- Ethereum’s market power has fallen to a 13% range low.

- The decline in market share comes amid weakening demand, increasing supply, and Bitcoin's growing dominance.

Ethereum [ETH] performance is inferior to Bitcoin [BTC] Over the past year. For example, Bitcoin is up over 120% year-over-year (YoY), while Ethereum is up about 50%.

Ethereum’s poor performance has continued its market dominance to the lows. At the time of writing, it was 13.85%, a notable decline from the year's high of nearly 20%.

Source: TradingView

Several factors are contributing to the decline in the dominance of the largest altcoins and their poor performance relative to Bitcoin.

Bitcoin's dominance increases

This year, Bitcoin’s dominance has increased significantly. The indicator has formed further highs since the beginning of the year and remains within an ascending channel.

Source: TradingView

One of the key factors driving Bitcoin's rise in dominance is the high demand for spot Bitcoin exchange-traded funds (ETFs).

data from SoSoValue You can see that the Spot Bitcoin ETF currently holds $57 billion worth of BTC. This indicates high institutional interest in promoting positive price performance.

Whales are selling Ethereum

Another factor causing Ethereum's decline in dominance is whale sales activity.

On October 8th, a large address that participated in the 2014 Initial Coin Offering (ICO) deposited 5,000 ETH worth $12 million into Kraken.

The whale deposited approximately 50,000 ETH worth $125 million onto the exchange over the past two weeks. spot on chain.

The Ethereum Foundation also bargain salecontributing to Ethereum's performance decline. Since the beginning of this year, the institution has sold over $10 million worth of ETH.

If whale selling activity picks up without demand increasing, ETH could continue trading in a range unless new buyers enter the market.

