Written by Egon von Greyarts

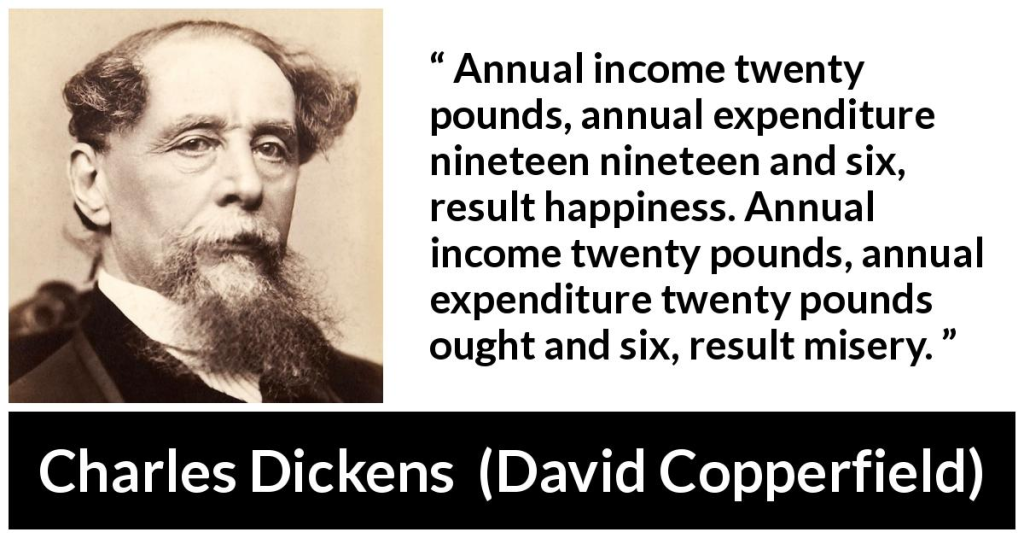

As Dickens wrote in David Copperfield, there is a fine line between happiness and unhappiness. Mr. Micawber, the landlord of Copperfield, was only sixpence away from happiness.

In a recent article entitled “The End of the U.S. Economic-Military Empire and the Rise of Money,” I wrote: “Unsustainable budget deficits and soaring debt levels, combined with a crumbling military, are the perfect recipe for the end of an empire. ”

So we're not talking about sixpence deficits in the case of the virtually bankrupt US empire, we're talking about debts that are now increasing exponentially by trillions of dollars every year. it is clear.

History doesn't just rhyme, it repeats itself over and over again.

Let's look at the final stage of the debt crisis.

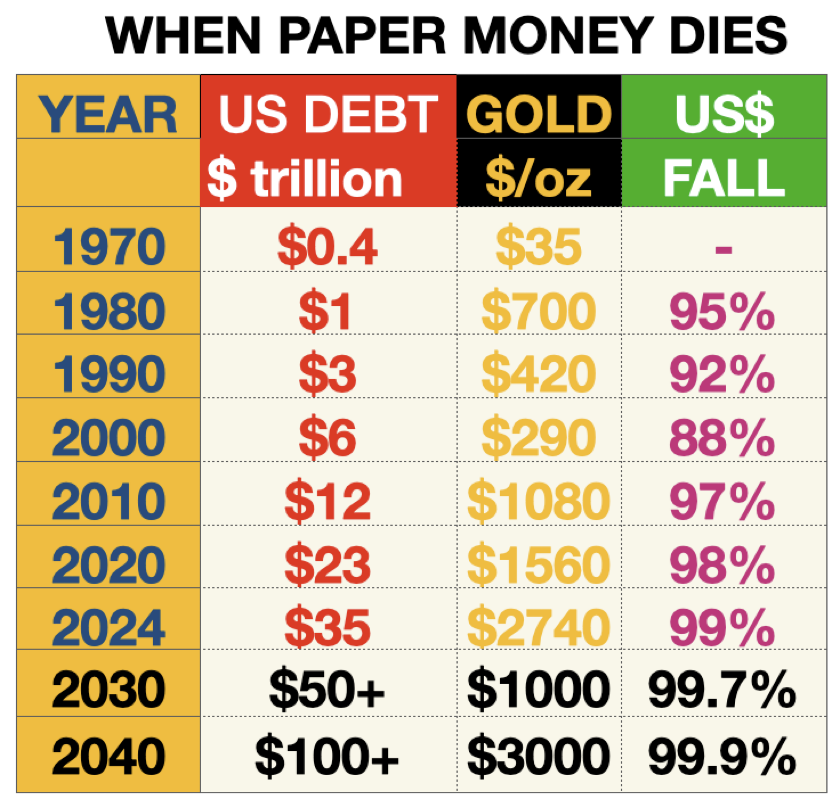

The table below shows the dire consequences of irresponsible governments over the past 54 years.

