- Despite the latest FUD, ETH price remains resilient.

- Major indicators flashed buy signals as analysts suggested a potential bottom.

Ethereum [ETH] Despite the intensification of FUD in recent months, prices have remained resilient.

ETH underperforms peers like Bitcoin [BTC] and solana [SOL]And more investors are calling for other options to sell.

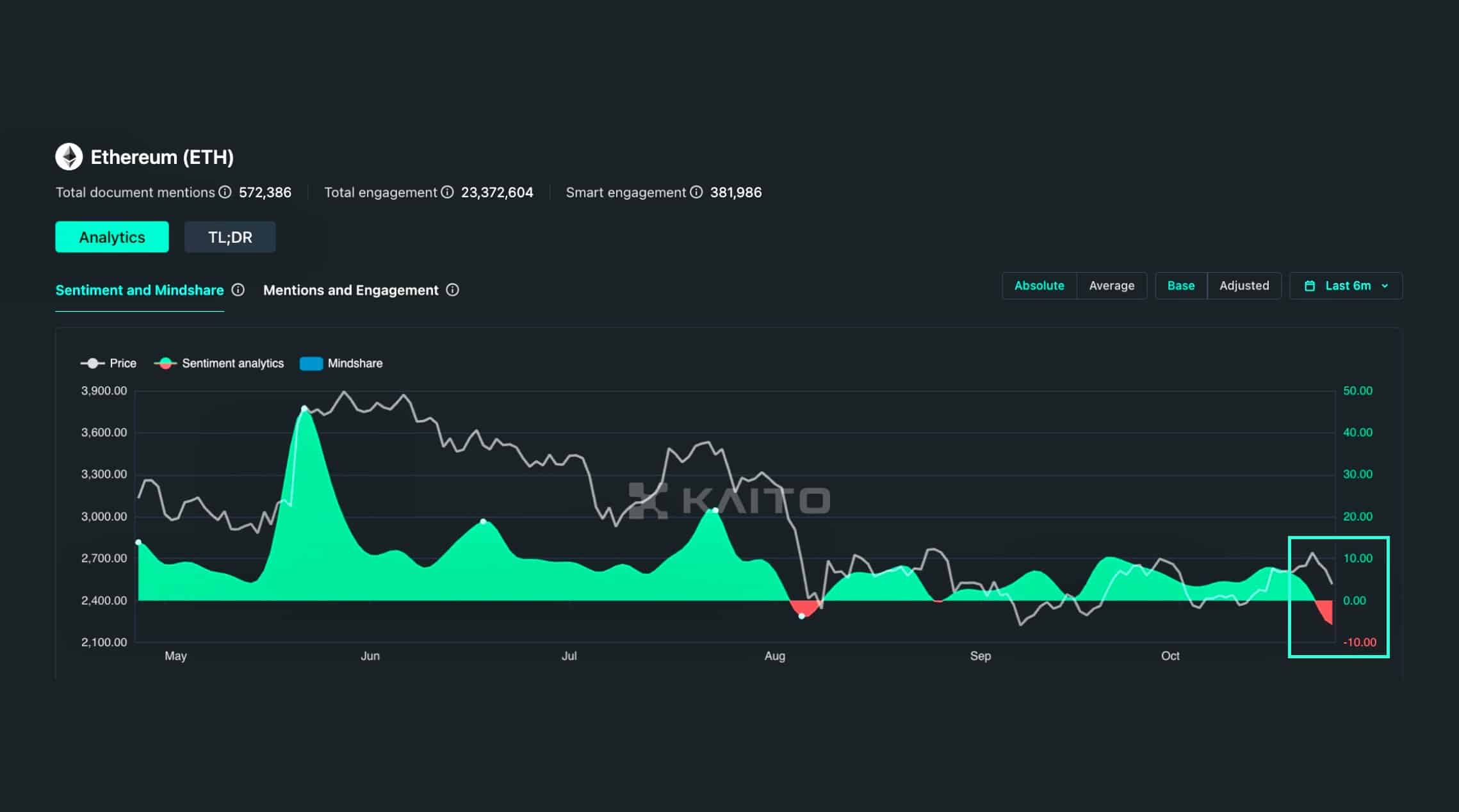

As a result, ETH market sentiment turned negative last week, hitting its lowest level since August.

Source: Kite

However, ETH remained resilient and appeared poised to recover from recent losses, according to Income Sharks market analysis.

ETH resilience

Despite the recent pullback and FUD, Income Shark has established that ETH’s market structure is solid with bullish signals from the supertrend. he said:

“$ETH – I’m happy to say everyone ended the low. Still making new highs and lows. Supertrend remains bullish.”

