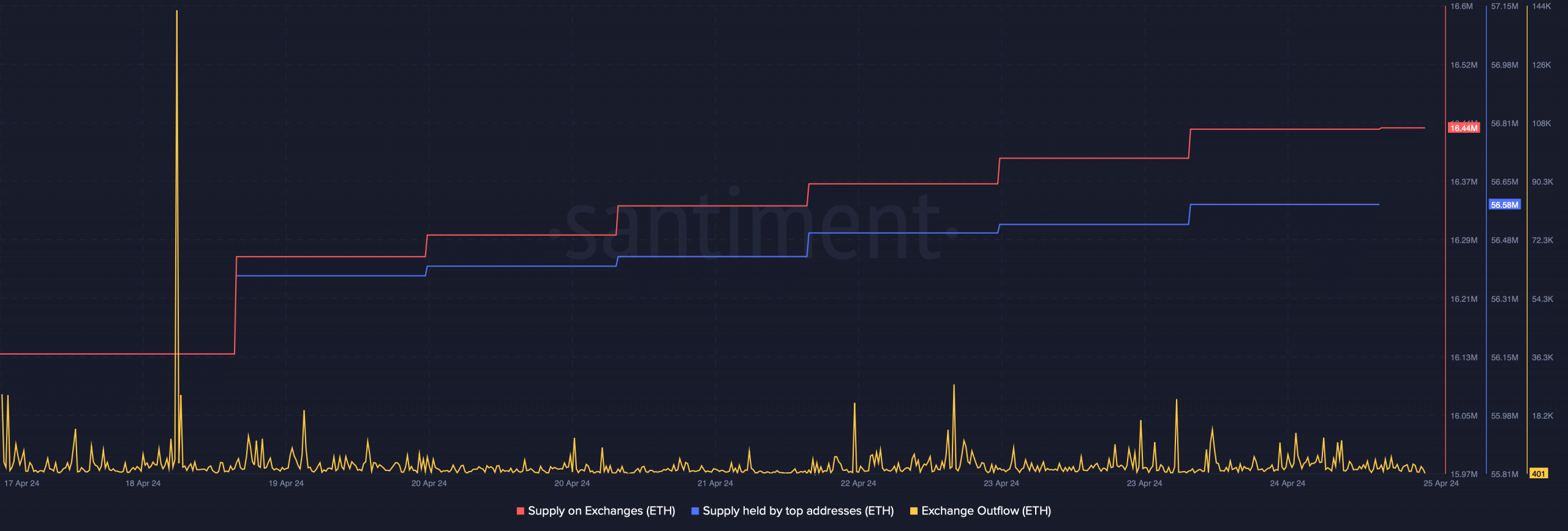

- The supply of Ethereum on exchanges has increased in recent days.

- ETH fell over 2% and the indicator looked bearish.

Ethereum [ETH] Last week, there was a significant outflow of funds from exchanges. This happened at a time when the company's price action was bullish.

However, the market turned bearish in the past 24 hours. Has this had a negative impact on ETH outflows?

Ethereum outflows are rapidly increasing!

Ethereum price has risen more than 6% in the past seven days and is well above the $3,000 level.

While that was happening, investors were stockpiling ETH and hinted that they expected the token's price to rise further in the coming days.

Popular cryptocurrency analyst Titan of Crypto recently made the following post. Tweet We emphasize this fact.

According to the tweet, the cryptocurrency exchange witnessed an outflow of more than 260,000 ETH, worth more than $781 million, in the past seven days.

Additionally, Justin Sun also accumulated ETH.According to recent information Tweet 15,389 ETH worth $49.78 million was once again withdrawn from Binance from Lookonchain, a wallet believed to belong to Sun.

The previous wallet had purchased 147,442 ETH worth $469.9 million for $3,179 since April 8th.

However, over the past 24 hours, there has been a shift in market sentiment, with the prices of most cryptocurrencies falling.according to coin market capETH fell more than 2%.

