- Ethereum's recent pullback follows a significant price rally, and the ETF approval is seen as bullish.

- Market volatility and trading activity suggest a mixed, yet potentially bullish, future for Ethereum.

Ethereum [ETH]The leading cryptocurrency and blockchain platform has seen significant market activity in recent weeks.

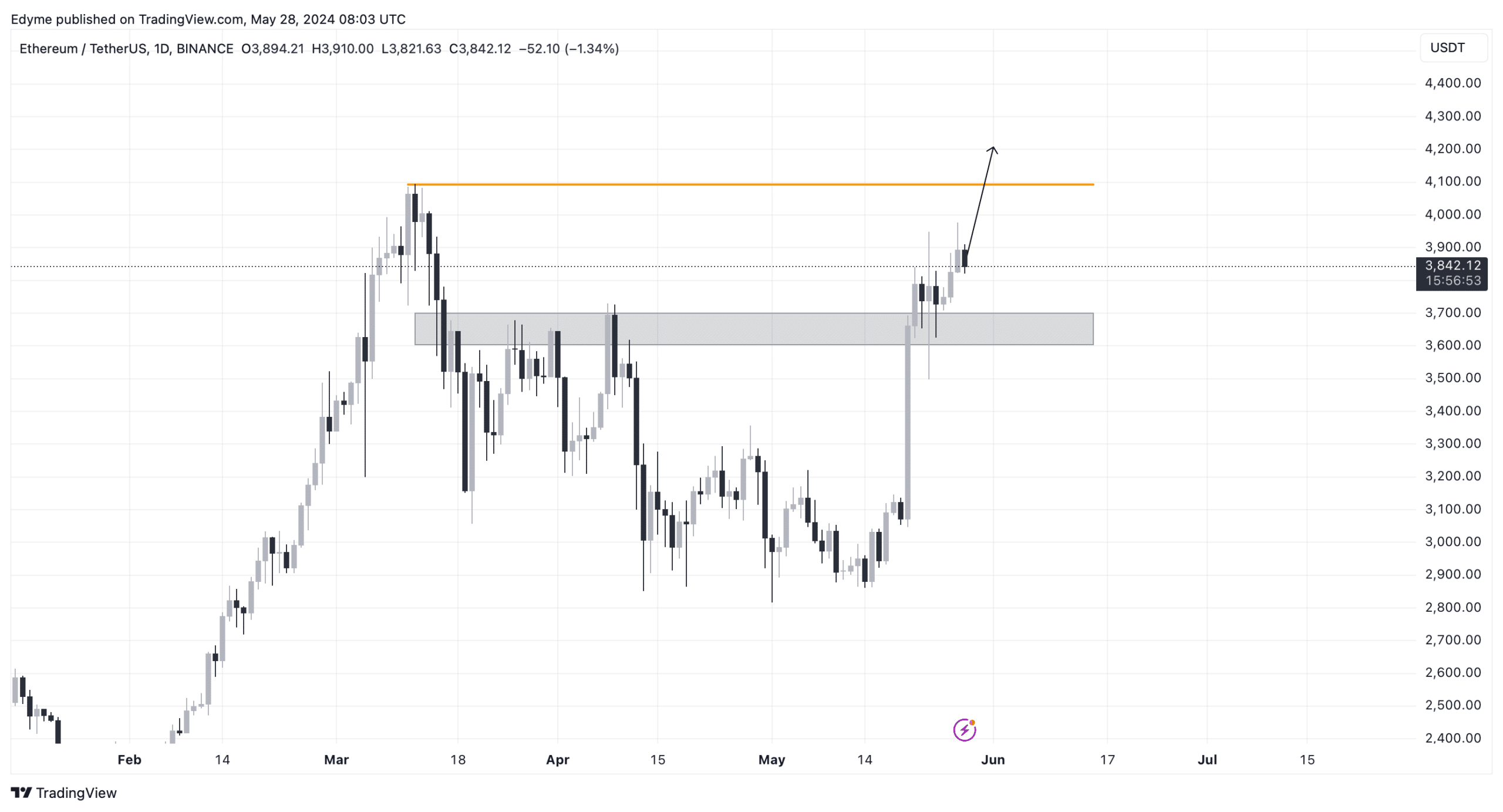

Ethereum recorded a massive rise of about 31.5% in two weeks, pushing its value above $3,900 before showing a slight pullback and settling around $3,845.

