Español.

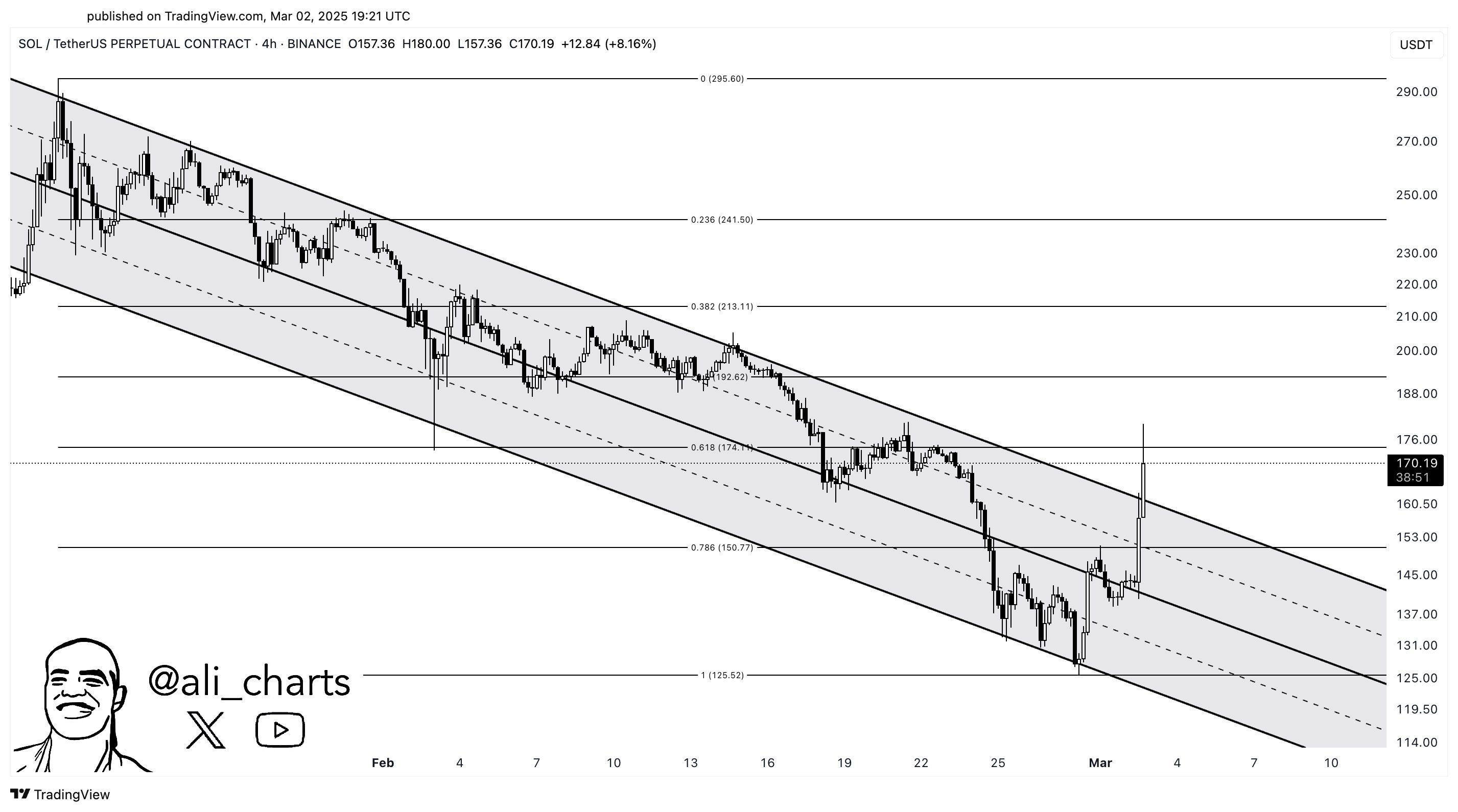

Solana (Sol) has brought about a dramatic change in market structure, surpassing the declining parallel channels that dominated the price measures for weeks. Ali Martinez (@Ali_Charts), who shared the attached 4-hour chart, suggests that this breakout will allow for tokens to be placed that could point the token to $213.

The Solanables regain momentum

The charts ranging from January to early March show a steadily declining pattern in which prices repeatedly test and respect the channel's upper and lower boundaries before the latest bulls push the sol beyond channel resistance.

The descending parallel channels highlighted in Martinez's analysis are visually evident from a series of low and low values, forming a consistent downward gradient. With each short recovery in the past few weeks, the midline of the channel was unable to clear, increasing bear pressure. However, as Sol's prices rose above this midline, bullish momentum began to build up, moving the cap decisively. This type of channel breakout often suggests that sellers are exhausted, allowing buyers to control the market.

Related readings

In particular, the breakout comes with two main catalysts from Solana. First, there will be a massive unlocking of Solana by FTX Estate (March 1). Secondly, yesterday, US President Donald Trump announced that the US strategic cryptocurrency sanctuary would include Bitcoin, Ethereum, XRP, Cardano and Solana.

