PMI® survey data for October showed the euro area economy stalled for the second consecutive month as growth in the services economy further slowed as factory activity fell.

A further deterioration in business confidence signals near-term downside risks, raising concerns about whether the economy can avoid a contraction in GDP in the fourth quarter. Concerns about the economic situation are causing companies to accelerate the pace of layoffs.

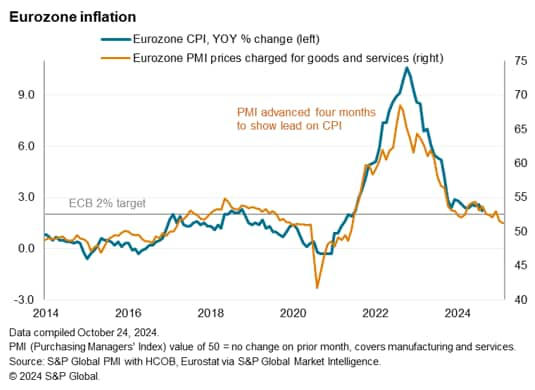

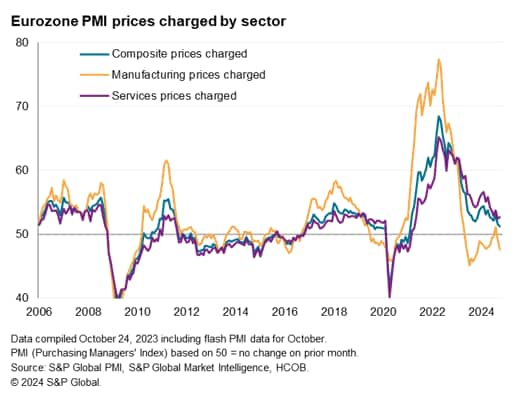

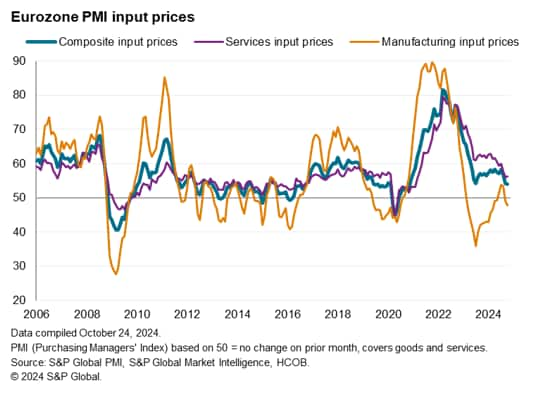

Fortunately, price pressures continued to ease in October, with average sales price inflation cooling further to its lowest level since early 2021. Notably, cost pressures in the services sector, a key area of concern for inflation hawks, have further eased.

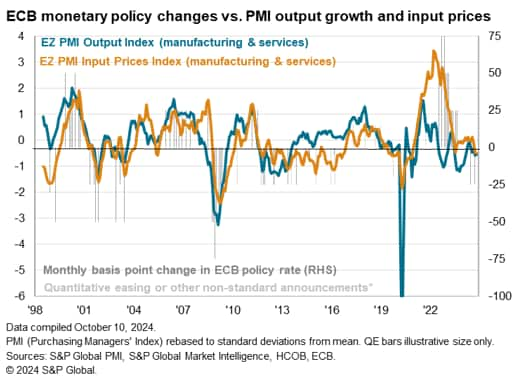

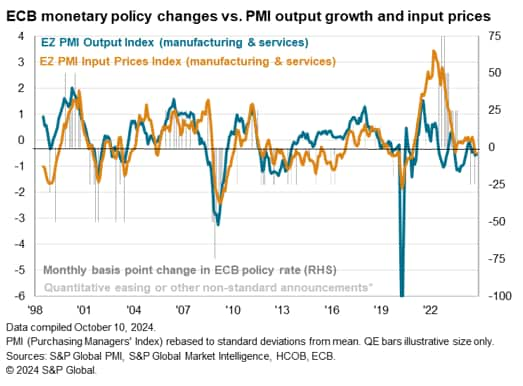

The latest PMI data shows an increasing risk of the economy contracting, with the Survey Sales Price Index falling further below levels consistent with the ECB's 2% target, after the 25th of February 2020. This suggests that the central bank may ease policy further. Basis point rate cuts seen so far this year.

Here are five important takeaways from October's PMI preliminary data.

