- Only about 11% of the total ETH supply was available for active trading.

- Investors were not very willing to part with their ETH holdings.

Are you interested in buying Ethereum? [ETH] But there aren't enough sellers on the market? Well, you might not be the only one.

ETH liquid supply decreases

With an impressive start to 2024, up nearly 57% year-to-date (year-to-date), and the possibility of a spot ETF on the horizon, ETH is currently one of the hottest entities in the crypto market. It might become one.

But for the king of altcoins, demand is not a problem. It's a supply.

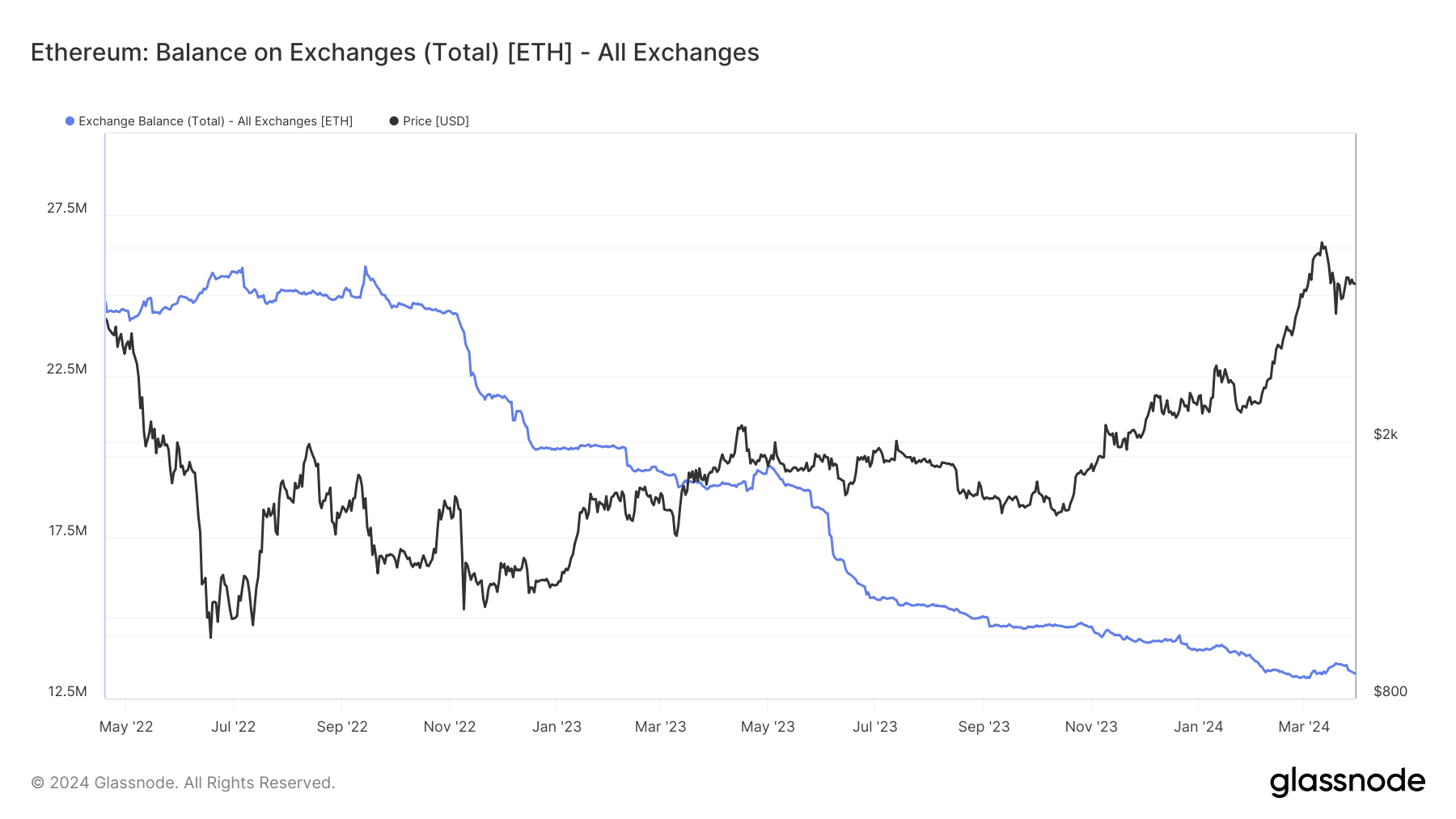

According to an analysis of Glassnode data by AMBCrypto, the exchange's ETH reserves have plummeted to new lows at the time of writing.

In fact, the supply available for active trading was only about 11% of total supply, down from 15.8% at this time last year.

This trend continues into 2024, even though the value of ETH has increased by 57% year-to-date (YTD). If the downward trend continues, the supply crunch will become even worse.

Source: Glassnode

Typically, such shortages can help push prices higher in the long run, as long as demand remains strong.

As is clear, supply declined sharply from 2022 to 2023, but ETH still underperformed due to the uncertainty caused by the bear market.

However, with improving sentiment around cryptocurrencies, coupled with ETH's own potential bullish catalysts such as spot ETFs, the pursuit to acquire the second-largest digital asset could intensify further.

