The cryptocurrency industry is on the brink of a potentially significant development, with key industry figures suggesting that a spot Ethereum ETF may soon be approved in the United States, which could spark a notable price rise for ETH.

Nate Geraci, president of the ETF Store, shared his insights on the planned launch timeline for the first spot Ethereum ETF.

According to Djerassi, Bloomberg's current forecast is calling for a mid-July launch. He detailed the procedural timeline via X, saying, “When will the Ethereum ETF launch? BBG holds for mid-July. Amended S-1 by July 8th. Final S-1 can be filed by July 12th. That theoretically means a launch the week of July 15th.”

At the same time, Steve Kurtz, head of asset management at Galaxy Digital, confirmed to Bloomberg on July 2 that the U.S. Securities and Exchange Commission (SEC) could approve a spot Ethereum ETF by the end of this month.

Kurtz stressed that extensive preparatory work has been done in collaboration with the SEC, and noted similarities between the proposed Ethereum ETF and Galaxy's existing spot Bitcoin ETF (BTCO), which was built in collaboration with Invesco. Kurtz expressed confidence in their preparations, saying, “We know the mechanics, we know the process… the SEC is involved.”

Bloomberg ETF analyst Eric Balchunas also commented in line with the mid-July forecast, highlighting that the SEC had instructed Ethereum ETF issuers to amend their S-1 registration forms by July 8, hinting at the possibility of further amendments. Notably, the SEC approved rule changes under 19-b4 in May to make it easier for such funds to be listed and traded, but the fund's issuance was pending final approval.

Ethereum Price Continues to Move Above Key Support

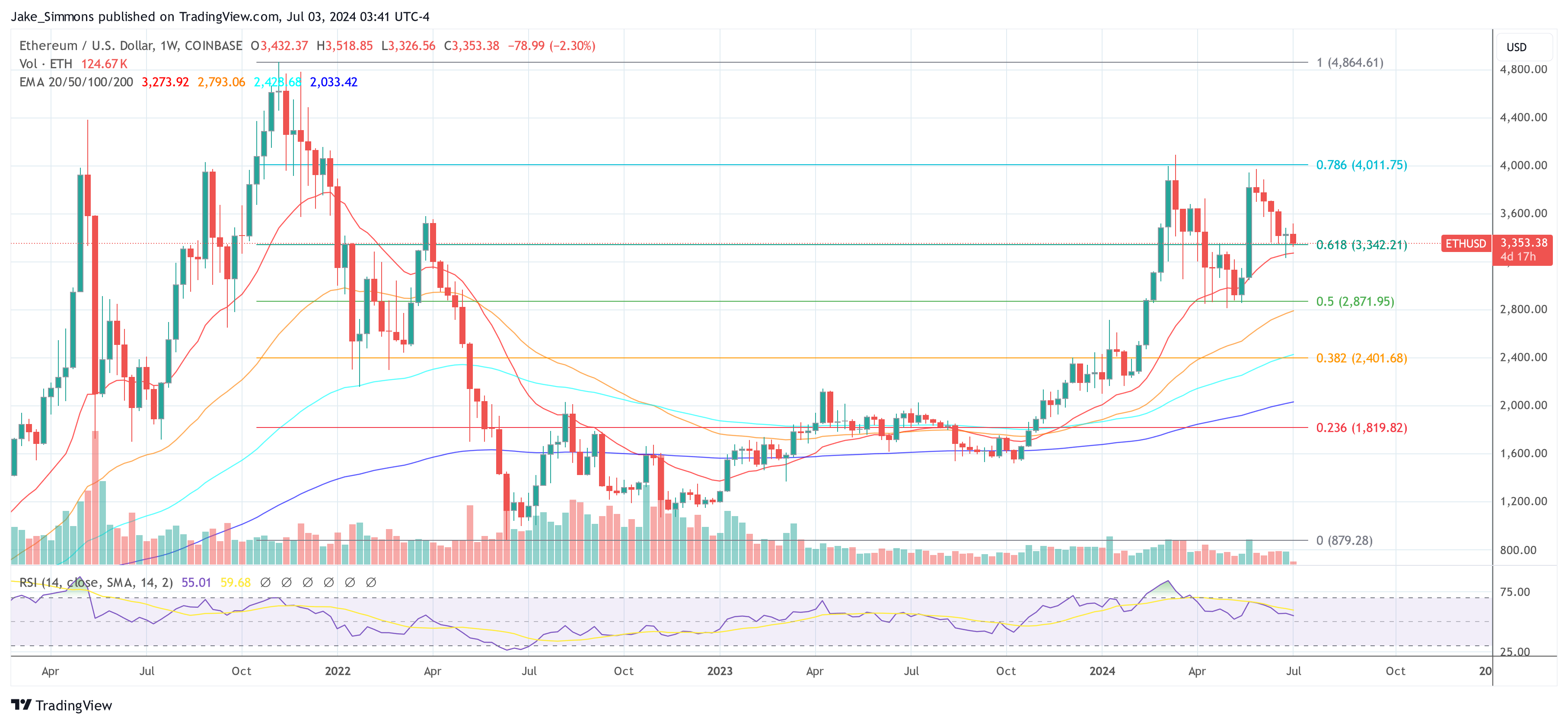

Anticipation of these approvals appears to be having a stabilizing effect on Ethereum price. Commenting on Ethereum's current price trajectory via X, crypto analyst IncomeSharks noted his optimism for a near-term breakout, saying, “ETH – More optimistic for Q3 breakout. Could see rise towards $4,000 this month or next.” According to the chart he shared, ETH price would need to sustain the $3,300 to $3,350 range to rise to $4,000.

Supporting this sentiment, Cold Blooded Shiller stressed that it is crucial for Ethereum to show momentum around current price levels, specifically around $3,400, as a key indicator of a potential higher timeframe impulse.

“ETH is still in a good position but needs to start showing momentum soon. The LTF divergence around this $3400 low is probably where I will try to capture the HTF impulse from the consolidation,” he commented via X.

From a historical perspective, analyst Jelle (@CryptoJelleNL) compared the current market phase to the extended consolidation from 2016 to 2017 before Ethereum's big rally, and urged perseverance and optimism: “From 2016 to 2017, ETH rose nearly 12,000% after consolidating for over 50 weeks. Today, people are giving up after less than 20 weeks, with an ETH ETF on the horizon. Stick to the plan, the best is yet to come.”

At the time of writing, ETH is trading at $3,353.

Featured image created by DALL·E and charts taken from TradingView.com