The weakness in the euro zone economy accelerated early in the fourth quarter, with private sector output falling at the sharpest pace in more than a decade, excluding pandemic-affected months, preliminary PMI survey data for October showed. . New orders are also decreasing at an accelerating pace, indicating a deterioration in the demand environment for both goods and services. As a result, companies cut jobs, the first since lockdowns in early 2021, and continued to focus on cost-cutting inventory management.

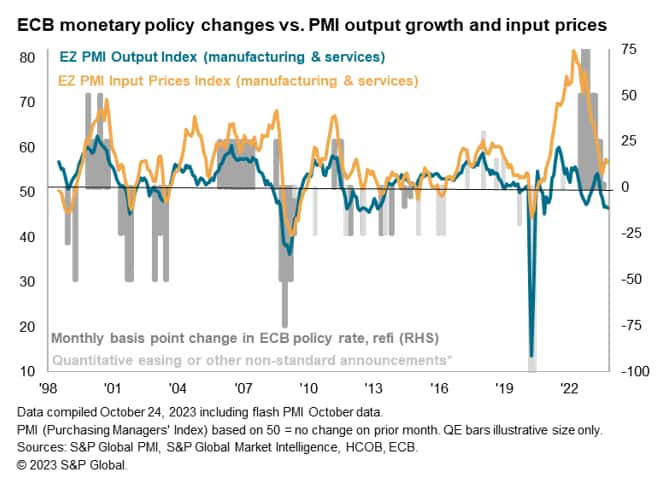

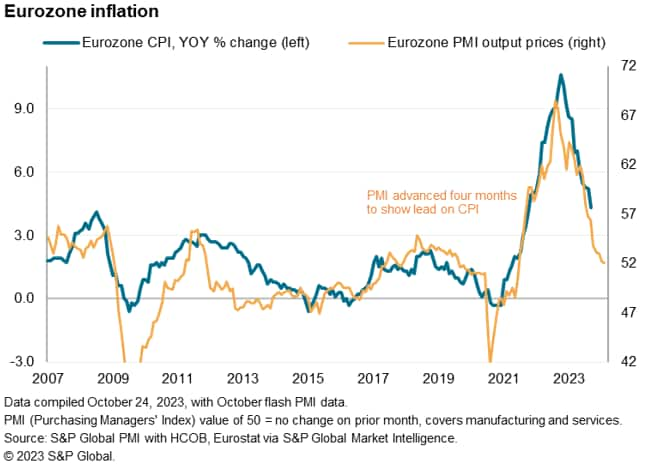

Goods and services inflation slowed slightly in October, to the lowest level since February 2021, despite upward cost pressure from rising oil prices. Along with the continued sharp decline in manufacturing and selling prices, sales prices in the service sector also moderated. inflation. Overall, the PMI suggests that headline CPI inflation will settle below the ECB's target by early 2024. However, rising oil prices pose some upside risk to inflation in the coming months.

