- In the past two weeks, investors have pulled $120 million from ETH-focused investment vehicles.

- The launch timeline for the Ether Spot ETF has been delayed after the SEC asked the issuer to resubmit an amended draft S-1.

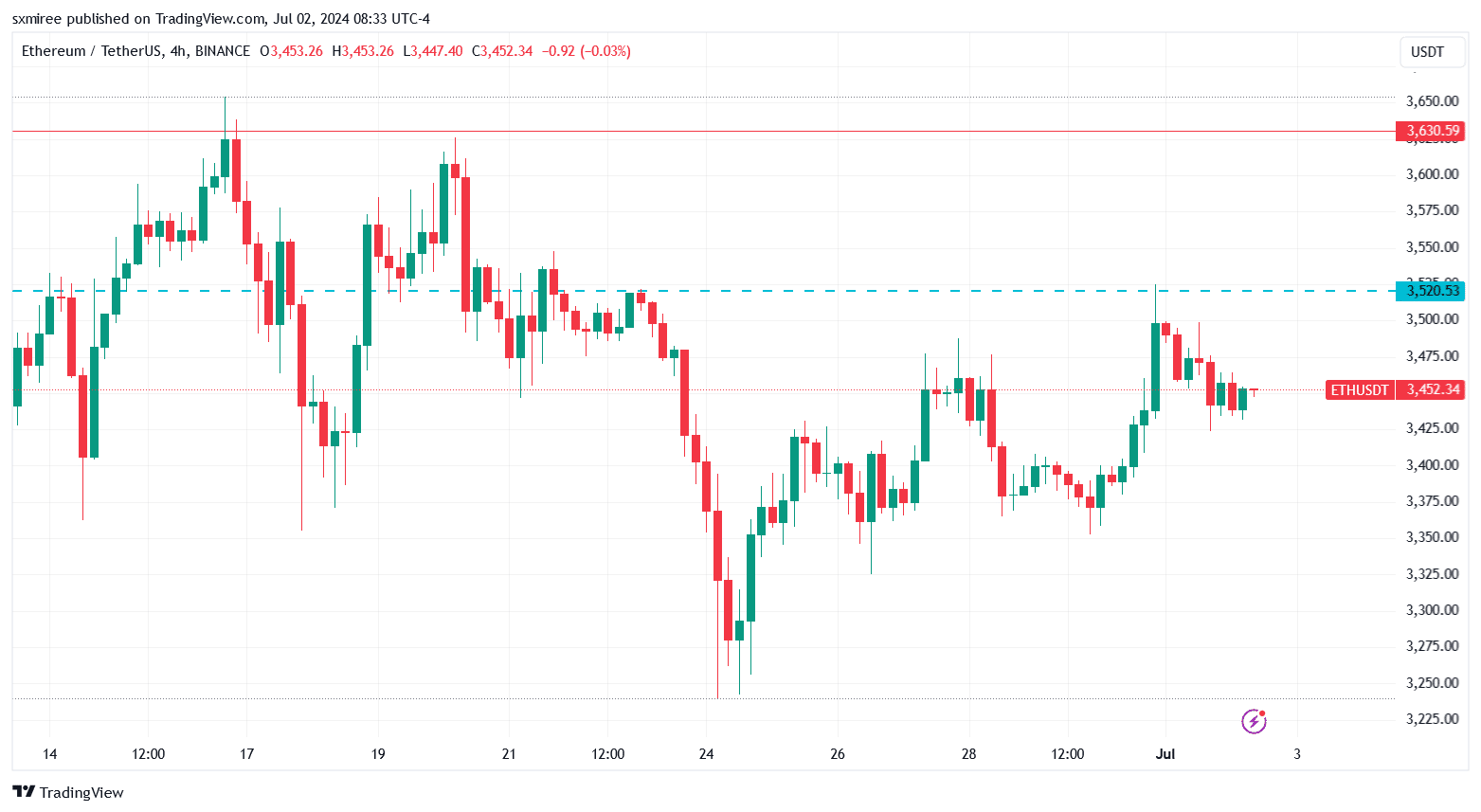

Ethereum [ETH] On July 2, it was trading around $3,448 and has remained largely unchanged in the past few hours. July's mostly positive story.