The government never tells the people that it is constantly destroying the value of their money.

In 1971, when Nixon stripped the gold backing of the dollar, he said: “Your dollar will have the same value tomorrow. ”.

If Tricky Dick were still alive, he could, of course, claim he wasn't lying.

Because, he would argue, a dollar today is still worth a dollar. But no one told me that 53 years later the dollar has lost 99% of its purchasing power.

Since Nixon closed the gold window in 1971, gold has increased 78 times. will be in phase acceleration.

As this article explains, gold will rise many times over in the coming years (with corrections obviously).

The silver content of silver denarius coins went from almost 100% to zero, but the Roman Emperor, who ruled the Roman Empire from 190 to 290 AD, could make a similar claim.

The same was true for Friedrich Ebert, president of the Weimar Republic in the early 1920s. He would argue that a mark is always a mark, even if 100% of the purchasing power is lost.

But money doesn't lie. Measured in real money, one ounce of gold in 1923 was worth 87 trillion marks.

The leaders' deceptions will never be exposed to the public until the hyperinflation collapses and the currency is completely wiped out.

But we must never forget what Voltaire said in 1729: “Banknotes eventually return to their intrinsic value, which is zero.”

Have you ever heard a leader say that we must protect ourselves from the unjust destruction of our wealth by continually devaluing the value of money?

Alan Greenspan said this in 1967.

“Without a gold standard, there is no way to protect savings from inflationary confiscation. There is no safe store of value…The fiscal policy of the welfare state requires that owners of wealth have no way to protect themselves. This is what welfare statisticians say about money. The dirty secret of our rants: Deficit spending is simply a scheme to confiscate wealth. Money acts as a guardian of property rights. It is not difficult to understand nationalist hostility to the gold standard.

Look at the table above again.

These are just a few examples of the thousands of currencies that have been destroyed throughout history.

Governments cause inflation by printing money and allowing the financial system to create unlimited credit in a fractional reserve banking system.

This means that a bank or other financial institution can take a deposit of, say, $100 and loan it back 10 to 50 times, or $1,000 to $5,000. Add in derivatives and the system can create trillions of dollars out of thin air.

This immoral and totally undisciplined financial model not only creates unlimited influence for financial actors, whether they are banks, hedge funds, private equity, or part of the shadow banking system;

This is probably the total global debt of $350 trillion. quadrillion dollars Including all the creative “financial weapons of mass destruction” that Warren Buffett calls. Please refer to debt pyramid Down below.

Historically, traditional investment assets such as stocks and real estate have been good protection, as they have appreciated significantly as a result of constant growth in credit and money supply.

Therefore, this large liquidity injection created huge paper wealth for most investors.

when will it end

The party is almost over. The valuations of these bubble assets have now reached dangerous levels. History teaches us that mania always ends badly.

But history doesn't tell us when they will end. Will it be tomorrow, in six months, or in a few years?

So can we predict the end?

Well, the most accurate of all sciences is hindsight. Thanks to this highly accurate method, many people would later say that the crash was inevitable.

Sadly, no one realizes that this time the push-buying will fail. Still, investors will continue to buy the push until they get tired of it. So when the market falls more than anyone expected, most investors will sit tight based on greed and FOMO (fear of missing out). And at that very point, the greatest destruction of wealth in history will occur.

Few people would consider alternative investments like gold to preserve their wealth until it's too late.

And at that point, the value of gold will have increased significantly, even though very few people will participate. Everyone will feel that gold is too expensive. Few people realize that while gold is not rising, paper money is falling.

A fascinating journey to the pot of gold

I was born in Sweden and have dual Swedish and Swiss citizenship. I started my career in a Swiss bank and then moved to the UK as a corporate employee.

In 1972, I was offered a job with a bank client, a small publicly traded retail company called Dixons. I became Finance Director in 1974 at the age of 29 and was later appointed Vice Chairman.

We built the company into the UK's largest electrical and home appliances retailer and a FTSE 100 company.

It was an incredibly exciting time building a dynamic business both organically and through acquisitions. As business leaders, we have experienced adversity as a positive challenge. In 1974, when there was electricity only three days a week due to a strike by major coal miners, we sold televisions and other electrical products by candlelight. And we grew by competing for acquisitions of companies much bigger than us.