production and demand

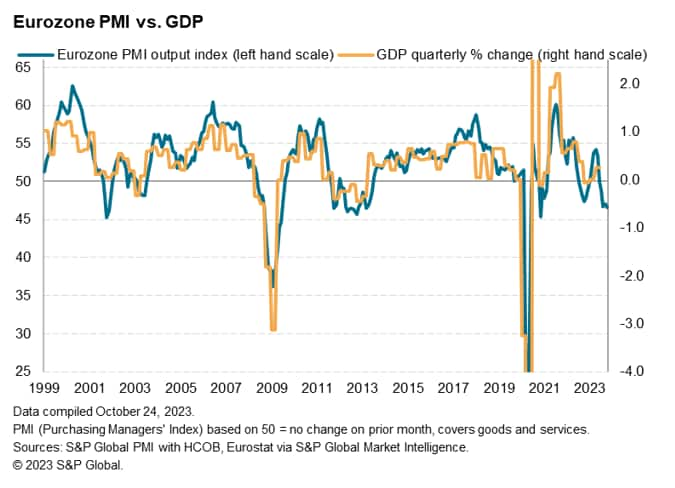

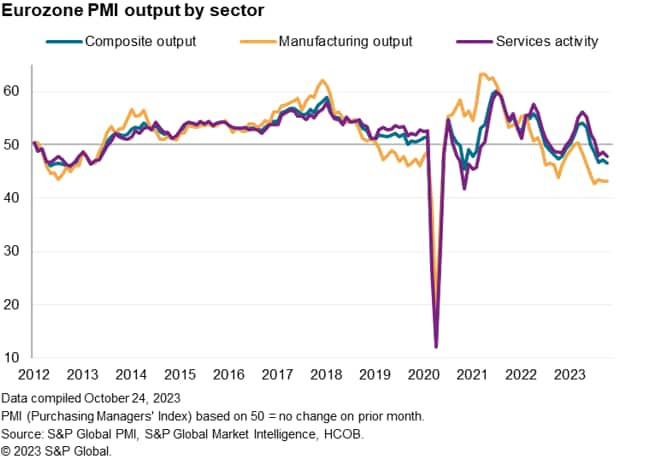

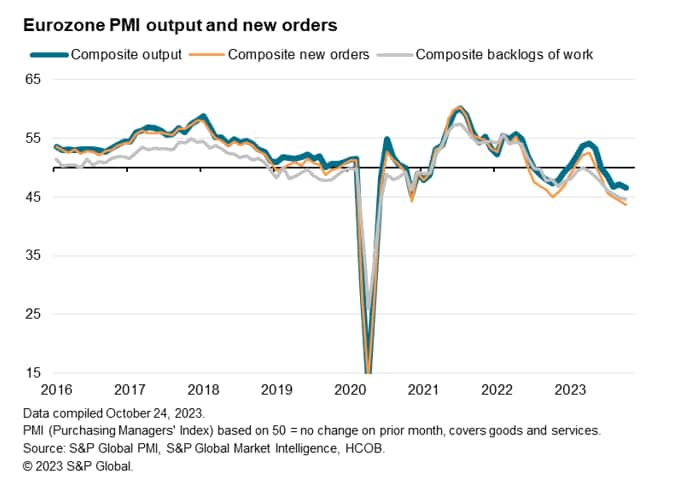

The headline HCOB Flash Eurozone Composite PMI Production Index, compiled by S&P Global based on about 85% of regular survey responses, fell from 47.2 in September to 46.5 in October, marking the fifth straight month of business activity. This marked the largest decline since November. 2020. Excluding the pandemic months, the drop in activity was the steepest since March 2013.

Historical comparisons show that the current level of PMI is roughly in line with euro area GDP, which fell at a quarter-on-quarter rate of around 0.4% at the beginning of the fourth quarter and implied a contraction of 0.3% in the third quarter. We are doing so.

Broad economic weakness was once again evident as manufacturing production fell for the seventh straight month and service sector activity also contracted for the third straight month.

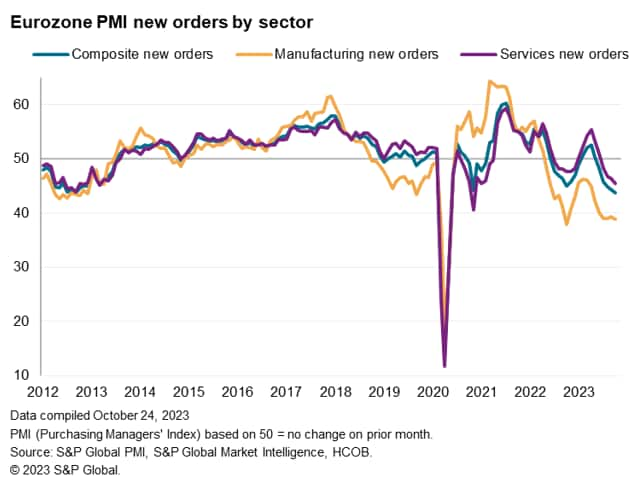

The goods production sector continued to report sharp contraction rates, with the pace of production decline unchanged from the notable pace seen in September, leaving factories in the deepest recession since 2009, excluding lockdowns early in the pandemic. It shows that Manufacturing production in the euro area has been in continuous decline since mid-2022, with the exception of a brief increase in the first quarter of 2023, as new orders flow into the sector continues for 18 months. This reflects the fact that it is decreasing. New manufacturing orders fell sharply again in October, falling at a slightly faster pace than in September, sustaining the sharpest demand decline since 2009.