1. Economy stagnates for two consecutive months

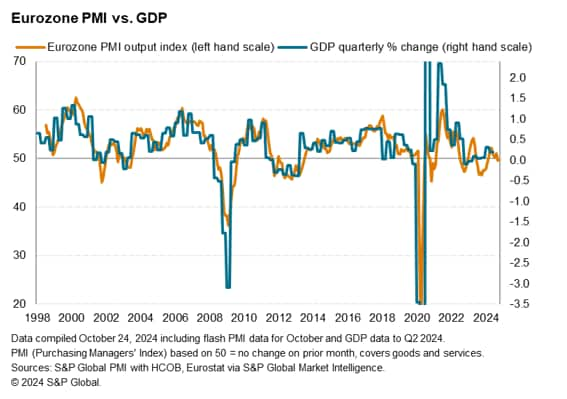

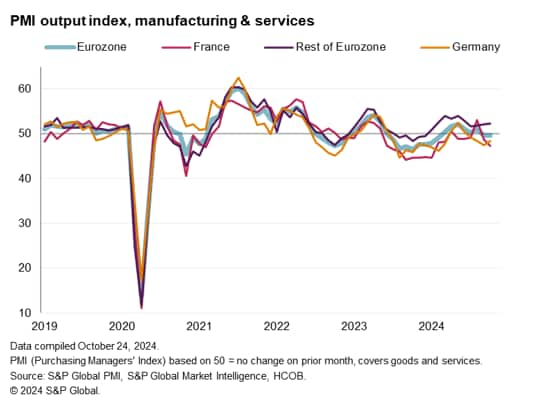

The seasonally adjusted HCOB Flash Eurozone Composite PMI Production Index compiled by S&P Global, based on about 85% of regular survey responses, hit 49.7 in October. The latest figures showed business activity in the euro area fell slightly on a monthly basis for the second month in a row, following September's 49.6.

Comparisons with official data show that the latest PMI readings broadly imply no GDP growth for the second month in a row. Therefore, developments in the PMI over the next two months will be closely watched regarding the possibility of a contraction in GDP in the fourth quarter.

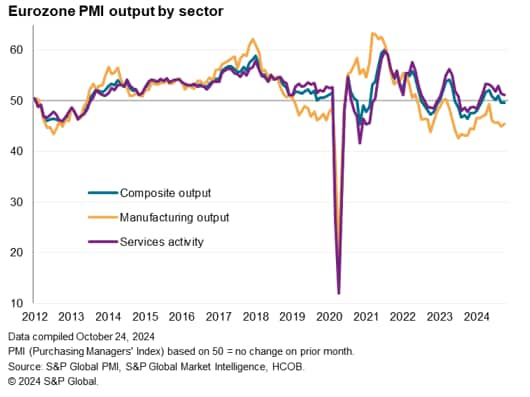

Weakness was once again led by manufacturing, with production once again falling sharply, for the 19th consecutive month of decline, as new orders fell even more sharply. Although the service sector expanded, the growth rate was the lowest in eight months as new orders for services fell for the second consecutive month, the slowest pace in nine months.

2. Economic downturn in France and Germany

At the country level, further economic weakness was observed in France and Germany, in contrast to sustained but modest economic expansion across the rest of the euro area.

France's composite PMI improved in August on the back of a surge in service sector activity coinciding with the Paris Olympics, but remained in negative territory for the second consecutive month in October, amid a sharp decline in production value. This was the sharpest decline since January. Whether in manufacturing or service industry.

Germany's preliminary composite PMI also rose slightly, but remained in contraction territory, although it suggested an easing of the rate of decline. Nevertheless, production has now fallen for the fourth straight month, with the services sector showing very little growth in October, along with a long and sharp decline in manufacturing.