ETH whales are busy stockpiling

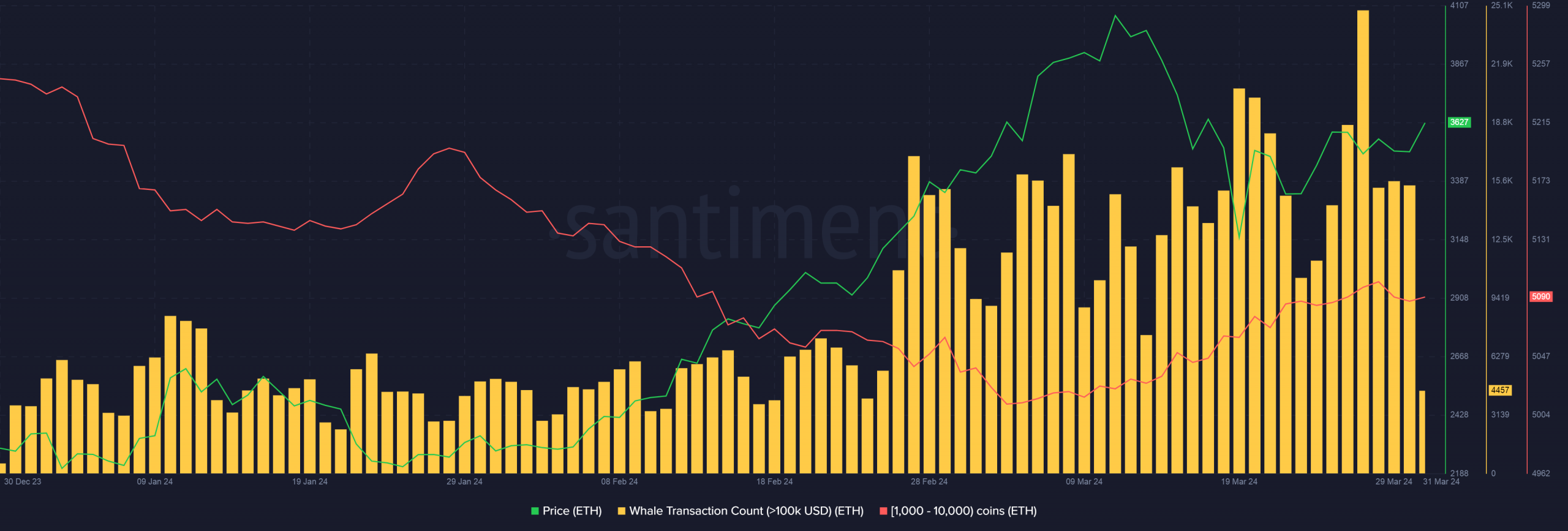

Whales, known for holding a large portion of the ETH supply, also appear to be bullish on ETH.

Despite the price correction, whale trades worth more than $100,000 increased recently, according to AMBCrypto, which analyzed Santimento data.

These transactions increased the number of wallets holding between 1,000 and 10,000 coins.

Source: Santiment

What can you expect from ETH?

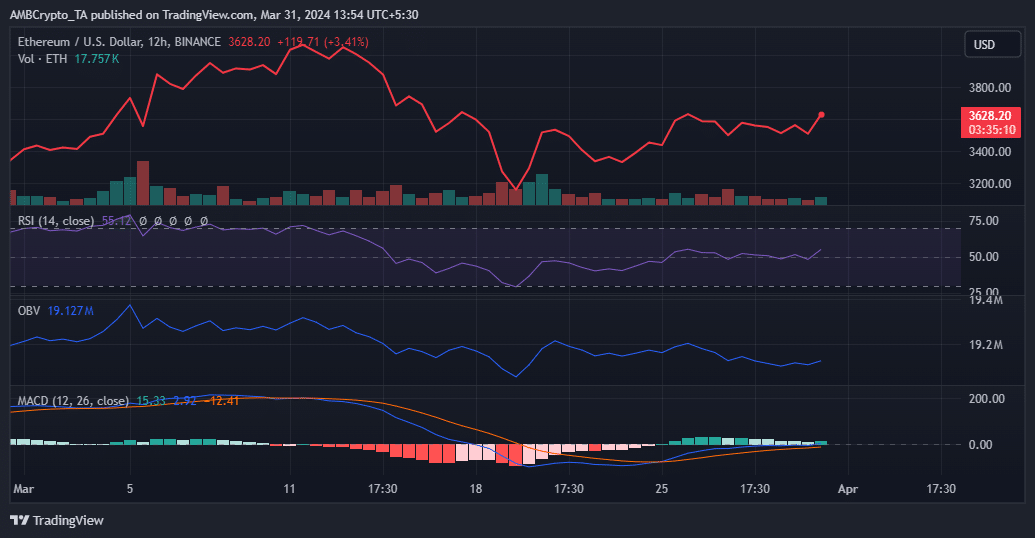

To get a better idea of the current market state of ETH, AMBCrypto analyzed some of the key technical indicators using TradingView.

The Relative Strength Index (RSI) rose above the neutral 50 line for the first time since mid-March. A break above 60 could intensify bullish sentiment and pave the way for a rally towards $4,000.

Having said that, on-balance volume (OBV) has not been able to make high peaks like price and has remained flat over the past 10 days. This suggested that the uptrend may stall.

Is your portfolio green? Check out our ETH Profit Calculator

Additionally, the Moving Average Convergence Divergence (MACD) was at risk of falling below the signal line in the coming days. An event like this would strengthen our bearish view.

Conversely, a move above zero could help further price increases.

Source: Trading View