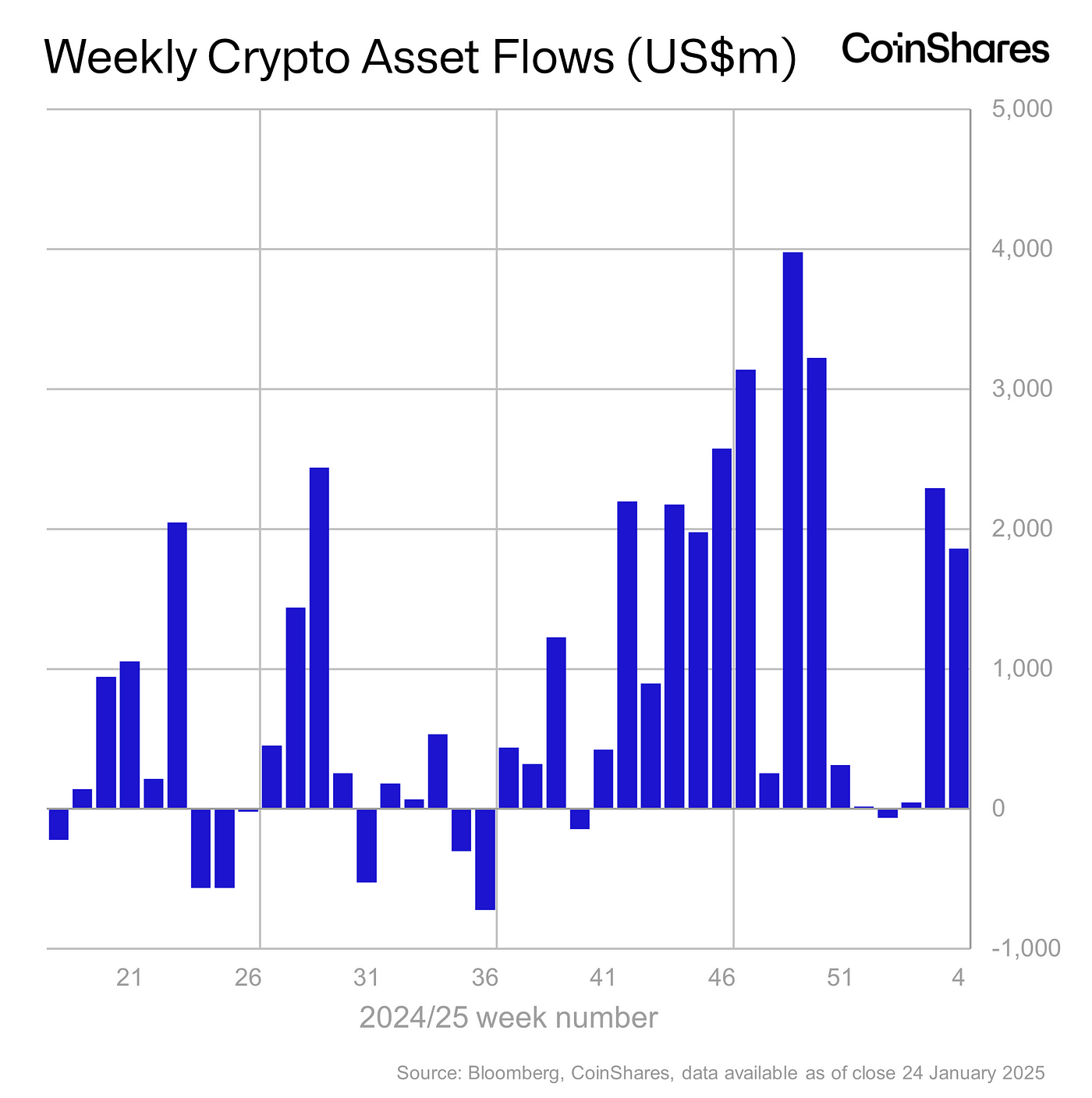

The weekly inflow into the Crypto ETF product reached $ 1.9 billion after Trump supported Bitcoin Reserve's proposal.

Last week, nearly $ 2 billion, the coin share revealed in a survey report on January 27 that the inflow from the beginning of the year has flown into cryptographic investment products to $ 4.8 billion.

Bitcoin (BTC) continues to dominate, drawing $ 1.6 billion last week, or 92 % of the total inflow. From the beginning of the year, we have collected $ 4.4 billion. According to the coin share, the inflow of $ 5.1 million in the short coin ETF is found to be possible from traders who are preparing a potential market pullback after the recent rapid increase in bitcoin. I added it.

The United States has led with an inflow of $ 1.7 billion. According to the data, Canada won $ 31 million, but Switzerland and Germany looked at $ 35 million and $ 23 million.

Ethereum (ETH) bounced off $ 250 million after the severe start of the year. XRP (XRP) was drawn in for $ 18.5 million, recorded the highest ever last week, and maintained its momentum. For small altcoins, Solana (SOL) brought $ 69 million, CHAINLINK (Link) saw $ 6.6 million, and Polkadot (Dot) added $ 2.6 million. James Butterfill, coinshares researcher, pointed out an amazing twist that “last week's digital asset investment products have not been leaked.”

The rapid increase in inflow occurs immediately after trading the amount of intensive exchange to $ 25 billion, accounting for 37 % of reliable encryption activities. Bataphil explained that the latest development was one of the most important weeks in recent memories promoted by the excitement surrounded by bitcoin as strategic preparatory assets.

There is still a debate on how smooth bitcoin is used as a spare asset. In late January, RIOT PLATFORMS VP Pierre Rochard accused Ripple's key lobby pushing to strategic bitcoin protection areas, and the company to block it. We argue that people are spending.

Rochard argued that Ripple continues to defend XRP -based stories and continue to promote digital currency supported by states. He also stated that Ripple had previously aimed for bitcoin mining under the Biden administration. But Ripple CEO's Brad Garlinghouse responded quickly, saying that the company's efforts matched the larger goal of the Biden administration.