The fluctuations come amid broader market trends and regulatory developments that could impact the asset's future trajectory.

Cryptography research company Kaiko Shining a light These trends, especially According to the U.S. Securities and Exchange Commission (SEC) Spot Ethereum ETF.

The approval is seen as a positive step for Ethereum, although it may lead to a short-term market correction.

Beyond the direct impact on price, the impact of these regulatory developments could shape Ethereum’s status in financial markets and have a significant impact on investor sentiment.

Ethereum: Market Reaction

According to Kaiko’s analysis, the introduction of an Ethereum ETF may initially trigger selling pressure due to potential outflows from existing investment vehicles such as Grayscale’s Ethereum Trust (ETHE).

The firm currently manages over $11 billion in assets.

Historical data from similar scenarios suggests that such an outflow could have a significant impact on daily trading volumes.

However, as seen with the Bitcoin ETF, initial outflows are eventually offset by subsequent inflows, suggesting that the ETF may stabilize after its launch.

Will Kai, head of indexes at Kaiko, highlighted the broader implications of the SEC’s decision, noting that it declares Ethereum’s status as a commodity rather than a security.

This classification will not only impact Ethereum trading and storage, but will also set a precedent for the regulation of similar tokens in the United States, likely promoting a more stable regulatory environment.

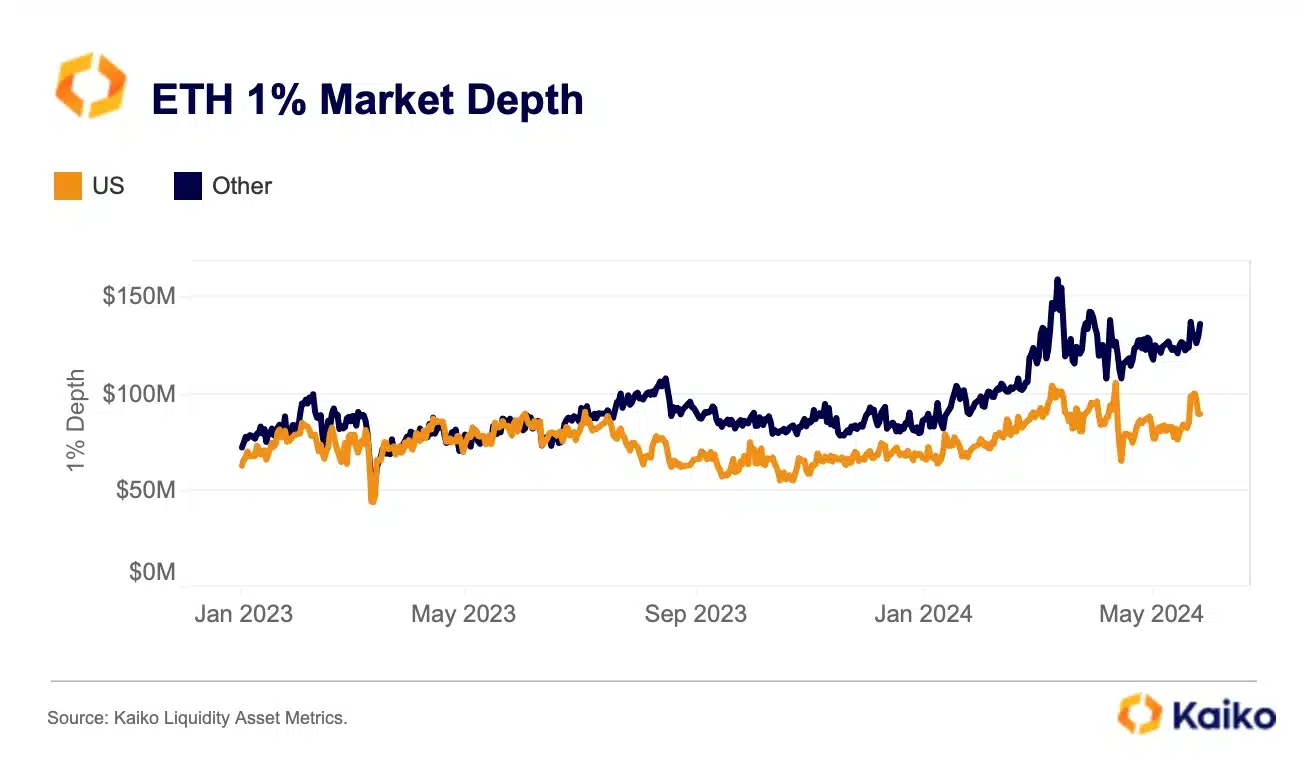

Meanwhile, Kaiko said the market cap of Ethereum on centralized exchanges was around $226 million at the time of the report, 42% lower than the level before FTX’s collapse.

Of this, just 40% is focused on U.S. exchanges, down from around 50% at the start of 2023.

Source: Silkworm

The research firm noted:

“Overall, even if inflows disappoint in the short term, this approval is significant for ETH as an asset and removes some of the regulatory uncertainty that has weighed on ETH’s performance over the past year.”

Volatility Insights

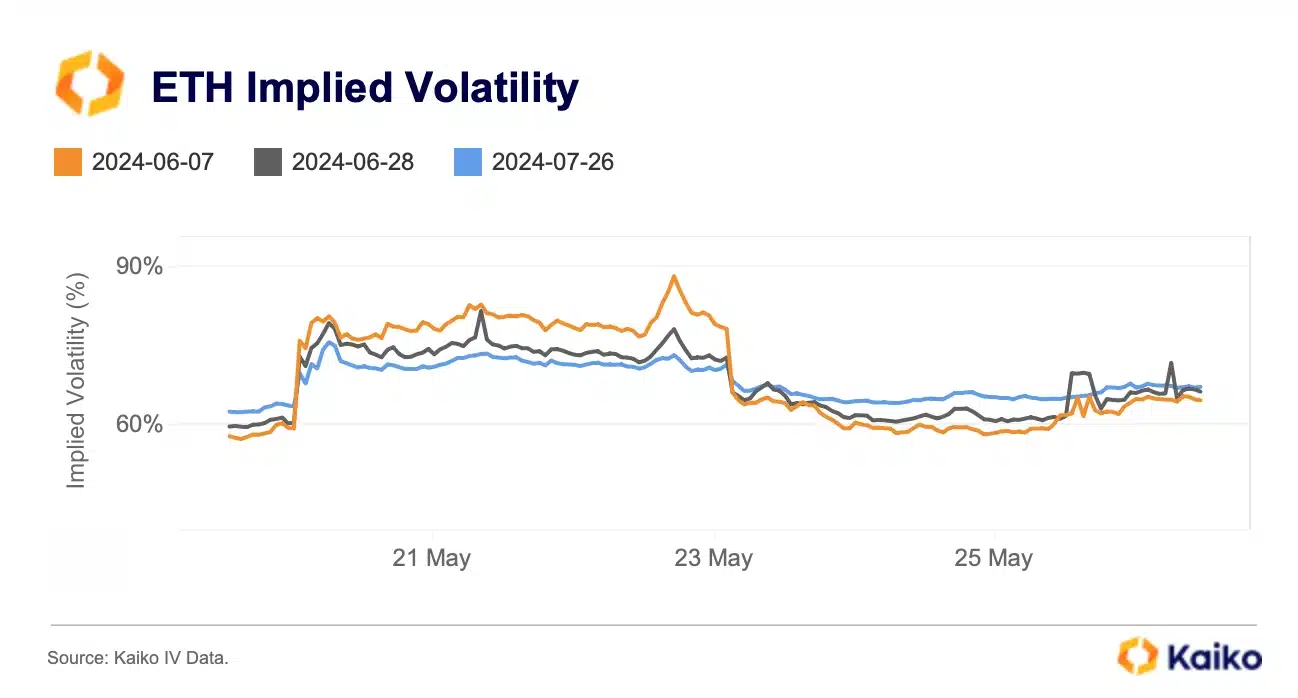

Further insights from Kaiko highlighted Ethereum volatility trends: In particular, Ethereum implied volatility rose dramatically in late May, signaling increased market activity and investor interest.