Demand for ETH ETF is weak

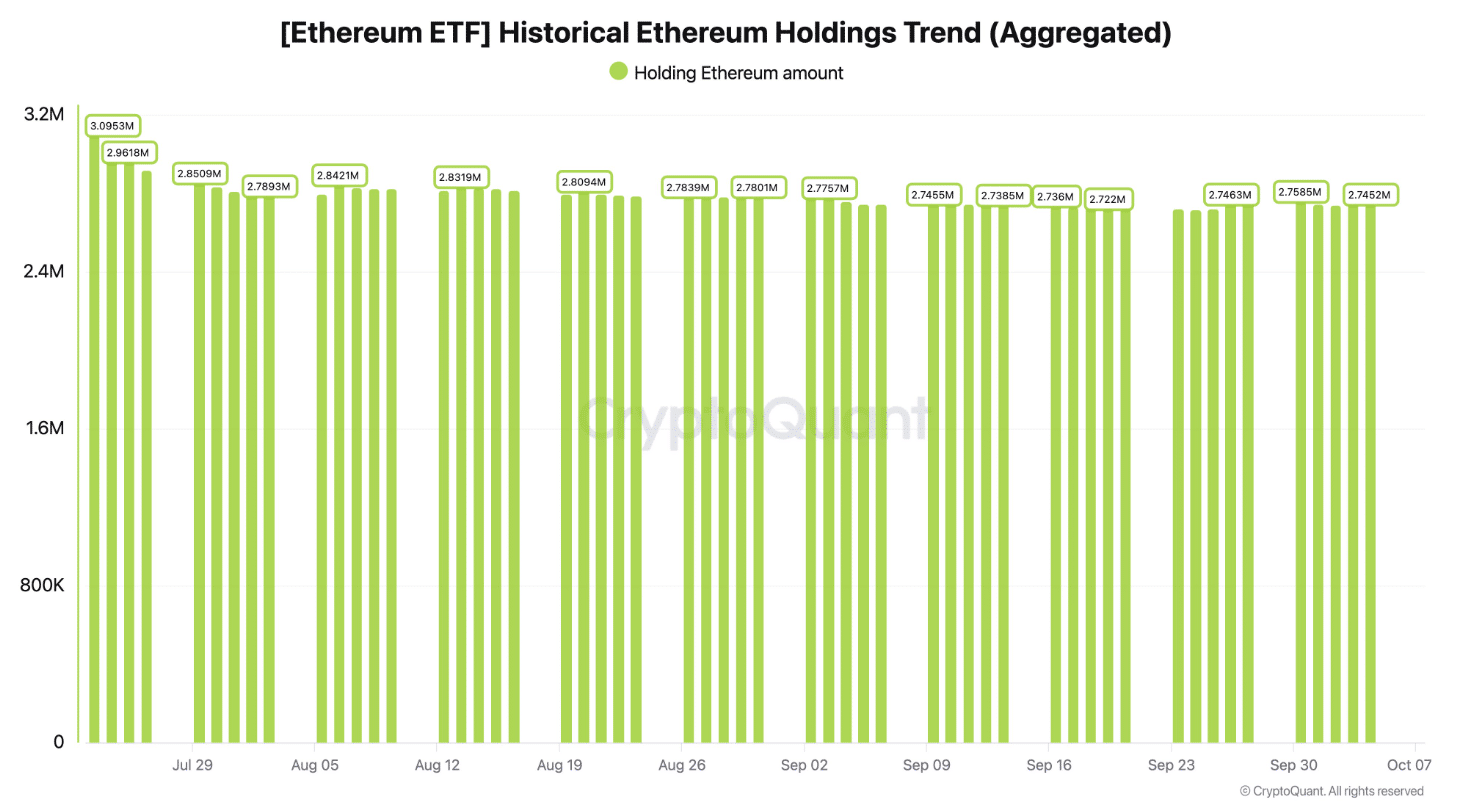

Unlike Bitcoin, Ethereum has recorded low demand for spot ETFs. These ETFs have recorded $849 million in outflows since their launch in July, according to CryptoQuant data.

Source: CryptoQuant

The leak was facilitated by the Grayscale Ethereum Trust. ETFs are also struggling with a lack of new capital inflows.

The BlackRock Spot ETH ETF has seen zero inflows over the past two days. At the same time, the Fidelity Ethereum fund did not see any positive flows this month, according to SoSoValue.

This weak demand has not been able to drive Ethereum’s gains, which has further led to a decline in its dominance.

