- Ethereum price falls as network growth and speed plummet

- At a macro level, the Ethereum network continues to grow

Ethereum [ETH] Like other crypto markets, it has experienced a significant price decline over the past 24 hours. At the time of writing, ETH was trading at $3,267.60, down 7.22% in value on the chart.

Ethereum takes a hit

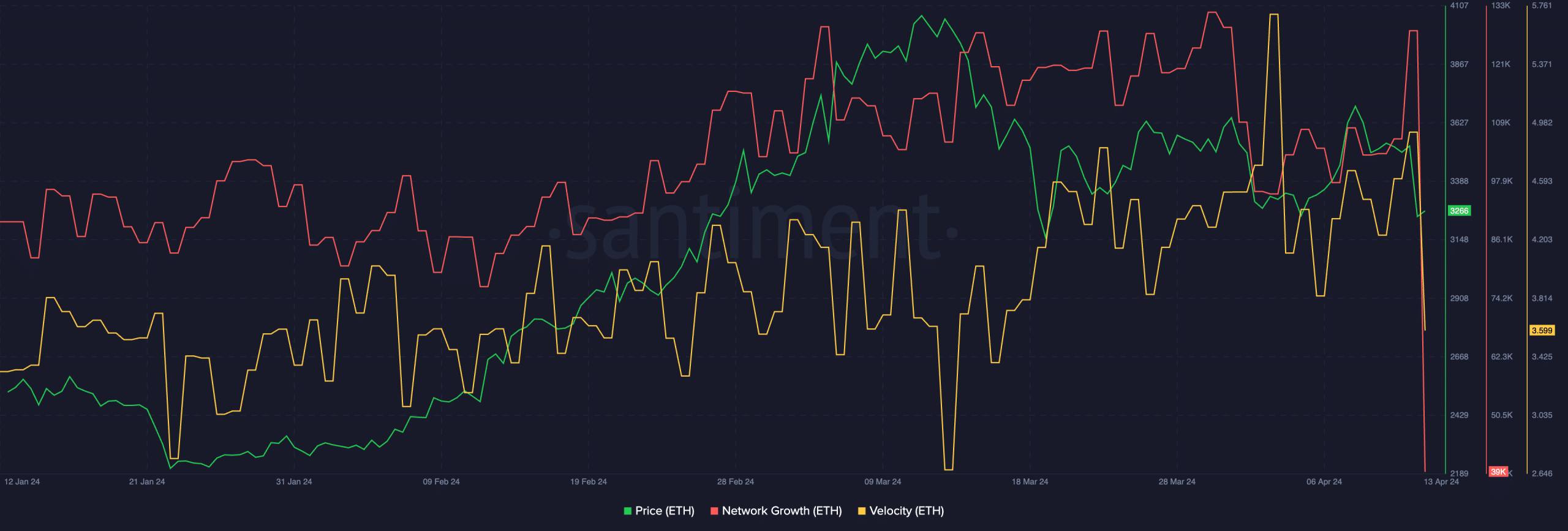

Over this period, Ethereum's network growth has decreased significantly. This shows that new users are losing interest in her ETH and the number of new addresses buying her ETH at this rate is very low. Additionally, the speed of ETH has also decreased, suggesting that ETH is being traded less frequently.