This has led to an inversion of the volatility structure, with short-term volatility exceeding longer-term expectations – a common indicator of market stress and heavy trading activity.

Source: Silkworm

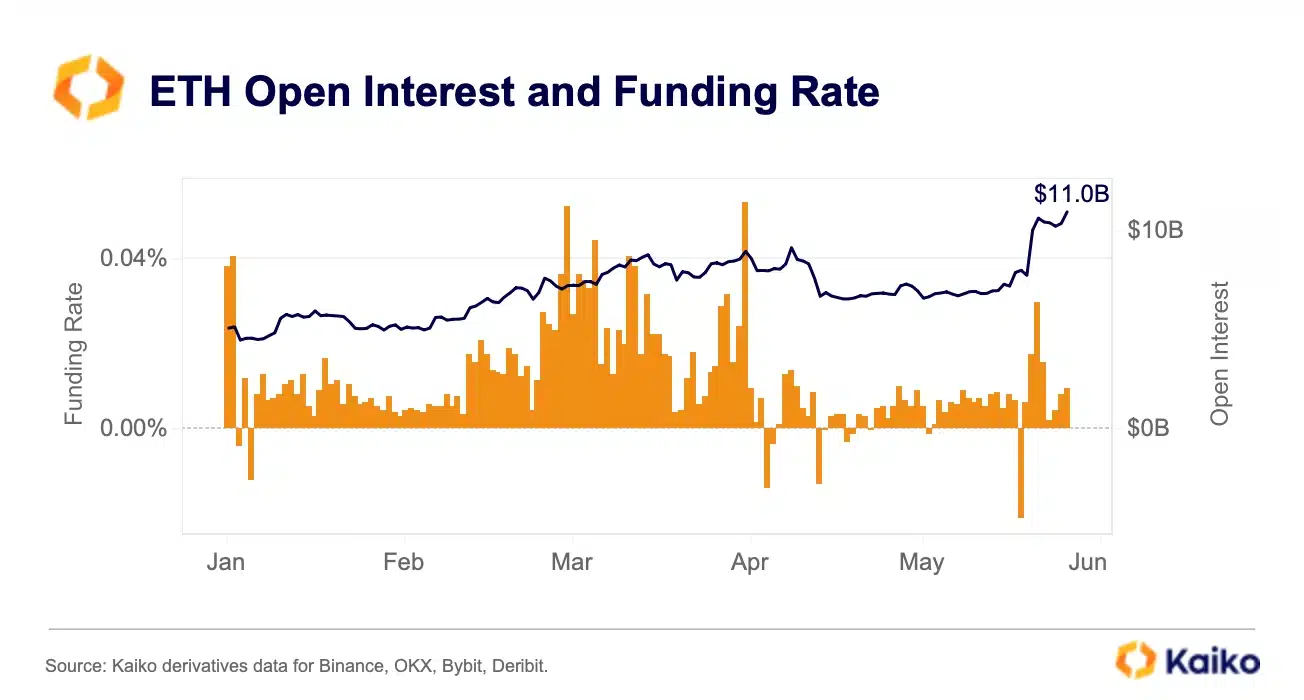

In the derivatives market, Ethereum has been making notable moves.

Ethereum perpetual futures funding rates have soared from their lowest level in over a year to their highest in months in just a few days.

At the same time, open interest in these futures reached a record high of $11 billion, suggesting strong capital inflows and increased trading activity.

Source: Silkworm

Despite these encouraging signs, some indicators call for caution.

