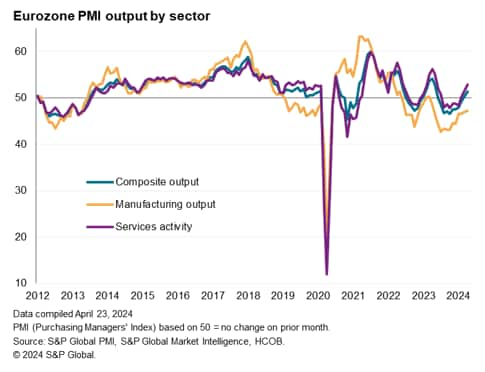

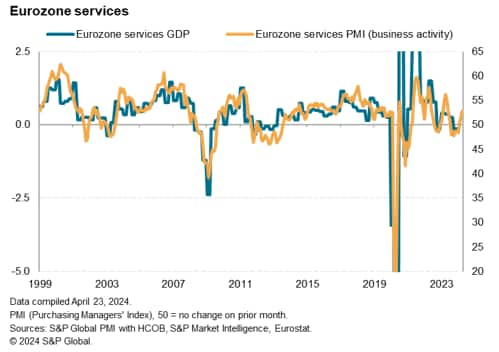

Preliminary data from the PMI® survey shows business activity in the euro area rose at its fastest pace in almost a year in April. This improvement comes as the region continues to emerge from its recent slump, despite growing only as fast as GDP, with a modest quarterly growth rate of just 0.1%, amid mixed sector performance. It shows that Nevertheless, growth in the services sector was increasingly robust, with signs that the downturn in manufacturing was easing further. Employment growth also accelerated as business confidence remained high at recent levels.

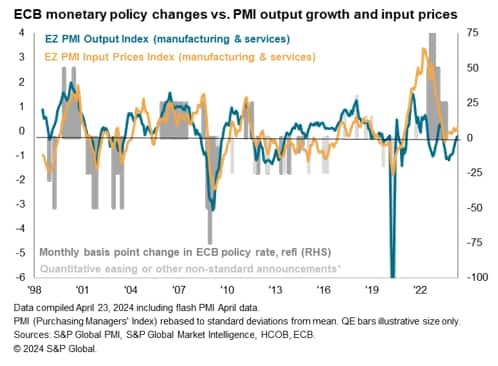

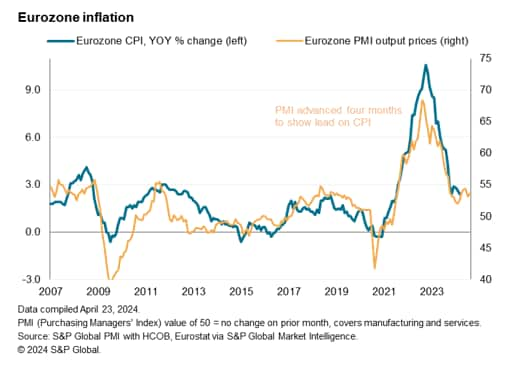

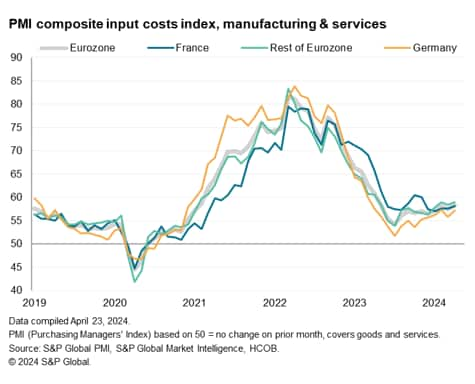

However, upward price pressures also increased across the euro area and were often associated with wage increases. Input costs and average selling prices both rose at a faster pace, reflecting persistently rising price pressures in the services sector.

Economic recovery gains momentum

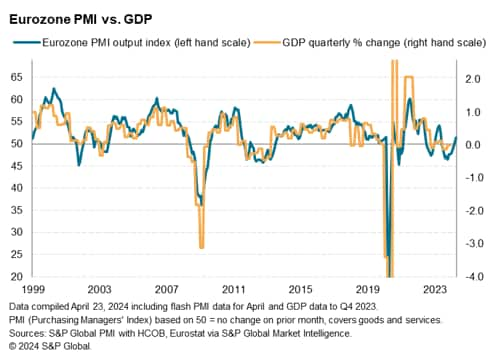

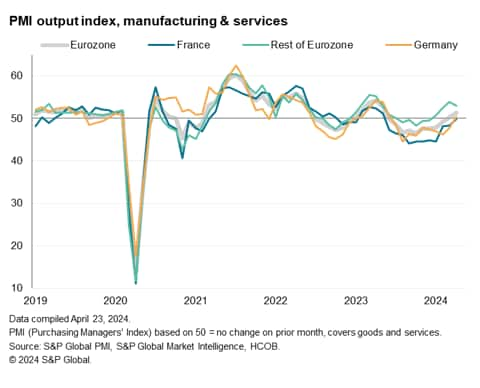

The seasonally adjusted HCOB flash eurozone composite PMI production index, compiled by S&P Global based on about 85% of regular survey responses, rose to 51.4 in April from 50.3 in March. The latest readings suggest that production rose for the second month in a row after falling continuously for the nine months to February. April's economic expansion was the strongest since May last year, but the pace was only modest and well below the pace seen at this time last year.

