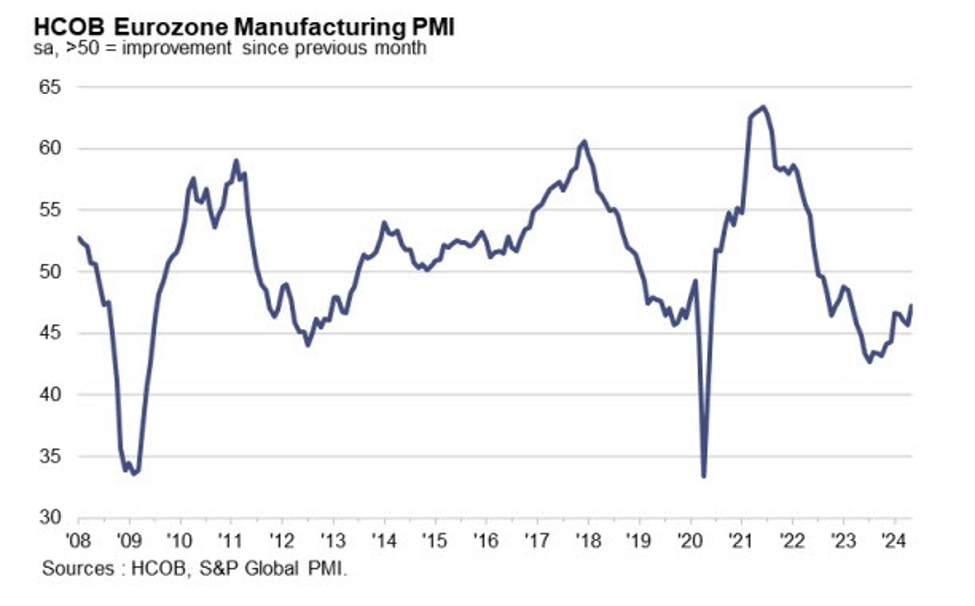

Headline indicators and output figures were both at their highest in 14 months, suggesting that the contraction in euro zone manufacturing is moderating. Business confidence improved, while the declines in new orders, exports and purchasing activity all slowed from the previous month. The HCOB noted:

“This could be a turning point for the manufacturing sector, as the industry is trying to halt the decline in production that has continued since April 2023, mainly supported by favorable trends in intermediate and capital goods. In addition, an increasing number of companies are seeing positive movement in orders from domestic and international markets, but this is still offset by declines for the majority of companies in May. Encouragingly, business confidence regarding future production is at its highest level since early 2022.

“Despite rising optimism, businesses remain cautious, continuing to cut staff numbers and holding back on purchases of intermediate goods. This caution may also be reflected in the accelerating drawdown of output inventories, suggesting that some businesses have been surprised by the recovery in demand and are unable or unwilling to respond quickly with increased production.”

“Germany may soon be poised to overtake its main eurozone rival. Germany's HCOB manufacturing PMI remains the lowest of the eurozone's four largest economies, but it is closing in on Italy. Italy, which was seen as a strong performer recently, is also worsening its situation. France is following suit, although its industrial sector's improvement has been less than that of its northern neighbour. But Spain is the only eurozone four country with a growing industrial sector, and for now it remains just out of reach.”