At the time of writing, the king of altcoins was trading at $3,165.53 and had a market capitalization of over $386 billion.

Is the ETH price decline affecting buying pressure?

As the price of the token fell, AMBCrypto checked its indicators to see if this was influencing buying pressure.

Analyzing CryptoQuant data It was revealed that the net deposit amount of ETH on the exchange was higher compared to the average over the past 7 days. This indicates that investors have started selling ETH.

Token exchange outflows have decreased in recent days. Furthermore, the fact that investors were selling Ethereum was further evidenced by the exchange supply graph as Ethereum rose.

Remarkably, the price drop had no effect on whale accumulation. This appears to be the case as the supply of ETH held by top addresses continued to increase last week.

Source: Santiment

from now on

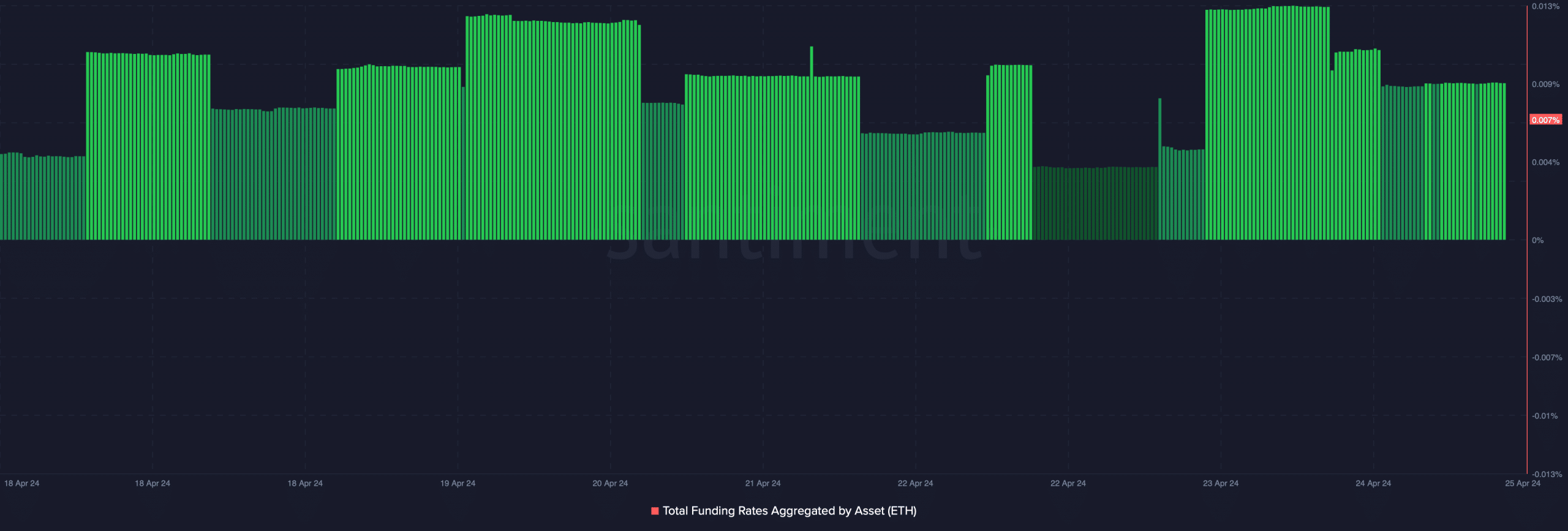

AMBCrypto then analyzed ETH derivative and technical indicators to see if the increased selling pressure could further impact the price. Token funding rate increased.

read ethereum [ETH] price prediction 2024-25

Generally, prices tend to move in the opposite direction of funding rates. This move signaled a continued decline in ETH price.

