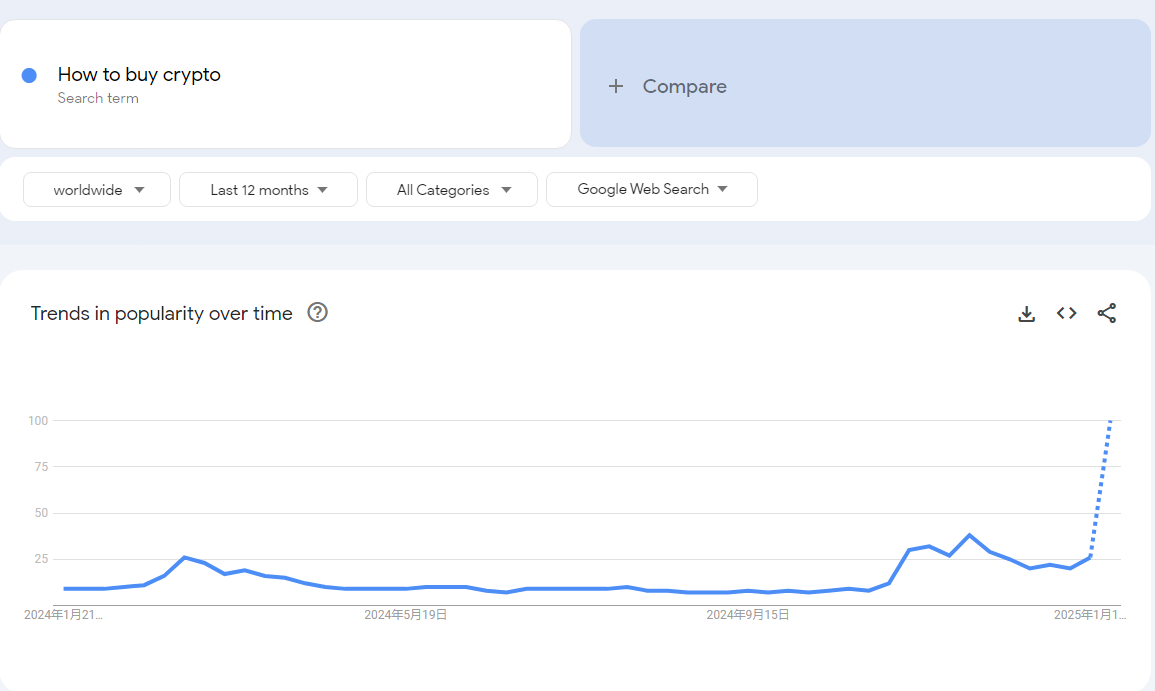

After President Donald Trump took office, the number of searches for “how to buy virtual currency” on Google Trends hit a new high. What does this mean for the crypto market?

On January 19th, global weekly searches for “how to buy cryptocurrencies” on Google reached the 100 mark, a 4x jump compared to last week's searches, and increasing further as the week progresses. It is predicted that this will happen.

The next day, Donald Trump was officially sworn in as President of the United States. His presidential term is expected to be more crypto-friendly than the previous Biden administration. Many leaders of major crypto companies have expressed confidence in the Trump administration and its potential to usher in an era of regulation that will benefit the crypto market.

Searches for “how to buy virtual currency” surpassed the search engine's previous record of 38 searches for the week from December 1 to December 7, 2024. This week was also the week when the price of Bitcoin (BTC) rose. ) reached the $100,000 mark for the first time in history, marking an important milestone for the cryptocurrency market.

Coincidentally, Bitcoin also hit a new all-time high on January 20 ahead of President Donald Trump's inauguration, reaching $109,114 before slowly declining. At the time of writing, Bitcoin is trading at $101,728, according to data from crypto.news.

Why do people search for “how to buy cryptocurrencies”?

The increase in global searches for “how to buy cryptocurrencies” may indicate that more people, especially first-time buyers, are interested in the crypto market.

These people may have never purchased cryptocurrencies before and are now interested in them due to recent events such as Trump's pro-crypto presidency and the spike in Bitcoin prices. There is sex. At the moment, the two events are inexplicably intertwined, as the previous Bitcoin rally that caused the $100,000 surge was also caused by Donald Trump's victory in the US presidential election.

Besides the United States, countries such as the United Arab Emirates, Singapore, Hong Kong, and Thailand have expressed external interest in expanding into digital asset hubs to keep up with the rapid growth of the global cryptocurrency industry. Masu.