- DOT's price has fallen 20% in the past 30 days.

- Several technical indicators appeared bullish for the token.

Polka dot pattern [DOT] The bears have been controlling the price of the token for several days as its value moves sideways. However, this may be just the tip of the iceberg, as the picture looks different.

Considering the latest data, DOT is likely to start a bull market.

Polkadot is getting ready to pump

according to coin market cap, DOT price has only changed slightly in the past 7 days. However, over the past 24 hours, the situation has worsened further, with the token's value dropping by more than 1.8%.

At the time of this writing, DOT was trading at $8.42 and had a market cap of over $12 billion. However, investors should not get discouraged as a bullish pattern has emerged on the token’s price chart.

according to Tweet According to an article by popular crypto analyst FLASH, Polkadot’s price was about to break out of the bullish pattern that previously triggered the bull market.

To be precise, DOT price gained bullish momentum after breaking out of similar patterns in February and November 2023. If history repeats itself, investors may soon see DOT's price touch March highs again.

Apart from this, DOT also achieved a milestone in terms of network activities. AMBC Crypto report A few days ago, the total number of DOT active accounts in the ecosystem exceeded 605,000. This reflects high network utilization and adoption.

Is a bull market inevitable?

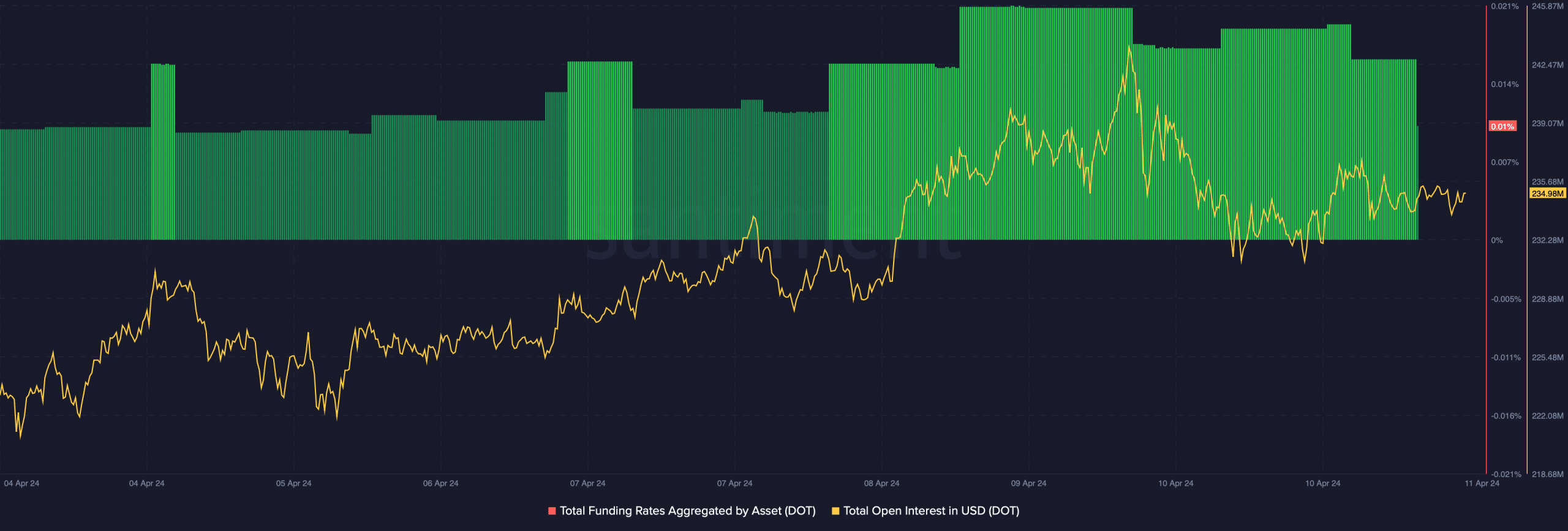

To confirm the possibility that DOT is actually outperforming the pattern, AMBCrypto looked at on-chain metrics. Analysis of Santimento data reveals that DOT's open interest remains relatively high.

Every time this indicator rises, it indicates that the ongoing price trend is likely to continue, and in this case it was bearish.

The token funding rate also looked bearish. In general, prices tend to move in the opposite direction of funding rates. Given DOT's high funding rate, it seems likely that DOT's value will fall further.

