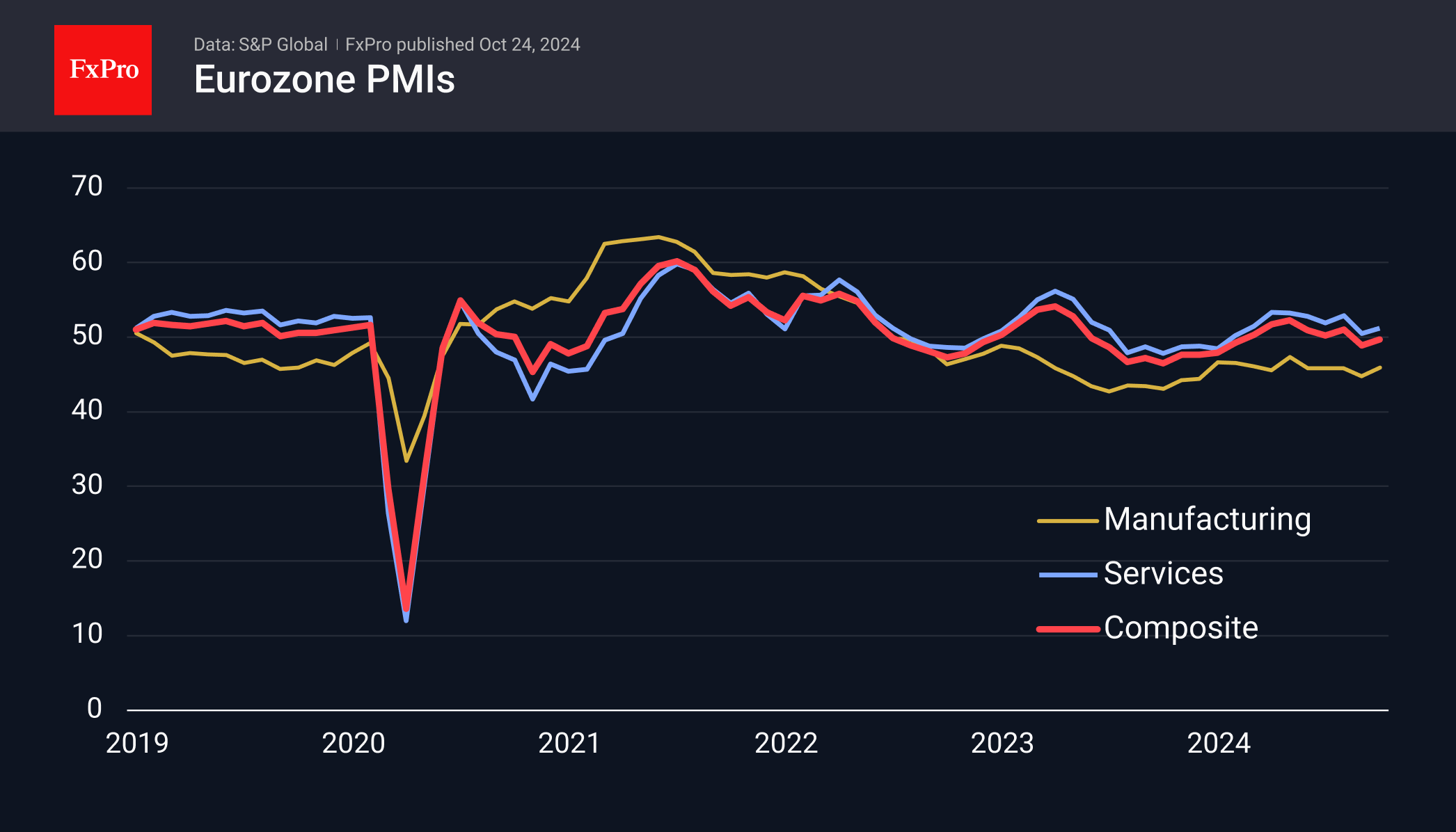

On Thursday, S&P Global released preliminary October PMI numbers for major regions. The importance of this data increases over time and often influences market trends in Europe.

European data was mixed, but currency markets noted stronger-than-expected numbers from Germany.