Meanwhile, ETH bulls were targeting new highs above $3,450, betting on a possible upside fuelled by hype surrounding an Ether Spot exchange-traded fund (ETF).

ETH/USDT. Source: TradingView

The new products, scheduled to be released in the US later this month, are: Promote, move ETH/USDT rose above the resistance at $3,630, where it was rejected on June 17.

Bullish speculators suffered minor losses on July 1 as Ethereum failed to sustain momentum above $3,520.

ETH attempted to break out of the descending channel on the 4-hourly chart overnight but has not been able to consolidate the move as of press time.

ETH/USDT 4-hour chart. Source: X/Satoshi Flipper

Notably, the recent rally towards $3,500 will not be a victory for the bulls if ETH fails to sustain above the $3,520 to $3,550 resistance zone.

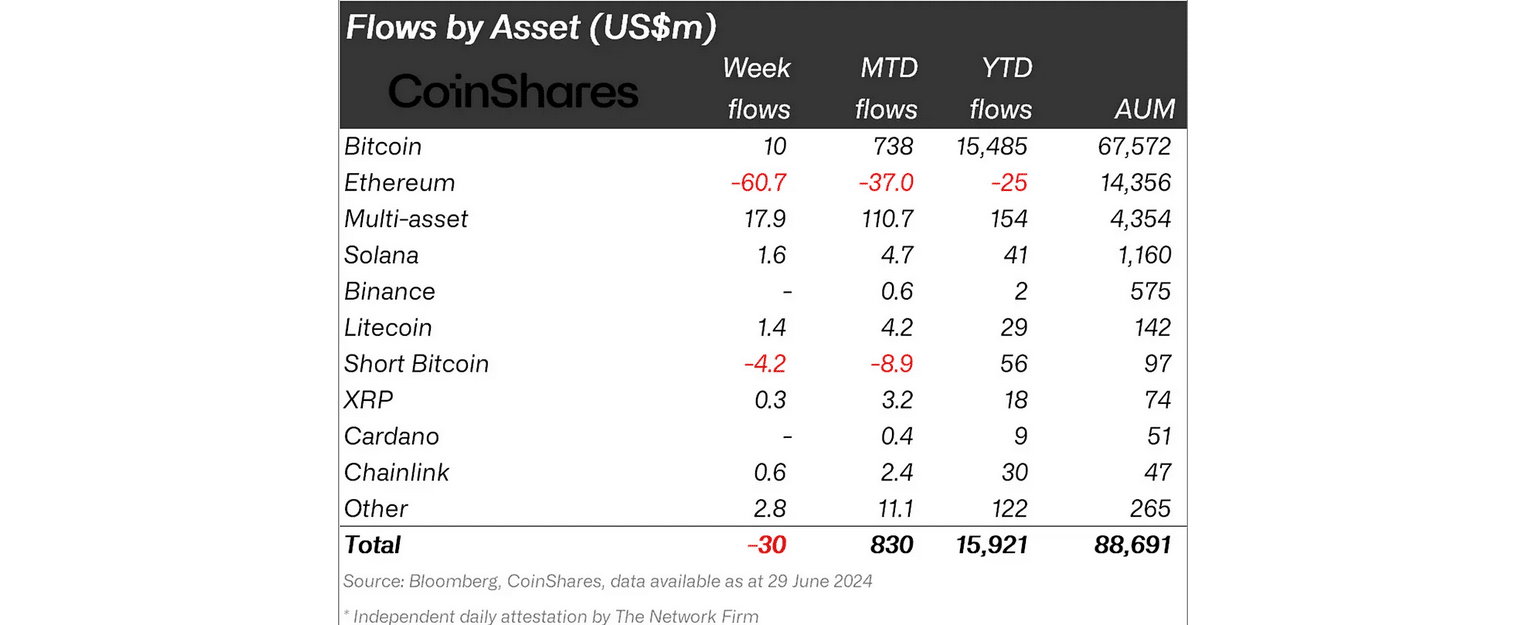

Institutional Adoption of Ethereum

In its digital asset flows report released on Monday, CoinShares reported that Ethereum investment products recorded outflows of $60.7 million last week.