increase in supply

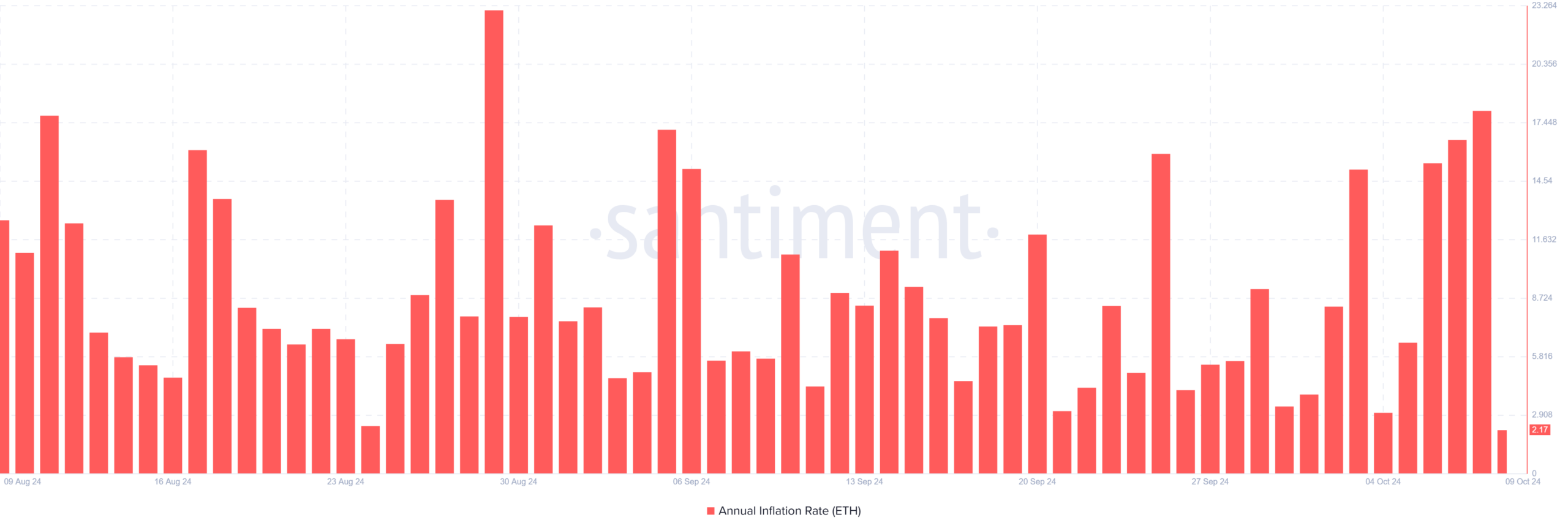

Ethereum is also suffering from a decline in burn rate due to coin inflation. data from ultrasonic money It shows that over 43,000 ETH tokens were added to the circulating supply in the past 30 days.

Ethereum’s annual inflation rate recently reached 18%, the highest level since August, according to Santiment data.

Source: Santiment

read ethereum [ETH] Price prediction for 2024-2025

A lack of new demand to absorb this increase in supply will increase seller pressure on Ethereum, forcing it to lose market share to Bitcoin and other altcoins.