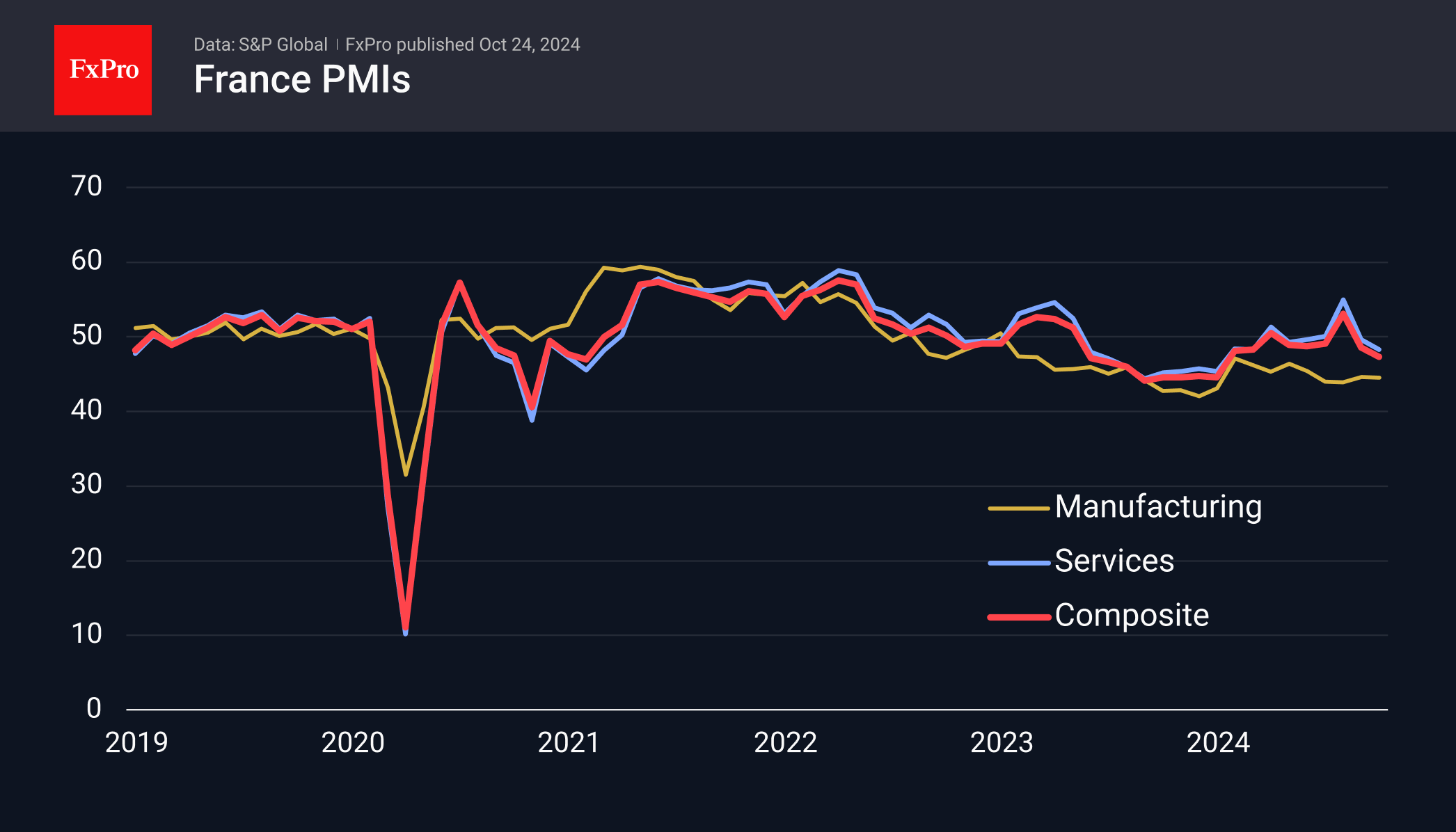

In France, the service sector is experiencing a serious decline due to the boost from the Olympics. The service index fell from 49.6 to 48.3, the lowest level since the end of last year. On the other hand, the manufacturing PMI remains in contraction territory at 44.5, falling below 50 for the second consecutive month. The comprehensive index also fell to 47.3, the lowest level in nine months.