Source: Santiment

Regardless of whether it is realistic or not, this DOT’s BTC market cap clause

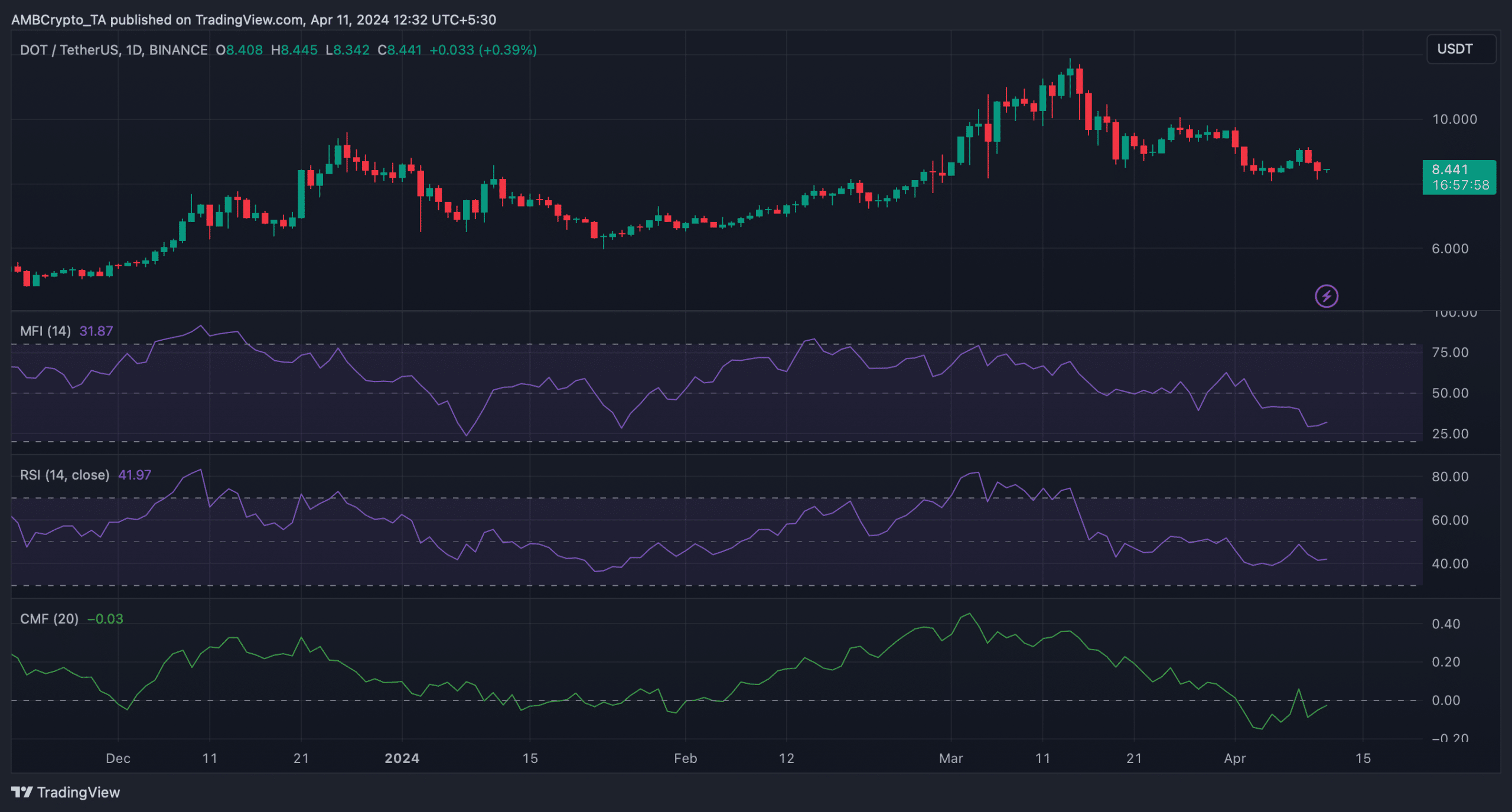

Next, we planned to check the daily chart of Polkadot to better understand the potential for DOT price to gain bullish momentum. According to the analysis, DOT's Relative Strength Index (RSI) was bearish as it was below the neutral mark.

However, Chaikin Money Flow (CMF) and Money Flow Index (MFI) confirmed the possibility of DOT breaking out of the bullish pattern. It is true that both of these technical indicators have recorded an increase in the past few days.

Source: TradingView