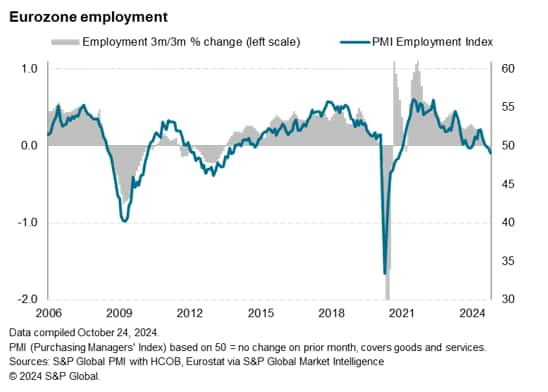

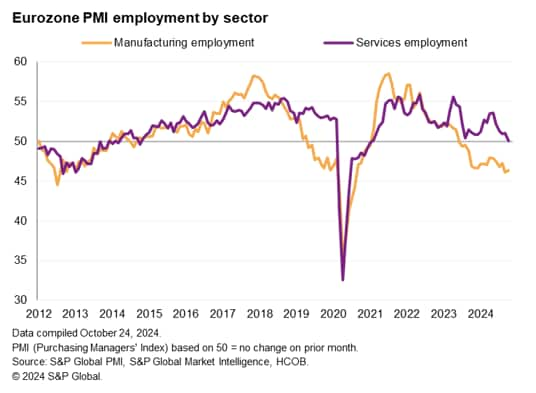

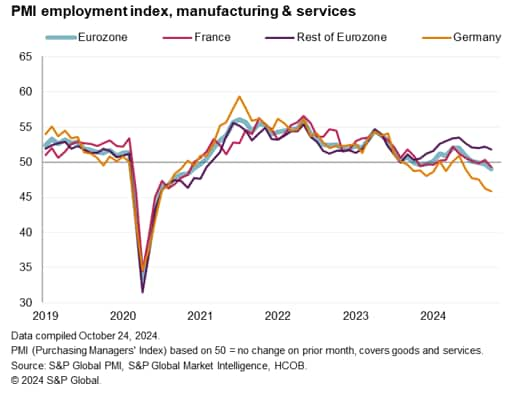

3. Employment declines at fastest rate since 2020

Eurozone companies accelerated job cuts for the third month in a row as customer demand weakened, with net job losses reaching their highest level since late 2020. It's worth noting that the decline in employment was the steepest, albeit small, outside of the pandemic. It has been recorded since the end of 2013.

While the layoffs were centered on manufacturing, the services sector has seen an alarming near-stagnation in employment, with employment conditions in the services sector the worst they've been in a decade, excluding the pandemic.

The employment picture is particularly bleak in Germany, which has seen the biggest round of layoffs since the early wave of the coronavirus pandemic in 2020. Employment also fell slightly in France, while staffing levels increased modestly elsewhere in the euro area.

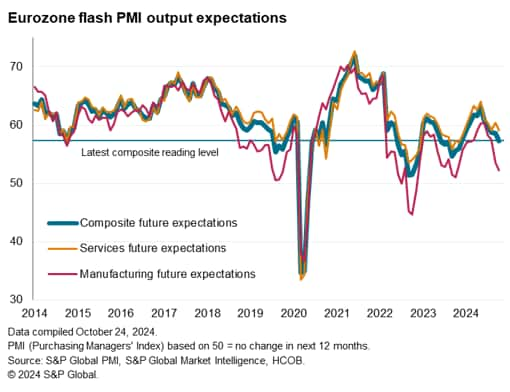

4. Confidence drops further.

Meanwhile, business confidence for the coming year has declined for the fifth consecutive month, reaching its lowest level in almost a year and falling further below the series average. Sentiment has declined in both manufacturing and services, with the former remaining particularly weak, suggesting near-term downside risks to output in both sectors.

The decline in confidence reflects weak demand, trade barriers, escalating geopolitical concerns, and concerns about government fiscal policy.

5. Price growth rate is slowest since early 2021

There was encouraging news for inflation as the rate of increase in business selling prices in October was the lowest since February 2021. The increase in service charges outweighed the decline in manufacturing and sales prices, resulting in a decline in the overall inflation rate. This is consistent with the European Central Bank's target for consumer price inflation of below 2%.

With the cost increase rate in October hitting the lowest level in less than four years, it is likely that there will be further downward pressure on selling prices in the short term. Manufacturing input costs fell for the second month in a row, at the fastest pace since March, on the back of lower energy prices and increased discounting due to competition among suppliers. Service input prices continued to rise, but the recent increase was one of the smallest since early 2021.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Phone number: +44 207 260 2329

chris.williamson@spglobal.com

© 2024, S&P Global. Unauthorized reproduction is prohibited. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers Index™ (PMI)®) Data is compiled by S&P Global for more than 40 economies around the world. Monthly data comes from a survey of senior executives at private companies and is available by subscription only. The PMI dataset includes headline numbers that indicate the overall health of the economy and sub-indices that provide insight into other key economic factors such as GDP, inflation, exports, capacity utilization, employment, and inventories. Masu. PMI data is used by financial and corporate professionals to better understand where the economy and markets are heading and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, an independently managed division of S&P Global.