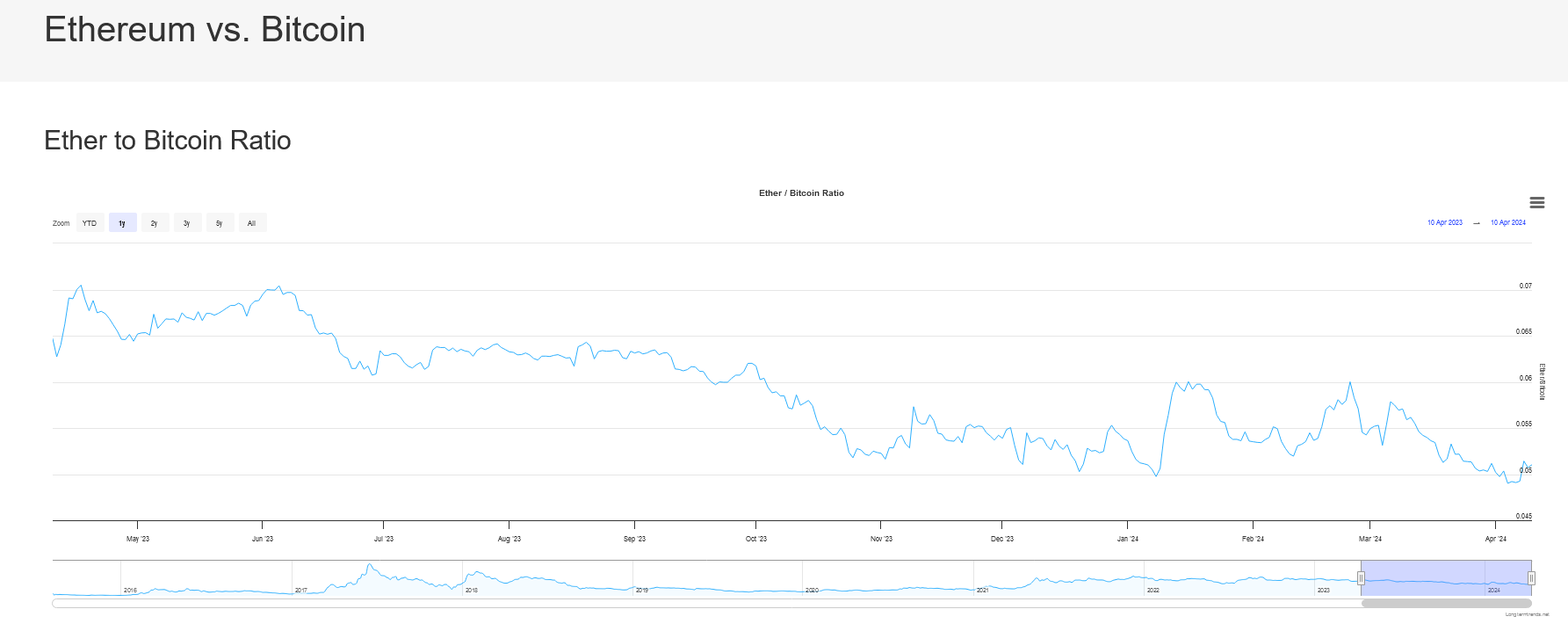

Ethereum's price may be lagging behind Bitcoin (BTC), but Kaiko analysts now point out that liquidity on global exchanges is rising rapidly. So why is the price of ETH falling?

While Bitcoin continues to be volatile, rocking the market today after a dramatic surge to new all-time highs in March, Ethereum presents a contrasting picture.

According to Kaiko, a blockchain analysis platform, the price of ETH is less volatile than the world's leading cryptocurrencies.

However, this seemingly slow movement has overshadowed Ethereum's massive development. Ethereum liquidity on global centralized exchanges like Binance and Coinbase is rapidly increasing.

Currently, Ethereum is changing hands above $3,400 and looking at the price trend on the daily chart, it is under huge selling pressure.

For example, the coin is down -17% from its all-time high. If sellers continue to push, ETH could fall to $3,200.

(ETHUSDT)

However, even though the price is falling, the increase in liquidity is a big boost for the coin.And this is key to ETH's long-term outlook for the year ahead.

In cryptocurrency trading, liquidity determines the ease with which tokens can be bought and sold through an exchange.

Because of the way they are set up, centralized platforms like Binance and Coinbase typically have more liquidity than decentralized exchanges like Uniswap.

When liquidity is high, the order book is deeper, which means more participants are placing trades at different price points.

Conversely, a deeper order book means less volatility for the asset in question, providing traders with a smoother experience and reduced risk.

Conversely, if liquidity is low, the experience will be rough as the assets being traded are volatile and trades are characterized by high slippage.

What’s behind this surge in Ethereum liquidity?

As identified by Kaiko analysts, several factors may be contributing to Ethereum’s increased liquidity.

One possibility is the expectation surrounding the potential approval of a spot Ethereum exchange-traded fund (ETF) by the stringent U.S. Securities and Exchange Commission (SEC) in May 2024.

If approved, this product will allow institutional investors to more easily enter the Ethereum market, taking liquidity to a new level.

Furthermore, ETH has a positive correlation with Bitcoin as well as other crypto markets.

(Ratio Gang)

Every time BTC prices rise, as they have since October 2023, it can create a ripple effect and draw investors into the broader crypto market, including Ethereum. This provides even more liquidity.

Bottom line: Don’t worry about ETH price after Fink approval

Beyond price-related factors, Ethereum supporters are overly bullish. This optimistic outlook is backed by BlackRock, the world's largest asset manager.

In a recent interview, the company’s CEO stated that Ethereum could become the platform of choice for tokenization in the coming years, signaling a tipping point for the financial industry.

If Fink is correct, the market could be worth trillions of dollars as traditional assets such as real estate and securities are tokenized on the blockchain.

This could push Ethereum prices higher, with some suggesting that large-scale asset tokenization could push ETH prices up to $10,000.

Explore: Don't copy blindly: 5 tips on how to make money from meme coins

Disclaimer: Cryptocurrency is a high-risk asset class. This article is for informational purposes only and does not constitute investment advice. You could lose all your capital.