domoscanonos

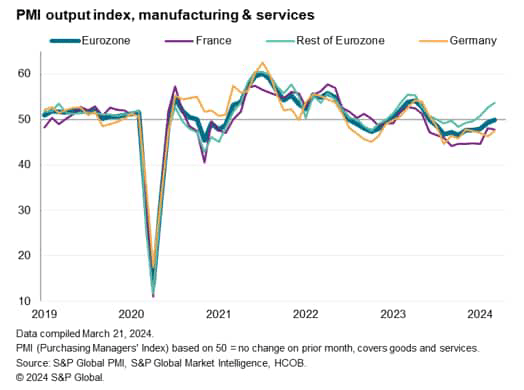

Business activity in the euro area approached stability in March, with preliminary PMI® survey data showing only a slight decline in output of goods and services. The slow recovery in service sector production gained momentum, and the economy slowed accordingly. Rate of decline in manufacturing production. However, continued production declines in France and Germany offset improvements in other parts of the euro area, pointing to an uneven economic picture.

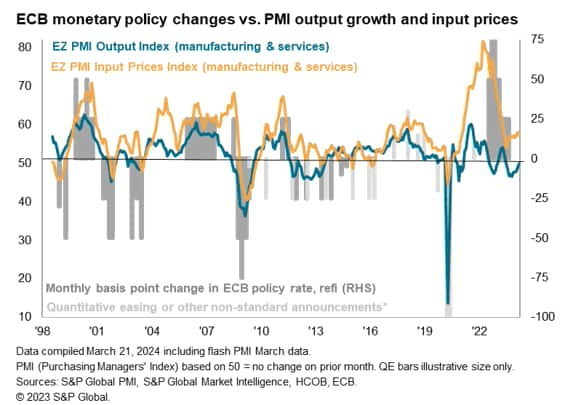

Encouragingly, the rate of decline in orders has slowed and business confidence for the year ahead has improved to a 13-month high. Supplier delivery times for product producers also continued to improve after Red Sea-related delays seen earlier in the year, driving further declines in manufacturing input prices. Meanwhile, input cost and selling price inflation in the service sector remains high compared to historical standards due to rising prices. Wage costs rose, but a slowdown in the pace of increase in cost burdens was recorded, limiting overall selling price inflation to some extent.

economic stability

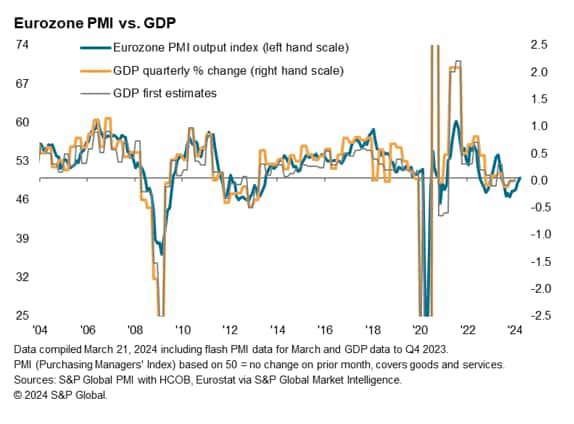

The seasonally adjusted HCOB Flash Eurozone Composite PMI Production Index, compiled by S&P Global based on about 85% of regular survey responses, rose to 49.9 in March from 49.2 in February. Although this marks the 10th consecutive month of production decline, the decline in March was small and the smallest since June of last year, indicating that production activity is largely stable. The rate of decline in new orders was the lowest in 10 months, and the rate of decrease in backlogs was also the lowest in nine months.

A simple model based on historical comparisons of headline PMI and quarterly changes in gross domestic product (GDP) shows that the PMI reading in March is consistent with flat GDP, and 0.1% on a quarterly basis for the first quarter as a whole. It has been shown that this suggests a decrease in

uneven picture

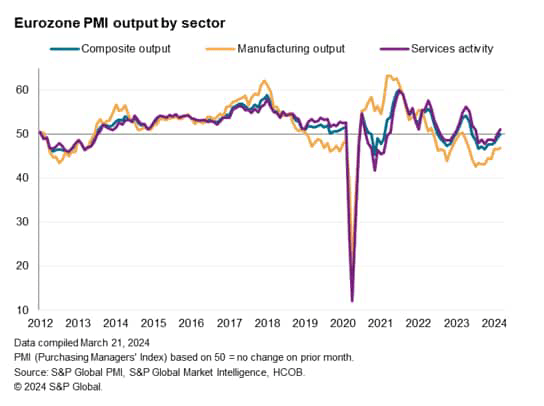

However, economic conditions again varied widely across the euro area, both by sector and by country.

