Unlock Editor's Digest for free

FT editor Roula Khalaf has chosen her favorite stories in this weekly newsletter.

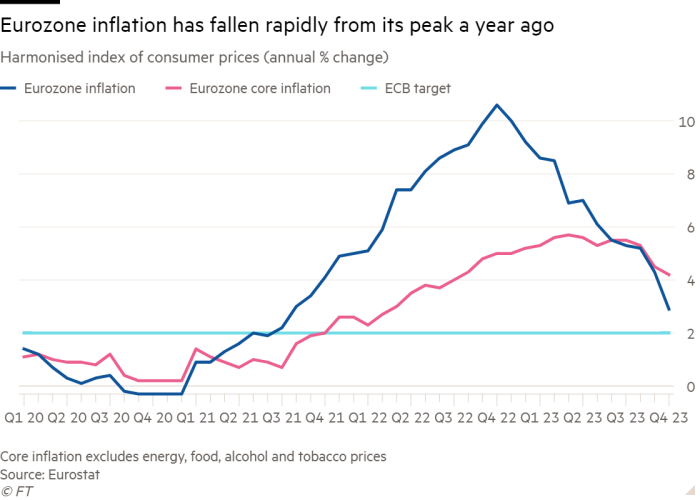

Eurozone inflation fell to a two-year low of 2.9% in October, increasing expectations that the European Central Bank will not raise interest rates further.

This figure compared with 4.3% in September and marked the region's slowest annual growth rate in consumer prices since July 2021.

The development comes after the region's economy began to contract in the third quarter, mainly due to lower energy prices and lower food inflation, the EU's statistics arm Eurostat said.

The 2.9% interest rate in October was 3.1% below economists' expectations, amid signs that the world's major central banks believe they have taken enough steps to bring inflation down to their 2% target. Ta.

“This is clearly moving into a situation where the big three central banks are recognizing that the first part of their job of combating inflation is done and are keeping interest rates the same for longer, but for how long? No one knows exactly how long it will last.” , Global Head of Macro Research at Dutch bank ING.

The ECB last week kept its benchmark deposit rate unchanged at 4%, ending an unprecedented 10 consecutive interest rate hikes.

The US Federal Reserve is expected to keep interest rates unchanged for the second consecutive time at its meeting on Wednesday. The Bank of England is thought to be likely to take similar action the next day. Figures on Tuesday showed UK store inflation fell to its lowest level in more than a year due to falling food prices.

But economists believe the slowdown in inflation is likely to slow as the Israel-Hamas war drives up energy prices and weakens the base effect that compares energy prices to last year's high levels.

“Looking ahead, it is unlikely that inflation will continue to decline this rapidly,” said Jack Allen Reynolds, an economist at consultancy Capital Economics. He added that “energy inflation will probably accelerate a bit in the coming months.”

Inflation rates within the euro zone remained wide ranging in the year to October, from 7.8% in Slovakia to -1.7% in Belgium.

But the sharp slowdown in prices reflects weakness in regional economic activity overall, with Eurostat saying economic activity contracted by 0.1% in the three months to September. This was lower than economists expected, as recessions in Germany, Ireland and Austria offset growth in Spain and France.

The euro zone economy has barely grown over the past year as consumers and businesses face rising borrowing costs, a slowdown in global trade and the biggest rise in the cost of living in a generation.

The figures released on Monday also confirmed that Germany is one of the world's weakest major economies after its gross domestic product contracted by 0.1%.

By contrast, the U.S. economy is expanding rapidly, with an annualized growth rate of 4.9% in the third quarter reported last week.

“The eurozone economy is heading into a period of economic stagnation, and growth will only pick up once real income growth turns sufficiently positive,” said Rory Fennessy, an economist at consultancy Oxford Economics. “Momentum into the fourth quarter remains extremely weak, weighed down by difficult financial conditions.”

Data on Tuesday showed core euro zone inflation, which excludes energy and food, at 4.2%, in line with expectations and down from 4.5% in September. This indicator is closely monitored by the ECB as a measure of potential price pressures.

But ECB President Lagarde warned last week that wage growth was also “very important in determining the inflation outlook”.

He stressed that details of the next collective wage bargaining agreement with unions would not be available until “well into 2024” and that the bank would wait until then to decide whether it could start reducing borrowing costs. suggested.

“The ECB needs to see wage inflation slow down, which could take another six months,” said Mark Wall, chief European economist at Deutsche Bank.