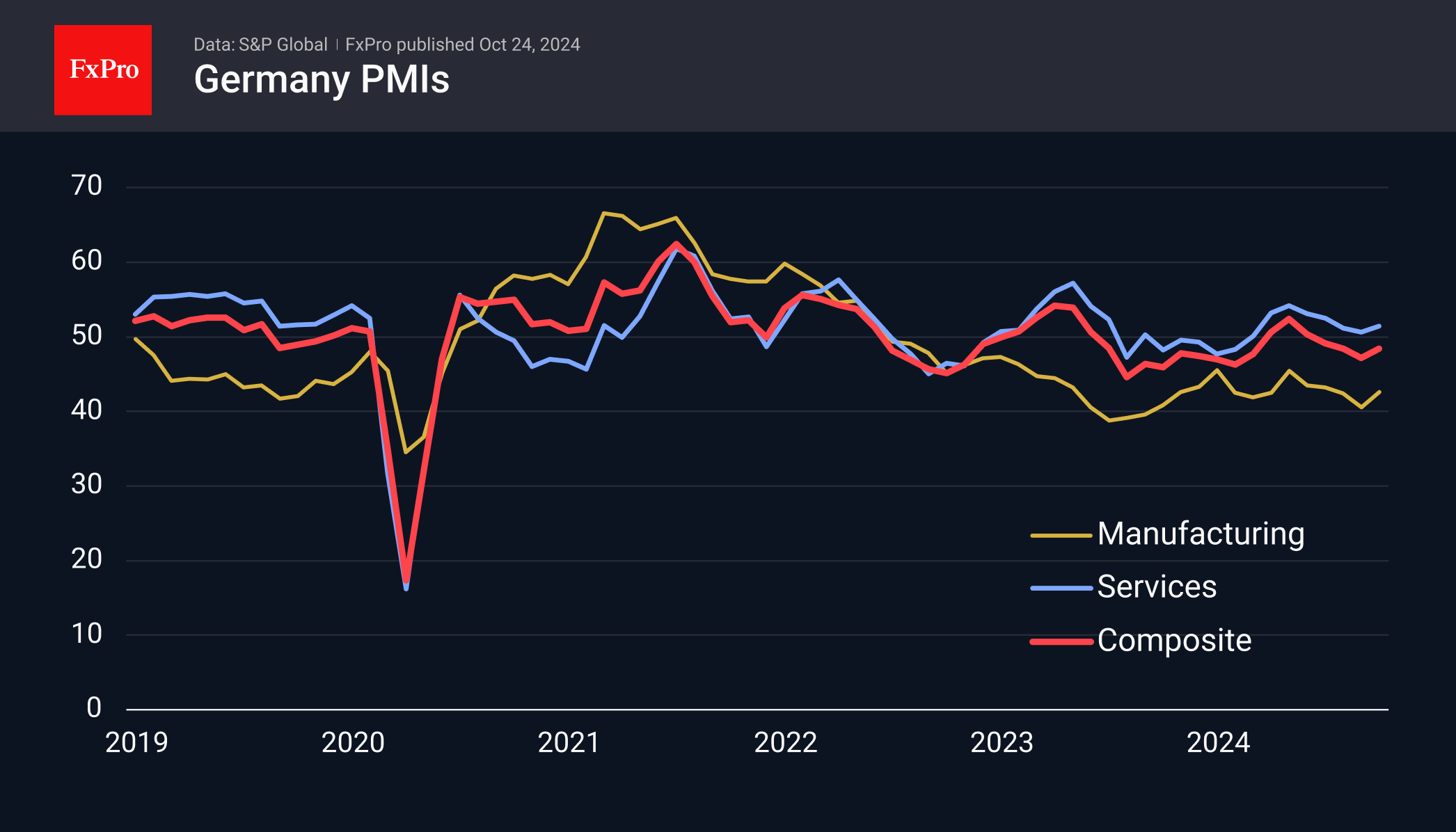

The German index forecast changed the trajectory of the euro, with the index coming in much better than expected. The service index fell for the first time in four months, rising to 51.4. Manufacturing PMI rose from 40.6 to 42.6, compared to the expected 40.7. This recovery brings some comfort, as German manufacturing, as measured by the PMI, has been in contraction territory since July 2022. As a result, the overall index for October was 48.4, remaining below the 50 threshold for the past four months.