Source: CoinShares

The figure was the largest seven-day negative outflow figure in nearly two years, bringing the two-week cumulative outflow to $119 million.

Additionally, the report highlights that based on net inflows, Ethereum was the worst-performing crypto asset in 2024, with monthly and yearly cumulative inflows of $37 million and $25 million, respectively.

US Ethereum Spot ETF

a US Ether Spot ETF The summer is fast approaching, after the Securities and Exchange Commission (SEC) approved the 19b-4 filings of eight prospective issuers on May 23rd.

However, the ETF product has not yet been approved to begin operations, pending approval of its S-1 registration statement.

of Recent setbacks The approval process is in the hands of the US securities regulator, which last week asked issuers to review their S-1 forms and resubmit them by July 8 with its comments.

As a result, the launch timeline for the spot Ethereum ETF has been postponed to mid- or late July.

Market Expectations

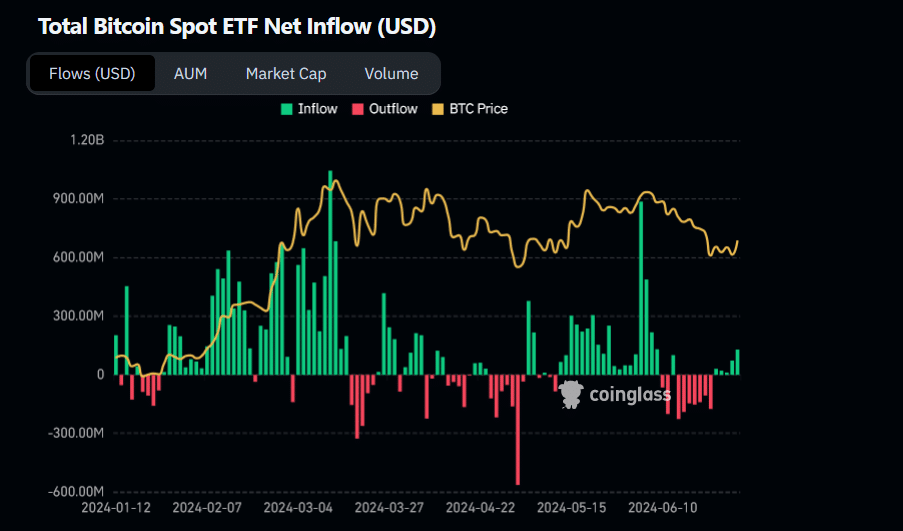

Last week, Bernstein analysts Gautam Chugani and Mahika Sapra predicted that demand for an Ethereum spot ETF would be slightly lower than that of Bitcoin. [BTC] ETFs are because the demand comes from much the same sources.

The co-authors also pointed out that the “lack of ETH staking functionality” among approved spot Ethereum ETFs is a deterrent that could dampen interest in the product.

Bitcoin ETFs have raised $55 billion so far since their introduction earlier this year.

While inflows have slowed from highs in February, analysts predict the figure is expected to exceed $100 billion by the end of 2025.

Source: Coinglass

Meanwhile, JPMorgan predicted that net inflows into Ethereum ETFs could reach around $3 billion by the end of the year ($6 billion if staking is allowed).

Ethereum [ETH] Price Forecast 2024-25

JP Morgan also Immediate market reaction He took a somewhat negative stance, pointing out the possibility of profit-taking by investors who purchased Grayscale Ethereum Trust (ETHE) in anticipation of it being converted into an ETF.

Also, last week, Bitwise CIO Matt Hogan said: Projected An Ethereum exchange-traded fund (ETF) is expected to attract net inflows of $15 billion in the first 12-and-a-half months.