Meanwhile, activity in the services sector contracted at an accelerating pace in October, the slowest pace since early 2021, excluding the height of the pandemic, and the slowest since May 2013. The performance of the services sector has changed markedly in recent months, partly reflecting the subsidence in the post-pandemic surge in spending on travel and recreation, reversing a strong resumption of activity at the start of the year. This is because Overall, new contracts received by service providers fell for the fourth consecutive month in October, with the rate of decline accelerating to the greatest extent since January 2021.

Measured across goods and services, the decline in new orders was the largest since May 2020 and since May 2009, excluding the early months of the pandemic. Additionally, the decline in orders is greater than the reported decline in production, meaning that companies are once again dependent on the industry. Process backlogs of previously placed orders to maintain activity levels. As a result, backlogs fell at a rate not seen since June 2020, and at a slightly faster pace in both manufacturing and services.

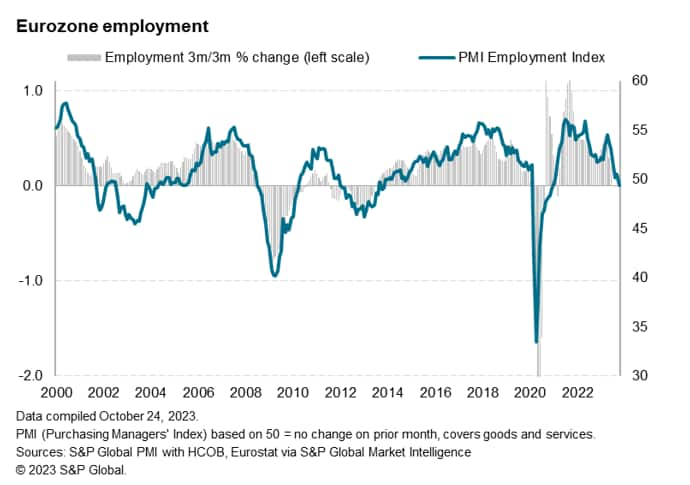

employment, inventory, purchasing

Companies are cutting jobs for the first time since January 2021 due to a decline in new orders and an accelerating decline in backlogs. The number of manufacturing workers fell sharply for the first time since August 2020, due to the fifth consecutive month of job losses in the factory sector. Employment in the service sector was on the verge of stalling.

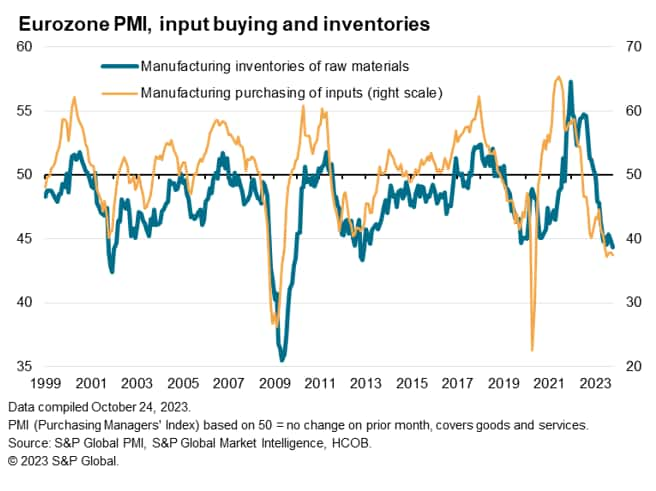

Manufacturers' purchases of raw materials were similarly further reduced, with the steepest rate of decline since April 2009, excluding the early months of the COVID-19 lockdown. Due to the reduction in purchasing activities, inventories of purchased goods decreased significantly for the first time since December 2012. Increasing focus on costs also led to a further decline in finished goods inventories in October, at the fastest pace since August 2021.