Manufacturing production fell for the 12th straight month across the euro area in March, with the rate of decline only narrowing slightly, marking another month of sharp contraction. New orders for goods similarly fell sharply by historical standards, but the rate of decline was the slowest recorded in the past year, after slowing for five straight months.

In contrast, after six months of decline, business activity in the services sector increased for the second straight month in March, building on the partial increase seen in February and increasing the pace of expansion, the largest since June last year. recorded an increase in Nevertheless, the overall pace of service expansion remained well below the pace seen at this time last year, as new subscriptions increased modestly during the month. However, the increase in new releases is notable in that it is the first recorded since June last year.

On a national level, production fell for the ninth straight month, albeit at a slower pace, as Germany's output fell sharply once again, services activity neared stabilization, and the steep decline in manufacturing eased slightly.

Production in France also contracted significantly, with the rate of decline accelerating compared to February, but still marking the second weakest decline since June last year, when France's current contraction period began. Services production fell at a faster pace, but the pace of decline remained weaker than at the beginning of the year, with manufacturing production posting its slowest decline in 14 months.

Meanwhile, other countries in the euro area generally reported production growth for the third month in a row, with the rate of expansion reaching an 11-month high. Manufacturing production rose slightly for the second month, and the services sector's growth was the fastest since May last year.

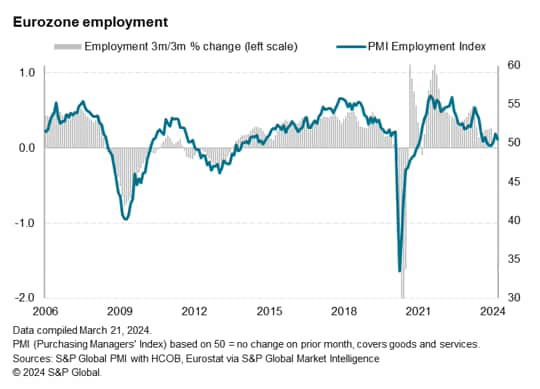

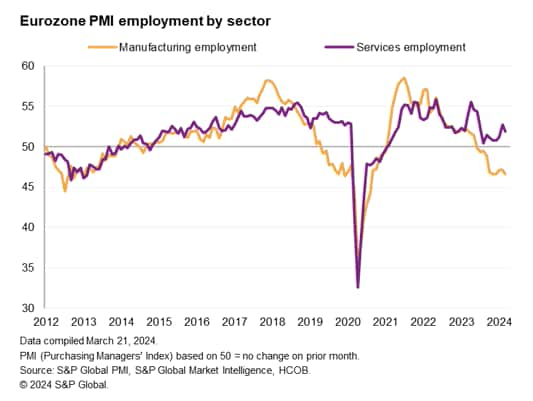

employment

Employment increased for the third straight month in March after two months of modest declines at the end of 2023, but the rate of increase slowed to a very modest pace.

There was a sharp increase in the rate of job losses in the manufacturing sector and a slowdown in the pace of job creation in the service sector. The decline in manufacturing employment was notable as it was the largest since August 2020.

On a country-by-country basis, both Germany and France saw again small headcount declines, while other parts of the region saw lower rates of decline, partially related to labor shortages, and service-led net declines. Further job creation progressed.

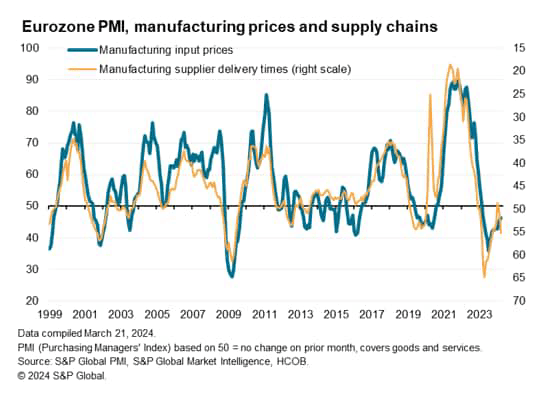

supply chain

The ongoing plight of the manufacturing industry is further highlighted by the continued sharp decline in raw material purchases by factories, resulting in raw material inventories dropping by the most since December (2012 since November 2012). (the largest decrease). A positive outcome of lower raw material purchasing levels was reduced pressure on the supply chain. Supplier delivery times extended for the first time in a year in January due to Red Sea-related transport disruptions, but March showed further easing of supply chain issues, with supplier delivery times shortening for the second month in a row did.