At current levels, the PMI broadly indicates that euro area GDP will grow at a quarterly rate of 0.1% in April, marking an improvement from the 0.1% decline shown in the first quarter.

Production in the service sector rose for the third consecutive month, putting the rate of increase on pace to record the highest rate of growth in 11 months, but manufacturing production in April fell for the 13th consecutive month across the euro area, and the overall economy It became a hindrance. . However, the rate of decline in factory production has slowed to a 12-month low.

Sector fluctuations were driven by underlying demand conditions. New orders for services in April increased for the second consecutive month at the highest pace since May of last year, but new orders for industrial products declined at a faster pace. The latter has been declining for two years now.

Germany returns to growth territory

Looking at individual countries, Germany in particular is returning to growth territory for the first time in 10 months, with the service sector showing signs of renewed growth as the economic slump in the manufacturing industry subsides. Meanwhile, production in France contracted only slightly, at its weakest level in 11 months, as a sustained decline in manufacturing was offset by an increase in service sector activity for the first time since May last year. . However, despite a slight slowdown in growth, production in April was the best overall performance as it increased for the fourth straight month on strong growth in the services sector and mostly stable manufacturing output. was in other areas.

employment

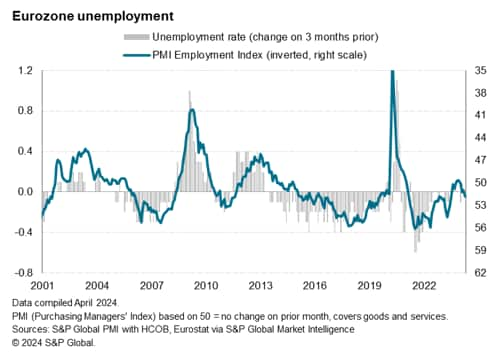

Employment across the euro area rose for the fourth consecutive month in April, after two months of slight declines at the end of 2023. The net job creation rate has accelerated to its highest level since June last year, commensurate with the unemployment rate, which is currently roughly stable. 6.5%, the lowest ever for a single currency area.

The increase was driven by the highest employment growth rate in 10 months in the service sector, while the pace of job cuts in manufacturing slowed to the lowest level in seven months.

Employment growth was recorded in France, reaching a nine-month high, Germany barely returned to growth, and employment in other regions remained strong.

price

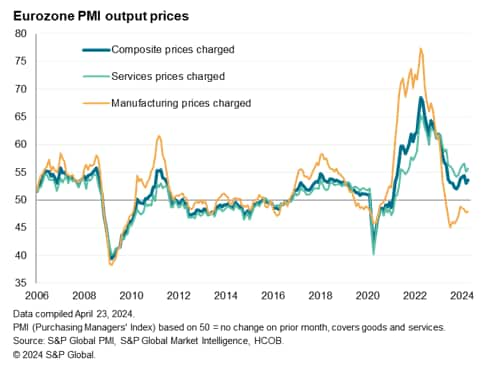

Price pressures strengthened slightly in April, with inflation rates rising in both input costs and average selling prices, with levels still higher than pre-pandemic norms.

Sales price inflation has rebounded from a four-month low in March and remains well above its long-term pre-pandemic average, suggesting stubborn inflationary pressures. While prices charged by manufacturers have fallen for the 12th consecutive month, prices charged by service providers have increased at an increasing rate and continue to rise at a high pace even by historical standards.

Measured overall, the PMI survey's sales price inflation rate points to consumer price inflation slightly above the European Central Bank's (ECB) target of 2% for the coming months.

Average input costs across the goods and services sector also accelerated again in April after cooling in March, posting the fastest growth in a year. Manufacturing input prices continued to fall, supported by improving supply conditions, but the decline was the smallest recorded in the past 14 months. Meanwhile, cost inflation in the services sector has risen slightly, although below the recent highs seen at the start of the year, with companies saying that rising wages are the main drivers of inflation, along with higher energy and fuel costs. is often reported. Particularly significant cost growth was observed in the German service sector.

Future projections show increasing convergence

Looking ahead, business expectations for the next 12 months fell slightly compared to March, but were at their second highest level in 14 months. Confidence in the services sector fell to its lowest level in three months, in contrast to optimism in the manufacturing sector, where production expectations rose to the highest level since February last year. Still, while sentiment remains relatively positive in services compared to manufacturing, the gap is now the narrowest in more than two years.

Business confidence has improved in recent months on expectations for lower interest rates, easing pressure on the cost of living and signs of a recovery in household and business demand. Manufacturing has also been boosted by signs that the global inventory cycle is starting to become more supportive of demand. However, geopolitical uncertainty and financial market volatility dampened some companies' optimism about their prospects in April.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Phone: +44 207 260 2329

chris.williamson@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers Index™ (PMI)®) Data is compiled by S&P Global for more than 40 economies around the world. Monthly data comes from a survey of senior executives at private companies and is available by subscription only. The PMI dataset includes headline numbers that indicate the overall health of the economy and sub-indices that provide insight into other key economic factors such as GDP, inflation, exports, capacity utilization, employment, and inventories. Masu. PMI data is used by financial and corporate professionals to better understand where the economy and markets are heading and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, an independently managed division of S&P Global.