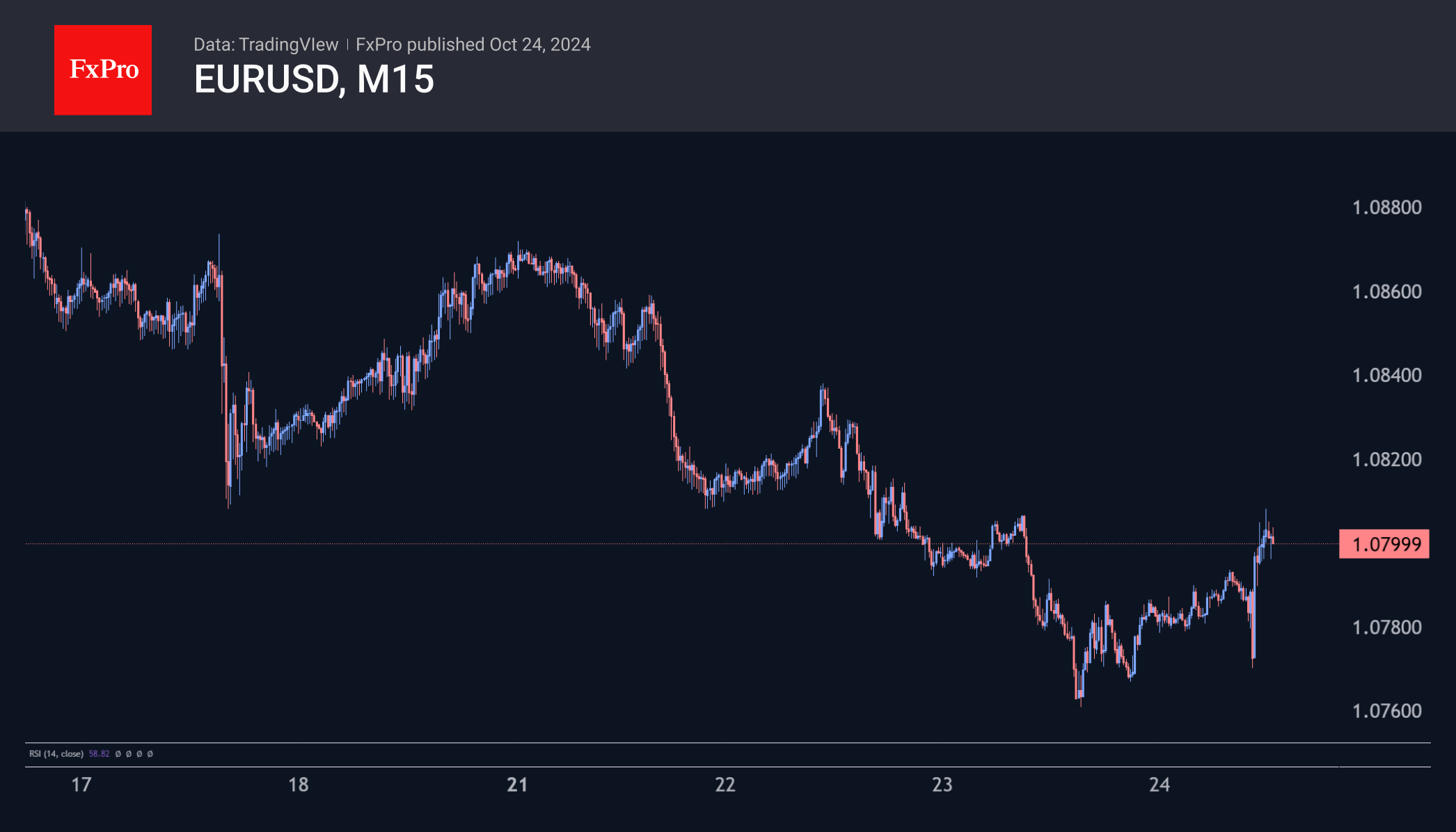

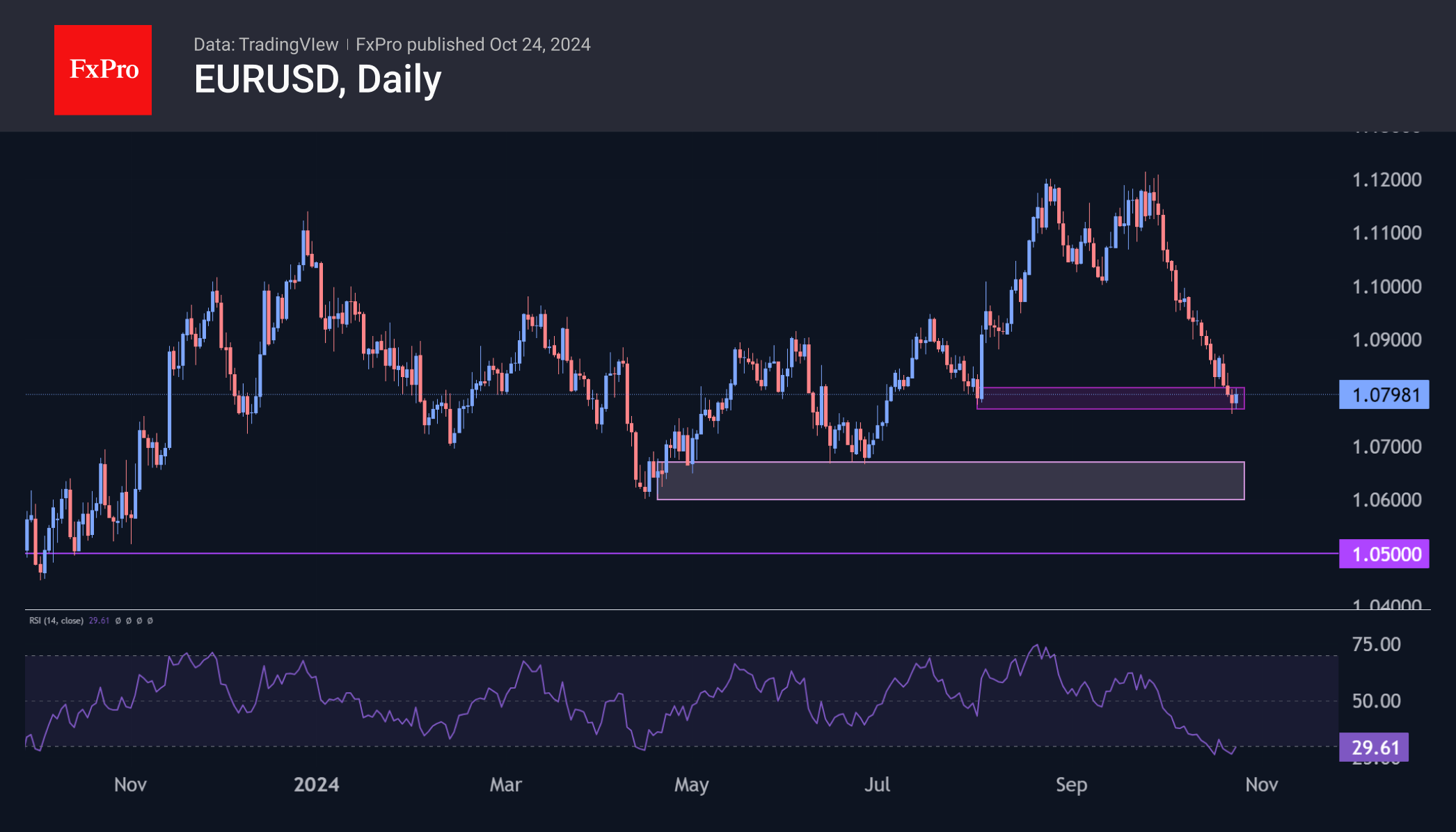

Investors and traders pointed to a slight reversal in Germany's PMI towards growth, and pointed to the 0.35% rise in EUR/USD immediately following the announcement, indicating there was light at the end of the tunnel. clearly shown. However, in the short term, the single currency has struggled to break above the 1.08 level, which appears to be creating resistance in the region.

Eurozone-wide PMI data beat expectations for the manufacturing sector, with the index hitting a five-month high of 45.9. On the other hand, the overall index rose from 48.9 to 49.7, remaining in the contraction zone, and growth in the service sector accelerated slightly.

German economic data beat expectations, halting the euro's decline. Against this backdrop, the EURUSD could begin a corrective rebound after almost continuous failure since the end of September. However, this improvement is too gradual to influence the ECB's dovish tone on interest rates in the coming weeks. The central bank is expected to continue cutting interest rates aggressively.

of FxPro Analyst team