Source: Santiment

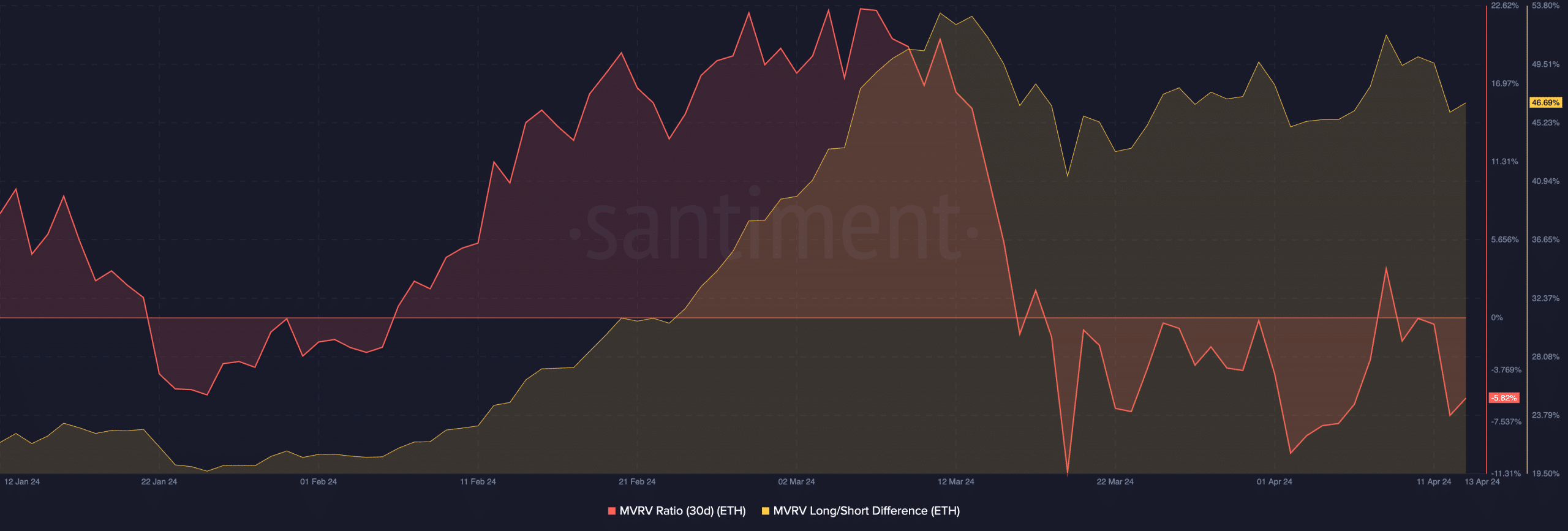

Additionally, Ethereum’s MVRV ratio has declined, indicating a decline in the number of addresses generating revenue. The ETH long/short differential has increased as well, indicating that the number of long-term ETH holders has increased.

Source: Santiment

Take a look at the larger picture

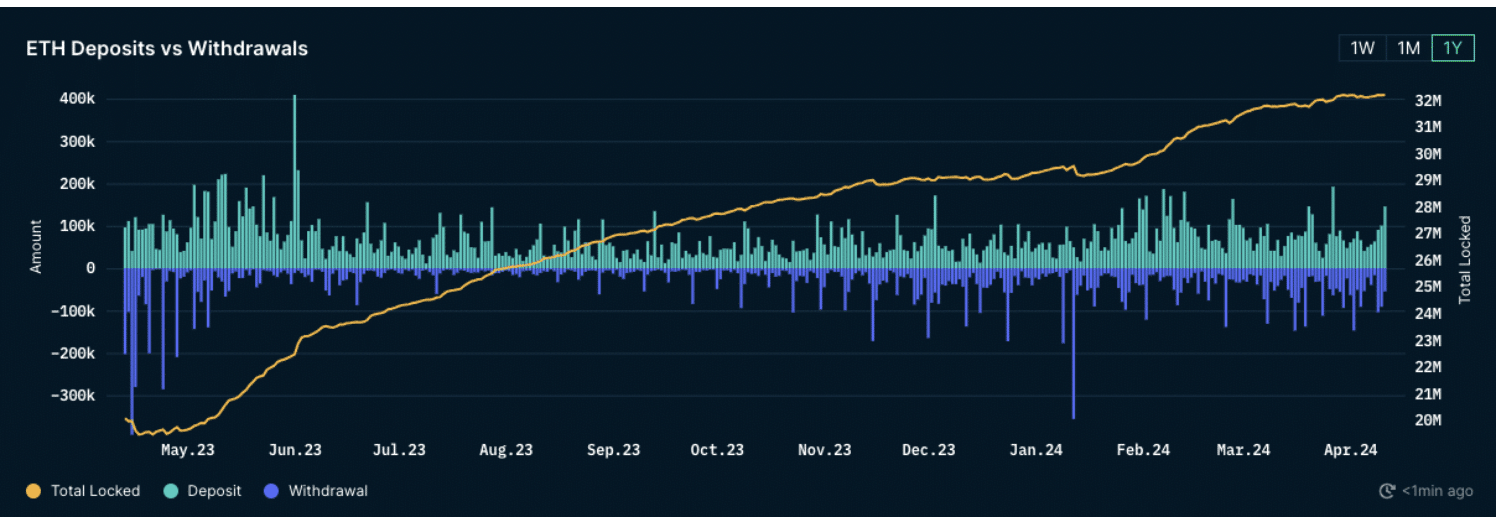

Although ETH appears to be struggling in the short term, the overall picture is much more promising. In fact, we can see that the Ethereum network has come a long way since last year.