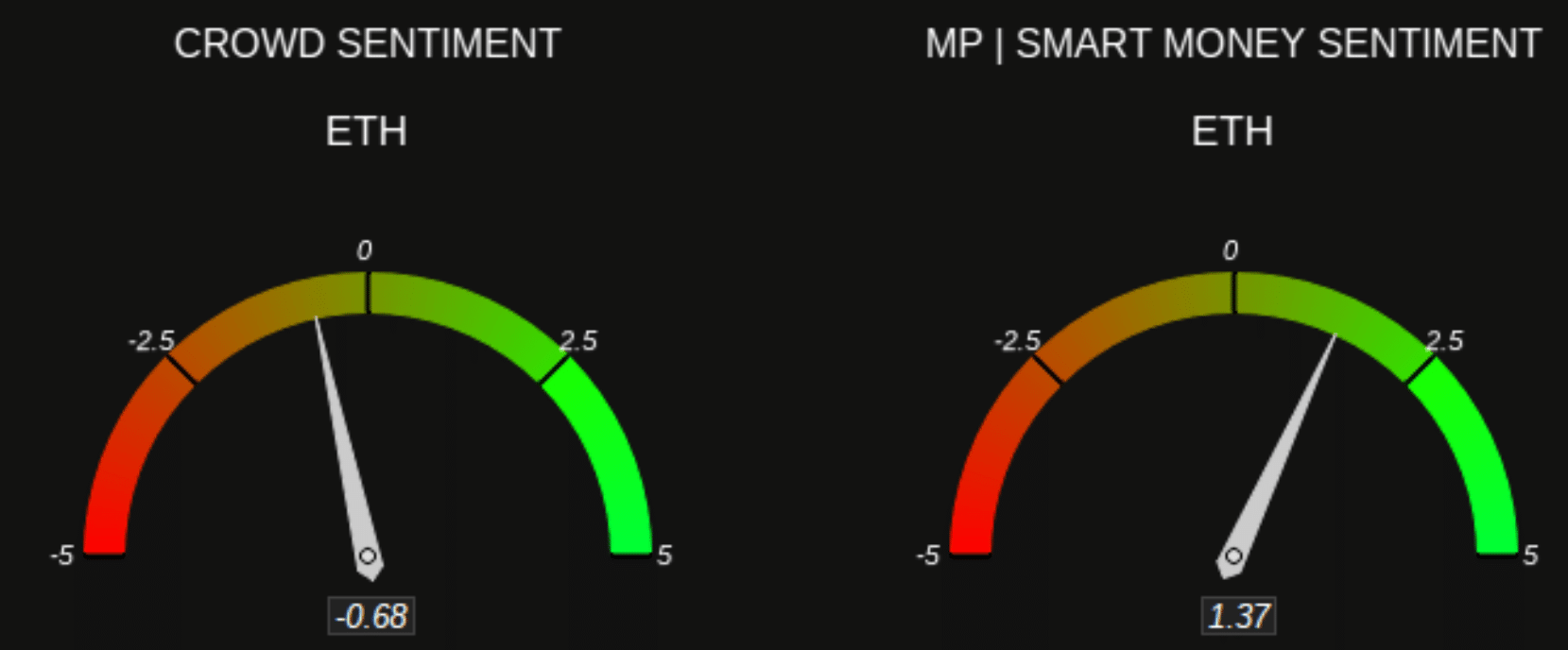

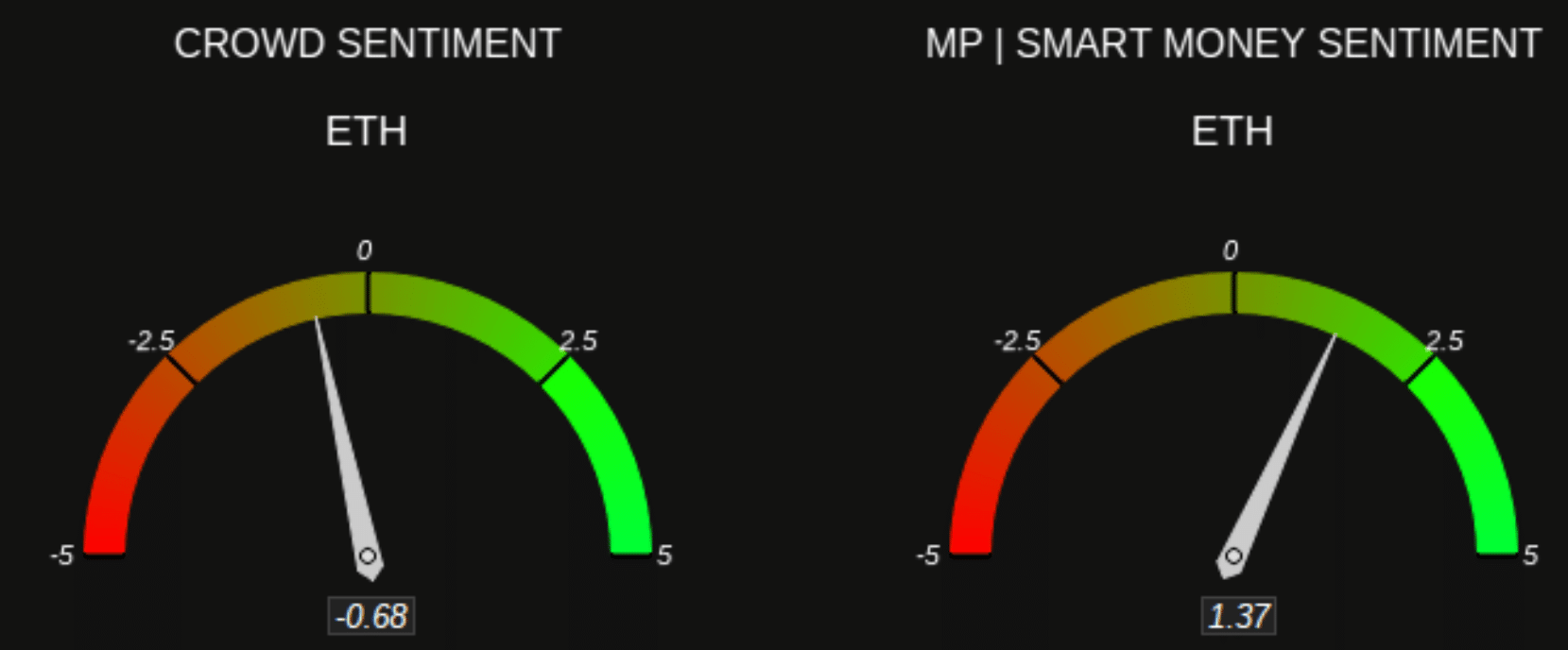

Ethereum's declining dominance is also contributing to weakening market sentiment. According to Market Prophit, most traders are bearish on Ethereum, but smart money and financial institutions remain bullish.

Source: Market Profit