One of the most important factors in Martinez's predictions is the $213 target, derived from channel height from breakout points in combination with the 0.382 Fibonacci retracement level. Now, in the aftermath of the breakout, a retest of broken resistance is being carried out. The $160-165 zone is an area where buyers may try to adhere to the new uptrends of tokens.

Conversely, significant Fibonacci retracement levels beyond Solana's current current price of $170.19 are $174.11 (0.618), $192.62 (0.5), $213.11 (0.382), and $241.50 (0.236).

Related readings

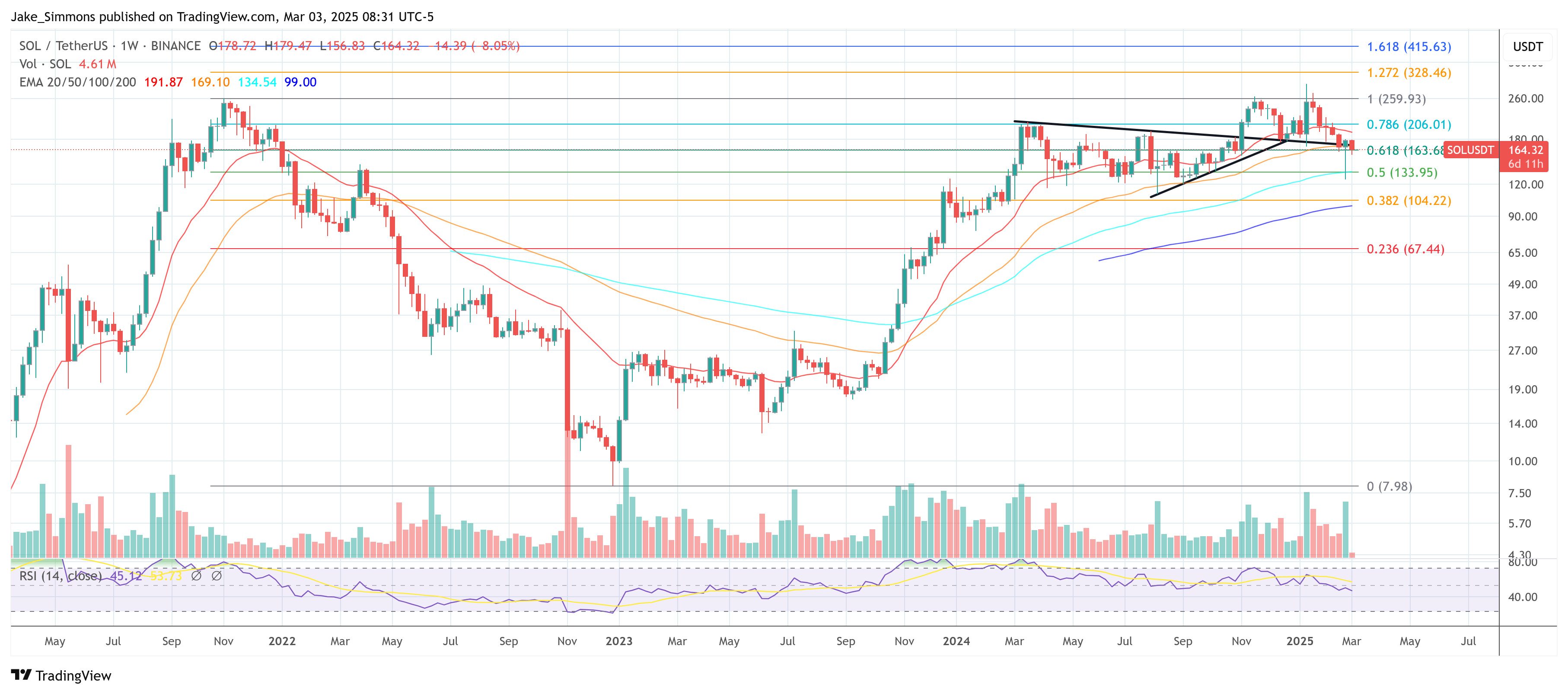

The analyst's overall sentiment supports Martinez's bullish outlook. Jelle (@cryptojellenl) pointed to the important Solana Unlock event that is currently behind us, highlighting the fact that weekly candles closed in green. According to his observations, Sol recovered important support after removing its lowness.

“The giant $sol unlocked behind us and weekly candles closed in green. Low prices, retest support, trendline holding. I'm sure the next sol push will send it to price discovery – hard,” he writes via X.

In addition to the positive market narrative, Placeholder VC partner Chris Burniske said BTC, ETH and SOL are all closed weekly in favor of through X, and the long-term trends for these major cryptocurrencies are being maintained. “BTC ETH and SOL could not seek better closures in a week, and the long-term trend remains.

From a technical standpoint, it relies a lot on Solana's ability to maintain a breakout. The downward channel serves as a clear reference to bearish emotions, and breaching it suggests a major shift in market psychology.

At the time of pressing, Sol traded for $164.

Featured images created with dall.e, charts on tradingview.com