Prices continue to cool

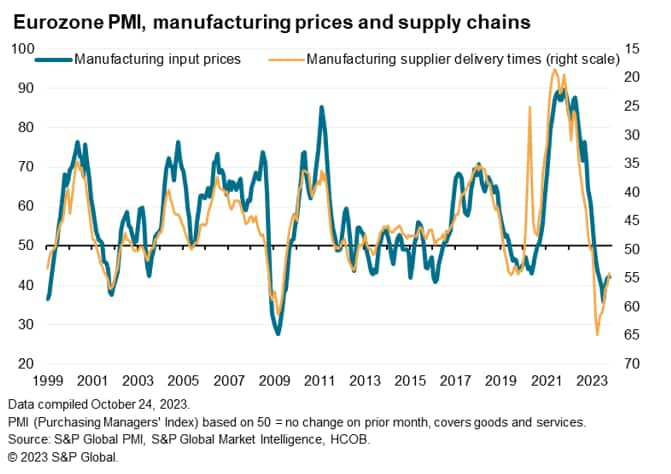

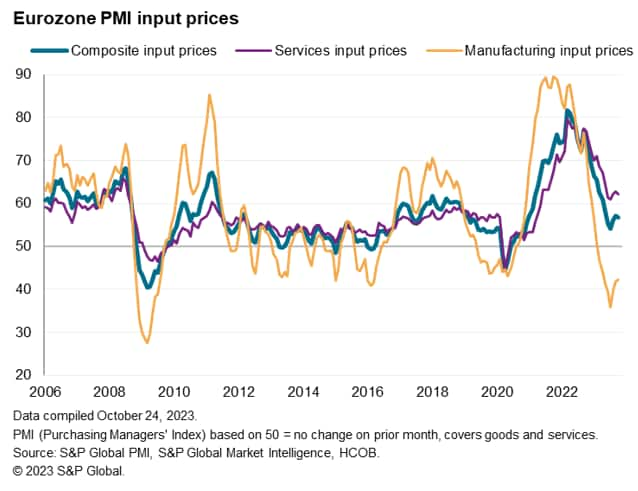

Lower demand for raw materials further eased price pressures in the supply chain, expedited deliveries and improved vendor lead times for the ninth consecutive month. The average cost of factory inputs fell significantly in October as supply exceeded demand, leading to discounts, despite reports that rising oil prices increased business costs during the month. Manufacturing input prices fell for the eighth consecutive month, but the rate of decline narrowed for the third consecutive month.

Service sector input costs were also supported by higher fuel prices, although the rate of increase was still slightly slower than in September. However, overall increases remain high, often linked to higher wage rates due to rising costs of living. Although service sector cost inflation has fallen significantly compared to a year ago, inflation remains higher than at any pre-pandemic period since 2008.

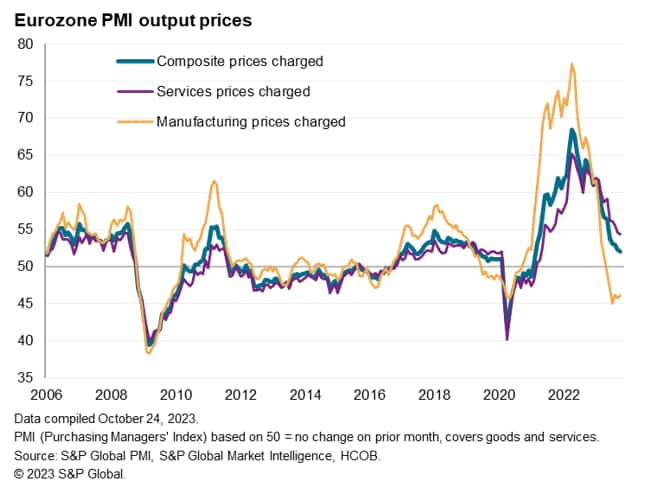

Encouragingly, average price increases for goods and services slowed slightly in October, with inflation falling to its lowest level since February 2021 and remaining below averages seen in the three years prior to the pandemic, particularly That's what happened. With a further significant decline in manufacturing and selling prices, service sector inflation cooled to its lowest level since May 2021.

Looking at the inflation inference, the overall signal from the sales price index PMI is that CPI inflation will continue to moderate in the coming months, from the current 4.3% pace (as of September) to below the ECB's 2% target. It means that the standard will drop. One caveat is that rising tensions in the Middle East pose an upside risk to oil prices and could lead to higher inflation if oil prices continue to rise.

View the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Phone: +44 207 260 2329

chris.williamson@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers Index™ (PMI)®) Data is compiled by S&P Global for more than 40 economies around the world. Monthly data comes from a survey of senior executives at private companies and is available by subscription only. The PMI dataset includes headline numbers that indicate the overall health of the economy and sub-indices that provide insight into other key economic factors such as GDP, inflation, exports, capacity utilization, employment, and inventories. Masu. PMI data is used by financial and corporate professionals to better understand where the economy and markets are heading and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, an independently managed division of S&P Global.