Crypto analyst Jere predicts that Ethereum could reach $5,000 by March.

The analyst cited long-term technological patterns and reported institutional accumulation. This prediction comes as ETH remains up 51.9% over the past year.

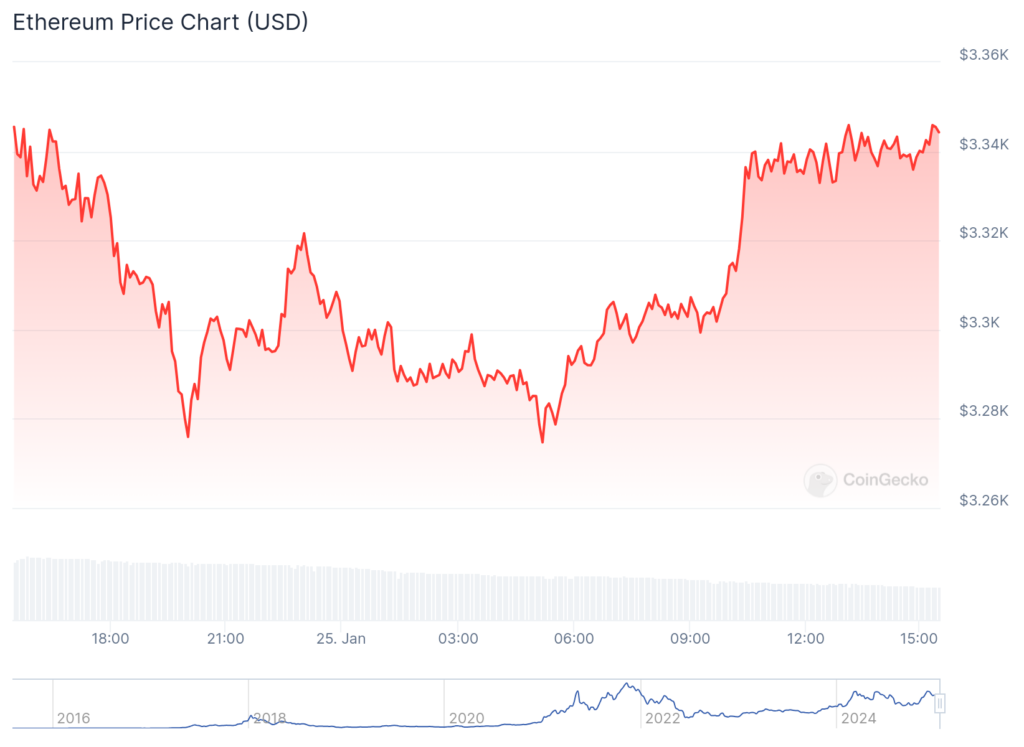

According to price data, Ethereum has gained 2.4% over the past week, but has fallen 1.9% in the past 24 hours. The asset's 30-day performance shows a modest decline of 0.4%, suggesting consolidation ahead of a potential breakout.

In a recent market analysis, Jere highlighted the bullish pennant formation that has been developing for almost four years. This technical structure can be confirmed by a trend line converging after a strong rally, but when verified by an increase in buying activity, it usually precedes a significant price increase.

Nearly 4 years inside this massive bullish pennant and the local lows have all been swept.

US Gov talking crypto stockpile, while the president keeps buying $ETH heavily.

They know something we don't.

Time for ETH to step back into the spotlights. pic.twitter.com/0BK0TdcXdS

— Jelle (@CryptoJelleNL) January 24, 2025

Market watchers say wallets allegedly associated with Trump's circle are accumulating Ethereum, coinciding with broader discussions about government crypto stockpiles. This institutional interest adds fundamental support to technical analysis.

Cryptocurrency price trends have shown resilience in maintaining annual gains despite recent market volatility. Although the short-term movement shows some uncertainty due to the 24-hour decline, the long-term uptrend remains intact, as evidenced by the underlying annual performance.

Technical analysts cite the completion of a localized low sweep as another bullish indicator. This suggests that the market has exited weak positions ahead of a potential rally.

However, ETH is still down more than 31% from its all-time high reached in November 2021. While BTC has managed to break above ATH multiple times recently, ETH has yet to show such strength.