Source: Santiment

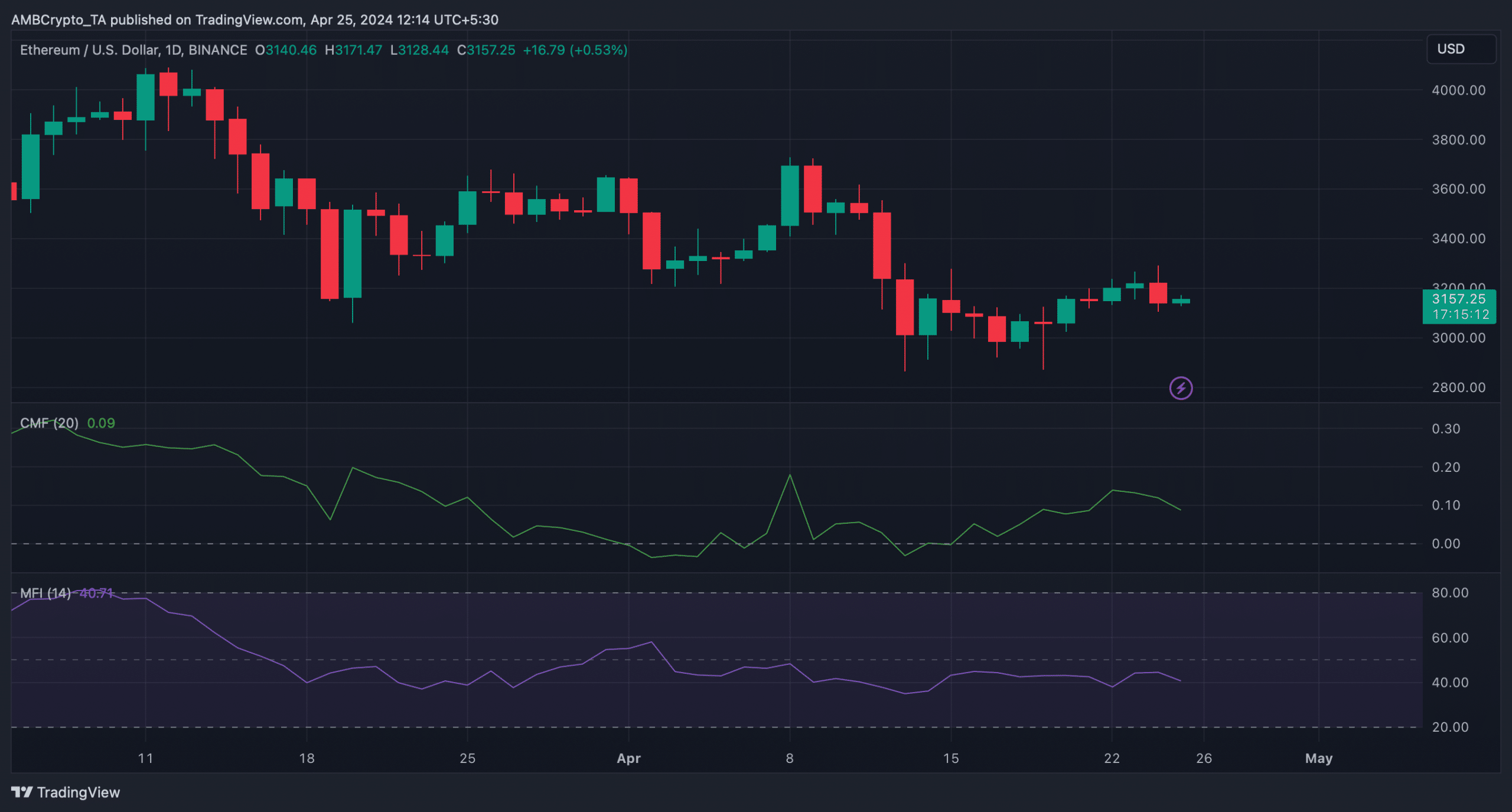

Technical indicators also looked bearish. For example, ETH's Chaikin Money Flow (CMF) and Money Flow Index (MFI) have both started to decline, indicating continued price decline in the coming days.

Source: TradingView