For example, staked ether has seen significant growth over the past year, jumping from 20 million ETH to 32.2 million ETH, according to Nansen data. Despite a slight drop in staked ETH due to withdrawals from centralized exchanges following the Shapella rollout, staked ETH has seen an astonishing 61% spike.

This represents a staggering $42 billion inflow into Ethereum's staking infrastructure based on recent pricing.

Source: Nansen

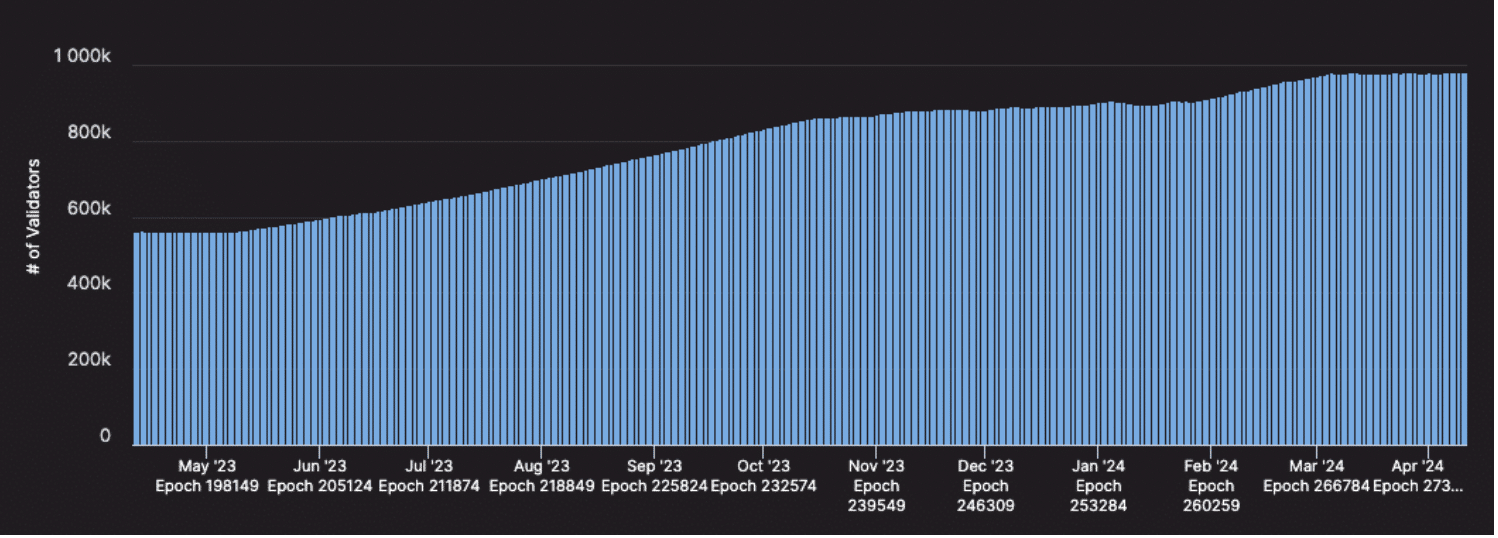

Since Shapella, the number of validators has also increased significantly, alleviating concerns within the Ethereum community about a potential mass exodus of validators. According to Austin Blackerby, his EVM Analytics manager at Flipside Crypto, this growth has allayed many concerns.

This time last year, there were approximately 563,000 validators securing Ethereum. Since then, this number has increased by more than 74%, bringing the number of validators to around 981,000.

As outlined in our September 2023 report, the continued growth of validators is raising further concerns among protocol developers and researchers. A large validator set size puts a strain on peer-to-peer networking and messaging, and can lead to node failures due to high computational load and bandwidth requirements.

read ethereum [ETH] Price prediction for 2024-2025

Source: Nansen

Additionally, larger validator sets make future upgrades more difficult and risky. The upcoming upgrade “Electra” is expected to address the challenges posed by the expanding validator set.

Simply put, the long-term future of the world's largest altcoin looks safer and more promising than the short-term one.