Source: Income Sharks

For context, a supertrend is a simplistic buy or sell indicator, and as of this writing is flashing a “buy” signal (green).

Additionally, a trend with higher highs always indicates a potential breakout and continuation of an uptrend. This suggests a potential bottom and breakout around the Income Shark, as ETH is following a similar pattern.

In fact, renowned analyst Ali Martinez said, I believed If it stays above $2,400, the asset could rise to $6,000.

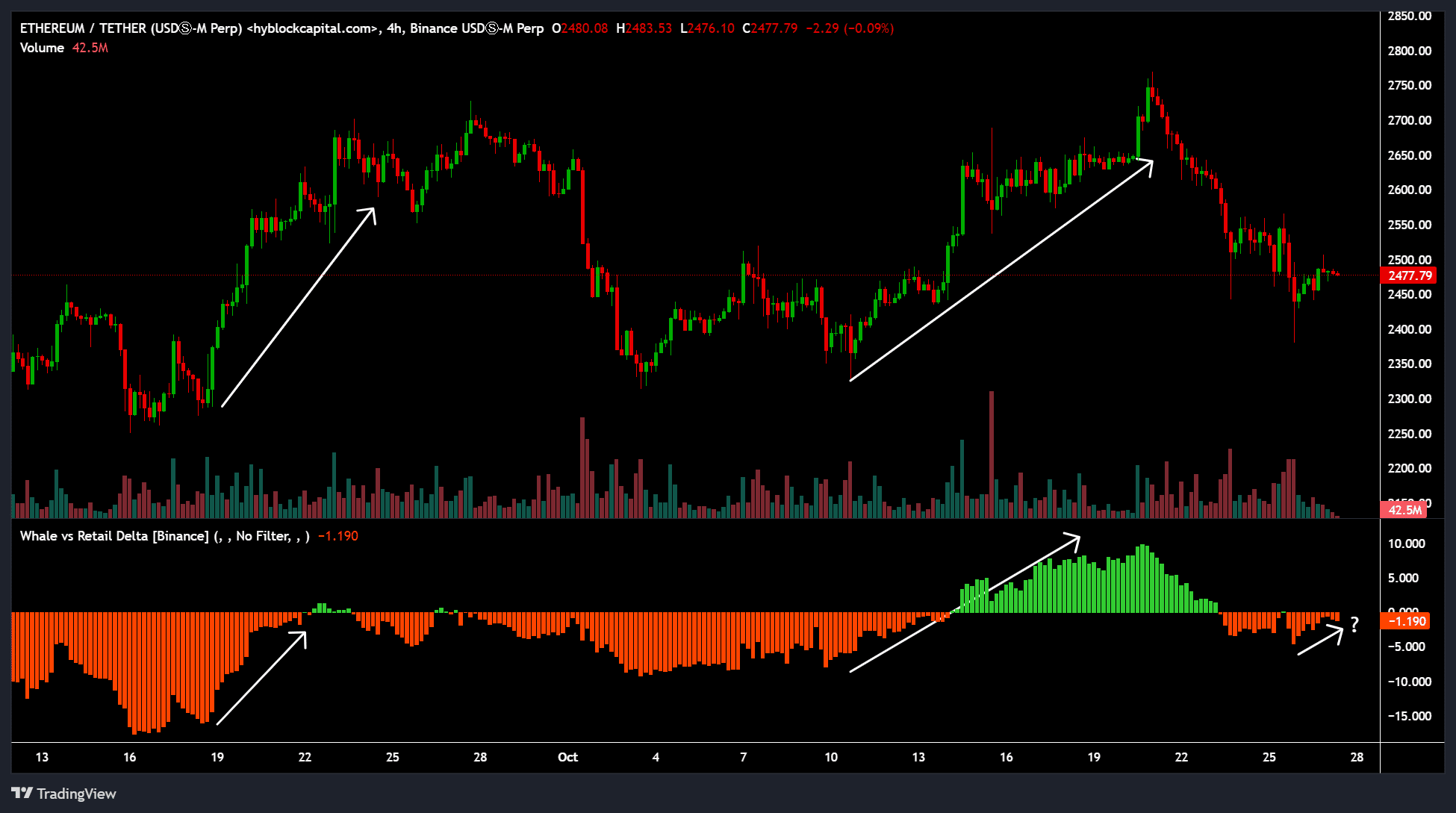

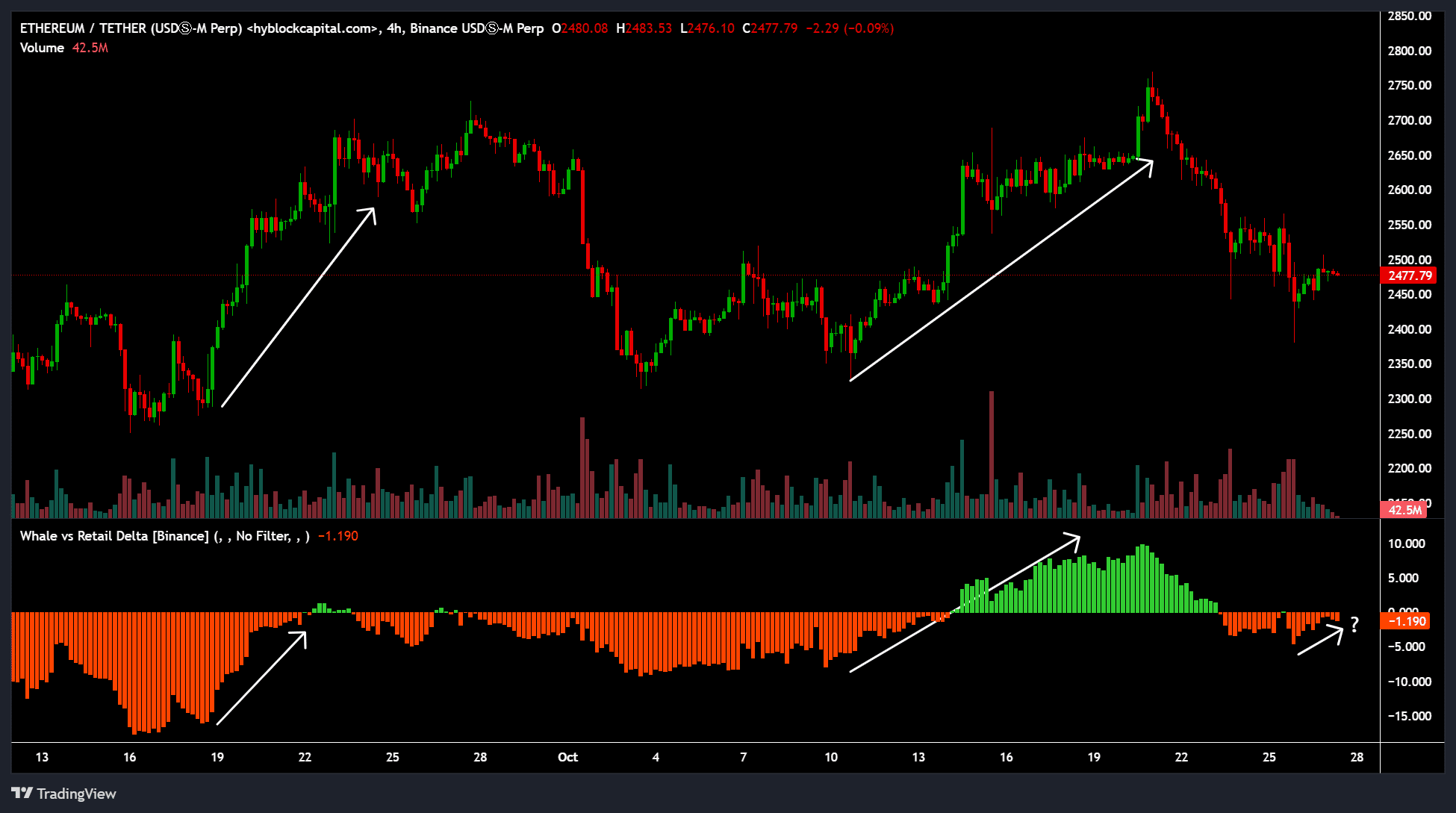

Source: High Block

However, at the time of writing, the whales were not that big in ETH.

Since October 22nd, whales have been reducing their ETH exposure, as shown by the decline in the Whales-to-Retail Delta indicator.

The recent backlash is interested in whales. However, at the time of writing there was again a small position by whales, but it was not strong enough (not green) to indicate strong market interest and a potential market rebound for ETH.

In other news, Ethereum co-founder Vitalik Buterin continues to say: fight FUD leveled the network, especially regarding his ETH sales and Ethereum Foundation activities.

However, at the time of writing, ETH was worth $2.4 million. However, it remains to be seen whether the ongoing FUD will derail the chances of a strong recovery for ETH.