to raise funds in yen almost free of charge.

This is the essence of the so-called yen carry trade, and is not limited to virtual currencies. Yen-denominated loans to foreign borrowers will reach about $2 trillion by 2024, an increase of more than 50% from two years ago, according to a report by ING Bank.

The end of Japan's 17-year-old policy

All that changed on July 31, when the Bank of Japan raised short-term government bond interest rates from 0% to 0.25%. (This came after a rate hike in March, when the bank raised interest rates from -0.1% for the first time in 17 years.) This seemingly innocuous move ultimately led to Bitcoin (BTC $55,514) and Ethereum (ETH $2,500) prices will fall by approximately 18% and 26%, respectively.

Traditional markets were also shaken up, with the S&P 500 index, an index of US stocks, dropping more than 5% on the day.

The trigger was not so much Japan's interest rate hike, but the subsequent sharp rise in the value of the yen in the foreign exchange market. (When domestic interest rates rise, the value of a currency often increases.) Since July 31st, the USD/JPY exchange rate has fallen from approximately 153 yen to 145 yen per dollar. Suddenly, those yen-denominated loans became significantly more expensive.

Traders began dumping billions of positions, whether due to margin calls from lenders or general caution. Jump Trading's sale of more than $370 million in ETH between July 24 and August 4 was controversial, but did not trigger an economic downturn. At best, the jump just amplified what was already destined to be a historic decline.

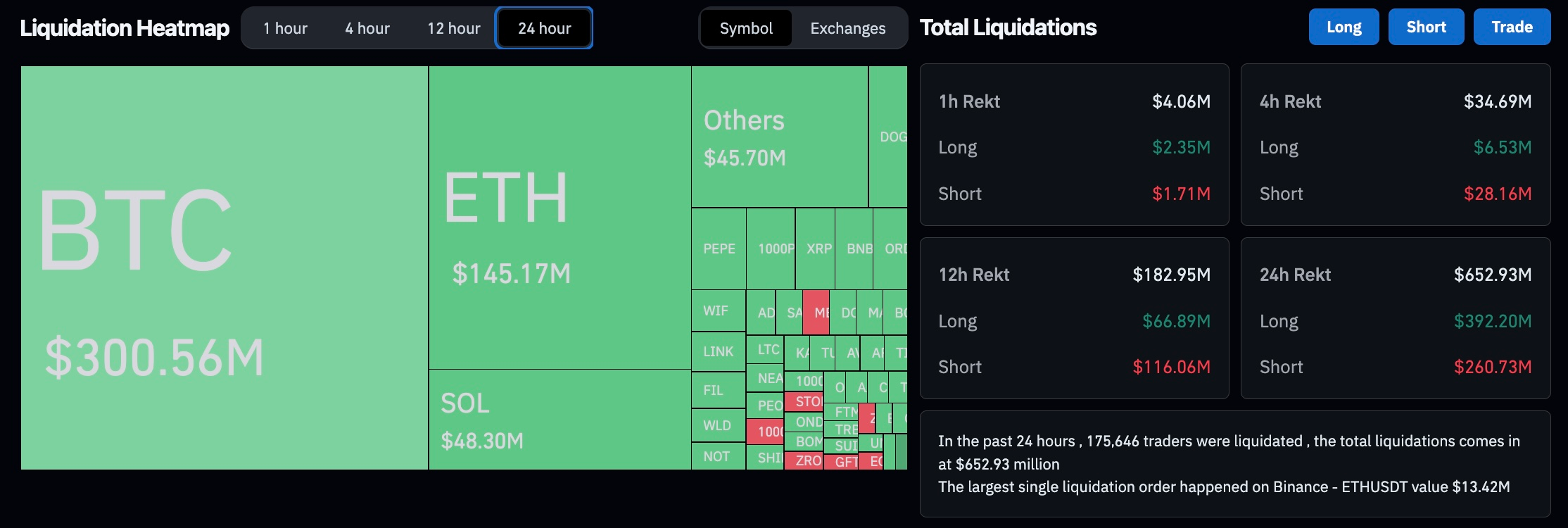

24-hour settlement data from the night of August 4th to 5th, 2024. Source: CoinGlass

In fact, according to Coinglass, over $1 billion in leveraged trading positions representing hundreds of thousands of trades were liquidated between August 4th and 5th.

Will you come back stronger?

Depending on the illness, fever may be a treatment. I hope that's what's happening in the market as well. Traders were forced out of risky, leveraged positions and ultimately reduced huge yen-denominated loan obligations. Net open interest in cryptocurrencies currently stands at $27 billion, nearly $13 billion less than before the crash.

Meanwhile, according to ING, there may be no room left for USD/JPY to fall.

If all else fails, rate cuts will always occur. On August 5, Japan's stock market fell by about 12%, the worst single-day decline since 1987. This could force Japan's central bank to intervene, softening the blow for borrowers. The United States could also receive relief after a July report showed a sharp rise in the unemployment rate.

David Aspel, senior portfolio manager at Mount Lucas Management, told Cointelegraph that “if ever intervention was ever going to work, now is the time” in Japan. “Given recent U.S. data, it appears the Fed will cut rates much more aggressively than was thought a few months ago.”

If this scenario plays out, cryptocurrencies could rebound in late summer. Of course, the cryptocurrency market is always unpredictable. If there's one lesson from all of this, it's that you should think twice before trying another leveraged trade.