Is Your Portfolio Green? Check out our ETH Profit Calculator

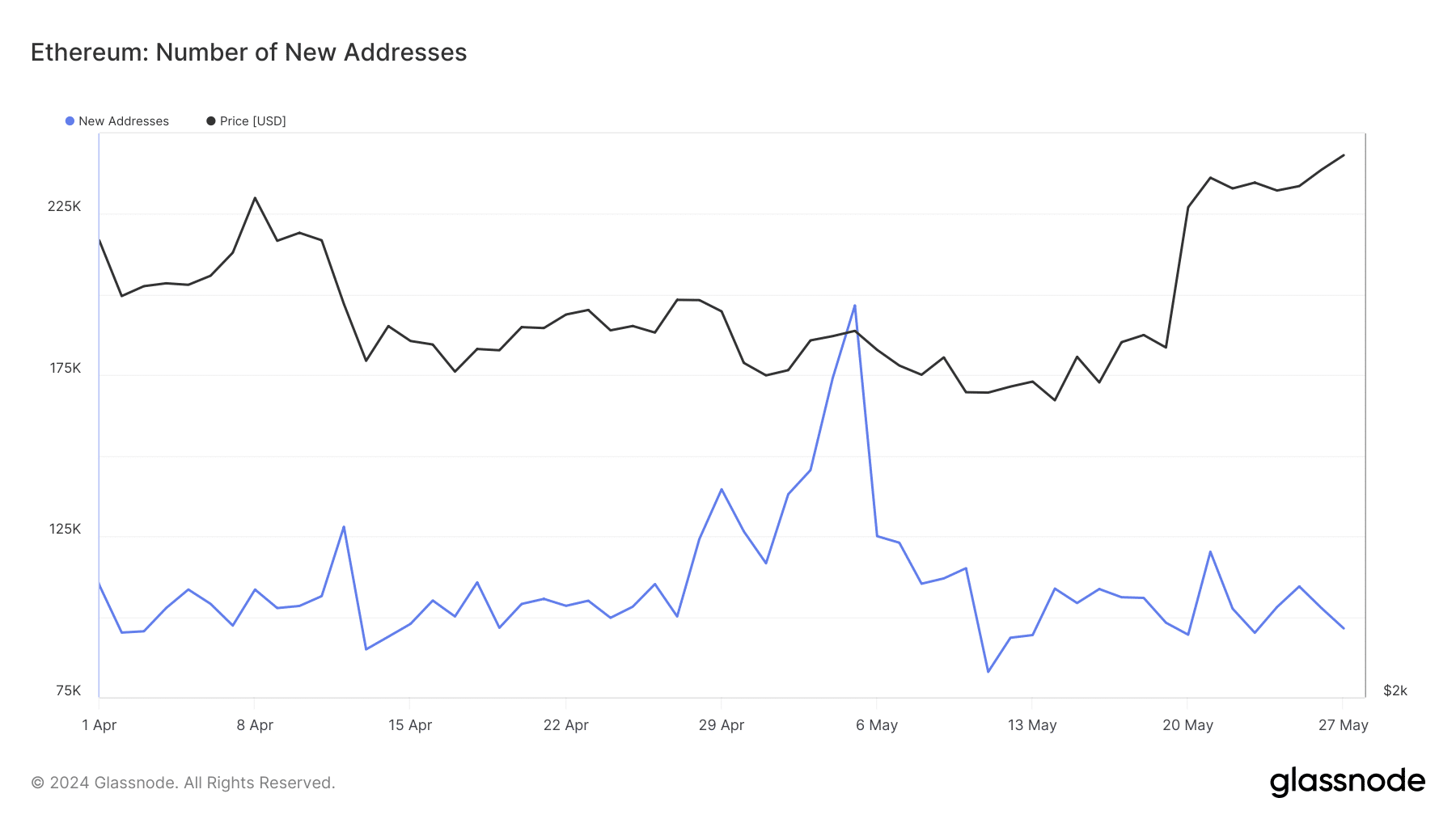

AMBCrypto's review of Glassnode data shows that the number of new Ethereum addresses has recently declined, which could indicate a slowdown in the influx of new participants into the network.

Source: Glassnode

However, a look at the daily chart of Ethereum reveals that the asset has recently converted a major resistance level into a support level, setting the stage for further gains and potentially a breakout above the $4,000 level.

Source: TradingView