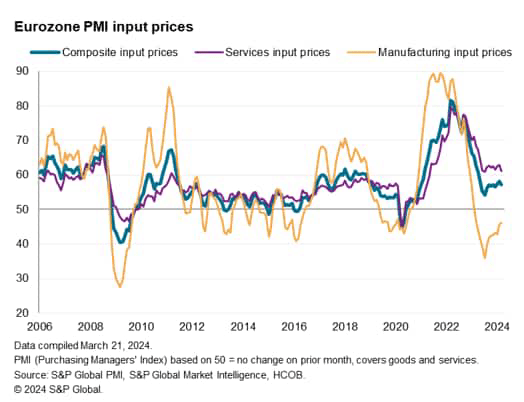

price

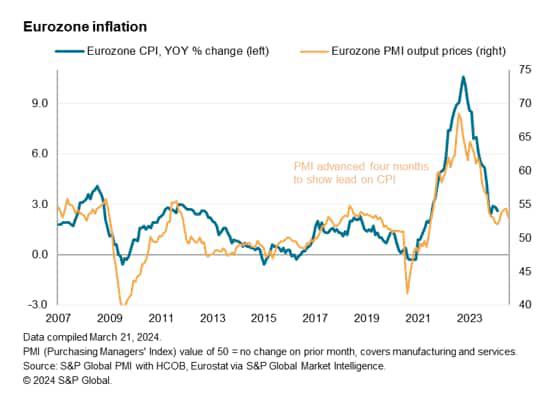

Price pressures eased during March but remained elevated relative to pre-pandemic norms.

Growth in average input costs across the goods and services sector slowed in March after accelerating in the past two months, bringing overall cost growth to its lowest level in three months. Interest rates fell across Germany, France and the rest of the world. Service sector costs rose at the slowest pace in eight months, while factory input prices fell at the slowest pace in a year. Continued declines in manufacturing costs helped overall input cost inflation move closer to the pre-pandemic 10-year average, while service sector inflation remained below pre-pandemic levels despite additional easing in March. It remains well above average, and this is often related to higher labor costs.

Sales price inflation slowed in March, slowing for the first time in five months after hitting a nine-month high in February. Sales price inflation slowed in France, Germany and the rest of the world combined. Manufacturers' average selling prices have fallen for the 11th consecutive month, while service charges, which continued to rise at a high pace by historical standards, have lost momentum and hit their lowest level in four months.

Outlook

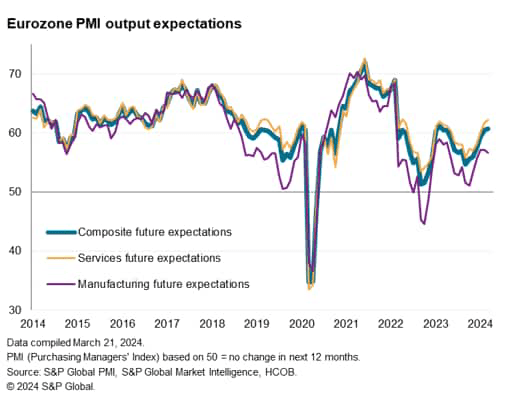

Looking ahead, business expectations for the next 12 months improved for the sixth month in a row in March, with the highest level of optimism since February last year. Confidence in the services sector hit a 23-month high, further recovering from its lowest point last September, but fell in manufacturing (though still higher than it was at the end of 2023). The improvement in sentiment in France and Germany contrasted with the decline in confidence elsewhere, although the latter continued to rise relatively.

Business confidence has improved in recent months, thanks in large part to lower interest rates and hopes of easing cost-of-living pressures. However, concerns remain about growing economic uncertainty amid global geopolitical concerns and still-high price levels.

original post

Editor's note: The summary bullet points in this article were selected by Seeking Alpha editors.