Corporate life in a dynamic business is very exciting. But since I started that career in my late 20s, I felt that my early 40s was the time to do my own thing.

So in the 1990s, I started investing my own money and the money of wealthy friends.

I have always been interested in understanding risks and preventing downsides, both in banking and corporate life.

In the 90's I started to worry about the growth of debt and derivatives. So I was considering the best way to preserve wealth.

Having experienced President Nixon's closing of the gold window and the subsequent 24-fold increase in gold prices from $35 in 1971 to $850 in 1980, I have always been fascinated by gold.

Watching debt, especially derivatives, grow unfettered and tech stocks in particular becoming a massive bubble in the late 1990s, I believe gold is the best asset to preserve wealth. I was convinced.

Having seen the price of gold rise from $35 in 1971, and from $850 in 1980 to $250 in 1999, I watched the gold price closely to see the bottom. . So, in early 2002, we made a large investment in $300 of physical gold for ourselves and a group of co-investors we were advising.

Since then, we have never looked back and have only increased our investment in gold over the years. Because we had built a superior system for purchasing and storing physical gold based on strict asset preservation principles, people around the world began asking for our help. That led to the creation of Matterhorn Asset Management/GoldSwitzerland. At the beginning of this year the company name was changed to VON GREYERZ AG.

Today, we have customers in more than 90 countries and are perhaps the world's largest company outside the banking system for acquiring and storing gold for wealthy individuals.

We have been active in gold for almost a quarter of a century and have experienced almost 10x growth in the price of gold since we started our business.

Still, we believe that Gold's journey is just beginning.

Why, you may ask.

Well, gold has been the best-performing asset class this century, outperforming the S&P when you include reinvested dividends, but still No one owns gold.

Only 0.5% of the world's financial assets are invested in gold.

It is completely incomprehensible that gold has increased 9.5 times. In this century, investors haven't even paid attention to such things.

So why is gold still so unloved?

Gold held in an investor’s name in a secure vault or jurisdiction outside the financial system is the ultimate form of asset protection.

But asset managers and banks hate gold because they can't earn fees on assets that can't be rotated regularly. Therefore, there are no fees or success fees. Also, very few people understand money.

In my view, gold is ready to explode in paper money terms.

I explained the reason, Many articles have profiled the upcoming explosion in gold, including this recent article.

However, remember that gold never goes up. It only reflects the destruction of fiat money by governments and central banks.

Gold is simply a stable purchasing power in a world where the prices of goods and services rise exponentially because the money to buy it will always be zero.

That being said, I expect gold to not only keep pace with purchasing power but deliver better results in the coming years.

Let me be clear once again: Paper money has never survived in history. (in its original form).

With such a perfect track record of money destruction, why do I think the FED, ECB, BoE (Bank of England), BoJ (Bank of Japan), or any other central bank has a chance to save the global financial system with $2? Can we believe that? Exposure to 3000 trillion toxic substances?

Well, I can personally guarantee that they are not.

No central banker would call it that, but remember that printing quadrillion banknotes and destroying the value of money is the technological default.

And creating digital money for central banks is just a technical diversion.

Debt cannot be canceled without completely destroying the value of the assets it supports. That's how balance sheets and double-entry bookkeeping work.

Therefore, this global financial system will collapse like other countries. However, this is the first time this is being done on a global scale.

BRICS countries will also suffer, but not as much as Western countries.

The future will be commodity-based. Take Russia, which has $85 trillion worth of nature reserves. They will be one of the major winners in the coming commodity era. They also have less debt.

So let's look at the risks.

danger of war

There are currently two major wars that could lead to global conflict or nuclear war.

Although US territory is not threatened, the US is directly involved in the conflict, both arms and money. The world's best chance of avoiding global conflict is if Trump is elected. He has proven and expressed that he will stop the war, especially in Ukraine. Harris has no intention of changing the direction of Biden and the neoconservatives, but this means the risk of global conflict is much higher.

Collapse of the global financial system

As outlined above, this collapse is inevitable. The only question is when and how much. I strongly believe that most of the BRICS countries will be able to reduce the damage from the collapse and recover from it faster.

The Western world, with its massive debt bubbles and moral decadence, has already begun a massive long-term decline that could last for centuries.

preservation of wealth

Money is not a panacea for the problems outlined above. However, history has proven that in times of crisis, gold has always served as a safeguard for both finances and personal security.

But most importantly, protect and help your family and friends.

Strong family ties and a close group of friends are more important than all the money in the world.

As Dickens said: