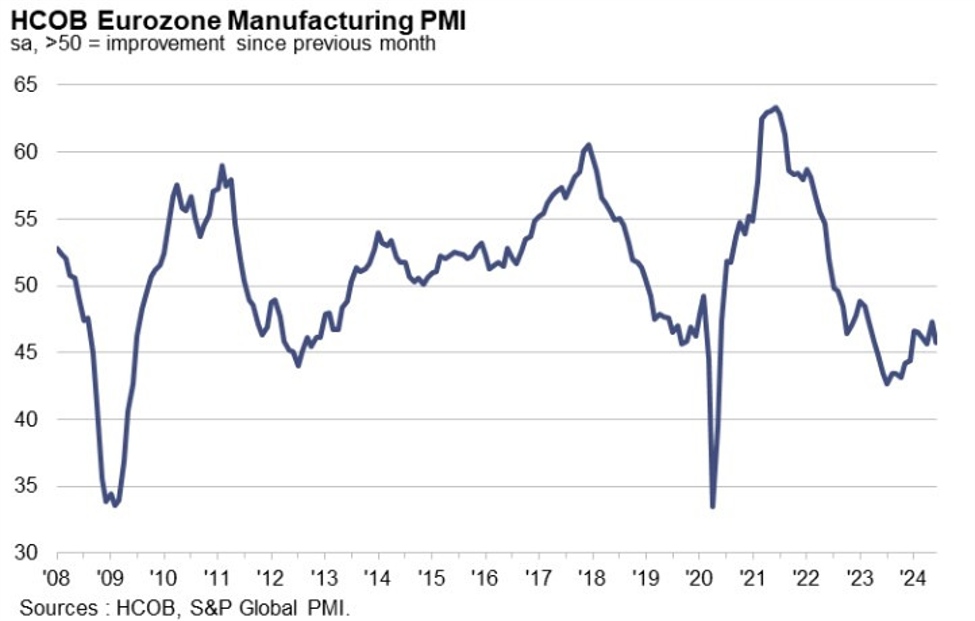

- The final manufacturing PMI was 45.8, compared with a preliminary reading of 45.6 and a previous reading of 47.3.

Key findings:

- HCOB Eurozone manufacturing PMI was 45.8 (May: 47.3), the lowest level in two months.

- HCOB Eurozone manufacturing PMI production index was 46.1 (May: 49.3), the lowest in six months.

- Despite a sharp decline in new orders and rising costs, the outlook remains positive.

comment:

Commenting on the PMI data, Dr. Silas de la Rubia, Chief Economist at the Hamburg Commercial Bank, said: “Is this another bull trap for manufacturing, similar to the false start at the beginning of 2023, when production improved temporarily only to then fall again for a long period of time? Indeed, PMI indices for all euro area countries except Italy worsened in June. However, we are inclined to see this as a temporary rather than a sign of a longer-term recession. Other parts of the world showed manufacturing growth in June, including the US, UK and India, according to their respective flash PMIs. This global recovery provides a favorable backdrop for euro area manufacturers. Moreover, optimism for future production remains as high as it was in May, suggesting that companies remain confident about next year.”

“The accelerating decline in forward-looking new orders is rather depressing. The decline comes after a record 25 consecutive months of declining demand, although a slight increase in the various indices in May raised vague hopes that things were improving. This means that any significant recovery is likely to be postponed until at least the late summer or early autumn.”

“It may be a positive sign that more companies are able to pass on some of the increased input costs to their customers. This suggests there is pricing power in the market, which typically re-emerges when conditions start to improve.”

“Germany has failed to escape its position as the worst performing euro area country tracked by the PMI survey. Austria is almost as bad, and manufacturing in France and Italy remains in recession territory. In contrast, manufacturing is growing in the Netherlands, Spain and Greece. Germany's weaker performance is likely due to its above-average exposure to the globally struggling automotive industry.”

Eurozone Manufacturing PMI